Trade Wars

With the new US presidency, a different type of international policy is going to be conducted, reminiscent of some aspects of Trump’s first four years as a president. Back then we saw, as today, trade wars, mostly with China, and a focus on tariffs and sanctions to force the hands of allies and foes alike.

However, this time feels different for a variety of reasons. From threats to annex Canada and Greenland, the ongoing war in Ukraine driving a strong division between the USA and the EU, and a much more assertive China, it feels like the pressure is ramping up much higher and quicker than in 2017.

So investors should pay even more attention this time, and keep track of existing and future tariffs, and their effect on international trade, the financial market, and maybe even the stability of major currencies.

Overall, the US has seen consistent and growing trade deficits since 1974. And it contributed greatly to the US de-industrialization, a major driver in dissatisfaction in so-called flyover states which form the base of Trump’s electorate.

Source: Visual Capitalist

Over the last 30 years, the trade deficit has increasingly been less about fuel imports and more about manufactured goods, while the US is positive in trades of services.

It seems Trump’s preferred method to tackle the problem of trade deficit will be tariffs, aka import taxes. You can learn more about the topic in “What is a Tariff, and How Do They Work?“.

What Trump Did So Far

First Surprising Tariffs

When everyone expected tariffs on Chinese goods early on, markets were caught by surprise at the harsh treatment reserved for Mexico and Canada. On February 1st, 2025, the White House imposed 25% tariffs on all goods imported from Mexico and Canada, and only 10% on China. An exception was made for energy from Canada (mostly oil) at 10%.

The reason claimed for the higher tariffs on America’s neighbors was the trafficking of fentanyl and other drugs, as well as illegal immigration.

According to Trump himself, the trade imbalance with these countries is “taking advantage of America and needs to stop”.

In 2024, the US trade deficit with Canada was $63.3B and with Mexico $171.8B. This brings the total for North American trade to $225.1B, a significant part of the overall $918.4B trade deficit of the US in 2024.

This also confirms a general belief by Trump that tariffs are a powerful tool, and was a successful strategy during his first mandate. So more of the same is to be expected.

“In response to China’s intellectual property theft, forced technology transfer, and other unreasonable behavior, President Trump acted with conviction to impose tariffs on imports from China, using that leverage to reach a historic bilateral economic agreement.”

The Tax Foundation estimated that these tariffs, if maintained, would increase federal tax revenue by $880B from 2025-2034 for the North American tariffs, $241B for Chinese tariffs.

Steel And Aluminum

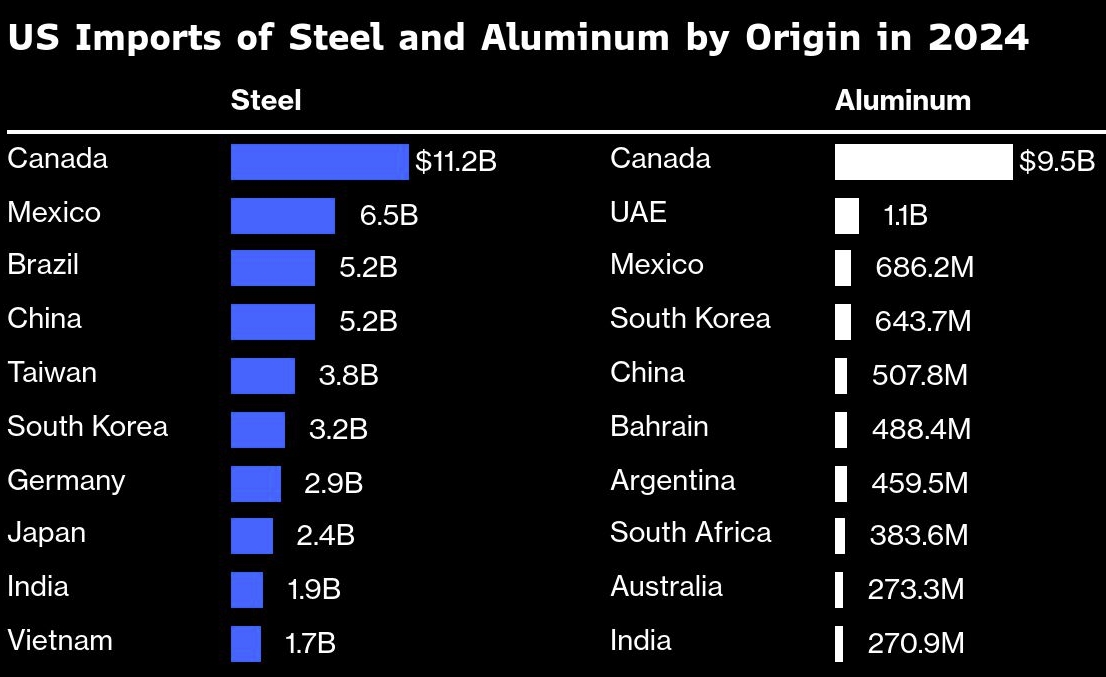

Imports of steel and aluminum are also ramping up from the previous 10% to 25%. The US imports most of its steel from Canada, Brazil, Mexico, and South Korea.

Source: Mining.com

Another change is that the tariffs will more broadly strike metal products, in order to suppress methods used to bypass the existing tariffs, like importing minimally processed Chinese and Russian metals or fabricated structural steel, aluminum extrusions, and steel strands for pre-stressed concrete.

“The steel and aluminum tariffs 2.0 will put an end to foreign dumping, boost domestic production, and secure our steel and aluminum industries as the backbone and pillar industries of America’s economic and national security.”

Peter Navarro – Trump’s trade adviser

Regarding aluminum, the main loser is Canada, by far the largest exporter of aluminum to the US, followed by the United Arab Emirates.

Fair Trade

Overall, the Trump administration clearly sees any US trade deficit as “taking advantage of America” and will fight aggressively against “unfair trade barriers”. This is the core of the “Fair and Reciprocal Plan” revealed on 13th February.

“Gone are the days of America being taken advantage of: this plan will put the American worker first, improve our competitiveness in every area of industry, reduce our trade deficit, and bolster our economic and national security. “

In the same announcement a few examples were given that are most likely going to be the first targets to be hit:

- Brazilian tariff on US ethanol at 18%, versus the US’2.5%.

- India’s 39% on US agricultural products, versus the US’ 5%.

- India’s 100% on US motorcycle products, versus the US’ 2.4%.

- EU’s ban on most US shellfish, “despite committing in 2020 to expedite approvals for shellfish exports”.

- EU’s 10% on US cars, versus the US’ 2.5%.

This is not by far the whole list, which might run in the 6-digits.

“A 2019 report found that across 132 countries and more than 600,000 product lines, United States exporters face higher tariffs more than two-thirds of the time.”

This focus on matching other countries’ tariffs might ultimately hurt the most developing countries like India and Brazil, as well as the EU, Canada, and Mexico.

Source: India Today

As a reminder, during his electoral campaign, Trump had considered a 60% tariff on goods from China and a tariff of up to 20% on everything else the United States imports.

EU And the VAT Question

The discussion around “fairness” raises an interesting question of what is or is not a trade barrier. Tariffs are pretty straightforward, but what other forms of taxes?

This is especially important regarding VAT (Valued Added Tax), a form of consumption tax leveraged by most European countries, most of the time above 20%, accounting for 18.6% of total tax revenues in the EU.

Source: Tax Foundation

“For purposes of this United States Policy, we will consider Countries that use the VAT System, which is far more punitive than a Tariff, to be similar to that of a Tariff.”

President Trump

The argument to consider is a tax on imports is that it reduces the attractiveness of imports in these countries. Another argument is that for example, a Volkswagen exported from Germany to the US does not see its price increased by VAT in the US, while a US-made Ford imported in Germany does.

However, the argument is debatable, as the Volkswagen made and sold in Germany is submitted to the same VAT as the imported American Ford.

This still presents a severe problem for all countries with a VAT system. On one hand, they are unlikely to dismantle the source of 1/5 of their taxes and a long-established system embedded into the economy.

On the other hand, Trump’s perception of VAT as equivalent to tariffs could trigger massive retaliation, likely collapsing the trans-Atlantic trade volume.

Retaliations

China

While they might help re-balance the trade deficit, tariffs are also equally likely to cause retaliation.

Already, China announced that increased tariffs will hit US exports:

- 15% on US exports of coal and liquefied natural gas.

- 10% on oil, agricultural machinery, and large motor vehicles.

Probably more consequential, China also announced non-tariff retaliations. This includes export controls on products related to five critical minerals: tungsten, tellurium, bismuth, molybdenum, and indium.

These non-tariff retaliations can have far-reaching consequences, especially for minerals like tungsten which are crucial for semiconductor manufacturing, tank armor, ammunitions, rocket & missile engines, etc. (follow the link for a dedicated investment report on tungsten, with a stock that doubled on the new of Chinese counter-sanctions).

“Customers are in a state of disbelief following Beijing’s move on Tuesday.

Our economy, manufacturing, defense, everything, is so dependent on it. And yet, Russia, China, and North Korea have about 90% of the output.”

Lewis Black – CEO of Almonty Industries, an out-of-China tungsten miner

Overall, these sanctions on rare earth and critical metals should hit the productive capacity of the US defense, aerospace, semiconductor, and renewable industries the most.

Canada

Canada has already vowed to retaliate against the tariffs.

The new tariffs were “entirely unjustified. Canada will give a “firm and clear” response to the latest trade barriers planned by US President Donald Trump”

Justin Trudeau – Canada Prime Minister.

On February 1st, the Government of Canada announced it is moving forward with 25% tariffs on $155 billion worth of goods.

The first phase will include tariffs on $30 billion in goods imported from the US, including orange juice, peanut butter, wine, spirits, beer, coffee, appliances, apparel, footwear, motorcycles, cosmetics, and pulp and paper.

Further tariffs could apply to passenger vehicles and trucks, including electric vehicles, steel and aluminum products, certain fruits and vegetables, aerospace products, beef, pork, dairy, trucks and buses, recreational vehicles, and recreational boats.

Mexico

The same response is happening with Mexico.

“I’ve instructed my economy minister to implement the plan B we’ve been working on, which includes tariff and non-tariff measures in defense of Mexico’s interests.”

Claudia Sheinbaum – President of Mexico.

The Mexican president was also outraged at the accusation of Mexico’s government having an “intolerable alliance with drug trafficking groups”.

It is not clear yet what level of retaliatory tariffs will be enacted and on which goods. USA’s largest exports to Mexico are corn, refined oil, and medical equipment.

The US State with the most exports to Mexico was by far Texas ($234B), followed by California ($36B), although the most exposed in the percentage of total exports was New Mexico (around 70% of all exports).

EU

The European Commission vowed to react “immediately” to Trump’s tariffs.

“Unjustified tariffs against the European Union will not be left without a response. We will take proportional and clear countermeasures.”

Ursula von der Leyen – EU chief executive

Maybe more concerning for US-EU trade is that the EU has strengthened its legislative and diplomatic arsenal regarding trade wars since Trump’s first presidency, notably its “Enforcement Regulation” and the “Anti-Coercion Instrument”.

In 2018, the counter-tariff mostly focused on symbolic products like Harley-Davidson motorbikes and bourbon whiskey.

This time, Big Tech might be the target, including Elon Musk’s X.com, especially as the EU buys a lot of digital services from the USA and is looking to better control the influence of foreign tech companies and social media.

“Those who say the EU is ill-prepared are wrong: During the past term, we have prepared ourselves exactly for a scenario that is unfolding at the moment. Because we have expanded our toolbox, we can now better defend our interests.”

Bernd Lange – Chairman of the European Parliament’s trade committee.

However, the actual activation of these tools is yet to be seen, as a qualified majority of 15 out of the EU’s 27 member countries would be needed.

Asia

So far, the Japanese government has requested that Washington exclude Japan from the targets of steel, aluminum, and reciprocal tariffs. It has however restrained from threatening to retaliate.

South Korea is likely to be less affected as 98% of its trade with the U.S. is tariff-free under the U.S.-Korea Free Trade Agreement. However, the growing trade war could have indirect consequences:

“If the US places tariffs on Canada and Mexico, all of the Korean companies who have invested in those regions will be hit hard,”

(according to a Ministry of Trade, Industry and Energy)

More than about tariffs, Taiwan is looking nervously at Trump’s declaration that “Taiwan had taken semiconductor chip business away from the United States and that he wanted it back“. The response has been very conciliatory, with Taiwan vowing to make more investments in the US chip industry.

India has previously been described by Trump as “a tariff king and a big abuser of trade ties“. No retaliation has occurred yet, but top US exports to India include crude oil and petroleum products ($14bn), LNG, coal, medical devices, scientific instruments, scrap metals, turbojets, computers, and almonds.

The Greater Context

US Vs. China

Trump’s trade wars cannot be understood in a vacuum, and need to be observed in the overall international context.

With the emergence of China as an alternative superpower, many countries are seeing their economic interest realigning away from the USA.

Since the end of the Cold War, China has become the most important trade partner for most of the planet, with the exception of Mexico, Canada, and Western Europe. A reduction of trade with the US following the tariffs might make these countries trade more with China as well soon.

Source: HowMuch

A New World Order

Another way to interpret the current situation is parallels to the 1930s when the 1929 economic crisis triggered a wave of mercantilism all over the world, driven in large part by retaliatory tariffs.

At the same time, the trend of de-industrialization in the US, and the West at large, has been largely driven by decades of globalization. It also created a destabilizing effect on society, impoverishing large regions and entire social classes, and fueling inequality and populism.

“The threat that I worry most about vis-a-vis Europe is not Russia, not China, it’s not any other external actor. What I worry about is the threat from within, the retreat of Europe from some of its most fundamental values.

When we see European courts canceling elections and senior officials threatening to cancel others, we need to ask whether we’re holding ourselves to an appropriately high standard.

Vice President JD Vance

When put in parallel to the possible partial conquest of Ukraine, harsh criticisms of the EU delivery by Vice-president Vance, talks of the US annexing Greenland from Denmark, a NATO ally, or even the invasion of Canada, this put the tariffs and trade wars as one part of a greater destabilization of the global international system.

“Canada should become our Cherished 51st State. Much lower taxes, and far better military protection for the people of Canada — AND NO TARIFFS!”

President Trump

Winners & Losers

As the US engages in trade wars with the entirety of the world, this will have far-reaching consequences, some apparent, some only clear later on. So this is the occasion for investors to review their portfolio in time and adapt to the incoming consequences of tariffs and trade wars.

North America

In the US the industries the most likely to benefit are local manufacturing, especially vertically integrated operations (no import of parts or material), with its imported competitors now much more expensive.

In reverse, US exporters, including ethanol and corn producers or US energy like LNG, might suffer from retaliatory tariffs.

In Canada, the most impact will likely be felt by the steel and aluminum industry, as well as all their suppliers. The impact will likely also be felt across the economy, as the USA represents the destination of 77% of traded Canadian goods.

For Mexico, the consequence could be far-reaching as well, with the possible move back of factories to the USA, including car factories, as well as damages to the Mexican agricultural sector.

China & Strategic Minerals

For now, the 10% tariff is likely to have only a moderate impact on USA-China trade.

The most likely immediate consequence will be on the industries the most impacted by export limits on critical materials, including the chip industry Trump wants to repatriate to the USA, as China often controls 80-95% of the supply chain.

Alternatively, non-Chinese producers of these minerals might suddenly be able to command a premium for their products, thanks to the more reliable supply they can offer for strategic materials.

Asia

In broader Asia, the economy of high-tariff countries like India is likely to be impacted heavily, as they will either have to see their exports decline or open their local market to new competitors.

ASEAN nations, especially Vietnam, Malaysia, and Indonesia, which had boomed from re-exports of Chinese goods, and factories moving from China to the SE-Asia might be impacted as well.

This comes on top of up to 271% tariffs on solar panels from the region, put in place by the Biden administration.

The impact on Japan’s and South Korea’s economies might be a bit more muted, mostly concentrated on the steel industry.

Similarly, Taiwan’s main focus will be to navigate policies around chip manufacturing, more than tariffs.

EU

The EU is in a complicated position regarding its relations with the US. It has long been depending on America to be a security provider to the continent, including in its support of Ukraine against Russia.

As the new administration is openly cutting off the Europeans from its negotiations with Putin, the trade tensions are just another element weakening the relationship between the two main parts of the Western alliance.

At the same time, it is yet to be seen how the EU will manage the fact that some of its members are much more friendly to the USA than others (potentially paralyzing retaliations), as well as its elite’s deep opposition to Trump’s politics, domestic and foreign.

Rest Of The World

Some specific companies in South America are likely to be impacted by the tariffs, notably steel companies in Brazil. The export of agricultural goods from Brazil and Argentina could be impacted as well.

Gold

In this context of increased tensions, it is important to remember one of the root causes of the US trade deficit. As the provider of the dollar, the world’s reserve currency, the US is trapped in the so-called Triffin Dilemma:

Robert Triffin believed the dollar could not survive as the world’s reserve currency without requiring the United States to run ever-growing deficits. A popular reserve currency lifts its exchange rate, which hurts the currency-issuing country’s exports, leading to a trade deficit.

The growing influence of China, the seizing of Russia’s currency reserves in 2022, and the growing US national debt are all slowly eroding the position of the US dollar.

As a consequence, gold and bitcoin surged, as they are both candidates for becoming an alternative reserve currency without counter-party risk or any specific nation controlling it.

Source: Gold Price

Bitcoin Price – Source: Google

Conclusion

So far, the willingness to impose tariffs by the Trump administration has mostly been met with an almost equal willingness to push back and retaliate, including from close allies of the USA.

This is likely going to redistribute the cards of international trade, with two likely final outcomes: either an acceleration of deglobalization or a turn of the rest of the world to other trade partners, especially China.

In the long run, the tariffs and trade war might, however, significantly contribute to the re-industrialization of the USA, especially in industries like metallurgy, automotive, shipping, semiconductors, etc.

Only time will tell if this was worth the price, especially as this could weaken the role of the dollar as the global reserve currency at a crucial junction in history.