The “FinTech” (Financial Tech) revolution is taking over the financial world by progressively replacing, or at least forcing change upon, the incumbent players in the sector, older banks, insurance companies, and investment funds that were more focused on rent-seeking than innovation.

What started with just online payment with companies like PayPal (PYPL +2.49%) is now becoming a major force shaping the financial industry.

As a result, international money transfer, currency exchange, banking, and many other financial services are increasingly moving online and becoming quicker, cheaper, and more user-friendly.

In some regions of the world, this is an even more important change because a large part, if not most of the population, is unbanked and unable to access financial services at all. This has long hindered the economic growth of the so-called “Global South”, with a large part of its population having to pay exorbitant fees, reducing their capacity for saving, investing, or entrepreneurship.

“Those moneylenders applied up to 280% of the original value of money credited in 24 hours, which is extortion.

In the legal system, it’s around 2.5% monthly. So fintechs became a suitable option for millions of people.”

Eduardo Montañes Silva, CEO of Bogotá-based consultant LiSim International

Luckily, modern fintechs are working on changing that, and nowhere is it as visible as in Latin America, with a dominant player emerging: Nu Holding, and its subsidiary Nubank.

Nu Holdings Ltd. (NU +0.97%)

Challenges and Opportunities in Latin America’s Financial System

Latin American banks have historically mostly served the wealthier portion of the population, leaving out of the banking and financial system a large part of the people. While this has somewhat improved, it still leaves anywhere from 13%-60% of the population unbanked, depending on the country, while the region is home to almost 670 million people.

Source: USCB

The sector is still currently highly concentrated; for example, in Brazil, nearly 70% of deposits are held by the top three banks.

“A significant portion of the population, both consumers and small to medium-sized enterprises, still lack full access to traditional financial services, creating a substantial opportunity for fintechs offering innovative and accessible solutions.”

Andrés Fontao – co-founder of Finnovista, a Mexican venture capital firm focused on fintechs

As for the e-commerce sector, the slow arrival of the Internet, and then the explosion of smartphone usage has radically altered consumption pattern in the region.

This is a phenomenon that has lifted other companies like MercadoLibre (MELI +1.2%), now a leader in e-commerce in the area, but also fintech (you can read more about MercadoLibre’s history and competitive position in our dedicated report).

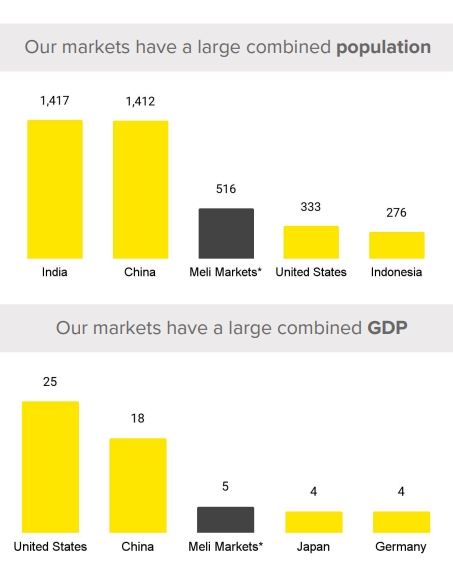

Source: Mercado Libre

Latin America as a whole is growing, but slowly, with 2.4% GDP growth expected in 2025. The region’s average rate of informal employment will stand at 46.7%, in slight decline, but still a significant obstacle to proper access to traditional financial services for most of that sub-segment of the population.

However, the region’s fintech sector has been growing strongly. In the first half of 2024, the region’s fintech companies attracted $1.2 billion in investments, a 20% increase from 2023.

“As five banks concentrated 80% of the financial services, the competition was really low.

In 2013, there were only two means of payment, and today we have more than 200 agents offering this service. As a result, there is more competition, and it’s positive for customers.”

Diego Perez – President of the Brazilian Association of Fintechs (ABFintechs)

What Services Does Nu Holdings Offer?

The company’s core is Nubank, which offers credit cards, digital wallets, investments, and bank accounts. These services are all centralized into a common app.

Source: Rest of the World

Overall, the company offers everything you can expect from a bank, with loans, insurance, investment, online payments, and even access to crypto, complementing the basics of bank accounts and credit cards.

Source: NuBank

NuBank credit card offers no maintenance fees, good international functions, with no hidden fees. Overall, the company’s marketing is oriented toward functionality, accessibility, and low costs, with as little friction as possible in every interaction with Nu Holding products.

As opposed to many traditional banks, which still ask for printed proof of credit history to be presented in person, all new applicants need to do with NuBank is to download the app and send pictures of their ID and a selfie.

If something is not clear to a user, the app offers quick access to troubleshooting with real people at help desks, not AI chatbots.

Among other offers, the company is offering:

- Shared physical card, with common limits and bank account.

- Virtual card: a safer alternative to buy online, in order to avoid fraud risks.

- NuShopping’s Cashback with up to 200 partner stores.

- A loyalty program (since 2017) with never-expiring program points that can be redeemed for a product catalogue or discounts on services, travel, and entertainment.

- Tags on expenses to help manage budgets.

How Fast Is Nubank Growing? A Look at Its Customer Base

Overview

Nu Holdings and its subsidiary, NuBank, are among the largest and fastest-growing fintech companies in Latin America, with 114 million customers in Mexico, Brazil, and Colombia.

Of these 3 major markets, the only one that is likely to reach some level of saturation soon is Brazil, with 90 million customers out of 211 million people.

In Mexico, the company reached the 10 million customer milestone at the end of 2024, up 91% year-to-year, or only 12% of the country’s adult population.

For many of the company’s users, this is their first credit card or bank account. This user count is growing extremely quickly, reflecting the company’s large expansion in recent years.

“2024 was a transformational year for Nu as we advanced our mission to empower millions across Latin America with accessible, transparent, and low-cost financial services.

We now serve over 114 million customers, with 20 million net additions during the year.”

In Brazil, Nu has become the third-largest financial institution regarding customer numbers. In Mexico, it passed the milestone of 10 million customers, and in Colombia, it has 2.5 million.

This represents an extremely quick expansion, as the company was founded in 2013 and saw its first transaction only in 2014. It has been publicly traded since the end of 2021. In 2023, it was the world’s largest digital bank.

Nu Holdings’ Expansion into Business Banking

The company is also active in the commercial banking sector, crossing the 4 million business customers threshold in March 2024, a 50% increase year-to-year. At the same time, it launched Working Capital, the company’s first business loan solution, offering entrepreneurs access to a line of credit for daily cash needs or other business demands.

To better serve this segment, NuBank is providing new functionalities:

- Desktop access beyond the NuBank app.

- Shared access and variable levels of authorization.

- Invoice issuance can be sent to accountants and clients directly in the company’s interface.

Cost Efficiency and Customer Revenue at Nu Holdings

The monthly average cost to serve per active customer remained below the dollar level, at $0.8 per customer, demonstrating strong operating efficiency.

This compares favorably to the average Monthly Average Revenue per Active Customer (ARPAC), standing at $10.7 in Q4’24. Especially as the acquisition cost per customer has been reported to be around $5/user.

This is likely not even fully reflecting the profitability of the company’s customers, as newly onboarded users are not yet using as many services as they could, and more mature cohorts already stand at $25 of revenues per user.

Ultraviolet by Nubank: Targeting Premium Clients

While it started with a digital wallet and a focus on unbanked customers, NuBank is also now hunting for customers with more wealth, as it launched NuBank Ultraviolet.

Ultraviolet was created in partnership with the Estonian-British fintech Wise, a specialist in cross-border payment and currency exchange, which expanded into banking and was listed in London (WISE.L).

A key selling point of Ultraviolet is its lower currency conversion rate (only 0.9%) and the ability to make up to two monthly foreign currency withdrawals at no charge.

As part of the launch marketing, Ultraviolet also provides a virtual SIM card with 10GB of internet access, valid for 30 days across 40 countries.

“The travel segment is a priority for this audience, and we enter it with the Ultravioleta differentials that customers already know – which can be used anywhere in the world, with special conditions and unique benefits, such as better conversion rates, as well as free internet included.”

Livia Chanes – CEO of NuBank’s Brazilian operation

This could help the company generate more profit, as this category of clients is likely to spend more and have more financial transactions.

Early after launch, Nu Holdings reported credit card purchases among its most premium clients more than doubled from $500 million a year before to over $1 billion per quarter.

In 2024, Ultraviolet’s customer base in Brazil expanded 132% year-to-year, to close to 700,000 customers. Quarterly purchase volume from Ultraviolet credit cards increased 106% year-to-year to $1.8B in Q42024.

A Breakdown of Nu Holdings’ Financial Performance in 2024

In 2024, it grew revenues by 58% year over year, reaching a total of $11.5B.

The company’s increasing scale allows it to better cover its general overhead costs, leading to an even faster rise in profit.

In 2024, net income grew 85% year-to-year, bringing the annualized ROE (“Return on Equity”) to a remarkable 29%.

“These results place us among the most profitable financial institutions globally, even while maintaining a significant excess capital position at the holding level.”

Nu Holding Q4 2024 Financial Results

Most of the company’s revenues come from loans, with an interest-earning portfolio (IEP) of $11.2 billion at the end of 2024, a 75% rise year-over-year. Total deposits increased 55% year-over-year to $28.9B at the end of 2024, of which $23.1B was in Brazil.

The lending portfolio more than doubled in 2024 to $6.1B, and the credit card portfolio expanded 28% year over year to $14.6B.

Nubank’s Global Expansion Strategy

Latin America

In addition to the planned expansion into the new core markets of Mexico and Colombia, the company is likely to expand in the rest of Latin America in due time. It will likely succeed in capturing a part of this market.

It might face a strong presence from MercadoLibre, the region’s dominant e-commerce platform. Leveraging its popularity as a marketplace, MercadoLibre might expand into fintech through a payment app and financial services.

This might still not be a deal killer, as NuBank has managed to succeed in Brazil, the second market in which MercadoLibre entered after its founding in Argentina.

Overall, incumbent banks are more likely to be vulnerable to disruption by local and international fintech and that the 2 largest fintech providers in the region will not hinder each other’s progress much.

Rest Of The World

NuBank is not only considering expanding in all of Latin America, but the USA and maybe Europe as well.

“We are actively thinking what are some of the jurisdictions that make sense for us to consider, as we think about the next 10 years of global expansion. We are considering the UK.

The U.S. has several regulatory agencies regulating the same thing. So if there is a simplification of the regulatory agencies, they could make a much more interesting environment for other players to come in.”

David Velez – CEO and Founder of Nu Holdings

Other emerging markets might be in play as well, as Nubank invested $150M in Singapore-based digital bank Tyme Group at the end of 2024, which has 15 million customers in South Africa and the Philippines.

New Services: NuTravel, NuCel, and More

More activities and more money per customer are the other areas of growth for the company besides entering more markets and acquiring more users.

For example, the company recently launched NuTravel for the purchase of air tickets from a multi-currency account, making it an additional service for Ultraviolet users.

The company also offers NuCel, a mobile phone service, an entry in telecom that is not without reminding investors of the ill-fated similar move by Rakuten, which might or might not turn out right for Nu Holdings.

How Nubank Is Using AI to Enhance Financial Services

As a “digital native bank”, NuBank is in a better position than most of the financial industry to embrace the AI revolution.

NuBank has been doing several acquisitions in the field of AI to boost their offer and internal efficiency, notably Cognitect and Olivia companies in 2021. Cognitech provided the company with functional programming languages and application development, and Olivia with advanced AI algorithms to provide users with financial advice and superior personal financial management.

“One example is the Payment Assistant, which finds, centralizes, and notifies customers about due bills, in addition to helping to organize expected expenses for the month. This evolution is the premise of the “Money Platform”: the customers practically have a private advisor”.

Vitor Olivier – NuBank Chief Technology Officer

The company is however wary of pushing AI for a direct profit, instead of improving customer satisfaction or the company’s efficiency. They believe that any such move would ultimately be self-defeating.

“This is not a long-term vision, because it will become obvious to the customer what kind of ‘advice’ this AI is giving. It’s like that friend who gives you a tip, but every time you follow it, it’s him who does well and not you.”

Vitor Olivier – NuBank Chief Technology Officer

Final Thoughts: Can Nubank Lead Fintech Beyond Latin America?

Nu Holdings is at its core a very innovative “neobank” that has been able to seize the inefficiency of the Latin American market and turn it into a growth engine.

Starting in Brazil, it is likely going to replicate its outstanding success in the rest of the region, with Mexico and Colombia, the next 2 largest countries by population, already well on the way.

In the medium term, these 2 countries, deepening profitability in Brazil, and expansion to the rest of Latin America, are likely going to be the key drivers of the company’s growth and its stock price.

In the longer run, NuBank might even expand in other regions, but it is yet to be seen if it can manage to outperform local competitors.

This is possible, as Brazilian customers’ complaints about their bank can be eerily familiar to Western customers as well. The markets of SE-Asia and Africa might be similar as well, with local actors often lacking the scale that NuBank has already achieved.