Home to the world’s second largest oil reserves, Saudi Arabia has not historically been associated with environmentally friendly investments.

But times are changing.

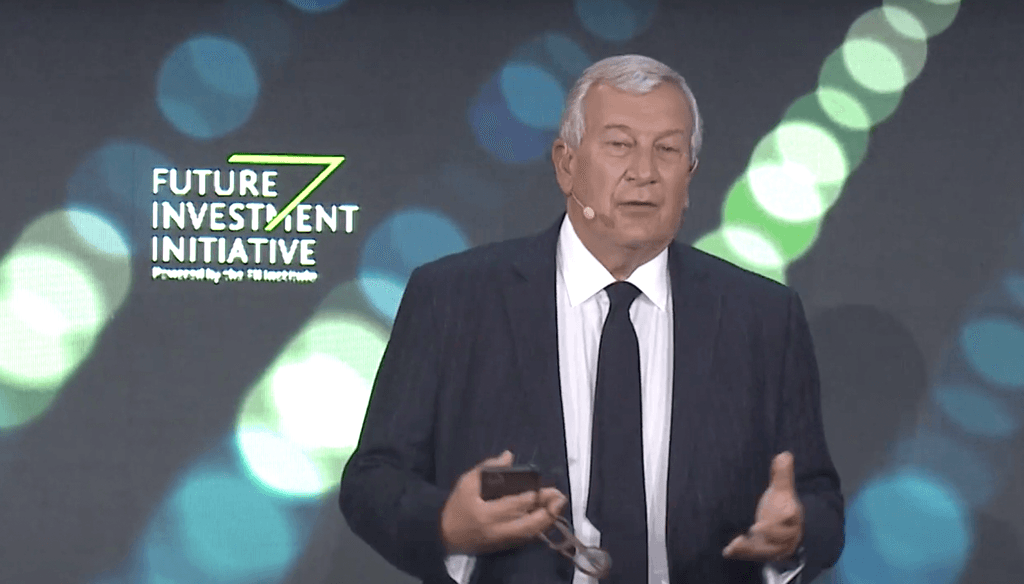

Last Friday, the heavyweights of Saudi business converged on London for a summit hosted by the Future Investment Initiative (FII) Institute, a global non-profit organisation, during which it unveiled a new inclusive ESG framework and scoring methodology, to “inform and accelerate ESG investments in emerging economies”.

The FII Institute, which itself has an investment arm, is now calling on ESG investors to publicly commit to raising the portion of capital allocated to emerging markets (EMs) to a minimum of 30 percent of committed and invested capital by 2030.

Headquartered in Riyadh, the FII Institute recently opened an office in Washington, DC.

“The FII Institute was born in the kingdom of Saudi Arabia,” said Richard Attias, CEO of the FII Institute, in a media briefing held on the sidelines of the summit.

“It’s not often that a not-for-profit foundation with global ambition is created in this part of the world. But we decided we wanted to challenge the current framework and so we’ve conceived what I’m calling ‘an ESG 2.0’ which includes multiple additional KPIs and parameters with one goal – to unlock more investment. We’re not just a think-tank – we’re a do tank. We invest the funds provided by our strategic partners to build a better world,” he added.

Established in 2019 with the Public Investment Fund (PIF), Saudi’s sovereign wealth fund as its founding partner, the FII Institute counts Saudi Aramco, Saudi mining giant Ma’aden and SABIC, a global leader in chemicals, among others, as its strategic partners.

To date, it has invested in electric aircraft, solar farms and AI projects, as well as launching several initiatives to create inclusive ESG principles and improve ESG performance across the world.

While there has been a boom in ESG assets under management to $41 trillion, EMs have largely been overlooked; they have received less than 10 percent of ESG flows, despite being home to nearly 90 percent of the world’s population and roughly half of global GDP.

According to the FII, the fact that ESG mainstream rating agencies currently employ key performance indicators not relevant to emerging markets is one of the main barriers to increasing investment in them.

The FII cites how existing frameworks focus too much on disclosure and ignore year-over-year performance improvement which creates bias in favour of developed markets (DMs) and penalises EMs.

The new framework, developed with the support of professional services company Ernst & Young, values performance improvement over time more than breadth of disclosure, emphasising sectoral challenges rather than country risks, to ensure fair competition between companies in both emerging markets and developed markets.

The FII’s new scoring methodology deploys 16 themes and 94 KPIs that a range of regulators, companies and experts have judged as of most significance.

“ESG has been one of the fastest growing investment strategies over the past few years, accounting for one third of all assets under management. But this growth is not even,” said Attias. “Working with our partners at EY, we identified and removed the barriers to ESG investment in emerging markets, which are often overlooked.”

The FII Institute simultaneously launched an ESG White Paper at the London summit which is designed to encourage greater ESG investment in emerging markets.

Along with calling on investors to raise the portion of allocated capital to 30 percent, it also calls on governments to encourage emerging markets-headquartered companies to become more proactive at disclosing relevant information through their normal reporting channels.

The Institute also announced that it was investing €500,000 ($527,515) in Timbeter, a leading green tech company specializing in timber measurement. Timbeter provides an artificial intelligence-driven photo-optics application that accurately determines quantities of logs in an area with precise length and diameter.

FII Institute’s strategic partners:

BNY Mellon, a global investments company

HSBC, one of the largest banking and financial services organizations

Ma’aden, the largest mining company in Saudi Arabia

NEOM, one of Saudi Arabia’s prime giga projects as part of its Vision 2030 plans to diversify the kingdom’s economy. Built on the Red Sea in northwest Saudi Arabia, the project will contribute 180 billion Saudi riyals ($48 billion) to Saudi GDP by 2030

Reliance Industries, a multinational conglomerate company

Royal Commission for AlUla, the commission working to preserve and develop the 2,000-year-old archaeological AlUla site in northwest Saudi Arabia

SABIC, a global leader in chemicals

Saudi Aramco, a public petroleum and natural gas company, and one of the largest companies in the world by revenue

Saudi National Bank (SNB), one of the Kingdom’s biggest banks

SoftBank Vision Fund, one of the world’s largest technology-focused investment funds

Saudi Telecom Company (STC), the Saudi-based leading telecom and technology services provider

The Red Sea Development Company, the developer behind the world’s most ambitious regenerative tourism project, The Red Sea Project (TRSP)