Volkswagen At The Crossroads

Volkswagen has an 87-year-long history that led it to become the second-largest automaker in the world by sales, with 9.24 million cars sold in 2023, just behind Toyota (11.23 million) and ahead of Hyundai (7.3 million).

It currently manufactures 250,000 cars per week.

The group owns many brands beyond Volkswagen itself (cars and light commercial vehicles), including:

- Audi AG, which itself owns the Audi brand, as well as Bentley, Lamborghini & Ducati.

- Porsche AG.

- SEAT & Cupra.

- Skoda

- Traton SE, a truck manufacturer owning the brands MAN, Navistar, Scania, and Volkswagen Truck & Bus.

- Bugatti (owned at 45% by Porsche AG)

- Jetta is a Chinese joint venture with the FAW Group.

- Scout Motors, an American off-road EV company, was created by Volkswagen after acquiring the Navistar Group in 2021.

Source: Volkswagen

For decades, the company has been a leader in high-quality and luxury automobiles (Audi, Porsche, Lamborghini, Bentley, etc.) and popular in the cheap and mid-price segments (Volkswagen, Skoda, SEAT, etc.). It is also a force to reckon with in the commercial segment, from light vehicles to major truck brands like MAN and Scania.

It is also a company built around the internal combustion engine (ICE) technology. A technology now under mounting pressure from EVs & hybrids, as well as potentially other new energy vehicles like hydrogen or ammonia-powered engines.

So, Volkswagen’s future is uncertain, with the open question of whether or not to switch to new mobility technology looming over the auto manufacturers and, with it, their ability to resist the competition from rising Chinese brands.

Overall, the company stock reflects this uncertainty, with a stock price barely above 2010’s prices and at 2006’s levels, for a P/E ratio below 3.5.

Source: Yahoo Finance

Signs Of Troubles In Germany?

Most recently, Volkswagen made headlines with the surprise announcement of a potential factory closure in Germany—the first in the company’s history. This would result in the firing of up to 18,000 people.

Not only could this trigger a massive conflict with the powerful German unions, but investors have been worried that the company foresees a decline in sales.

“The European automotive industry is in a very demanding and serious situation. The economic environment has become even tougher, and new competitors are entering the European market.

In addition, Germany in particular as a manufacturing location is falling further behind in terms of competitiveness.”

Oliver Blume – Volkswagen Group CEO

This might not come as a total surprise to the close observers of the German economy. The Eurozone PMI index stood at 45.8 points in August 2024 (below 50 is a contraction of activity), and it has been below 50 since July 2022.

Source: Trading Economics

A key factor is energy costs, which have risen due to multiple reasons. Firstly, there has been an interruption in the supply of cheap Russian gas (due to the Ukraine war and the Nord Stream pipeline sabotage) and, secondly, the premature closing of German nuclear power plants.

This makes for the longest slowdown in 30 years for Germany’s manufacturing sector.

Overall, it also indicates that more than a problem of the Volkswagen Group, this is a concern about the profitability of industrial production in Germany.

This is especially true for energy-intensive industries (metallurgy, automotive, chemicals, etc.) with for example the giant BASF closing 11 factories in Germany in favor of the lower-energy cost US and China.

However, Volkswagen is far from a Germany-only company, with many other manufacturing sites. In fact, less than half of the group’s employees (300,000 out of 650,000) are in the country.

So, while significant, the challenges faced by the German industry are not the only focus of the Volkswagen Group.

The EV Question

Succeeding in EV adoption will be key to Volkswagen’s long-term survival. There is a lot to unpack on this topic, from the existing car lineup, new models in development, and the arrival of Chinese EV competition in Europe, Volkswagen’s main market.

Volkswagen & EVs

The company already has a strong line of EVs from a technical point of view. The segment is dominated by the ID series and has been steadily growing in the past years, mostly thanks to stronger demand in China, even if demand has been weaker in Europe and the US.

Source: Volkswagen

Some other models have been less successful, notably the ID Buzz.

This re-imagined EV version of the classic Type 2 Bus from the 1950s is mostly a commercial failure, largely due to its very high price, starting at $60,000 in the US. A short 230-mile range, despite a massive battery pack, also disappointed.

Source: Volkswagen

Fixing Battery Supply

EV brands and models live and die by the quality of their batteries as they determine the vehicle’s range and cost.

A negative factor for Volkswagen has been that historically, each branch of the group had its own battery system, leading to complexity and lack of economy of scale. This complexity of the group is not unique to batteries, with for example until recently hundreds of different gearboxes.

The switch to electric has become the chance to redesign from scratch ALL the VW group’s models around common core hardware and software through the shared Scalable System Platform (SSP).

The first cars built around this new architecture are expected for 2028, a delay from the initially planned 2026.

Source: Volkswagen

The new SSP architecture should provide a charging time below 12 minutes, engine power from 120-1,300 kW, and cover the entire range of the company, from cheap models to luxury brands.

The upcoming centralization of Volkswagen’s supply chain is illustrated by PowerCo, showing where most of the batteries for European and North American factories will come from. Production will start in 2025 and each factory will be operated 100 percent on electricity from regenerative sources.

PowerCo supply will be supplemented partially by third-party suppliers in Europe and fully by local suppliers in China.

Source: Volkswagen

Software Problems

Another segment where Volkswagen has been slow to modernize besides EVs is software. This is an increasingly important topic for automakers, both for a better customer experience and also because EVs are a lot more software-dependent than ICE vehicles.

Volkswagen’s software division, Cariad, has been the priority to fix for the new CEO Oliver Blume.

The Audi Q6’s software was the biggest cause of reflection for Blume. According to some test participants, the car displays were not always working, reflecting the software issues that have plagued the Group’s vehicles for years.

Just like the ID.3 was produced with incomplete software in 2020, the Audi Q6L e-tron assembled at Audi’s new factory in Changchun will also be parked on overflow lots until the software issues are ironed out.

AutoEvolution.com

Partnership With Rivian

A key point on Volkswagen’s path to progress in EV tech is a newly minted partnership in a joint venture with Rivian. Its focus is not batteries but software.

Volkswagen Group is to invest an initial $1 billion in Rivian, with up to $4 billion in planned additional investment for a total expected deal size of $5 billion. This is done through a $1B unsecured convertible note that could give Volkswagen a larger ownership in Rivian, with investments in Rivian common stock expected later.

Not only is this partnership expected to bring our software and associated zonal architecture to an even broader market through Volkswagen Group’s global reach, but this partnership also is expected to help secure our capital needs for substantial growth.

RJ Scaringe – Founder and CEO of Rivian

This could be a win-win deal. Rivian urgently needs cash to cover its $39,000-per-vehicle loss, and Volkswagen needs to fix its software issue as quickly as possible to make the 2028 deadline for SSP deployment.

On one hand, this demonstrates how deep Volkswagen’s software issues are, that it needs a billion-dollar investment in someone else’s technology. On the other hand, it shows the group is now actively fixing the problems that have hindered its progress in the EV market.

Chinese Competition

It all comes not too early, as hungry new competitors are looming over every European automaker. Chinese EVs are looking to enter the market, among which is the world’s largest EV producer, BYD.

BYD is the leading EV company in China, with 1,860,000 vehicles sold in 2022, €20B of revenues in 2022, and one of the largest private companies in China. The company started as Motorola’s first supplier of Lithium-ion batteries in 2000 and entered the automotive business as early as 2003. Today, it is also active in buses, trains, semiconductors, and battery energy storage.

Source: BYD

And with the release of $10,000-$12,000 cars like the Seagul, using sodium batteries, a whole new market might open for BYD EVs. The Seagull might sell in Europe for around $20,000, but it is still risking hurting the market share of local producers like Volkswagen.

Source: BYD

Chinese EVs are now subjected to tariffs, of 100% in Canada & USA, and lower 17-36% tariffs in Europe. So they might be cheap enough to compete in Europe at least, and also take some of the sales of international automakers in markets like Mexico, South America, SE-Asia, Africa, etc.

Scout To Take Over America?

One market that has long been somewhat difficult to crack for Volkswagen is the US and North America, at least for non-luxury lines. A key reason has been that the group has always somewhat lagged behind when it came to big pickup trucks, a favorite of consumers in North America.

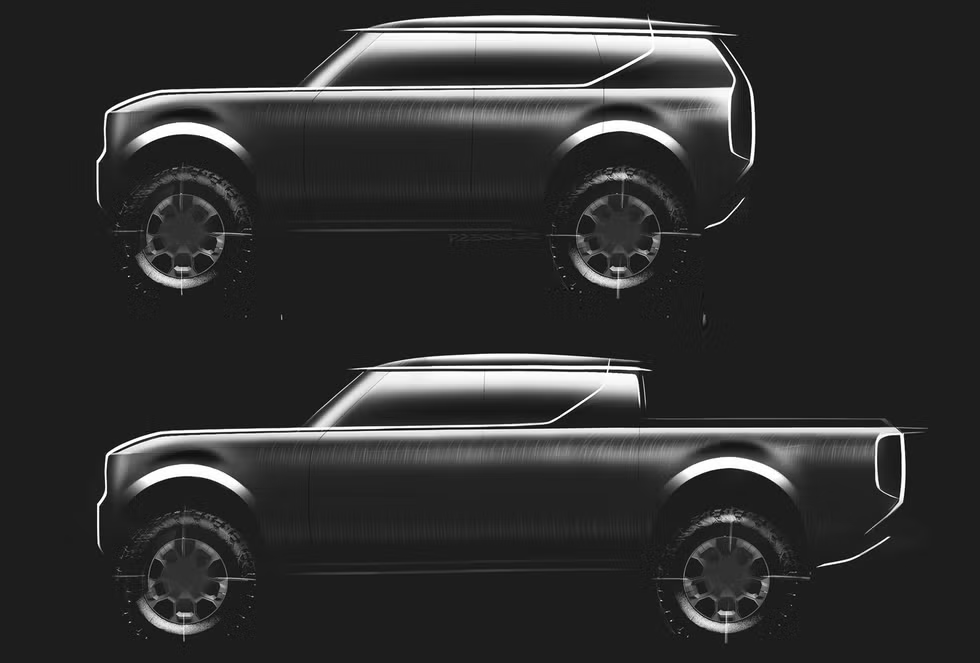

When it acquired semi-truck company Navistar in 2021, the Volkswagen Group also acquired rights to the iconic Scout moniker, promptly spinning it offer into its own company known as Scout Motors, an American off-road EV company. Notably, this marks the revival of the once iconic branding, originally offered by International Harvester, which was active in 1961-1980 in the consumer vehicles sector.

After a long silence, the company has finally announced it will reveal its electric line-up in October 2024. Although quite more conventional, the square, boxy design is a little reminiscent of Tesla’s Cybertruck while clearly striving to invoke memories of the old International Harvester Scout design.

Source: Car and Driver

Source: Inside EVs

Production is scheduled for 2026 from a brand new $2B factory in Blythewood, South Carolina, with a target of 200,000 EVs / year. This will bring Scout’s truck in direct competition with Rivian R1S and the Ford F-150 Lightning.

Source: F150 Lighting Forum

Volkswagen hopes that the Scout brand legend, as well as a focus on rugged design, locking differentials, tons of accessories at launch, and actual, physical buttons instead of screen controls, will help it succeed in the off-road US truck market.

Scout truck will use a new body-on-frame truck platform built from scratch, instead of a repurposed ID-frame, in an effort to convince buyers of the truck’s toughness.

Investing In Volkswagen

Volkswagen is a group out of favor with investors, in large part due to past blunders in the last decade, from missing the transition to EVs, software issues, and the 2015 emission scandals hurting the image of the company in financial markets.

It is, nevertheless, still the second-largest automaker in the world. In the Summer of 2024, it had $24B in operating income and $14.9B in net income. It also has a cash position of $51B.

Despite these solid financial data, it trades at a low single-digit P/E, giving a >8% dividend yield, reflecting the extreme pessimism about the company’s future.

So this will make the stock a contrarian investment, where buyers of the stock will assume that the market overestimates the company’s troubles, and count on it staying in the top 3 or top 5 global automakers for the decades to come, overcoming the problems from energy costs in Germany & Europe, and the turn to EV technology.

You can invest in auto-related companies through many brokers, and you can find here, on securities.io, our recommendations for the best brokers in the USA, Canada, Australia, the UK, as well as many other countries.

If you are not interested in picking specific automotive companies, you can also look into ETFs like iShares STOXX Europe 600 Automobiles & Parts UCITS ETF (EXV5), Fidelity Electric Vehicles and Future Transportation ETF (FDRV), or First Trust S-Network Future Vehicles & Technology ETF (CARZ) which will provide a more diversified exposure to capitalize on the quickly evolving auto and EV industry.

You can also check out our article about the “Top 10 EV Stocks To Invest In”.

Which Stock Listing?

The Volkswagen Group’s stock can be bought in US dollars under the VWAGY ticker and in euros under the VOW3.DE ticker. Which one to hold is mostly a choice, depending on your location and preferred currency.

Another option is to buy shares in Porsche SE (PAH3.DE), the holding Group of the Porsche family, which owns 31.9% of Volkswagen and 53.3% of voting rights, as well as smaller investments in many other companies.

Source: Porsche SE

This should not be misidentified with Porsche AG, the industrial company holding the Porsche brand and producing Porsche cars, and listed under the P911.DE ticker.

Porsche SE owns 12.5% of the total capital of Porsche AG. However the Volkswagen Group owns 75.8% of Porsche AG after the 2022 IPO, so it makes for a rather complex ownership structure, not uncommon with German industrial companies.

Family Ownership

The argument to favor Porsche SE’s stock over Volkswagen Group’s stock is that it is trading at an even deeper discount, despite (or due to?) the extra investment in the holding and the rather arcane and confusing ownership structure.

It is also a family-controlled holding company, which carries its own risks and should probably be favored only by experienced investors able to handle the added complexity.

Overall, any investor in Volkswagen Group’s stock or Porsche SE stock should be aware that both are essentially a family-owned company, which can bring advantages (alignment of the majority shareholder with the long-term future of the company), but also potential problems (respect of minority shareholders rights).