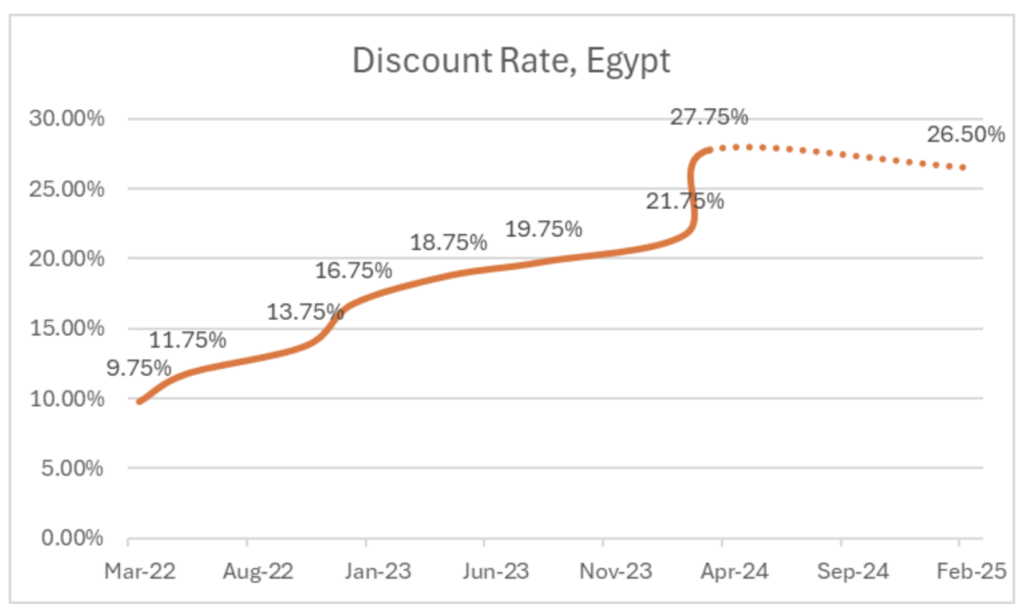

Speculation on the future of interest rates in Egypt has spread quickly. Each statement can either send a saver’s heart racing with worry over their deposits or bring relief to an investor hoping for lower borrowing costs to boost profits. As the Central Bank of Egypt (CBE) prepares for its February 20th meeting, the question is: Will we see the first rate cut in four years, or will the CBE hold firm to protect purchasing power and financial stability?

The Debate: Where Do Experts Stand?

Every CBE meeting sparks predictions, but analysts are particularly divided this time. Before the bank’s last six meetings, most experts correctly anticipated no changes in interest rates. This time, however, the landscape is different, with growing speculation that a rate cut might be on the horizon.A CNBC survey of 14 analysts found that 57% expect the CBE to lower rates after Thursday’s meeting. So, where does the disagreement lie?

Many analysts predict an interest rate cut

Generally, central banks lower interest rates to stimulate economic growth. A rate cut makes borrowing cheaper, encouraging businesses to expand and consumers to spend. This, in turn, boosts economic activity and investment.

Over the past few years, though, the CBE had to maintain high interest rates to combat inflation, which reached record highs. However, in recent months, inflation has been steadily declining. With this downward trend, many economists argue that the CBE now has room to shift its focus toward growth rather than inflation control. A lower interest rate would make it easier for businesses to access credit, potentially accelerating economic recovery.

Others think interest rates will not change

Some economists caution that inflation could make a comeback, driven by two key factors:

- Global Trade Pressures: Trump’s trade policies could drive global prices higher, affecting imports and raising inflation in Egypt.

- Ramadan Spending Surge: Consumer demand typically spikes during Ramadan, which could put upward pressure on prices, making it riskier for the CBE to cut rates now.

Moreover, lower interest rates may diminish the appeal of Egyptian government debt instruments, complicating efforts to finance the budget deficit.

A Threat to Purchasing Power

For millions of Egyptians—especially retirees—interest income from bank deposits is a vital source of financial security. With inflation still a concern and the government’s announced plan to eliminate fuel subsidies by year-end, lowering interest rates could erode savings and worsen financial hardships for many households.

The Big Question: Growth of Stability?

Should the Egyptian Central Bank prioritize attracting investment and economic growth, or maintain high rates to protect consumers? The decision will impact borrowers and savers and shape Egypt’s economic trajectory in 2025.

All eyes are on the CBE’s upcoming meeting. Whatever the outcome, it will set the tone for Egypt’s financial landscape in the months ahead.

If you see something out of place or would like to contribute to this story, check out our Ethics and Policy section.