Between July 2023 and June 2024, the UAE received over $30 billion in crypto, ranking the country among the top 40 globally

The Middle East & North Africa (MENA) region ranks as the seventh-largest crypto market globally in 2024, with an estimated $338.7 billion in on-chain value received between July 2023 and June 2024, accounting for 7.5 percent of the world’s total transaction volume, a new report said on Wednesday.

Although the market is smaller compared to other regions, MENA includes two countries ranked in the top 30 of the global crypto adoption index: Türkiye (11th) and Morocco (27th), capturing $137 billion and $12.7 billion of value received, respectively.

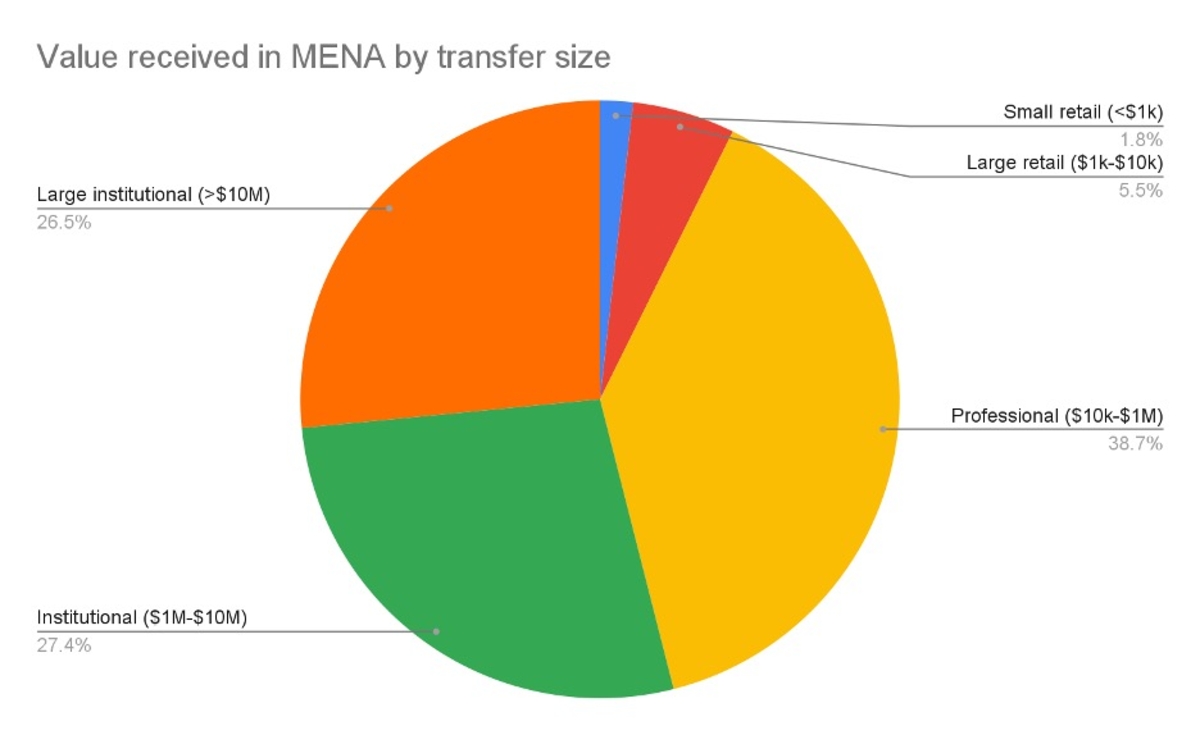

Institutional and professional-level activity drive most of the crypto activity in MENA, with 93 percent of value transferred consisting of transactions of $10,000 or above, the Chainalysis report titled ‘Middle East & North Africa: Regulatory Momentum and DeFi Fuel Adoption’ added.

Centralized exchanges (CEXs) remain the primary source of crypto inflows across MENA overall, indicating that most users and institutions still prefer traditional crypto platforms, but decentralized platforms and DeFi applications are also steadily gaining traction.

Crypto adoption gains momentum

In the UAE, the adoption of crypto is picking up.

“Financial institutions are exploring crypto services, while industries like retail, tourism, and logistics are experimenting with blockchain tech. This openness, coupled with regulatory clarity, has attracted many crypto players to the region, spurring innovation in different fields,” said Eric Jardine, cybercrimes research lead at Chainalysis, in a statement to Economy Middle East.

High interest in UAE, Saudi Arabia

Notably, Saudi Arabia and the UAE demonstrate high interest in decentralized platforms, the report said. The majority of DeFi activity across MENA occurs on DEXs (decentralized exchanges), with Saudi Arabia participating in other DeFi activities at a marginally higher share than the other nations shown.

Saudi Arabia, a G20 economy with a population of over 30 million, benefits from a disproportionately young population — around 63 percent of its citizens are under 30 years old.

This demographic is especially meaningful from an emerging technology perspective, as younger generations tend to be more open to experimenting with new financial technologies.

The UAE also shows higher DeFi adoption than the global average, likely attributable to its progressive regulatory stance which has fostered clarity around specific classes of crypto participation.

The UAE’s proactive and collaborative regulatory approach to crypto and web3 companies has attracted a diverse range of users, and solidified the UAE as a hub for DeFi and broader crypto activity. In contrast, users in Türkiye and Qatar remain heavily reliant on CEXs, with lower DeFi participation compared to global averages.

Varying stages of development

Jardine, however, noted that crypto regulatory frameworks across the GCC are in various stages of development, with countries adopting approaches aligned with their priorities and ecosystem maturity.

“The GCC region reflects this diversity. While some countries within GCC have proactively laid out clear regulatory frameworks, notably UAE and Bahrain, others are in the process of evolving their regulatory direction,” he said.

“It’s important to note that both Saudi Arabia and Qatar do not yet have a comprehensive regulatory framework in place for virtual asset service providers (VASPs) and therefore do not yet have local CEXs, but encouraging new developments in Qatar that allow companies to apply for a license to become token service providers could reshape the landscape in the future,” the report added.

Stablecoins, altcoins make gains

Across MENA, stablecoins and altcoins are gaining market share over traditionally preferred assets like Bitcoin and Ether, particularly in Türkiye, Saudi Arabia, and the UAE, which have higher shares of stablecoin volume, the report said.

For example, in Türkiye, which has a long history of economic instability and high inflation, retail users’ reliance on stablecoins reflects their concerns over volatility and a need for consistent stores of value. In contrast, in the UAE, where the local currency (the Emirati dirham) is pegged to the U.S. dollar, the growing adoption of stablecoins likely reflects their popularity as an on-ramp to broader crypto services and trading.

Ether (ETH) usage across the region is relatively consistent, but falls below the global average, with Türkiye leading in engagement. Meanwhile, Israel and Saudi Arabia demonstrate a strong interest in altcoins, well above the global average, possibly reflecting a higher risk appetite and interest in a wider variety of assets beyond the major cryptocurrencies.

Balanced crypto ecosystem in UAE

The UAE continues to experience rapid growth in the crypto space, driven by a combination of regulatory innovation, institutional interest, and expanding market activity, the report said.

Between July 2023 and June 2024, the UAE received over $30 billion in crypto, ranking the country among the top 40 globally in this regard and making it MENA’s third largest crypto economy.

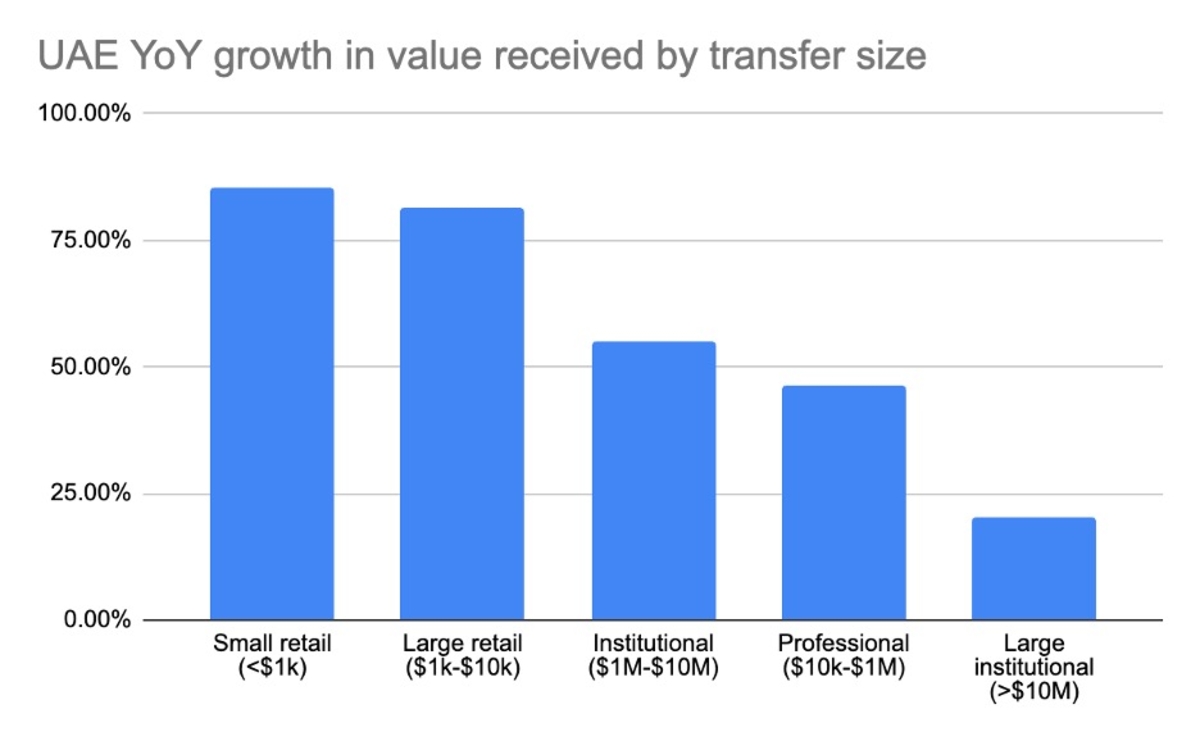

Unlike most countries globally, the UAE’s crypto activity is growing across all transaction size brackets, signaling a more balanced and comprehensive adoption landscape.

The country also boasts a diversified crypto ecosystem, with significant activity beyond CEXs, including DeFi.

Sound regulation has also helped increase the trustworthiness of the crypto ecosystem, Jardine noted.

“Participation in crypto is a function of the perceived trustworthiness and utility of the ecosystem. Trustworthiness can be promoted through sound regulation, which can help minimize abuses on-chain. The perceived utility of crypto is related to people’s understanding of digital assets and decentralized finance, which can be promoted via educational efforts,” he told Economy Middle East.

Rapid expansion

Crypto investments are also expanding quickly as numerous VC funds and blockchain businesses set up shop in the UAE — including Chainalysis, which debuted its regional headquarters in Dubai this May. Tether, the issuer of the world’s most traded cryptocurrency, also recently announced plans to launch a stablecoin pegged to the Dirham.

“Traditional financial institutions such as banks are actively exploring their roles within the crypto ecosystem, showcasing the growth of a crypto-TradFi nexus,” noted Arushi Goel, head of policy for the Middle East and Africa at Chainalysis. “This engagement is further supported by a robust and evolving regulatory framework.”

Regulatory frameworks

Indeed, as global crypto markets rebound, governments are working towards crafting regulatory frameworks that balance innovation with necessary safeguards. The UAE is at the forefront this effort, with various regulatory authorities across its emirates developing tailored approaches. At the federal level, the Securities and Commodities Authority (SCA) regulates virtual assets services, while the Central Bank of the UAE (CBUAE) oversees payment token services.

Additionally, the two financial free zones — the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM) — operate independent financial regulatory regimes, each with its own distinct virtual asset framework.

Dubai’s Virtual Assets Regulatory Authority (VARA) is also playing a critical role in this regulatory expansion. Established in 2022 as the world’s first standalone regulator for virtual assets, VARA is not only shaping the local market, but also attracting global attention.

Legitimacy boost for crypto

Jardine also spoke about how Bitcoin and other crypto exchange traded funds have undoubtedly boosted the perceived legitimacy of crypto assets.

“The approval of spot BTC ETFs in the United States, Hong Kong, and the equivalent elsewhere have provided a way to participate in crypto without needing to become familiar with trading platforms, self-custody, seed phrases and hardware wallets. This new avenue opens up the asset class to new participants,” he said.

“Second, there is an incredibly strong signaling effect of BlackRock and the other major asset managers issuing BTC ETFs, as these actions suggest that the asset is here to stay and that Bitcoin is a legitimate asset class for investors,” he added.

For more technology news, click here.