From Golden Age to Stagnation to Renaissance

When it was invented, nuclear power was touted as the future of energy and envisioned powering everything, from the electric grid to individual cars, trains, and even planes. Unfortunately, that vision failed to manifest.

The omnipresent nuclear power imagined by science-fiction writers hit the issues created by the need for heavy radiation shielding, making portable nuclear power a fantasy.

Nuclear power generation in large power plants did experience a golden age, especially in the aftermath of the two oil shocks of the 1970s. This ascending trajectory would be brutally interrupted by the Chernobyl incident and even further by the Fukushima disaster.

As a result, nuclear power generation has stagnated since the 2000s and has even declined if measured in the percentage of total power generation.

Source: Nuclear Energy – Our World in Data

This is changing rapidly, with nuclear energy making a massive comeback, carried by a multitude of converging factors. This will create a steadily growing demand for refined uranium in the coming decades.

Factors Behind The Nuclear Renaissance

Not Enough Electricity

The largest factor behind the restart of nuclear power as a growing industry is the need for ever more electricity.

The first reason is the trend of electrifying sectors previously powered by fossil fuels, like transportation (EVs) and heating (heat pumps). This is done to reduce carbon emissions, and low-carbon energy sources are benefiting from this drive.

In the very long run, renewables, especially solar, are likely to be our main power source and bring on a new “solar age”. But nuclear is likely the best candidate for cold climates or for producing some of the baseload required by the electric grid.

Another factor is the growing energy consumption of our society, especially the massive AI data centers currently being built by the tech industry, as well as the ever-growing computation need for streaming services, cryptocurrencies, etc.

New Technologies

Another factor behind the nuclear renaissance is new technologies. The reactors being built or in projects are much safer and more advanced than the older designs that melted down in Chernobyl and Fukushima.

This will be even more true with the 4th generation of nuclear power plants, with designs that are 100% meltdown-proof (pebble beds) or can burn nuclear waste (fast reactors), or small modular reactors (SMRs).

As the nuclear stagnation of the last 2 decades was driven by safety concerns, these improved solutions should help the nuclear industry win the PR battle to restore the reputation of nuclear energy in the public’s eyes.

Geopolitics

It is not a secret that we are experiencing a massive flaring in international tensions, with a growing confrontation between the West and a nascent Eurasian bloc (Russia, Iran, China, North Korea).

This carries a few consequences for energy markets and the nuclear industry:

- An open question on the reliability of fossil fuel supplies, especially concerning Russian supplies and with brewing wars in the Middle East.

- Concerns about possible interruptions of uranium imports from Russia and Central Asia.

- A rearmament phase, with the build-up of nuclear weapons becoming a consumer of uranium, after 3 decades of providing the market with supply from dismantling the Cold War stockpiles.

The potential unreliability of fossil fuel supply is a major driver in most of Europe’s warming up to the nuclear industry, and it is also why China is looking to build 100+ nuclear reactors in the coming decades.

The growing demand for uranium and uncertain supply increases the need for Western-based uranium mining.

Uranium Overview

Uranium Supply

Today, a massive part of the world’s nuclear supply comes from Kazakhstan, often refined into usable fuel in Russia. The differential between the supply of mined and demand by nuclear power plants was caused by the uranium supplied by disarmed nuclear bombs.

Source: World Nuclear Association

Uranium prices have been recovering steadily since their low point in 2018, but are still below the previous 2008 peak, especially if take inflation into account.

Source: Cameco

Due to low prices in the 2010s and the end of supply from disarmed nuclear weapons, the industry is expected to enter into a chronic supply deficit for several years to come.

In all scenarios forecasted by the World Nuclear Association (WNA), uranium supply will be in a steep deficit.

Source: WNA

Source: WNA

This is especially true for uranium Western markets, with demand expected to stay higher than local supplies for more than a decade.

Source: Paladin Energy

Price Insensitivity

Uranium represents a very small portion of the costs of running a nuclear power plant. By far, the largest expenses are derived from capital expenditure at construction and operating costs from complex safety regulations and qualified personnel.

Source: Nuclear Energy Agency

This means that nuclear utilities are relatively uncaring about uranium prices as long as they stay reasonable and will pay the market price to keep the plant running.

It makes this energy market very different from fossil fuels like gas or oil, where consumption can vary strongly depending on prices.

Uranium From Seawater?

In theory, the largest deposit of uranium on the Earth’s surface is its oceans. Around 4.5 billion tons of uranium are available from seawater. In addition to this “stockpile”, 32 thousand tons of uranium flow into oceans per year via rivers from the erosion of rocks. So, this should provide, in theory, an unlimited uranium supply.

The issue is that extraction of uranium from seawater would be 10x more expensive than mining it with current technology. So this is unlikely to be a serious competitor to the uranium mining industry anytime soon, although it is an interesting notion that the nuclear industry can virtually never truly run out of fuel.

Of course, new extraction methods could change that. You can more about a recent innovation on this topic in “Seawater Uranium One Step Closer to Being A Viable Energy Source“.

Uranium Trade Wars

Uranium has been at the center of many international conflicts in the past year.

The US banned the import of Russian uranium in May 2024 (but authorized temporary exemptions), Niger (the world’s 7th largest producer) revoked the license of a major uranium mine belonging to the French company Orano after a pro-Russian coup in the country, and in November 2024, Russia announced it would stop exporting uranium to the USA entirely.

This could be a big deal, as the USA imports a lot of the uranium feeding its nuclear power plants, with its largest suppliers being Canada (27%), Kazakhstan (25%), Russia (12%), Uzbekistan (11%) and Australia (6%).

Kazakhstan’s main uranium miner, Kazatomprom, recently hinted that it might stop exporting to the West altogether due to sanctions on Russia making exports difficult logistically:

“It is much easier for us to sell most, if not all, of our production to our Asian partners — I wouldn’t call [out] the specific country . . . They can eat up almost all of our production or our partners to the north.”

Investing In Uranium

Investing in nuclear power production can be done by investing in leading companies in the sector, as we covered in “Top 5 Nuclear Stocks To Invest In”.

Investors looking at investing in uranium specifically have 4 major options:

- Investing in the commodity itself, with several recently created funds directly owning a stockpile of uranium.

- Invest in uranium and nuclear industry ETFs for diversified exposure

- Investing directly in large uranium miners with a proven track record.

- Investing in junior miners who have yet to finish building their uranium mine.

Uranium Commodity Funds

Because of the forecasted deficit in uranium supply compared to demand, the financial industry has created dedicated investment TOOLS to speculate on rising uranium prices.

The largest is the Sprott Physical Uranium Trust (SRUUF +1.53%), holding 66.2 million pounds of uranium. It has rather low fees, with a Management Expense Ratio of 0.60%.

Another large physical uranium fund is Yellow Cake, traded in London under the ticker YCA.L, whose name comes from the low-grade uranium ore used to create nuclear fuel. Total operation costs are aimed so to stay below 1%. Yellow Cake has a long-term partnership with Kazatomprom (the National Kazak uranium miner) to provide it with uranium. Storage is done in facilities in Canada (Cameco) and France (Orano).

Zuri Invest is a Swiss asset management firm that created the Uranium Actively Managed Certificate (AMC). AMCs are accessible to qualified, institutional, and professional investors through their bank, offering costs benefit from a low-cost structure.

Kazatoprom created ANU Energy in 2021, a privately held physical uranium investment fund financed by Kazakhstan National Bank and sovereign wealth fund.

Uranium ETFs

Global X Uranium ETF (URA +3.53%) is mostly focused on uranium miners, both established and juniors, with 6 miners out of the top 10 holdings. The top 10 also includes participation in uranium physical funds (11.35% of the ETF holdings) and SMR companies Nuscale (3.57%) and Oklo (2.59%).

Sprott Uranium Miners ETF (URNM +3.56%) top 10 holdings are even more focused, with all top holdings miners and physical funds.

Defiance Daily Target 2X Long Uranium ETF (URAX +7.24%) is an ETF seeking to replicate the daily leveraged investment results of two times of Global X Uranium ETF. (Inexperienced investors should be aware that leverage ETFs like this one are generally not a good vessel for long-term holding, and are more designed for day traders)

Sprott Junior Uranium Miners UCITS ETF (URNJ +2.66%) is focused on junior miners, companies not yet with a running and producing mine, more risky but potentially more profitable as well.

Large Uranium Miners

Kazatomprom (KAP.LI)

By far the largest uranium producer on Earth, Kazatomprom is Kazakhstan’s national uranium company. The country is relatively developed, with a GDP per capita in PPP (Parity of Purchase Power) in the same level as Slovakia, Turkey, or Malaysia, and ranked 25th according to World Bank 2020 “Ease of Doing Business”.

Kazakhstan also has the world’s second-largest uranium reserves on Earth.

Source: Kazatomprom

Since the post-Soviet era, Kazatomprom has grown production tremendously. It has however suffered from missed production targets in recent years, generally blamed on a shortage of sulfuric acid, a required chemical for uranium extraction.

Source: Kazatomprom

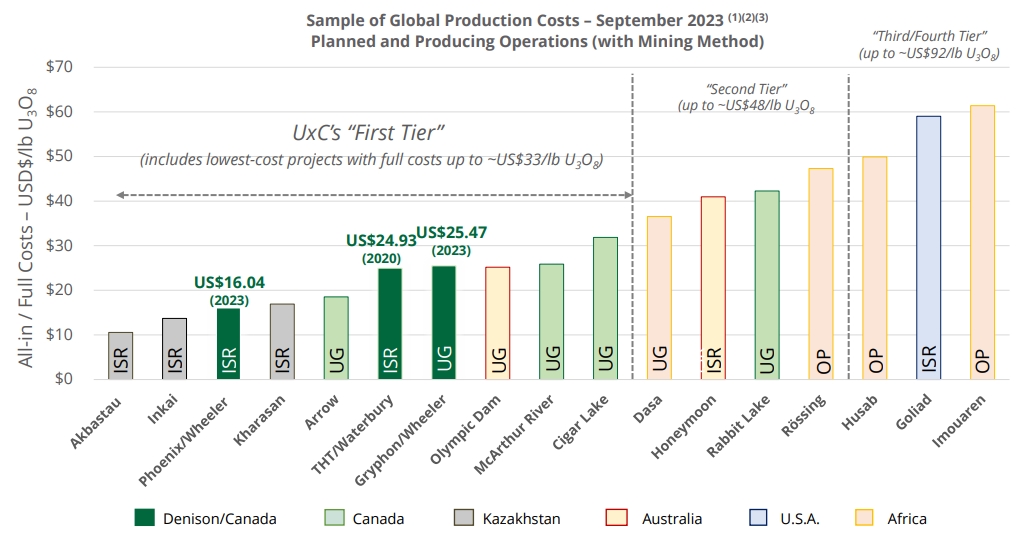

The company has some of the cheapest-to-operate uranium mines in the entire industry, with a full cost often below $20/pound of uranium, or a quarter of the most recent spot prices.

Source: Kazatomprom

Despite its good economics, the company might be at risk due to its geographical position bordering both Russia and China, as well as the fact that a lot of its uranium facilities are designed for refining in Russia. While Kazatomprom is considering relying exclusively on the Trans-Caspian Road ending in Turkey, logistical and geopolitical pressures & risks are something investors should keep in mind.

Cameco

Cameco Corporation (CCJ +5.76%)

The second largest uranium producer in the world, Cameco is mostly active in Canada, as well as Inkai, a joint venture with Kazatomprom (40% owned by Cameco).

Cameco’s active mines are Cigar Lake and Mc Arthur River in the Athabasca Basin in Canada, with several others not active at the moment, but now being reactivated.

Source: Cameco

In 2022, Cameco took the decision to acquire Westinghouse (49% of Westinghouse), the leading builder of nuclear power plants in the USA, together with a giant investment firm, Brookfield (51%).

Brookfield did it through its massive renewable/low carbon power generation division in the form of $19B Brookfield Renewable Partners (BEP -1.34%). Brookfield Corporation as a whole is a massive asset management company with almost a trillion dollars under management.

This means that Westinghouse is now going to be able to access a very deep pool of capital, something that is often an issue for nuclear reactor builders, as new projects require years of investment before bringing revenues.

While longer to materialize into revenues, once in construction, a new reactor generates revenues for Westinghouse from the 6th year after design and engineering studies and will keep doing so for the entirety of the construction project for a period more than 10 years long.

Source: Cameco

Overall, even if the supply issue around uranium gets solved and uranium prices crash, the ownership of Westinghouse should allow Cameco to benefit from the ongoing nuclear renaissance for several decades at least.

enCore Energy

enCore Energy Corp. (EU +2.87%)

The company operates two uranium mines in the US, in South Texas with a 3.6 Mlbs/yr capacity. It has also a pipeline of new projects with 74 million pounds in resources.

Source: Encore

South Texas production is expected to grow to 3.6 million pounds capacity per year by 2026, with a total of 5 million pounds per year by 2028.

Source: Encore

The location in South Texas might alleviate some concerns about mining in the USA, a jurisdiction sometimes hindered by very tight regulations. Texas is described by the company as the “most progressive permitting and production jurisdiction in the US”.

Investing In Junior Miners

By definition, junior miners are still developing their mines and not producing any significant cash flows. This makes them inherently more risky, as they are vulnerable to unforeseen costs, inflation, permitting delayed or refused, etc.

Would the bet pay off, it would however be usually a much bigger gain as well.

NextGen

NexGen Energy Ltd. (NXE +4.8%)

One of the largest Canadian junior in the uranium space, and globally, is NextGen, a massive mine that if fully cleared by regulators, could alone push Canada to become the world’s largest producer of uranium over the coming decade, knocking Kazakhstan out of the number one spot.

This is a very ambitious project tapping into a massive deposit, which could make NextGen the world’s largest supplier of uranium.

Source: NextGen

Ultimately, NexGen’s uranium production is expected to be enough to power 46 million homes (1/3rd of the US), with 300 million tons of CO2 emissions avoided, or the equivalent of 70 million cars off the roads every year.

As a result, this is also a junior miner that absolutely depends on enough demand materializing in the next year. Construction of the mine should start soon if fully approved, and will take still a few years.

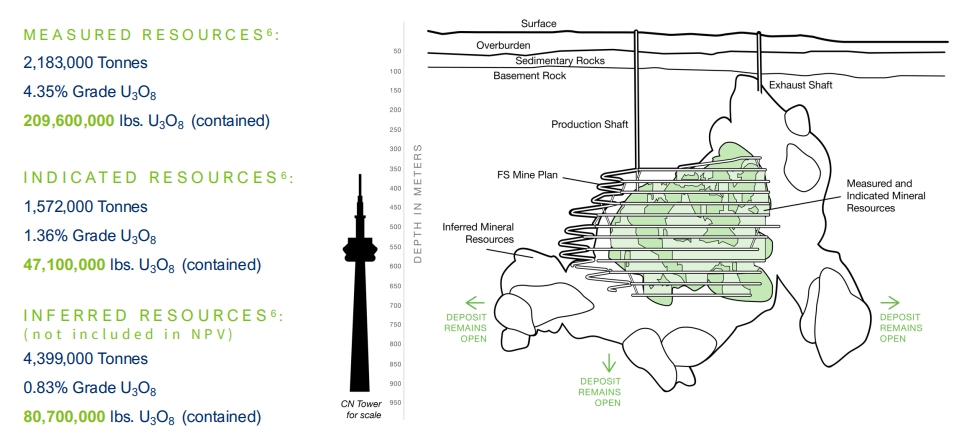

Denison Mines

Denison Mines Corp. (DNN +3.51%)

The Canadian company’s flagship project is the Wheeler River project, which includes the Phoenix and Gryphon uranium deposits. The first production is targeted for 2027-2028.

It owns 69.44% of the Waterbury Lake project.

A key feature of the Denison mines project is that they are forecasted to be very low cost, some even competitive with the very cheap-to-operate Kazakh mines.

Source: Denison Mines

The company also has an interest (22.5%) in the McClean Lake Uranium Mill & Mines. This facility processes 11% of the global uranium. It also already has approval for expanded tailing (mining residues), giving the potential to increase production in response to an increase in Canadian uranium production.

The company also has various minor participation in other uranium potential projects, including 22.5% in McClean Lake (Orano), 25.17% in Midwest (Orano), and 15% in Millennium (Cameco).

Paladin Energy

Invesco FTSE RAFI Developed Markets ex-U.S. Small-Mid ETF (PDN +0.14%)

Contrary to many other Canadian junior uranium miners, Paladin is already producing some uranium from the Langer Heinrich Mine (LHM) in Namibia, which was put in care & maintenance in 2018 and restarted production in 2024. LHM is owned at 75% by Paladin, and 25% by the Chinese national company CNNC.

But the core of the future business will be the Michelin Project, concerning 6 uranium deposits, some of the largest in North America, with a total of 127.7Mlb of Mineral Resources.

And here too, contrary to most Canadian uranium companies, Paladin Michelin Project is located in Labrador, in the East of the country. It is also doing exploration for projects in Australia (Mount Isa and Manyingee).

Source: Paladin Energy

Paladin is looking to acquire the Saskatchewan uranium developer Fission for C$1.1 billion, but the deal is for now slowed down by an extended national security review by Canada’s Minister of Innovation, Science and Industry.

Uranium Energy Corp

Uranium Energy Corp. (UEC +3.19%)

Describing itself as “America’s largest and fastest growing uranium company”, Uranium Energy has acquired in September 2024 for $175M Rio Tinto’s Sweetwater plant and Wyoming uranium assets.

This is the latest in almost $1B worth of serial acquisitions. In the latest years, it also acquired an inventory of 1.16 million pounds of uranium, for a price ranging from $20 to $45 per pound.

Source: Uranium Energy

The company has one of the largest resource portfolios in the industry, and also extensive processing facilities, reducing the risks of depending on another company to treat its mined uranium ore. It is also debt-free and focused on North America, making it a relatively safer bet than some of its competitors.

Energy Fuels

Energy Fuels Inc. (UUUU +1.73%)

This is a smaller uranium company, already producing some volume so not technically a junior. But it has many large-scale uranium projects in the permitting of development or standby phase (70 million pounds of combined uranium resources, potential for 6 million pounds/year), giving it large potential to increase production in a few years time span. Its already-producing mines are located in Arizona and Utah.

The company is also producing rare earths, titanium, and zirconium in Africa, with projects in South America and Australia.

Vanadium is also extracted from the same ore that produces uranium, a product of which Energy Fuels is the largest US producer.

Source: Energy Fuels

The presence in multiple strategic minerals key for specialty stainless steel (vanadium), electronics, aeronautics, and weapons (rare earth, titanium), and uranium make the company especially important for USA’s national interests, including the defense sector.

Source: Energy Fuels

The 150,000-200,000 yearly production of uranium is an advantage as well, providing some cash flow and demonstrating the technical ability of the company.

Deep Yellow Limited

Energy Fuels Inc. (UUUU +1.73%)

This uranium junior miner is based in Australia and Namibia, with production expected to start soon, from as early as 2026.

In addition to the 2 advanced projects with a total of 223 million pounds of resources combined, the company also has 2 others with a total of 158 million pounds potential.

Source: Deep Yellow

Despite having the world’s largest resources in uranium Australia has lagged behind in actual production. Deep Yellow mines in development are like to change that, with very long-lasting mine life, in the 25-30 years range.

Uranium Royalty

Uranium Royalty Corp. (UROY +1.13%)

As financing a mining project can be complex with financial markets or banks, some companies prefer to rely on royalties companies. The concept is that the royalty company finances the mining project, and gets a fraction of the future production in exchange.

Uranium Royalty specializes in investing in uranium projects, an innovation in a business model for now mostly applied to gold, silver, and copper projects.

Source: Uranium Royalty

Uranium Energy Corp is a strategic partner of the company, as well as an initial shareholder, bringing deep uranium expertise to the table.

The company is overall trading at a discount to net asset value, a common situation for smaller royalties companies.

Source: Uranium Royalty

The company portfolio is mostly focused on North America, especially Canada’s Athabasca Basin and South-West USA. Probably the crown jewel of this portfolio is a 1% Gross Revenues Royalty (GRR) on the McArthur River projects and Cigar Lake, both from Cameco (13.5 Mlbs and 15 Mlbs produced in 2023).

Source: Uranium Royalty

Other projects involving Uranium Royalty include uranium mines by Cameco, Uranium Energy, Uranium Energy, Encore Energy, Energy Fuels, Paladin Energy, Anfield Energy, Laramide Resources, etc.

This royalty plays double in a physical uranium investment, with the option to acquire from Yellow Cake up to US$21.25M (US$2.5M –US$10M per year) of uranium until Jan 2028. Currently, the company holds 2.7 million pounds U3O8 at a weighted average cost of US$60.12/lb. U3O8 (below current prices).

Overall, while more complex than ETFs, royalties companies can be a good way to diversify asset and company risk in the inherently risky mining sector, as demonstrated by the multi-decade success of the initiator of this model like Franco Nevada (FNV +1.47%) and Wheaton Precious Metal (WPM +1.07%).

Conclusion

Investing in uranium can feel complex, as this requires having an understanding of nuclear energy production, the commodity cycle specific to these resources, as well as the major companies mining uranium, and upcoming new projects.

For investors just willing to bet on increased demand from new nuclear power plants (and maybe nuclear weapons build-up), a simple option is to either buy uranium physical funds, ETFs, or royalty companies, providing diversified exposure to the sector.

Direct investing in foreign companies will be inherently riskier, although the risk might be compensated by a lower valuation. Similarly, larger profitable companies might be safer but will come at a premium valuation compared to smaller and riskier junior miners.