Scaling back operations, chasing profitability over investor funding and divesting from acquisitions has resulted in the Middle East’s first unicorn finally turning profitable.

Egypt-born ride hailing app SWVL has survived a turbulent time during which the Nasdaq-listed startup faced the possibility of being delisted.

SWVL was valued at $1.5 billion when it went public in 2021 but saw its market cap tumble and stock price fall by approximately 99 percent – to about $5 million – within a few months.

Thanks to “ruthless” corrective measures including downsizing, the market cap now stands at $73.5 million. However, the stock price is still 95 percent below its peak.

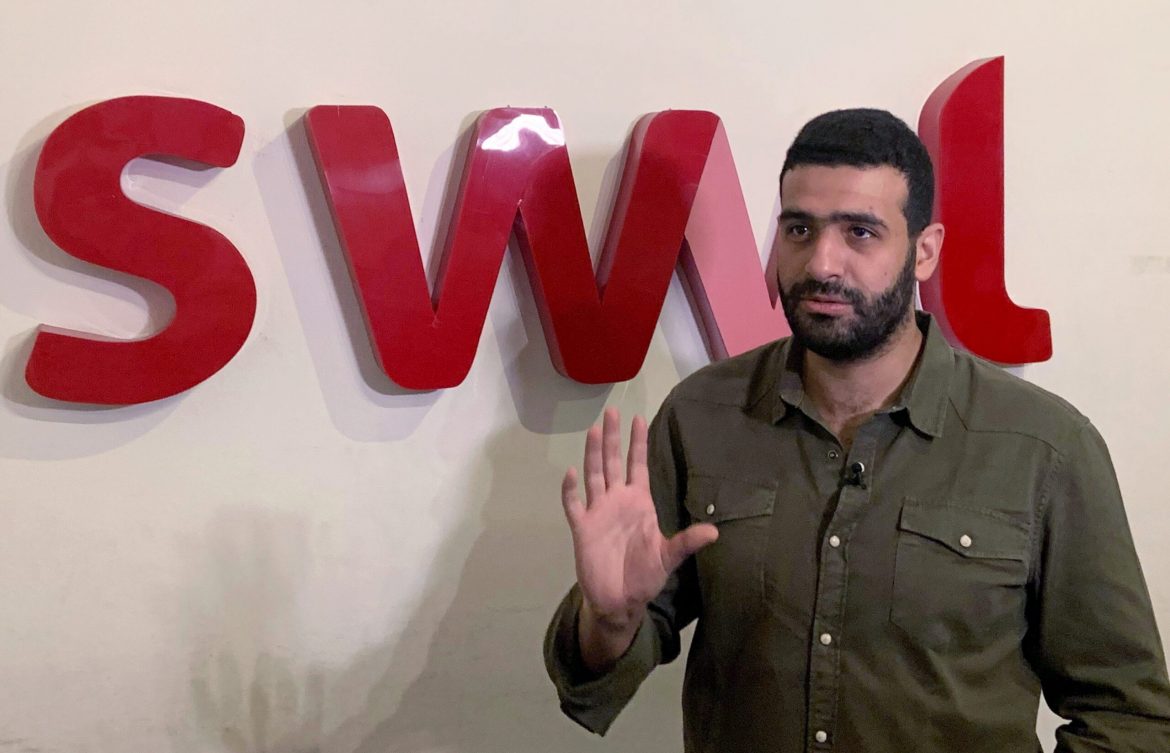

“Hindsight capital is the best investor,” Mostafa Kandil, co-founder of SWVL, told AGBI.

“I still think listing on Nasdaq was a good idea. It is the deepest pocket in the world.

“There was no private capital available then and the only way to raise capital was by going public.

“And we weren’t at a scale that could allow us to turn profitable at the time. So if I went back I’d do exactly the same,” he said.

- Careem could yet be hailed a smart buy for Uber

- MBC Group buys stake in Anghami

- Borse Dubai to sell $1.6bn stake in Nasdaq

SWVL went on an acquisition spree in 2022 and expanded into Europe, Latin America, Mexico and Asia.

It has since unwound its $40 million takeover of Volt Lines (Turkey), sold its Latina American subsidiary Urbvan for $12 million, terminated its $100 million acquisition of UK-based Zeelo and shut down its operations in Pakistan.

“We’ve done well in expansions by becoming a household name from Argentina to Pakistan. Our problem was that we expanded before getting the money,” Kandil said.

Reuters/Ehab Farouk

Reuters/Ehab FaroukSWVL is focusing on Egypt, Saudi Arabia and the UAE as its key markets and has shifted its business model from B2C to predominantly B2B.

About 70 percent of its business comes from companies, schools and government bodies that use SWVL’s software or transportation services.

While the founder will not be “chasing investors” to sustain the business, he believes venture capital still has a place in the market.

SWVL received $170 million in VC funding across five rounds and many of its investors, including Dubai’s Beco Capital, Kuwait’s Agility, UK’s Zouk Capital and Bahrain’s Zain Ventures, are still involved.

Watch the video to learn more about the highs and lows of SWVL’s evolution.