Powering The Nuclear Renaissance

When talking about green energy, solar and wind power are usually included, along with maybe geothermal. However, nuclear energy is increasingly being included. This is because nuclear energy is equally low in carbon emissions, which is the main reason for the push toward renewables.

It is also able to produce energy continuously and in a very predictable fashion, no matter the weather, something renewables are still struggling to do without expensive utility-scale battery packs.

And the need to decarbonize our power source is urgent enough that the massive amount of oil, gas, and coal, still the large majority of our energy mix, should also be replaced by available nuclear power, instead of waiting too long for battery technology maturity and deployment to be ready.

Source: Our World In Data

But nuclear power plants need to be supplied with uranium, a resource increasingly at the mercy of geopolitical adversaries of the West like China and Russia. Luckily, one country is picking up the slack: Canada.

Uranium As A Strategic Resource

Uranium has been a strategic resource since the dawn of the nuclear age, and the USA’s access to large amounts of ore was a key factor in the success of the Manhattan Project, which led to the development of the first atomic bombs.

The destructive power of the atom made the production or access to a sufficient amount of uranium a vital national interest for all the great powers, from the USA & The Soviet Union to France, the UK, China, etc.

After the end of the Cold War and the dismantling of parts of the nuclear arsenals, uranium became a more “boring” commodity, frequently supplied in large amounts to the USA and Western powers by Russia and former Soviet Union countries like Kazakhstan.

Today, a massive part of the world’s nuclear supply comes from Kazakhstan, often refined into usable fuel in Russia. The differential between the supply of mined and demand by nuclear power plants was caused by the uranium supplied by disarmed nuclear bombs.

Source: World Nuclear Association

A New Unstable World Order

The post-Cold War era is certainly over, with great powers like Russia and China challenging the US and its allies. This has a few consequences for the uranium markets.

The first is that the supply from atomic bomb dismantling, which had already slowed down drastically, is over. Not only that, but it is likely that nuclear weapons are going to be net consumers of uranium moving forward, especially with China rapidly building up a nuclear arsenal of up to 1,000 bombs by 2030:

“China is undergoing the most rapid expansion and ambitious modernization of its nuclear forces in history.

Compared to the PLA’s nuclear modernization efforts a decade ago, current efforts dwarf previous attempts in both scale and complexity.”

Pentagon Intelligence Arm Report

It should also be noted that this is still a lot smaller than the US and Russian nuclear bomb stockpiles, respectively, 3,748 and 5,580 warheads, maybe indicating that China will keep this effort or even accelerate it.

After all, at the peak of the Cold War, the Soviet Union had 46,000 warheads and the US 31,225, which explains why disarmament could provide the market with surplus uranium for decades post-1990.

Uranium As A Geopolitical Weapon

The supply of uranium to Western nations by Russia, using Kazakh and Uzbek ore, has been a hot topic since the beginning of the Ukraine war.

The US banned the import of Russian uranium in May 2024 (but authorized temporary exemptions), Niger (the world’s 7th largest producer) revoked the license of a major uranium mine belonging to the French company Orano after a pro-Russian coup in the country, and Putin said Russia is considering uranium export restrictions in September 2024.

In November 2024, Russia announced it would stop exporting uranium to the USA entirely.

This could be a big deal, as the USA imports a lot of the uranium feeding its nuclear power plants, with its largest suppliers being Canada (27%), Kazakhstan (25%), Russia (12%), Uzbekistan (11%) and Australia (6%).

Source: EIA

Kazakhstan’s main uranium miner, Kazatomprom, recently hinted that it might stop exporting to the West altogether due to sanctions on Russia making exports difficult logistically:

“It is much easier for us to sell most, if not all, of our production to our Asian partners — I wouldn’t call [out] the specific country . . . They can eat up almost all of our production or our partners to the north.”

Meirzhan Yussupov – Kazatomprom’s CEO

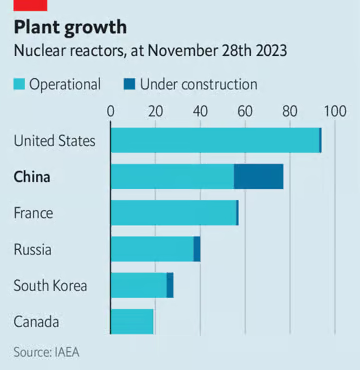

Kazatomprom’s declaration also comes in parallel to China’s plan to build a massive park of 100+ nuclear power plants for the decades to come, essentially guaranteeing rising Chinese demand, even without taking into account China’s nuclear weapon build-up.

Source: The Economist

Nuclear power plants supply the US with 19% of its electricity, almost as much as renewables (21%). So it is clear that a lot of Eurasian uranium supply will need to be replaced by more reliable and safe sources, and urgently.

Canada To Become The West’s Uranium Capital

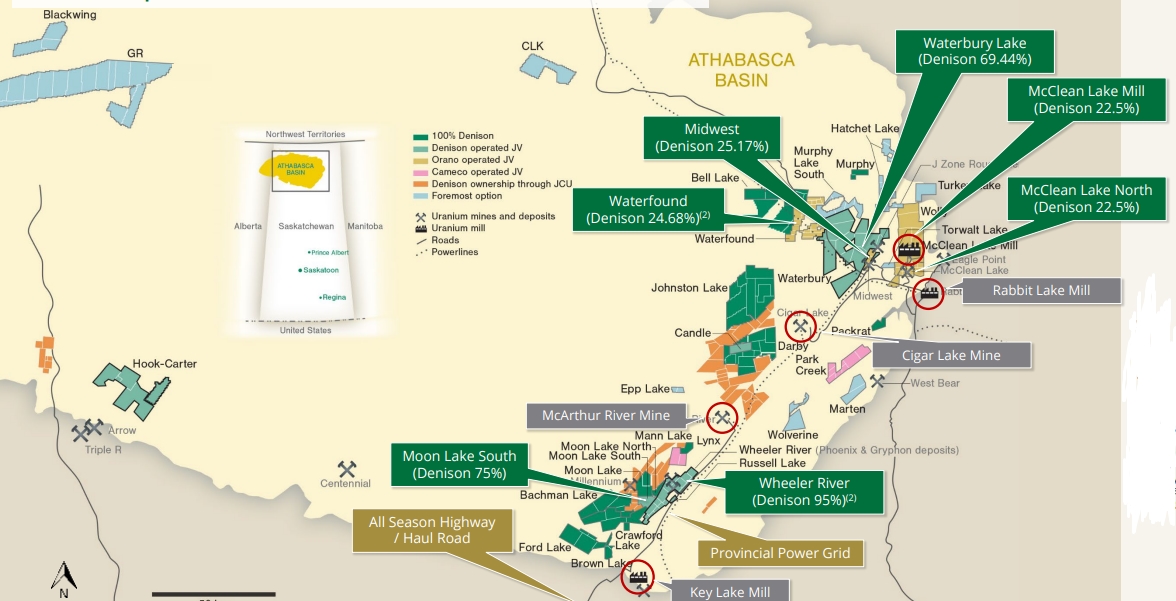

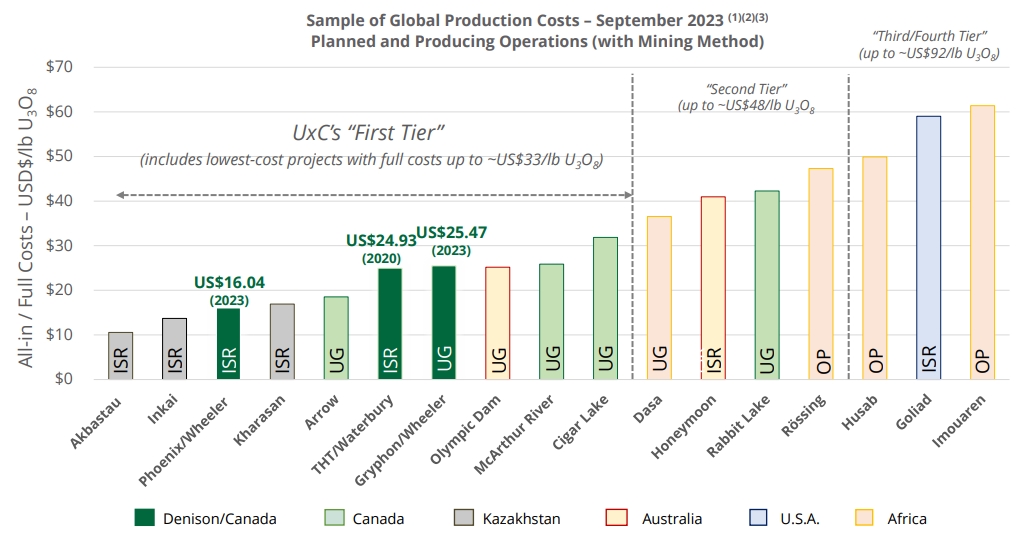

Canada, especially the Athabasca Basin in the northern Saskatchewan region, is very rich in uranium, with ore rich enough to be commercially viable. The high-grade ore generally makes production cheaper, more ecological, and easier to scale up.

Source: Denison

“Uranium can be found around the world, though it is heavily present in Canada, Australia, and Kazakhstan.

But what makes Canada’s Athabasca Region unique is that its uranium is especially high grade.“

Markus Piro – Professor of nuclear engineering at McMaster University on BBC.

This includes several active uranium mines like Cameco’s (CCJ +1.97%) Rabbit Lake and Mc Arthur River, and many other proposed mines.

Source: World Nuclear Association

The country also has several nuclear fuel cycle installations, that turn the raw uranium ore into richer usable nuclear fuel. So overall, Canada is already a one-stop shop for nuclear fuel, with the potential to keep growing bigger.

The large deposits in the Athabasca Basin and the growing demand for uranium have created a rush for new mining projects.

They are going to sit together with the existing massive production from Cameco, the 2nd largest uranium producer in the world, which we cover in detail in a dedicated article: “Cameco (CCJ) Spotlight: The Foundation of the Western Nuclear Renaissance”. Cameco also owns 49% of Westinghouse since 2022, making it both a Canadian uranium mining stock and a leading nuclear powerplant manufacturer.

New Canadian Uranium Projects

NextGen

NexGen Energy Ltd. (NXE +2.04%)

One of the largest future uranium mines in Canada is NextGen, a potentially massive mining company that, if fully cleared by regulators, could push Canada to become the world’s largest producer of uranium over the coming decade, knocking Kazakhstan out of the number one spot. By itself, it could provide up to 50% of Western supply.

This is a very ambitious project tapping into a massive deposit, which could make NextGen the world’s largest supplier of uranium.

Source: NextGen

Ultimately, NexGen’s uranium production is expected to be enough to power 46 million homes (1/3rd of the US), with 300 million tons of CO2 emissions avoided, or the equivalent of 70 million cars off the roads every years.

Denison Mines

Denison Mines Corp. (DNN +1.1%)

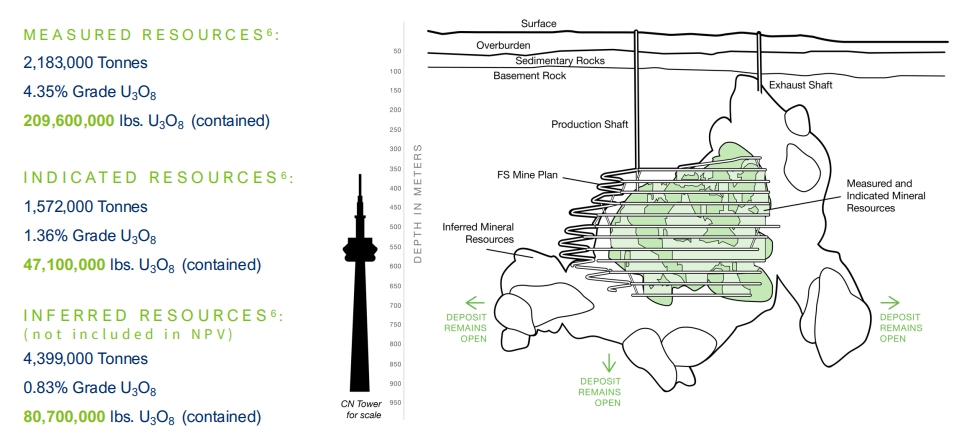

The company’s flagship project is the Wheeler River project, which includes the Phoenix and Gryphon uranium deposits. The first production is targeted for 2027-2028.

It owns 69.44% of the Waterbury Lake project.

A key feature of the Denison mines project is that they are forecasted to be very low cost, some even competitive with the very cheap-to-operate Kazakh mines.

Source: Denison Mines

The company also has an interest (22.5%) in the McClean Lake Uranium Mill & Mines. This facility processes 11% of the global uranium. It also already has approval for expanded tailing (mining residues), giving the potential to increase production in response to an increase in Canadian uranium production.

The company also has various minor participation in other uranium potential projects, including 22.5% in McClean Lake (Orano), 25.17% in Midwest (Orano), and 15% in Millennium (Cameco).

Paladin Energy

Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF (PDN +0.11%)

Contrary to many other Canadian junior uranium miners, Paladin is already producing some uranium from the Langer Heinrich Mine (LHM) in Namibia, which was put in care & maintenance in 2018 and restarted production in 2024. LHM is owned 75% by Paladin and 25% by the Chinese national company CNNC.

However, the core of the future business will be the Michelin Project, which will concern six uranium deposits, some of the largest in North America, with a total of 127.7Mlb of mineral resources.

And here too contrary to most Canadian uranium companies, Paladin Michelin Project is located in Labrador, in the East of the country. It is also doing exploration for projects in Australia (Mount Isa and Manyingee).

Source: Paladin Energy

Paladin is looking to acquire the Saskatchewan uranium developer Fission for C$1.1 billion, but the deal is for now slowed down by an extended national security review by Canada’s Minister of Innovation, Science and Industry.