Lithium’s Rise: From Obscurity to Strategic Metal

For most of human history, lithium was a relatively irrelevant metallic compound with little practical applications. This started to change with the invention by John Goodenough and others of the lithium-ion battery, a work rewarded by the Nobel Prize in Chemistry in 2019, which we detailed in a dedicated report.

The technology allowed for the explosion in small portable electronics, from the initial Walkman to today’s omnipresent smartphones, laptops, and tablets.

But it is with the emergence of EVs that lithium-ion batteries moved from important technology to world-changing technology. Only lithium-ion had the energy density required to give a commercially viable range to EVs.

Because an EV consumes as many batteries as hundreds or thousands of electronic devices, the electrification of transportation has made all the battery production before the EV revolution took off in the mid-2010s look like a footnote of history in comparison.

Source: Statista

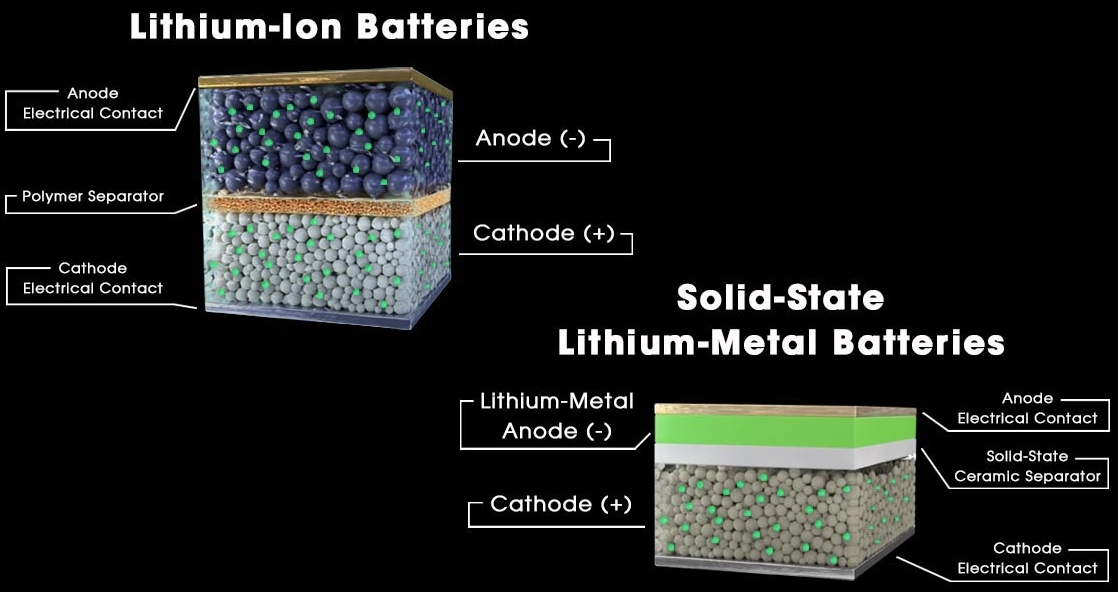

Today, lithium-ion technology is being challenged by many alternative chemistries that could deliver even better performances: quicker charge, higher energy density, more durability, etc.

But while some of these options try to bypass lithium entirely, like sodium-ion batteries, many of these alternatives are as dependent on lithium supply as lithium-ion batteries: ultra-durable solid-state lithium metal batteries, laser-printed lithium-sulfur batteries, lithium-CO₂ batteries, lithium-indium batteries, cold-resistant lithium-ion batteries, graphene lithium-ion batteries, etc.

Source: Flash Battery

So ultimately, even if each potential battery chemistry has its own set of advantages and weaknesses, lithium is still a key component for high energy density batteries.

Source: Lithium Harvest

For investors willing to bet on electrification, renewable energies, and a fossil-fuel-free future, besides other “green” metals like copper and aluminum (follow the links for a dedicated investment report on each), investing in lithium can be a way to do so without having to guess which exact battery chemistry will win in the end.

Why Lithium Offers Unmatched Battery Performance

The reason why lithium is so popular among battery researchers is due to its unique electrochemical properties.

Lithium was first discovered in 1817 by Swedish chemists. It is the lightest solid element, with the atomic number 3 (only 3 protons in its nucleus).

Source: Medium

Lithium atoms’ small size means that they have only one electron on their outer charge, and when this electron moves to another atom, this gives them an enormous electric potential change per atom.

So while other elements might be easier to work with, or cheaper, lithium is the go-to atom to use for high-performance and high energy density in batteries.

The Global Lithium Market & Major Producers

Where Is Lithium Produced? Top Global Producers

The global lithium market is valued at approximately $37.4B in 2024 and is projected to reach $164B by 2033.

In 2024, 2/3rd of lithium production came from ore mining, in large part from spodumene deposits in Australia, the world’s largest producer. This is also the type of lithium production that is predominant in China.

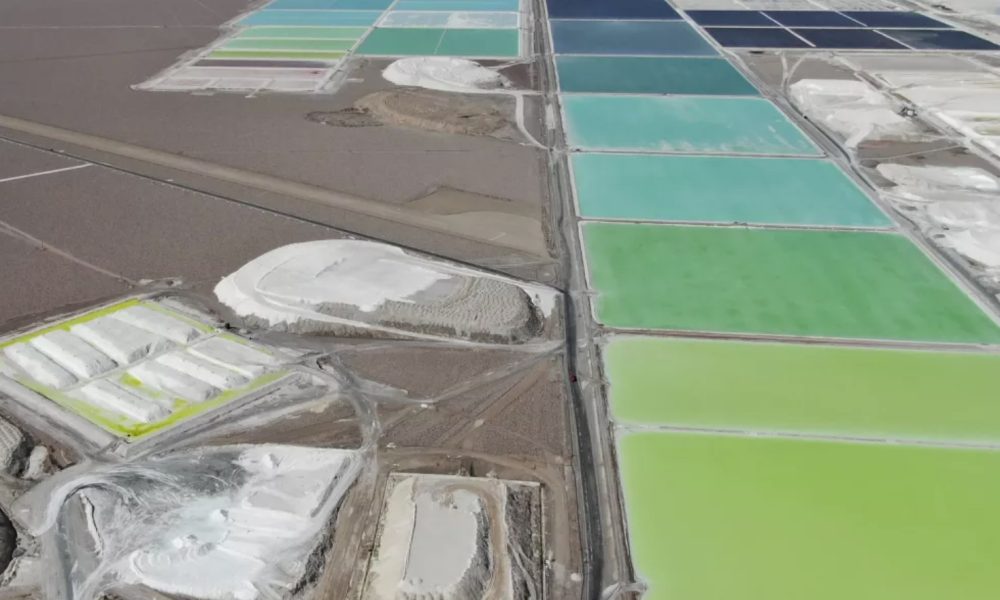

Another 1/3rd come from brines, mineral-rich waters generally found underground. The largest producers of this type of lithium are the so-called “Lithium Triangle”: Bolivia, Argentina, and Chile.

Source: Lithium Harvest

However, the largest proven reserves of lithium are located in the lithium triangle, giving the region the largest potential for future production growth. Together, these three countries represent almost 50% of the world’s lithium reserves.

Source: UFine Battery

Spodumene and Hard-Rock Lithium Extraction

Spodumene and other lithium-rich rocks are extracted through a complex process requiring the rocks to be crushed, calcinated at 1,100 °C (2000 °F), treated with acid and chemicals, and then purified with multiple membranes.

Source: Pall Corporation

It makes the process generally more complex than other lithium extraction methods. It is however a lot easier to scale up, and cheaper, as it utilizes the same methods developed for the extraction of other minerals by the mining industry.

Lithium from Brine Sources

Brines are mineral-rich waters usually found in underground aquifers. Lithium-rich brines tend to be found in desert regions, where the climatic and geological conditions contribute to concentrating lithium.

It is generally a more expensive process, in large part due to the need for reagents like sodium carbonate (soda ash) and lime. While not especially toxic, these chemicals represent a large cost of brine lithium extraction operations, almost as large as the entire cost structure of rock-based lithium production.

Source: S&P Global Market

Emerging Clay-Based Lithium Deposits

A third potential source of lithium, clay deposits, is now being explored by many new lithium companies, thanks to its more equal distribution, allowing for countries looking to bring home lithium production to do so. This is especially true for the USA, with the McDermitt Caldera Lithium Deposit, potentially worth $1.5T.

Ultimately, great power competition and the growing importance of lithium for EVs, green electric grids, and reindustrialization overall might overcome any technical issues or local concerns in favor of national interest. If this is the case, Lithium Americas Corp. (LAC -0.37%) could be one of the companies to benefit.

‘They seem to have hit the sweet spot where the clays are preserved close to the surface, so they won’t have to extract as much rock, yet it hasn’t been weathered away yet.’

Thomas Benson -Geologist at Lithium Americas Corporation

Why Battery-Grade Lithium Refining Matters

Where lithium is mined does not tell the whole story. Another important element is where lithium is refined into a usable product.

Industrial-grade lithium used in glass, ceramics, and lubricants is less purified lithium, and comparatively easy to refine.

In contrast, battery-grade lithium is highly purified, at least at 99.5%, but often up to 99.9%, 99.99%, or even 99.999% for improved performance and battery durability.

Battery-grade level of lithium purity is harder to achieve and requires specialized infrastructure and expertise. Currently, it is a specialty of Chinese producers, with around 67% of global lithium supply processed by China.

“We [the west] don’t build refineries and conversion capacities anymore, the way that we would once. It is foolish to think we could ever remove our dependence on china.”

Sarah Maryssael– Chief strategy officer of Livent

This is another reason for Western countries to look to build their own lithium-supply chain, as the geopolitical and trade tensions with China keep rising.

“Lithium is not merely another commodity – it represents energy independence, technological competitiveness, and climate action capacity all rolled into one mineral resource,”

The International Energy Agency in its Critical Minerals Outlook.

Forecasting Lithium Demand Through 2030

Where Future Lithium Demand Will Come From

Battery-grade lithium is already the largest demand source for lithium and will be even more so by 2030, making up 94% of total demand.

Source: Lithium Harvest

This demand will be driven by a massive built-up in “gigafactories” (factories with more than 1GW of battery production volume per year), with North America and Europe trying to catch up to China’s capacities (9x and 11.7x growth from 2022’s capacity for the USA and Europe respectively).

Source: Lithium Harvest

By far the key driver for future demand will be the quantity and type of batteries used globally.

On one hand, the demand for EVs will of course be a factor. But so is the quality of the charging network, as more charging stations will alleviate range anxiety, reducing the need for large battery packs good for 500+ miles to convince hesitant buyers.

The type of battery will also have an impact. If sodium-ion batteries start to have a high enough energy density, they might start to take market share from lithium-based batteries, at least for the cheaper EV models.

The mass production of solid-state batteries, still to be mass produced and adopted, would likely accelerate greatly the trend of car electrification.

Lastly, an important factor will be the adoption of electric drive trains for heavy vehicles. If most buses, trucks, trams, trains, or even boats start to electrify, this will strongly boost battery demand. For example, the future Tesla Semi is expected to have a 9x-22x larger battery pack than the typical EV.

Key Factors Behind Lithium Price Volatility

Lithium prices have acquired in the past decade a reputation for being extremely volatile, fluctuating widely.

Source: Benchmark Minerals

The 2023 price spike was due to quick growth in demand with not enough supply, as new mines are slow to get started. This was immediately followed by a dramatic fall in prices, stemming from the combination of massive new production capacity coming online and EVs’ adoption rate slowing down at the same time.

Since then, the industry has been in a downturn, with many small producers or mines with too high costs losing money.

As a result, many expansion plans and new mine starts have been canceled, frozen, or delayed. In addition, permitting issues and public protests (like for Rio Tinto (RIO -0.58%) Jadar project in Serbia) have also reduced the anticipated new capacity that should have come in the next years.

As a result, the lithium market is increasingly exposed to a new supply shock, after two years of depressed lithium prices and falling lithium companies stock prices. Only if the demand stays close to the base case will the upcoming supply be enough, even with supply in 2029 alone expected to grow to more than all the lithium mined from 2015-2022 combined.

Source: Lithium Harvest

Overall, any increase in demand from re-accelerating EV adoption, heavy-duty vehicles switching quicker to electric, or more demand for utility-scale battery parks could create a rebound in lithium prices.

How Tariffs Impact the Lithium Market

So far lithium prices have not been dramatically affected by Trump’s tariffs, in large part because China’s control over the industry is strong, but not as severe as for other minerals like rare earths.

So EV manufacturers in the US are anyway able to source their lithium from other countries if needed. That is, if they produce their batteries themselves, and do not import them already manufactured from China, which is a very common situation.

The tariffs could also have an indirect impact on battery manufacturing, at least in the US, as the retaliation on rare earth exports from China could make EV and battery production much more difficult in the country. Especially as it could take 5-15 years to rebuild a rare earth supply chain out of China.

The same holds true for other battery components, for example, 80% of the world’s cathode materials are made in China, along with over 90% of anode materials (the two poles of a battery).

Innovations in Lithium Extraction & Recycling

Direct Lithium Extraction (DLE) Techniques

The commonly used lithium concentration methods rely on evaporation and/or mineral concentration.

Instead, direct extraction targets the lithium atoms through a selective extraction process. This can be achieved through a few different methods:

- Adsorption-based DLE, where the lithium is physically absorbed by a dedicated material.

- Ion Exchange-Based DLE, where the lithium is exchanged against cations (positive ions).

- Solvent Extraction-Based DLE, where an organic liquid solvent absorbs and dissolves the lithium away from the brine.

- One last method was published recently, EDTA-aided loose nanofiltration (EALNF) to extract lithium.

Source: Lithium Harvest

Overall, direct lithium extraction could be a game changer for the industry, allowing for extraction without chemicals and much less energy required.

The company Arcadium, recently acquired by Rio Tinto has been working on direct lithium extraction (DLE) since 1996, in combination with evaporation pounds, and recently made significant progress in making it commercially viable as a stand-alone extraction method.

In addition, Arcadium acquired ILiAD Technologies in 2023, which was developing a selective adsorbent for a “vast range of lithium laden brines under a wide variety of conditions”.

Another, still mostly theoretical method could be Electrochemical Lithium Extraction. The idea is to use a powerful electric current to separate the lithium from the other minerals in the brine.

The brines contain many other minerals with similar ionic sizes and charges including magnesium, calcium, sodium, and potassium. This makes difficult any method based on ion properties only, as you need to do it many times to fully select only the lithium.

The alternative could be using electrical current instead, but the brines often contain a lot of chloride ions which can turn into extremely toxic chlorine gas during traditional electrochemical processes to isolate the lithium.

Chlorine gas, also known as halogen, was notably used as a combat gas during World War 1. However, the problem of its production during electrochemical lithium extraction has so far blocked this technology from being commercially used.

However, a 3-chamber electrochemical reactor developed at Rice University could maybe open the way for that method to become economically and industrially viable.

The Role of Battery Recycling in Future Supply

As more and more batteries are being produced, the more they become a potential pool of resources to “mine” for producing new batteries.

Battery recycling has so far been poorly done, with only a fraction of lithium-ion batteries recycled. However, this could change and have a dramatic impact on future lithium demand from newly opened or expanded mines.

A recent study showed that under a high-demand scenario with low recycling, as many as 85 new and additional lithium deposits would need to be opened up by 2050.

But this could be dramatically reduced, to as few as 15 new mines, through policies that push the market toward smaller batteries and extensive global recycling.

Investors will need to pay attention not only to the EV adoption rate, and new mines opening but also to the growth of battery recycling to determine the real needs for lithium in the upcoming decades.

Investing In Lithium And Battery Tech

Lithium-ion batteries have already changed the world several times, from allowing people to carry advanced electronics everywhere to powering cars with electricity only.

They might still do so again, or other types of batteries, by allowing for a 100% renewable power grid or allowing for airplane electrification when reaching a high enough energy density.

You can invest in battery-related companies through many brokers, and you can find here, on securities.io, our recommendations for the best brokers in the USA, Canada, Australia, the UK, as well as many other countries.

If you are not interested in picking specific lithium or battery companies, you can also look into biotech ETFs like Amplify Lithium & Battery Technology ETF (BATT), Global X’s Lithium & Battery Tech ETF (LIT), or the WisdomTree Battery Solutions UCITS ETF, which will provide a more diversified exposure to capitalize on the growing lithium and battery industry.

Or you can consult our “Top 10 Battery Metals & Renewable Energy Mining Stocks”.

Leading Lithium Miners & Battery Tech Stocks

Rio Tinto: A Major Player in Lithium and Beyond

Rio Tinto Group (RIO -0.58%)

Rio Tinto is a giant of the mining industry (the world’s second-largest), with a strong presence in iron mining, as well as copper, aluminum, gold, uranium, etc.

Rio Tinto is expanding quickly, notably with the mega iron mine project of Simandou in Guinea and the Oyu Tolgoi copper mine, the largest project in the history of Mongolia.

Rio Tinto is expected to provide 25% of the growth volumes in global copper supply in the next 5 years.

Recently it has made a massive entry into the lithium mining sector, with the acquisition of lithium giant Arcadium Lithium, itself the result of the merger in 2023 of large lithium producers Allkem & Livent, making it the 3rd largest lithium producer in the world.

Source: Arcadium

The merger created a company present at all lithium production and processing steps. Arcadium had expansion plans in place to more than double capacity by the end of 2028 that are now going to be carried by Rio Tinto.

Arcadium’s Direct Lithium Extraction (DLE) Technology

Regarding this acquisition, what has been described as “Rio Tinto’s real prize” is Arcadium’s direct lithium extraction (DLE) technology. Arcadium has actually been working on DLE since 1996, in combination with evaporation pounds, and recently made significant progress in making it commercially viable as a stand-alone extraction method.

Notably, Livent acquired ILiAD Technologies in 2023.

“ILiAD Technology Platform combines a superior lithium selective adsorbent with continuous countercurrent bed processing”

“Livent is the world’s foremost practitioner and largest user of DLE-based production processes, and we are thrilled that they have recognized the advantages that ILiAD brings to the future of DLE.

It seems that the long-term expertise of Arcadium with DLE, and the “vast range of lithium laden brines under a wide variety of conditions” of ILiAD were a prime reason for Rio Tinto’s decision to acquire Arcadium, on top of its low valuation due to the cyclical nature of lithium markets.

While in the long run, electrochemical lithium extraction might replace adsorbent-based methods, it is also likely that experience in scaled-up DLE will anyway payoff if this becomes the main lithium extraction method in the future.

Printable Lithium Foil (LIOVIX) Overview

Arcadium also developed LIOVIX, a form of printable lithium foil that could be used to boost battery performances, reduce manufacturing costs, and reduce lithium use.

Source: Arcadium

Rio Tinto’s Broader Green-Metal and Battery Initiatives

Arcadium’s acquisition firmly put Rio Tinto in the camp of mining industry innovators when combined with its tech branch improving copper extraction methods through its venture Nuton.

Nuton’s new technology allows for a much higher rate of copper recovery from mined ore.

Rio Tinto’s aluminum production is low-carbon, thanks to hydropower being used to refine bauxite into alumina and then aluminum.

Rio Tinto also invested in other lithium projects, recently acquiring the Ricon project in Argentina and the controversial Jadar lithium project in Serbia (potentially the largest lithium project in Europe).

Due to its recent acquisitions and new projects, Rio Tinto should increasingly be seen as still an iron miner at the core, with an increasingly green profile and strong growth in all the metals required by the energy transition, especially copper, low-carbon aluminum, and lithium.

As a result, Rio Tinto is a company that should be able to benefit from the energy transition not only from potentially volatile lithium prices but also from more stable sales of aluminum and copper.

Albemarle Corporation: The World’s Largest Pure-Play Lithium Producer

Albemarle Corporation (ALB +2.36%)

For investors interested in a much more lithium-focused stock, Albemarle offers a mix of brine and spodumene-sourced lithium and is the world’s largest lithium producer in the world.

Source: Albemarle

Among other chemicals produced in parallel to lithium can be mentioned bromine, used in industrial water treatment, and flame retardants. Albemarle is also the owner of Ketjen, a provider of advanced catalyst solutions to leading producers in the petrochemical, refining, and specialty chemicals industries.

Source: Albemarle

The company’s largest segment is the energy storage segment (battery-grade lithium), followed by chemical specialties and Ketjen.

Source: Albemarle

Albemarle has mining operations in South America, Australia, and the USA, as well as refineries in the USA, China, and Germany.

Source: Albemarle

Due to the low lithium price, the company has put on hold most of its expansion plans, cutting growth capex by more than $1.3B since 2023 to save cash.

It is also on the way to save up to $400M from improvements in its cost structure (energy efficiency, fewer management layers, etc.) and increased productivity (yield improvements, plant ramp-ups, common ERP platform, etc.).

Thanks to these improvements, the company expects to reach breakeven free cash flow in 2025.

Source: Albemarle

The company is also looking to improve its environmental profile, with for example 24% of total purchased electricity coming from renewable energies in 2024 and the development of a comprehensive Product Carbon Footprints (PCFs) measurement.