Bitcoin On The Rise

As Bitcoin prices experienced a stratospheric rise following Donald Trump’s election, interest in companies that had the foresight to have been investing in the asset followed.

Source: Google Finance

No company has been more vocal about its devotion to Bitcoin than MicroStrategy and its charismatic and controversial ex-CEO, Michael Saylor. So this seems like the perfect time for a deep dive into MicroStrategy, the tech company that turned into a Bitcoin derivative.

MicroStrategy Incorporated (MSTR +9.58%)

MicroStrategy: The Software Company

MicroStrategy is, at its core, a software company. Its main product is MicroStrategy ONE, a business intelligence platform. This type of enterprise software is designed to combine business metrics to help decision-makers better understand their company’s activity and revenue drivers.

Source: MicroStrategy

MicroStrategy still sells this product, which is one of the company’s main sources of operating cash flow. Notably, companies like Pfizer, Visa, Sony, Hilton, and Guess all use it.

MicroStrategy ONE extensively uses AI to analyze enterprise data and is integrating with most major cloud providers (AWS, Azure, GCP). The AI tools offered include, among others:

- Auto SQL for data modeling.

- Auto Dashboard for content generation.

- Auto Answers and AI Bot for natural language interaction.

The software revenues are rather steady and growing on a yearly basis, with a lot of variation quarter-to-quarter.

Source: MicroStrategy

It should, however, be noted that the software business line is not profitable and was responsible for a loss of $18.5M in Q3 2024, entirely driven by a $19M from non-cash stock-based compensation expense.

MicroStrategy’s Bitcoin Buying Spree

While MicroStrategy was a respected but somewhat niche tech SaaS company, its Bitcoin activism brought it into the investing spotlight. For the last four years, the company has been buying more Bitcoin, often ignoring the short fluctuation and focusing on the high price it considers Bitcoin will reach in the long term.

Source: MicroStrategy

As a result, most of the company’s Bitcoin was acquired at much lower levels than today’s Bitcoin prices, less than half of the most recent Bitcoin value. With Bitcoin holdings worth around $23B on 18th November 2024, this completely dwarfs the $94.9M or revenues done from software subscriptions in the whole of 2023.

Source: MicroStrategy

MicroStrategy’s Bitcoin Plan

What has driven the company’s focus on Bitcoin acquisition was its ex-CEO Michael Saylor’s dedication to the cryptocurrency.

Source: Michael Saylor

He notoriously made extraordinary forecasts for future Bitcoin prices, with the end target of $13,000,000 ($13M) per Bitcoin by 2045. In a shorter outlook, he is looking forward to the $100,000 threshold to be breached soon.

However, this unwavering faith in Bitcoin was not a smooth ride. Price instability and Bitcoin’s decline in 2022 led MicroStrategy to register an impairment charge of $917M.

Soon after, Saylor stepped down as MicroStrategy’s CEO, assuming the role of an executive chairman, to focus even further on the company’s Bitcoin initiatives.

“As Executive Chairman, Mr. Saylor will focus primarily on innovation and long-term corporate strategy, while continuing to provide oversight of the Company’s bitcoin acquisition strategy as head of the Board’s Investments Committee.

As Executive Chairman I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations.”

This was actually probably for the best, as Saylor’s focus had clearly become Bitcoin, potentially leaving the company’s CEO to neglect its SaaS business.

Raising Bitcoin Money

Leveraging Bitcoin

The way MicroStrategy had enough money to buy billions of dollars worth of Bitcoin was to raise money through the company balance sheet. One part was through issuing debt, especially benefiting from the very low rates available in the last years.

Most of this debt has less than a 1% annual interest rate, which is much below the current US and global inflation rate. This means that, in practice, this debt has a negative real rate, with persistent inflation paying back some of the money. This debt’s maturity is also quite far in the future, with a payment date ranging from 2028 to 2032.

Overall, even ignoring it was done to buy Bitcoin which skyrocketed in price, it was a very solid corporate management strategy, raising money when interest rates were rock bottom and locking in capital at much below the inflation rate.

Source: MicroStrategy

Using Equity

The company has also consistently issued new shares to finance more Bitcoin purchases. MicroStrategy has issued between 182,000 and 255,000 shares annually since 2020, raising significant money from them as well.

As MicroStrategy was the first publicly traded company to use Bitcoin as its main asset, it early on made it a sort of proxy for Bitcoin. This was at a time when many potentially interested investors would not go on owning Bitcoin directly:

- Some retail investors were more comfortable owning MicroStrategy than owning their own Bitcoin wallet.

- Most institutional investors (banks, insurance, pension funds) were not authorized by regulation and their own charters to invest in Bitcoin, even if some of their shareholders or their management were open to it.

- Microstrategy being technically first a software company and traded publicly since 1998, it was sitting in a sort of grey area, making it an ideal proxy for Bitcoin.

- It should be noted that this is less of an interesting point about MicroStrategy now that Bitcoin ETFs exist.

MicroStrategy Valuation

MicroStrategy’s market capitalization is somewhat high, considering that the majority of the company’s value is from its Bitcoin holdings. At $71B, its valuation largely outpaces its $23B Bitcoin stash. Of course, MicroStrategy is not a Bitcoin wallet but a publicly traded company, so there is more to that story.

The first element is that, as a company, it can leverage its assets (like its Bitcoin holdings) to raise more money. This opens at least two possibilities:

- It can issue more shares, using the differential between its stock price and Bitcoin price to buy a lot more Bitcoins.

- It can sell debt (bonds) to increase its leverage and use the money to buy Bitcoins.

And this is exactly what the company announced, with its “42 strategy”: $21 billion through equity offerings and another $21 billion via fixed-income securities between 2025 and 2027. This adds to the $4.6B in Bitcoin purchase in November 18th 2024.

The 42 strategy would almost triple the company’s Bitcoin total holdings at the current price. This would also make MicroStrategy owning almost 4% of the world’s total bitcoin supply; a supply that is going to grow slower and slower over time, as per the algorithmic rules governing Bitcoin.

Does MicroStrategy Valuation Make Sense?

So far, investors in MicroStrategy have done just great. Not only did they beat the so-called Magnificent 7 :

- Alphabet (GOOGL +0.93%)

- Amazon (AMZN +0.03%)

- Apple (AAPL +1.69%)

- Meta Platforms (META +0.47%)

- Microsoft (MSFT +0.06%)

- NVIDIA (NVDA -1.74%)

- Tesla (TSLA +6.98%).

But they also beat Bitcoin itself, with returns over the last 4 years double that of the leading cryptocurrency.

Source: MicroStrategy

This also makes MicroStrategy a stock that performed better since it adopted its Bitcoin strategy in August 2020 (+1,989%) than even the AI mega-winner Nvidia (+1,165%).

So you can find among the main reasons for optimism regarding MicroStrategy’s future strategy:

- A continuation of the over-performance, thanks to strategic leverage, continues to pay off.

- The inertia of stock markets, with winners tending to keep rising due to past performances.

- The practicality and legal/regulatory aspect of investing in MicoStrategy’s stock instead of owning directly Bitcoin wallets & ETFs.

- The trust in Saylor’s ability to stay steady and capitalize on Bitcoin’s temporary weaknesses.

- The tendency of financial markets to maintain extreme valuation multiples, with the premium to Bitcoin’s value potentially growing bigger.

The Risks

In every spectacular rise in value in the stock market, there is always the risk of a bubble popping and taking down the previous winners. This is especially true when a lot of leverage is present, meaning that the short-term losses could lead to failure & bankruptcy before a recovery can make up the losses.

However, it should be noted that any decline in Bitcoin price creates an accounting loss on paper only for MicroStrategy (but not in actual cash), at least as long as it does not need to pay back all its bonds.

On top of this, MicroStrategy’s valuation seems for now to have run up quite far ahead of its balance sheet Bitcoin holding. So the current price only makes sense if the planned leverage of the “42 strategy” turns out to compensate for the current extra price an investor pays for MicroStrategy’s Bitcoins.

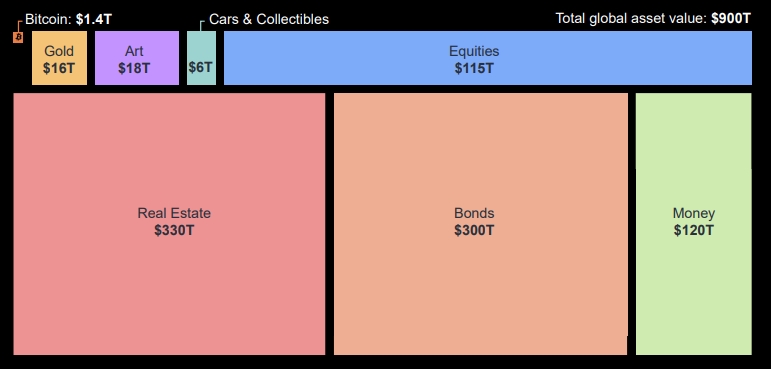

So this is a risky bet, no matter what, as it does not just require Bitcoin prices to keep growing slowly or stay stable but to rise significantly. It still could work, as the total value of Bitcoin is still a very small volume compared to other asset classes.

Source: MicroStrategy

In that respect, it could paradoxically mean that the planned $21B in new debt to buy Bitcoin might actually be a little too low.

If it was an outrageous $70-100B of extra debts (as much as the current market cap), the current extra valuation would be irrelevant: either Bitcoin goes to the million-dollar mark, and this is a massively winning strategy thanks to the multiplying effect of debt leverage. Or it does not and MicroStrategy stock was a bad investment.

Of course, Michael Saylor is now known as a technologist with a knack for taking big risks at the right moment, so maybe he is planning something that big, and did not make it public just yet.

Speculating On MicroStrategy.

MicroStrategy is already more volatile than any S&P500 stock, making it a stock only for seasoned investors able to handle its wild price moves.

Source: MicroStrategy

This is also one of the stocks with the most speculative activity. When looking at MicroStrategy-related options or daily-traded volume, it is in the same category as Alphabet, Amazon, or Netflix, and only behind NVIDIA, Tesla, Apple, and Meta.

Source: MicroStrategy

So, for the most experienced and daring investors, adding their own speculation through derivatives and/or their own leverage seems to be a way to multiply further the already built-in leverage on Bitcoin present in MicroStrategy’s valuation.

Conclusion

From its foundations as a SaaS company, MicroStrategy is mostly today a Bitcoin holding company, buying digital assets with increasing levels of leverage. As such, it should probably be fairer compared to Bitcoin derivatives than any stock, Bitcoin ETF, or direct Bitcoin ownership.

Maybe the best description could be that MicroStrategy’s stock is Bitcoin future with an expiration date in the 2030s-2045. If Bitcoin rises to multi-million dollar marks, being a shareholder of MicroStrategy will pay off probably more than any other investment. And if Bitcoin somewhat stabilizes and stops rising for a long time (or worse, decline in value), it will be a costly mistake.

As such, investing in the company is a way to take a riskier bet than direct Bitcoin holding, with larger rewards and larger risks, which should therefore be done in a balanced strategy. Therefore, MicroStrategy’s stock belongs together in a portfolio with other assets, including direct Bitcoin holding, other cryptocurrencies, equities, and other asset categories like bonds, real estate, etc.