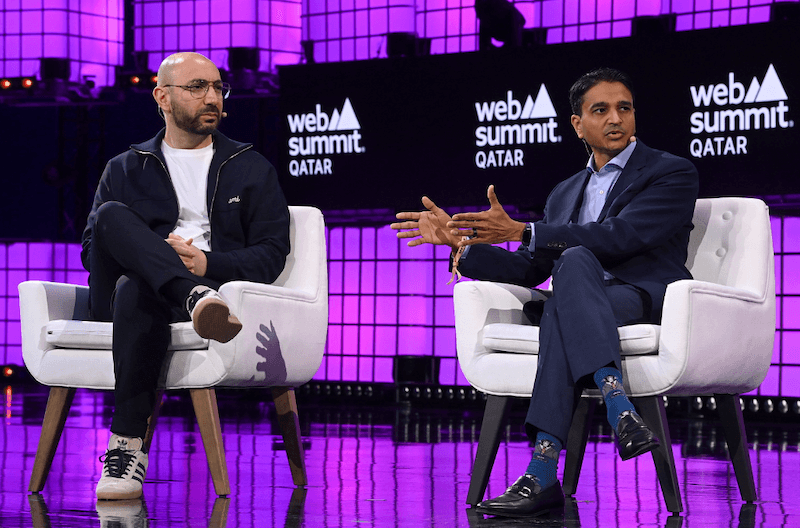

Creative Commons/Stephen McCarthy/Web Summit Qatar via Sportsfile

Buy now, pay later (BNPL) operator Tabby has raised $160 million through a new funding round, more than doubling its valuation to $3.3 billion.

The Series E financing round was led by Hong Kong-based investor Blue Pool Capital and Saudi pension company Hassana Investment Company, in addition to Saudi Technology Ventures and Wellington Management.

Founded in Dubai in 2019, but with its headquarters in Riyadh since October 2023, Tabby was valued at $1.5 billion following its previous funding round in 2023.

The fintech has almost doubled its annual transaction volumes to over $10 billion. It acquired Tweeq, a Saudi Arabia-based digital wallet, last September, expanding its product portfolio.

“This investment will allow us to accelerate our rollout of products,” CEO Hosam Arab said.

Tabby has more than 15 million registered users and over 40,000 sellers.

The startup, which is backed by Abu Dhabi sovereign wealth fund Mubadala, has hired HSBC, JP Morgan and Morgan Stanley to work on a potential IPO, Bloomberg has reported.

CEO Hosam Arab told Reuters the company was likely to pursue a listing within the next 18 months.