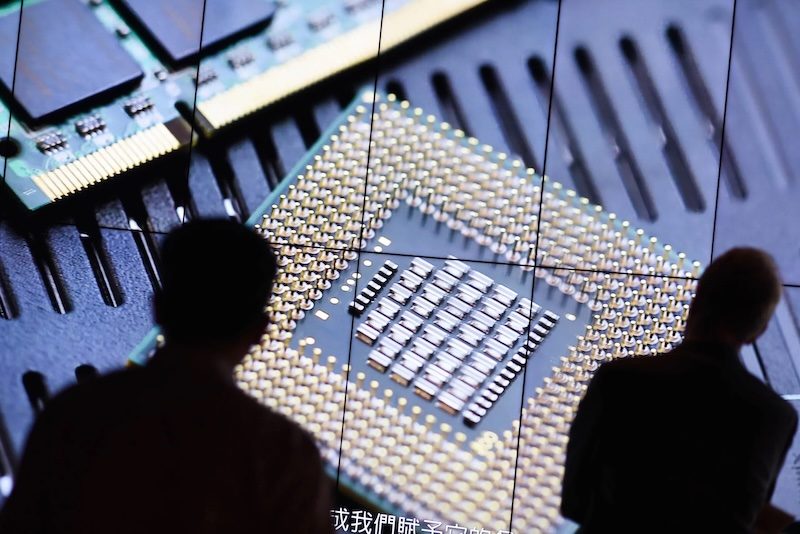

GlobalFoundries, the world’s third-largest contract chipmaker, reported a year-on-year net income fall of 29 percent to $178 million in the third quarter of 2024.

Revenue at GlobalFoundries, which is backed by Abu Dhabi’s Mubadala Investment Company, was down 6 percent year on year to $1.7 billion.

The company’s smart mobile devices end-market reported an 11 percent jump in quarterly revenue to $868 million.

Net profit is expected to be between $161 and $236 million in the fourth quarter.

The Nasdaq-listed chipmaker expects adjusted profit per share to be in the range of 39-51 cents in the fourth quarter.

- UAE bypasses Nvidia chip restrictions to grow AI capabilities

- Aramco to buy AI chips from Abu Dhabi fund-backed Cerebras

- G42 links with Nvidia to launch climate tech lab

Its share price is up 4.3 percent to $41.37 in the last month, but it is down by about third since the start of the year.

In July, GlobalFoundries bought the rights to gallium nitride (GaN) technology from semiconductor company Tagore Technology for an undisclosed sum to boost power in electric vehicles, artificial intelligence and data centres.