The Backbone Of Videogames

As time passes, an increasing portion of our daily reality is becoming digital. Our social network moves partially online, we work remotely, and most of our entertainment comes from a screen.

This is definitively true with video games, which have evolved from a niche of children’s toys to a cultural phenomenon for all ages and a massive industry. And so, the importance of the tools to craft virtual content has grown in parallel.

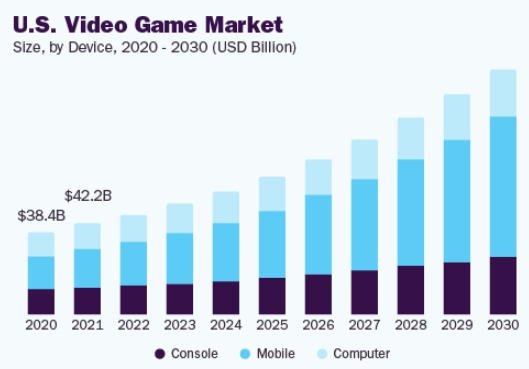

Today, the video game industry is larger than film, television, and music combined, with $1887.7B in revenues forecasted for 2024. In addition to its massive footprint in the entertainment markets, the industry is expected to continue growing at a 12% CAGR until 2030.

Source: Grand View Research

Videogames are also essentially universal among younger generations: among Gen Z (born from 1997 to 2012), 90% identify as gamers, among Generation Alpha, the youngest generation, it is 94%.

Most modern videogames are built using a handful of so-called “game engines”. These dedicated software programs provide the framework and tools for content developers and programmers to articulate smoothly their work together, without having to reinvent the wheel for every project.

As a result, game engines, commercial or developed in-house, have become the center of most video game development. 60% of game developers utilize a game engine of some sort today, and virtually all large commercial projects and 3D video games use one.

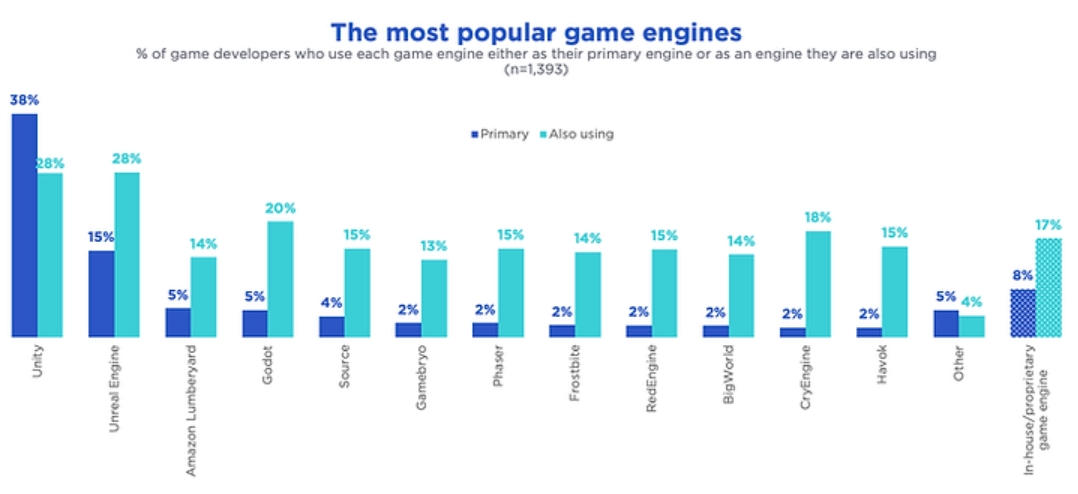

Source: Slash Data

Today, one game engine is especially dominant: Unity Technologies.

Unity Technologies

Unity Software Inc. (U -1.82%)

History of Game Engines

Historically, the first video games were directly developed by programmers using various coding languages. This was a tedious task requiring a lot of talent, and it was not necessarily the most efficient way, as it made every game a custom project requiring the building of everything from scratch.

Instead, a game engine provides a stable framework for simulating physics, managing collision between virtual items, 3D modelization, menus and saving systems, multiplayer connectivity, payment systems, download updates, etc.

The first engine was often an in-house system reusing what was previously developed for a game. For example, the smooth side-scrolling engine developed by Nintendo for the Nintendo Entertainment System (NES) that would be used for Super Mario Bros.

Progressively, it became an industry habit to license the engine used for other games made by other companies, changing only the “visible layer” to create a new game.

A pioneer of this approach was Epic Games and their Unreal engine, initially developed for the Unreal shooter game, but soon becoming a massively popular tool among videogame developers.

Source: Unity

The Game Engine Wars

The Unreal engine, first developed in 1998, was among the first ones to gain massive use, thanks to its high 3D image quality and having been developed for shooters, one of the most popular game styles of all time.

Unity was first released in 2005, focusing not so much on top-of-the-line performance like Unreal, but instead making game development easy for developers of all possible backgrounds.

Unity’s user-friendly interface and extensive documentation were an immediate hit. It also supported independent developers who did not have the budget to license hundreds of thousands of dollars for commercial game engines of the time.

Another important factor in Unity’s success was the early realization of a bright future for casual gaming, at a time when the industry focused on ever-improving performances. Browser support helped boost usage rate, quickly boosting Unity use for web-based games, competing directly with Flash.

It also quickly added another important feature, the possibility of cross-platform development, helping developers bring their finished games to multiple gaming hardware: to Mac and iPhones in 2007, to Windows phones and Blackberries in 2012.

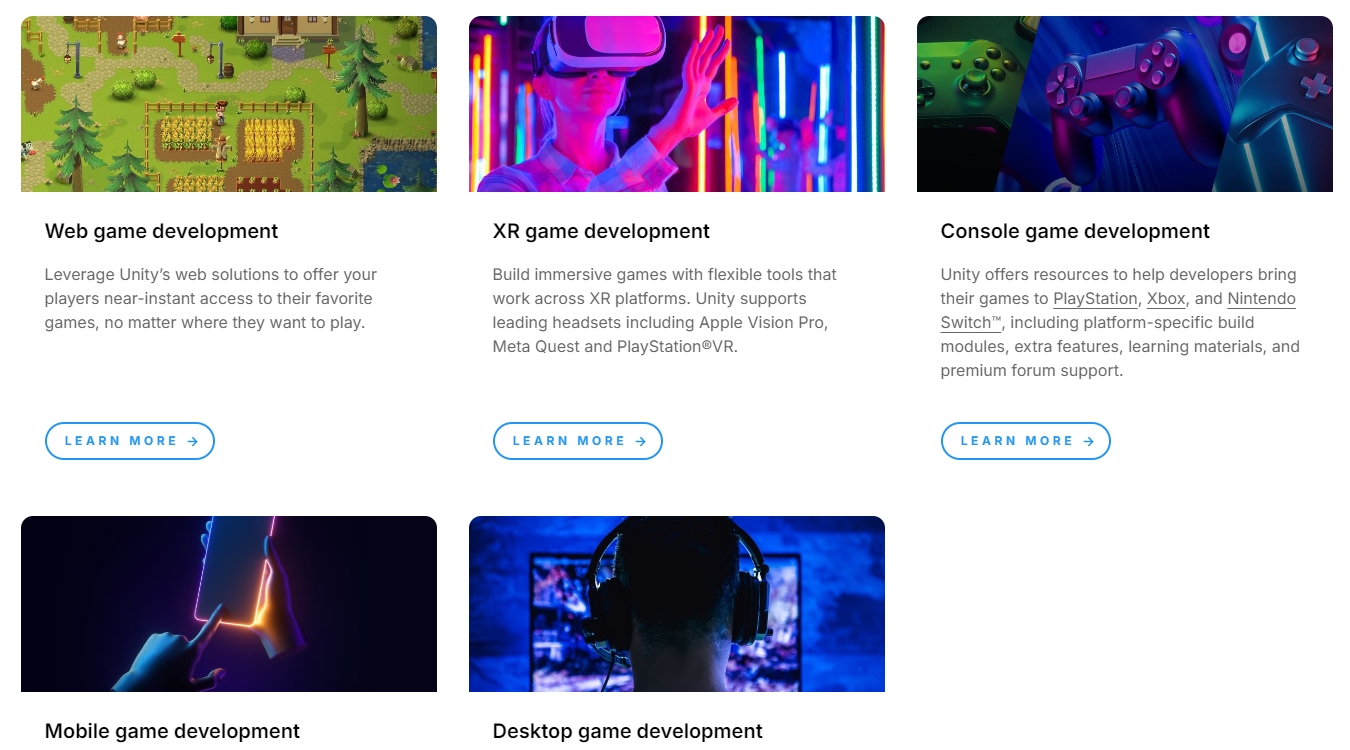

Today, Unity-made games can be deployed on virtually all PCs, smartphones, gaming consoles (including the normally insular Nintendo), VR headsets, and even smart TVs.

Source: Unity

Overall, it can be said that despite some better results on higher-end graphics and better performance optimization of the Unreal engine, Unity’s ease of use and learning curve have served it well and helped it become the dominant game engine in the industry.

This is despite plenty of competition, including many free and/or open-source options.

Source: GitHub

38% of game developers who use game engines use Unity as their primary engine. The next most popular game engine, Unreal Engine, has only 15% usage as a primary engine.

Source: Slash Data

(you can read more about Unity’s early history in this paper written by John Haas)

Unity Overview

Unity allows us to bring all the elements of a game into one place and have them interact with each other in the intended way. This includes 3D models, textures, special effects, programs/scripts, player accounts, saved files, etc.

The software also offers a comprehensive set of tools to perfect the game and interact with other programmers, including:

- A bug tracker.

- Discussions and forums.

- Case studies and Webinars.

- Tutorials & online classes.

- Asset store (see below).

Unity 6.0 has been released in October 2024.

Source: Unity

This new version brings several improvements:

- Better performance & visuals, especially for mobile games (the majority of today’s gaming market).

- Simpler creation of multiplayer games.

- Possibility to run Unity project in mobile browsers.

- RunTime AI, allowing for the detection of real-world inputs (camera, microphone, and motion sensors) and adaptative gameplay.

Pricing

Until 2016, Unity was sold as a standalone software license. It has since then moved to a subscription model, following a global trend in the software industry initiated by Adobe (ADBE -0.15%).

The current pricing plans range from free (for students and teachers) to €170.00/month for the pro subscription, a per-seat price for enterprise, and €414.00/month for industry and access to non-game focused tools.

At the end of 2023, the company faced a brutal backlash from its customers for a new fee it was considering establishing. The so-called runtime fee has since been canceled (see below for a more detailed explanation).

Asset Store

Another important innovation of Unity, later replicated by its competitors, was the asset store.

While videogame developers often create from scratch their own programs and 3D models, they sometimes prefer to buy a premade one to save time and money.

This can include a lot of premade digital assets that game developers can buy and directly use with little effort. Why pay someone $200 worth of work hours to recreate something available for $20 in the Unity Asset Store?

This can,, for example,, include a 2D or 3D model, music and sound effects, light effects, and even an entire template for a game genre (card game, platformer, shooter, etc.).

Source: Unity

While Unity is far from the only game engine with such an offer, it is by far one of the most extensive available.

This model creates a new type of user for the software, who creates assets for game developers but no game themselves. This also allows game developers to make extra revenues from their game assets.

This concept even created the rise of a new type of game, often developed by a single person or a very small team, where gameplay, writing, and ambiance are the most important things, and all visual and sound assets are bought pre-made.

Overall, Unity collects 30% of all transactions in the Asset Store, creating an extra revenue stream while also further locking the game developer in the Unity ecosystem.

Game Publishing

As a core business partner for many, if not most, game developers, Unity has also expanded in the publishing business through its Supersonic department. Games published by the department have accumulated 5.7 billion installations, with 185 million monthly active users.

This activity seems to be solely focused on mobile gaming. This is definitely a segment where Unity is dominant, with 70% of the top 1,000 mobile games made with Unity.

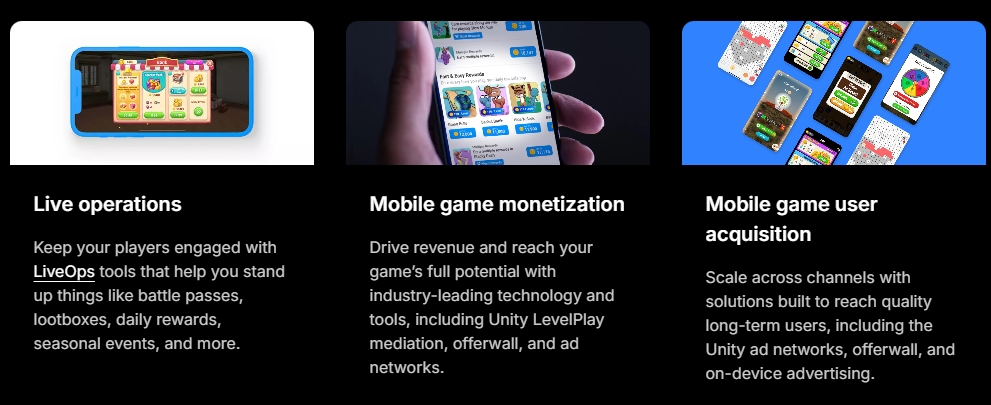

Source: Unity

Unity Grow: Ads & Marketing

The historically strong presence of Unity in mobile gaming made it latch early on to the marketing side of the business.

While PC and console gaming might be more reliant on hype, gaming journalists, influencers, platform promotion (Steam), etc., mobile gaming tends to be a much more marketing/acquisition-heavy business model.

82% of the top 100 games use Unity to grow their games.

Unity’s offering includes not only monetization & engagement tools (in-game currency, lootboxes, A/B testing, in-app purchase, etc.) but also marketing tools (ads, user analytics, etc.), including Aura, an on-device platform integrated into the OS of over 1.9B+ devices by the phone operators.

Source: Unity

Unity Industry: Non-Game Businesses

The origin and core business of Unity is still focused on video games. However, 3D tools are increasingly important for plenty of other design tasks, especially in the industrial field.

Source: Unity

To leverage pre-existing Unity assets, as well as integrate itself into industrial companies workflow, Unity has created the Pixyz plugin, which integrates the “main” Unity with CAD and 3D models like Blender or Maya, making it compatible with 70+ file formats.

Source: Unity

The system also leverages the already existing Unity Cloud & Unity Server services for data storage, collaboration of large and potentially remote teams, and quality insurance.

This is a relatively new segment for the company, but where it is already meeting some serious success, like with Volvo. The automotive company (now part of the Chinese Geely) created a “product simulator” in Unity, for rendering, animation, dynamic content, and scene creation at various stages of production.

“Like many automotive OEMs, Volvo Cars relied on expensive prototypes to communicate designs as they progressed. With Unity, it only needs to create these physical models at certain milestones.

In between we use virtual experiences to iterate and do research and user testing to see what we want to push into production,”

Timmy Ghiurau – Innovation Leader, Virtual Experiences at Volvo Cars

Virtual reality is playing a big part here, as designers and engineers are actually catching up to the progress made by the video game industry. Unity also provides industrial companies with the “Industry Success” program, a 300-hour training program, and a direct point of contact in Unity to smooth out any onboarding issues.

Source: Unity

This segment is viewed as an important source of future growth by the company.

We are beginning to achieve global scale through partnerships with global system integrators (GSIs), distributors, and value-added resellers (VARs) in every region. New Unity customers in the quarter include Dutch airline KLM and Deutsche Bahn, the national railway company of Germany.

These last 2 contracts illustrate the potential for Unity far beyond gaming:

- KLM used Unity to build a VR cockpit training application that allows pilots to practice, hone their skills, and enhance situational awareness

- Deutsche Bahn used Unity to build guided customer experiences in AR to help passengers navigate transit changes and created VR environments for staff training, including fire safety & railway interlocking system simulators for train dispatchers.

Financials

Total revenues for the company in Q3 2024 were $447M. Of these revenues, the largest segment was, maybe surprisingly, not the “Create” segment (the game engine), at $132M, but the “Grow” segment at $298M.

Adjusted EBITDA was $92M in Q3 2024, with a large net loss of $124M.

Among the drivers of this loss from a positive EBITDA were large stock-based compensation expenses ($105M), and amortization of intangible assets expenses ($88M), mostly from previous acquisitions of mobile ads companies.

A Self-Inflicted Wound

Unity’s stock price and reputation are still recovering from a PR disaster triggered by the announcement of a new fee structure in September 2023.

The new fee looked to charge Unity game developers as much as $0.20 per installation of the game. The fee was going to be charged when sales reached a threshold of $200,000 in revenue over 12 months and 200,000 total installments.

This immediately created a massive backlash for a few reasons:

- The metric would be impossible to measure by the developers, becoming something Unity would have to be trusted to not manipulate in its favor.

- Cheap games, especially “indies” (independent developers) usually selling for a lower price would be badly affected. Free-to-play mobile games would be badly affected too.

- This fee would trigger every time someone reinstalled the game on their computer or mobile, potentially leading to some developers losing money with their most active users.

- As the videogame industry is increasingly a hot spot of the culture war (the anti-woke “Gamergate 2.0“), this could also have been used as a way to directly make targeted companies lose money, with activists & influencers encouraging their followers to simply install and remove the game repeatedly thousands of times.

- Pirated copies would also likely trigger the fee, meaning that pirates would not only become lost revenues but an actual financial drain on developers.

This unilateral brutal change of business model, on top of a monthly subscription, led many to look for alternatives or cancel their plans to use Unity in the future.

Healing The Damages

Ultimately, the company’s CEO would be fired a month later. The new fees would finally be officially canceled in September 2024, more than a year later. To compensate, the cost of Unity Pro subscriptions will rise by 8%, and Unity Enterprise subscriptions will rise by 25%.

The repercussions of this disaster are still echoing in the company’s management team, with a new CTO in October 2024 and a new CFO starting on January 1st, 2025. Clearly, the company’s board and shareholders have decided that everyone responsible for these decisions and waiting a year to cancel the fee had to go.

By now, the company is putting this episode behind it, and the PR storm has calmed down. It, however, points out that the company does not have unlimited pricing power and will likely have to rely solely on subscriptions and revenue sharing from marketing tools for its future income.

AI

Compared to the rest of the tech industry, Unity looks like it has been a little slow in embracing AI technology.

In large part, this is likely due to management being distracted by the installing fees controversy. Another element is that using AI for game development is actually rather controversial, both among developers and gamers.

The criticism is that it would encourage a reduction of further human touch and make AAA games (the largest productions) even more similar to each other. It could also encourage studios to fire employees in an industry already experiencing a downsizing trend.

In general, this debate overlaps the discussion over the use of AI in art, with most gaming enthusiasts and professionals seeing videogame as an art form.

“The people who are most excited about AI enabling creativity aren’t creatives.

The suspicion among workers is that bosses see AI as a path to cutting costs when labor is their biggest expense. Rather than creating their own material, artists worry they could end up supplementing AI’s efforts, rather than the other way around.

Jess – a member of the Independent Workers Union of Great Britain’s game workers branch on BBC

Still, Unity will not lag behind its competitors either, and is planning a “more fundamental data infrastructure and machine learning work for a 2025 launch”.

The company’s AI roadmap includes:

- Muse: an AI-powered chat, code generation, and generative asset tool, to create textures, 2D sprites, animations, etc.

- Sentis: a neural engine that runs AI models to unlock automated game agents, object recognition, speech-to-text, etc.

Conclusion

Unity is a global leader in game development engines, with a significant advantage in the largest segments of the markets, like mobile games.

It is also good at getting beginner solo or indie developers used to their tools early on, with their habit, skill, and experience honed early on Unity, making switching to another system later in their career a difficult move.

The company is also making quick progress in entering non-game markets, especially industrial design and VR training & customer experience.

It is, however, still an unprofitable company due to high R&D costs to keep up with competitors like Unreal Engine. So, investors in the company will need to judge the potential of the non-game segment for future growth, as well as the pricing power of the company in the gaming segment.