The Reusable Revolution

Since the first satellites were put into orbit with Sputnik in 1957, to the 1969 Moon landing, the 1971 first space station, and the 2001 first space tourist, all access to space was done with one-use rockets.

Source: Daily Sabah

There were good technical reasons for single-use rockets, from the stress put onto materials by reaching the orbit to the difficulties of avoiding damage with the extreme heat of reentry and the risks associated with landing. Still, this is rather crazy from an economic point of view.

Imagine if every time a passenger or cargo jet took off from Paris to New York, the entire plane would be broken for scrap. This would make air travel prohibitively expensive, limited to the most rare circumstances. And that’s where space flight was stuck, usable only for highly valuable commercial and military satellites, expensive scientific programs, and projects only justified by national pride.

This has all changed with Elon Musk’s SpaceX, which managed what was thought impossible: reliable reusable rockets.

By having only to refurbish small parts of the rocket, this amortizes the cost of the orbital rocket launcher over dozens of launches, bringing the total costs lower than ever.

Source: ARK Research

This has also opened the way for many other companies to replicate SpaceX’s success, each with their own tweak to SpaceX’s formula. It also reignited a new space race between the great powers, with China and Russia banding together against the USA and its innovative companies.

And ultimately, it should open the way for mankind to a true space-based global economy, with promises of Moon bases, Martian colonization, and unlimited orbital solar power.

How Reusable Rockets Work

The reason for making a rocket reusable is self-evident. Reusing it several times makes the total costs of the rocket much lower on a per-launch and per-kilo-to-orbit basis. Any other things making the rocket cheaper or easier to build are, of course, equally welcome.

How to do it is a trickier question, one long thought impossible to properly answer with current technology. While other companies might bring their own method to the mix, SpaceX’s method has truly cleared the way on how it could be done, relying on a few key ideas that made reusable rockets a reality.

Vertical Integration

The first important decision SpaceX took was to essentially rely on nobody for their rocket design. So instead of the usual method of assembling technology from various companies each specializing in either rockets, fuel tanks, electronics, etc, SpaceX decided to either buy off-the-shelves components and assemble them themselves in their own design, or even manufacture them from scratch.

While more complex, this gave a much greater level of control over the final design and a deep understanding of what could be improved or go wrong.

This also removed a lot of middlemen from the economic equation, increasing margins.

Rethinking “Space Grade”

For a very long time, space companies have stuck to using only “space-grade” components for their rockets. This often means custom design parts, often built only in small quantities, that could not benefit from economy of scale in either design or production.

As a result, every single part of a traditional rocket was grossly overpriced. A good example is how SpaceX built its own radio system, reducing the price paid by 10-20x.

“In addition to building its own engines, rocket bodies, and capsules, SpaceX designs its own motherboards and circuits, sensors to detect vibrations, flight computers, and solar panels.

The cost savings for a homemade radio are dramatic, dropping from between $50,000 to $100,000 for the industrial-grade equipment used by aerospace companies to $5,000 for SpaceX’s unit.”

Ashlee Vance in her new biography of Elon Musk

Failing Fast, Innovating Even Faster

Another change was a very uncommon attitude toward failure. Traditional space companies were notoriously conservative, unwilling to take risks to not endanger vital funding and reputation.

With nothing to lose, SpaceX would be ready to stick to a very quick test and launch schedule, at the risk of catastrophic failures at times.

This Silicon Valley-imported company culture fostered innovations and creativity in the team and also helped attract top talents eager for a chance to do more with less bureaucracy, even for lower salaries.

This willingness to take risks has translated into quick turnaround time for refurbishing the rockets after a launch, with the average reuse of Falcon 9, currently the main SpaceX rocket, falling below 50 days in 2024 and hitting a record 14 days for the fastest one.

Source: ARK Research

Embracing New Technologies

From this tolerance to failure also came the integration of new concepts and technologies. For example, 3D printing has been embraced early on by SpaceX, while it might have taken years of testing and discussion in a more established space company.

Source: Elon Musk

Different fuels have also been chosen, like the methane-burning rocket engine on the Starship, which will be a perfect choice for future refueling using on-site resources on the Moon or Mars.

Back To Basics

Alternatively to risky new tech, in some cases, going back to basics was the right choice. For example, the Starship body is entirely made of stainless steel, instead of the more “fancy” alloys or carbon fiber usually chosen by space companies.

This was a choice made because the manufacturing, soldering, repair, and maintenance of stainless steel is a well-understood technology, likely to increase the reliability of the final product.

In a similar way, the simple fact that more is better has been embraced by SpaceX. The biggest rocket ever, Starship, can carry more into orbit for a cheaper price simply due to its sheer size. And the best way to make it fly is simply to use no less than 33 engines at once, instead of trying to design a more complex and more powerful engine.

Source: Space.com

Building Your Own Demand

Because space travel was so expensive, there was no massive demand for a lot of successive launches, each with a massive orbital payload. This could have become a serious issue for SpaceX, as economies of scale only kick in if there is enough demand.

The solution was to create its own demand, with the creation of a Low-Earth Orbit (LEO) constellation of telecom satellites, Starlink. Starlink provides high-speed Internet to even the most remote locations.

With lower launch costs and serial mass production of the Starlink satellites, as well as cheaper & lighter components (antennas, semiconductors, solar panels), the cost of satellite bandwidth has been decreasing exponentially.

Source: ARK Research

However, it will ultimately need the heavier and bigger Starship to manage the final goal of a 42,000 satellites constellation, as the decay of their orbits will require a constant stream of relaunch, with each individual satellite having a 5-year lifespan.

On average, it will require a Starship launch every 2.3 days, a realistic target as it is similar to the current launch frequency of the smaller Falcon 9.

Source: ARK Research

Currently, Starlink is on the way to reaching 5 million users, a number increasingly accommodated with the V3 Starlink satellite design, with 10x the bandwidth of the previous version.

In total, the addressable market for satellite connectivity could be as large as $130B, mostly driven by households with no or poor access to broadband and direct-to-device connectivity, a technology now successfully brought to the public by Starlink and T-Mobile.

Source: ARK Research

Hypersonic Travel’s Potential

Another market that easily reaches orbital and sub-orbital altitude could be created from scratch is hypersonic travel.

When traveling in the air, aircrafts both use the atmosphere to generate lift but are also slowed down by friction, limiting the maximum speed and the efficiency of supersonic flight.

This might be partially solved by innovative design, like, for example, the supersonic flight not generating a supersonic boom at surface level recently tested by Boom Supersonic. Some new jet engine designs, like the Ram-Rotor Detonation Engine (RRDE), could make hypersonic planes a possibility, traveling at speeds above Mach 5 and more.

Another option is simply to fly high enough that air friction is a non-existent problem.

In this case, the Starship, with its 100-200 tons of orbital payload, and more for lower altitude flights, could be an interesting option for transporting relatively speaking light human passengers.

Point-To-Point Orbital Flight

By going into orbit before landing back, rockets like Starship could turn a 28-hour round trip, like a trans-Pacific flight, into merely a 6-hour round trip, with likely more time in the airport/spaceport registering luggage and passports than in flight.

With an estimate of ultimately $200/kg to LEO with Starship, and an average passenger + luggage mass of 110kg, this would bring a roundtrip travel to any point of the globe to $44,000.

While this is a large price tag, it could be enough to simply capture a small portion of global flights to make it economically viable.

For example, just 5% of the passengers flying first class switching to hypersonic flight would be a $35B market. If half did, it would be a $35B market.

Source: ARK Research

The same type of ultra-fast flights are being considered for military and humanitarian applications as well by the Pentagon, through the Rocket Cargo Program.

Investment Opportunities

SpaceX

By being 10 years ahead of its competition, privately-listed SpaceX is the elephant in the room of companies looking to grab the orbital launch market.

From Falcon 1 to Falcon 9 and now Starship, SpaceX has been pushing what is possible for the space flight industry, leaving incumbent competitors like Boeing in the dust.

The company’s ambition seems to make it focus on the largest possible rocket it has available, with the small launcher Falcon 1 now essentially abandoned, and rumors of the same fate for Falcon 9 when Starship has proven its reliability.

This is likely to happen relatively soon, as Starship managed several mid-air catches by the “Mechazilla” landing tower.

Still, some issues are still to be cleared, as illustrated by the recent explosion of the second part of the Starship, leading to a “rapid, unscheduled disassembly”, with another test a month after looking to fix the issue that caused it.

In the long run, SpaceX’s ultimate goal is not so much Earth’s orbit, but contributing to the Artemis Mission target of building a Moon base, and maybe even before that a private run to make the first landing on Mars, Musk’s true life goal.

This focus on deep space missions requiring in-orbit refueling, as well as building the Starlink constellation, might leave space for other launch providers, as these ambitious goals will likely soak up most of SpaceX’s launch capability for several years, or even a decade if Musk truly wants to build a city on Mars.

Rocket Lab

Rocket Lab USA, Inc. (RKLB +0.89%)

By far the most prominent publicly-listed rocket company, Rocket Lab is after SpaceX, the company with the most launches per year, ahead not only of private competitors but also China and Russia.

The company is currently relying on its small launch partially reusable rocket Electron, a rocket roughly equivalent to SpaceX’s Falcon 1, specialized in quick launches and rare orbital paths.

It should launch its new heavier rocket, Neutron, in the upcoming year, which will be roughly equivalent to SpaceX’s Falcon 9.

Source: Erik Engheim

The company is simultaneously developing HASTE (Hypersonic Accelerator Suborbital Test Electron), a modified Electron rocket with a large 700kg payload to suborbital altitude to help the US test new designs to catch up with Chinese and Russian hypersonic missile technology.

Source: Rocket Lab

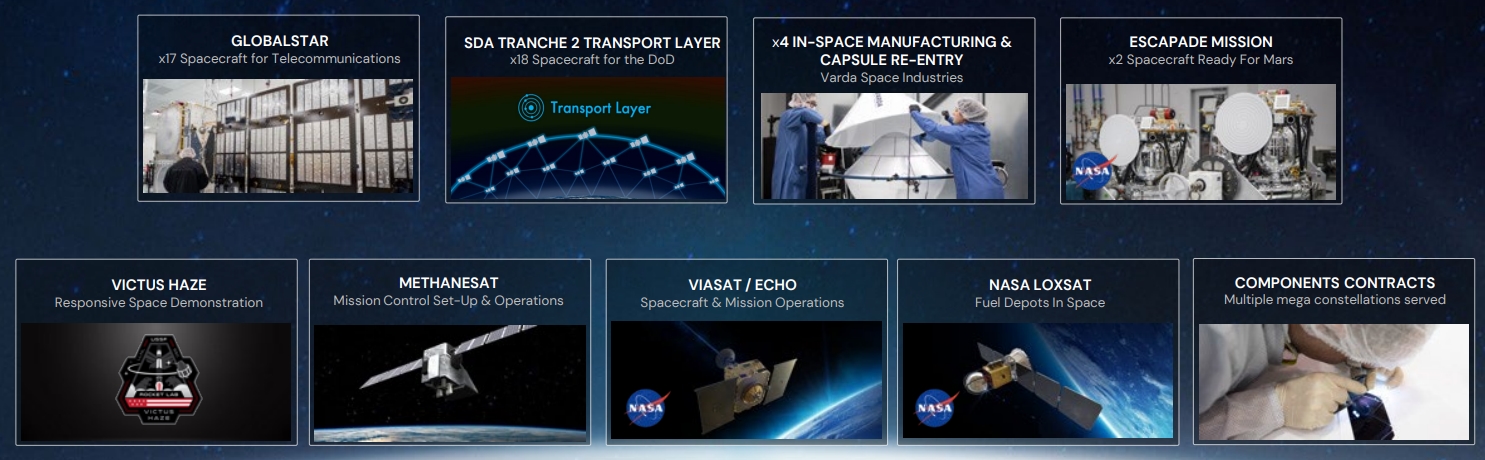

Rocket Lab is also a builder of satellites and satellite components, being the first “end-to-end space company” for non-telecom satellites (where SpaceX could claim the crown). This makes it a key partner for defense contractors, and scientific & telecom companies.

Source: Rocket Lab

Rocket Lab has been important in space solar panels manufacturing, since its 2022 acquisitions of SolAero Technologies. It has 1000+ satellites powered by these panels and 500+ satellites scheduled to launch in the next few years with Rocket Lab solar hardware, for 4MW worth of solar cells manufactured in total.

The satellite operation is providing a lot of cash flow to the company, as well as a valuable pipeline of launch contracts.

In the long run, Rocket Lab’s success will likely depend on the ability of the Neutron rocket to catch enough contracts to reach the required economies of scale to compete toe-to-toe with SpaceX.

Blue Origin

Another tech billionaire pet project, Blue Origins was created by Amazon founder Jeff Bezos. Despite much larger funding, it has so far been somewhat lagging behind SpaceX in terms of development.

While this can be attributed to different technological choices, the more important factors are a very different end goal and approach to engineering.

While SpaceX has a “break things and moves fast” philosophy, Blue Origin (and Amazon) have something of a “slow and steady” approach, reflected in its motto “Gradatim Ferociter,” which is Latin for “Step by Step, Ferociously.”

This makes the comparison between the two companies a potential reminder of the hare & the tortoise tale. It is a comparison Blue Origin clearly embraces, up to having a turtle in its company’s coat of arms.

Source: Ars Technica

The long-awaited New Glenn successful flight in January 2025, making the company’s first orbital launch attempt, has put Blue Origin back into the race in a spectacular fashion. This success came after a change of leader, with Blue Origin’s CEO coming from Amazon, Dave Limp, replacing the previous CEO Bob Smith coming initially from Honeywell.

New Glenn is also a massive rocket, bigger than even Falcon Heavy and only dwarfed by Starship.

Source: Technology.org

New Glenn should be able to launch 45 tons into orbit, an impressive capacity, especially for a first-ever orbital launch. Blue Origin is also completely vertically integrated and is now ramping up production and both the booster and second stage of New Glenn.

Another future project for Blue Origin is its lunar lander, with the Mark 1 expected to launch somewhere in 2026, and the Mark 2, twice bigger, already in preparation.

Lastly, Blue Origin’s end goal is also unique. It is not the Moon or Mars, but the idea of moving all heavy and polluting industries off Earth, and maybe even most of the world’s population as well, into massive artificial habitats.

Source: Blue Origin

Challenges & Risks

Safety

Space launch vehicles are by their very nature dangerous, carrying 90%+ of their weight in very reactive and unstable fuel, and then using it for high-temperature propulsion at high velocity.

So, while reusability is in itself now a proven and tried technology, the risk of missing some mechanical stress or hidden critical failure during overhauls lasting barely a few weeks persists.

This is already problematic with satellites, but less tolerable with astronauts; and completely not acceptable for regular hypersonic flight with commercial passengers.

The larger the rockets, the more risks for ground-based facilities and population as well in case of a failure.

So overall, while our future is clearly being in space, and sooner than hoped before SpaceX, we can expect that safety and regulation might slow us down a bit on the way to casually book a flight ticket to the Moon or Mars.

Government Contracts

Until now, a lot of SpaceX and all other space companies have been strongly linked to government contracts, from NASA missions to secretive Pentagon contracts or the national interests and scientific & industrial policies of the European, Russian, and Chinese space agencies.

To truly become an industry on its own, we will need space companies to win most of their revenues from commercial activity.

Currently, the two most likely sectors to provide the hundreds of billions yearly to sustain the industry progress are space-based Internet and hypersonic flights.

Commercialization & Investing Strategy

Another likely candidate for commercial by the 2040s will be space-based solar power, which could ultimately provide Earth with an unlimited supply of constantly produced green energy, an idea we developed in detail in “Space-Based Energy Solutions For Endless Clean Energy”.

Before that, space tourism might become an industry in itself, as the experience of weightlessness, and maybe a short stay of a few days in orbit would be highly prized and would compete with other forms of “extreme luxury adventures” like climbing Mount Everest.

One last option could be asteroid mining, a still undeveloped technology, but which could potentially replace a large part of the $2.2T mining industry. However, all these options are likely to take a decade or two before they generate significant revenues, which can be deadly for most companies.

So no matter the path to commercialization of space, it is likely that only a few key providers will succeed. Historically small launch providers have had a high failure rate, with only 17 operational out of the almost 200 created since 1996.

Source: ARK Research

With the already strong position of private actors like SpaceX and Blue Origin, and likely new strong competitors coming from China with state support in the future, this might be a tricky landscape for investors.

Potentially, other forms of space companies, like for example developing habitat modules or autonomous hydroponics farms for future space hotels and Moon bases, might be other types of winning investments in the future space economy.

Conclusion

The collapsing costs of reaching the orbit are completely changing the space industry, opening an entirely new way of making money from reaching the orbit. This is making the sector move from a defense and government-driven industry to more commercially focused businesses.

In the near future, telecom is likely going to be the main revenue driver, followed by hypersonic flights and space tourism. In the longer run, much larger industries like the energy and mining sectors, or even manufacturing, might start to move to space as well.

For now, SpaceX has been the almost uncontested winner of this new space race, thanks to Elon Musk’s leadership. This might, however, change soon, with serious contenders like Rocket Lab and Blue Origin catching up, as well as future competitors from China.