Why Copper is More Essential Than Ever

Early on in human history, some people figured out that some special rocks contained metal and that this metal could be melted away and purified. Thanks to their lower melting points and the relatively easy detection of rich veins of ore, gold and copper were among the first metals to be refined.

For millennia, copper and later bronze (copper + tin alloy) were the most important metals on Earth. They formed the basis of every tool and weapon and created the first international trade networks, with tin from the British Isles or central Asia making its way as far as today’s Egypt and Iraq.

Source: Phys.org

After the invention of iron smelting, copper became a much less strategic metal, as it was progressively relegated to low-value coins, jewelry, accessories, roofing, etc.

This was until the industrial revolution, and the discovery of electricity, as copper is an excellent electricity conductor. In practice, gold is an even better one, but copper is the only one cheap enough for practical use, with gold’s electrical applications limited to small amounts in computer chips.

Today, copper is more needed than ever before, in large part due to the trend of electrification of everything: energy production, transportation, heavy industries, heating & cooling, etc.

So, for investors, investing in copper is adjacent to investing in renewable energies, EVs, etc. And it appears we might need a lot more copper than the industry is ready to produce.

Global Copper Markets Overview

Where Copper Comes From: Major Ores and Mining Locations

Copper can be found in many forms of mineral deposits, usually in an oxidized form, giving it a greenish color.

Source: Geology Science

Among the most important copper ores are chalcopyrite (Copper-iron-sulphur CuFeS2), bornite (copper-iron-sulfide Cu5FeS4), malachite (copper-carbonate Cu2CO3(OH)2), and chalcocite (copper sulfide Cu2S), among others.

Chalcopyrite is the most abundant and historically has been used for the most profitable copper mines. Copper sulfide ores can be highly concentrated, but are rare and more costly to process into purified metal.

Source: Britannica

Copper can be found all over the world, but the most abundant resources are in the Americas, following the Andes and the Rocky Mountains, especially as these deposits tend to be of high concentration, making them more economical to mine.

Source: Visual Capitalist

By far, the 3 largest copper-producing countries are Chile, Peru, and Congo, followed by China, the USA, Russia, and Australia.

Source: Visual Capitalist

What Drives Copper Prices?

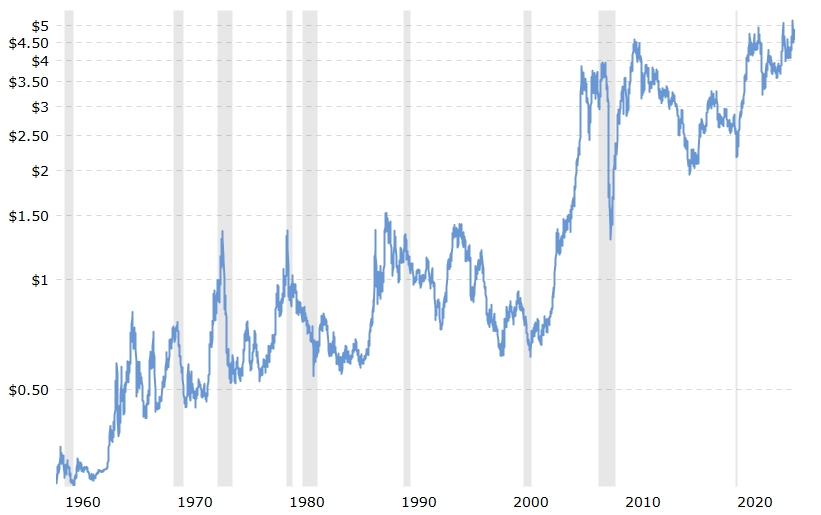

Like most commodities, the copper price is driven by the balance between supply and demand. Overall, the metal has performed well in the past years, especially since 2021.

Source: MacroTrends

Because copper is a quintessential industrial metal, its price is deeply tied to the health of the global economy. It has earned this commodity the nickname of Dr. Copper among traders, with a surplus of copper considered a solid sign of recession in the real economy. And alternatively, high prices and shortages indicate strong industrial activity.

Copper Supply Constraints and Mining Trends

The annual production of copper was standing at 23 million metric tons in 2024.

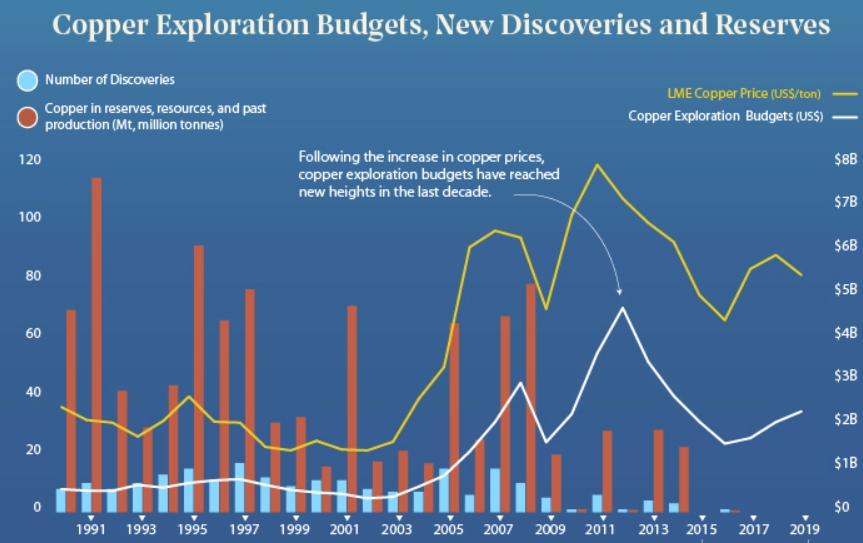

It is likely that many of the largest and easiest-to-exploit copper deposits have already been found. This idea is supported by the low number of new discoveries in the past years, despite copper miners’ very high exploration budget since 2005.

In practice, no significant discovery of large copper deposits has been made since 2015.

Source: Visual Capitalist

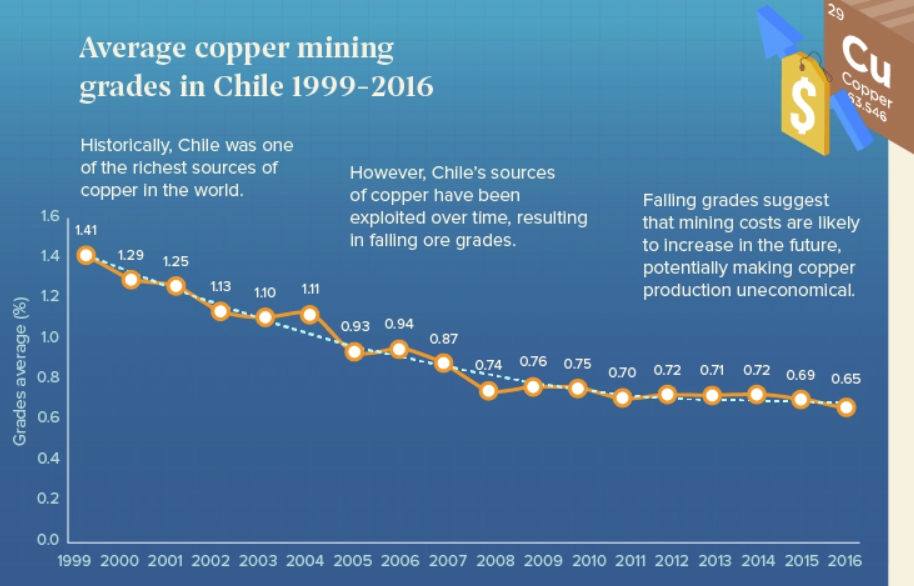

This low replenishing of copper reserve is compounded by the declining quality of some of the world’s best copper-producing assets, notably Chilean mines, which have seen the concentration of mined copper ore more than halved since 1999.

As ore grades fall, exploitation becomes more expensive, requiring higher prices to sustain the production.

Source: Visual Capitalist

It is estimated that no less than $2.1T of investment is required over the next 25 years to meet the demand for copper.

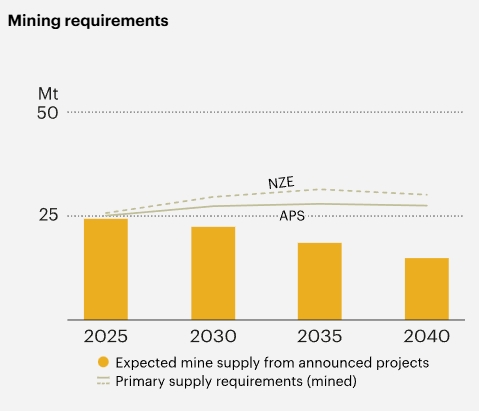

So far, the existing and future mines seem to fall short of expected demand in the next 10-15 years.

Source: IEA

Growing Copper Demand: China, AI, EVs, and Clean Energy

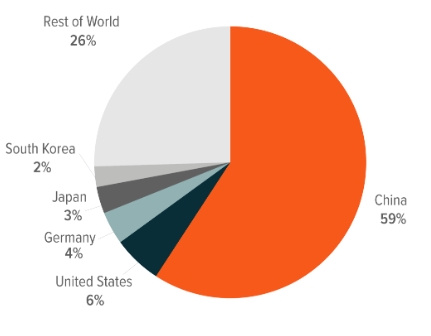

Because of its importance in green tech and industrial goods in general, it is not surprising that by far the largest copper consumer is China, with more than half of the world’s consumption.

It is then followed by other major industrial powers, such as the USA, Germany, Japan, and South Korea.

Source: GlobalX ETF

China is also responsible for 46% of global copper refining, so most of its consumption is from raw ore imported to China and refined in the country.

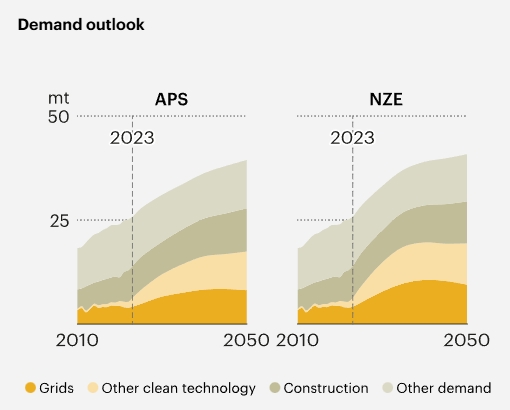

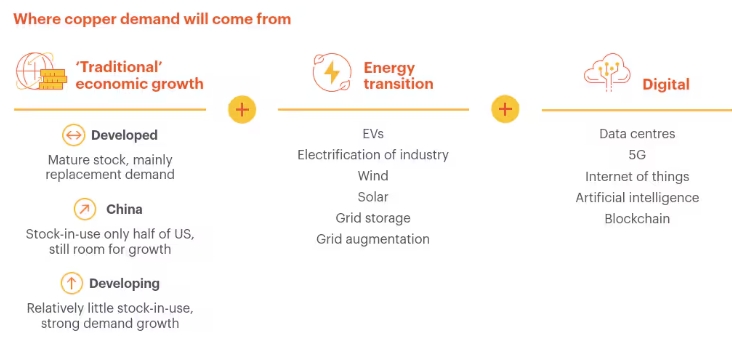

Copper demand is expected to grow quickly, in large part driven by electric grid expansion and clean technologies, with construction and other source of demand staying steady or growing slightly.

Source: IEA

“As we look towards 2050, we foresee global copper demand increasing by 70% to reach 50 million tonnes annually.

This will be driven by copper’s role in both current and emerging technologies, as well as the world’s decarbonization goals,”

Rag Udd – BHP’s chief commercial officer

Another factor in growing copper demand is the overall growth of energy consumption and power generation, as a result of the development of massive countries like China, Southeast Asia, India, etc. Computing power also requires a lot of copper for AI applications, blockchain, 5G connectivity, etc.

Source: BHP

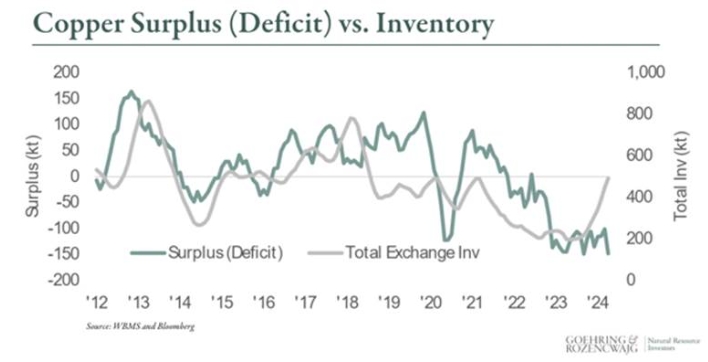

Due to growing demand and no significant new mines opening, the copper industry has been in chronic supply deficit since 2022, with the deficit deepening in the past 2 years.

Source: Mining.com

Copper Recycling: Meeting Demand Sustainably

Besides mining, recycling is becoming an essential additional copper source. It currently supplies around 1/3rd of the world’s copper demand.

Theoretically, copper is 100% recyclable, which should reduce the pressure on new mining to provide this key metal in the long run. Recycling also saves up to 85% of the energy required to produce copper.

In practice, copper is not always recycled well, either because it is found in small amounts among other metals, or because of poor recycling and trash management practices, with only a 32% recovery rate currently.

By integrating advanced processing technologies with significantly improved recycling rates, around two-thirds of newly available end-of-life copper scrap could be recovered and recycled by 2040

Source: World Resources Institute

Significant legislative changes are also made to help recover more metal. For example, in the European Union, the End-of-Life Vehicles Directive mandates that all end-of-life vehicles achieve a minimum of 95% recovery and 85% recycling based on their average weight, including materials such as copper.

Key Industries Driving Copper Demand

Copper in Heating and Cooling Systems

Copper is not only a very powerful electric conductor, but also an excellent heat conductor. This is why it is used in large quantities in air conditioning systems and heat pumps.

A typical air conditioner compressor might contain anywhere from 1 to 5 pounds of copper depending on their size and complexity. As most of the “Global South” is developing quickly, this has been a powerful source of demand.

Up to 21 kg/46 lbs of copper can be found in a heat pump’s evaporators, condensers, compressors, piping, connections, control, and sensor cabling.

As 43% of US household energy consumption is for heating both living space and water, and 31% of European households, the electrification of these sectors away from natural gas is going to be almost as important for copper demand as EVs and renewables deployment.

Copper’s Role in Renewable Energy and Green Technology

Copper is the most important metal for green technology overall, with a high importance in photovoltaic, wind power, electric grid, EVs, and energy storage.

Source: GlobalX ETF

Solar energy installations consume around 5.5 tons of copper per MW of nominal capacity.

As solar power has become increasingly cheaper, it has not significantly reduced its copper consumption per MW, as this is mostly for cables, wiring, and overall electricity transfer, which are not easy to improve through technological improvement, contrary to the efficiency of the photovoltaic components.

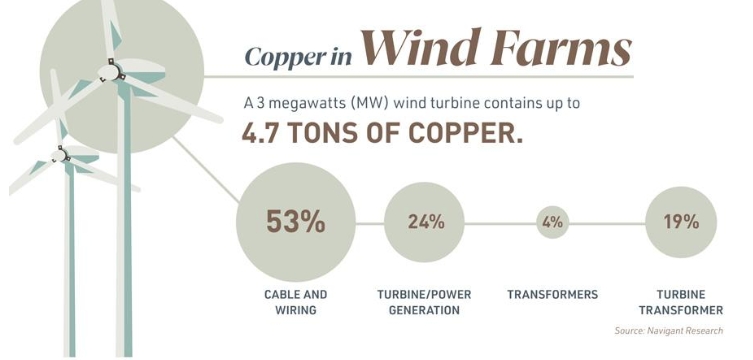

A 3MW wind turbine consumes around 4.7 tons of copper, with roughly half used in cable & wiring, and the rest in the turbine and transformer.

This does not fully reflect the future consumption of copper by wind projects, as the largest projects of the industry are expected to be offshore wind projects in the coming years. Offshore wind consumes a lot more copper, up to 10-11 tons per MW, due to much longer cables, which consume up to 80% of the copper used in these projects.

Source: Copper.org

How Electric Vehicles Drive Copper Consumption

Copper is a key element of electric cars and other electric vehicles, with cabling, more electronic controls, and the battery pack being the main consumers.

An average electric car contains almost up to 100kg/200 pounds of copper, or 2-3x times more than a fuel car. The ratio is even higher for heavy-duty vehicles like buses and trucks.

So overall, the electrification of transportation is going to be a major driver of copper consumption moving forward. It should be noted that hybrid vehicles are much less copper-hungry, so the scale of their adoption to move from ICE (Internal Combustion Engine) cars will be important.

The Electric Grid and Storage Boom: A Copper-Heavy Transition

Copper is already commonly used in construction for the wiring inside buildings.

The electrification of transportation, industry, and heating requires a lot more power. And this requires a lot of charging stations, transformers, etc. which are themselves using a lot of copper.

It should however be noted that long-distance power lines do not consume much copper, as these are made of aluminum.

Additionally, renewable energy requires a lot of battery storage to work due to the natural intermittence of their energy production, only when the wind blows or the Sun shines.

Source: Copper Development Association

All types of batteries require large amounts of copper, around 440-540 pounds per MW of capacity. Even pumped hydro requires 320 pounds per MW, mostly from the powerful electric pump that this energy storage requires.

If we were to switch to a mostly renewable-powered electric grid, the battery system could become a copper demand source as large as the rest of the grid.

AI, Data Centers, and Copper: The Computing Connection

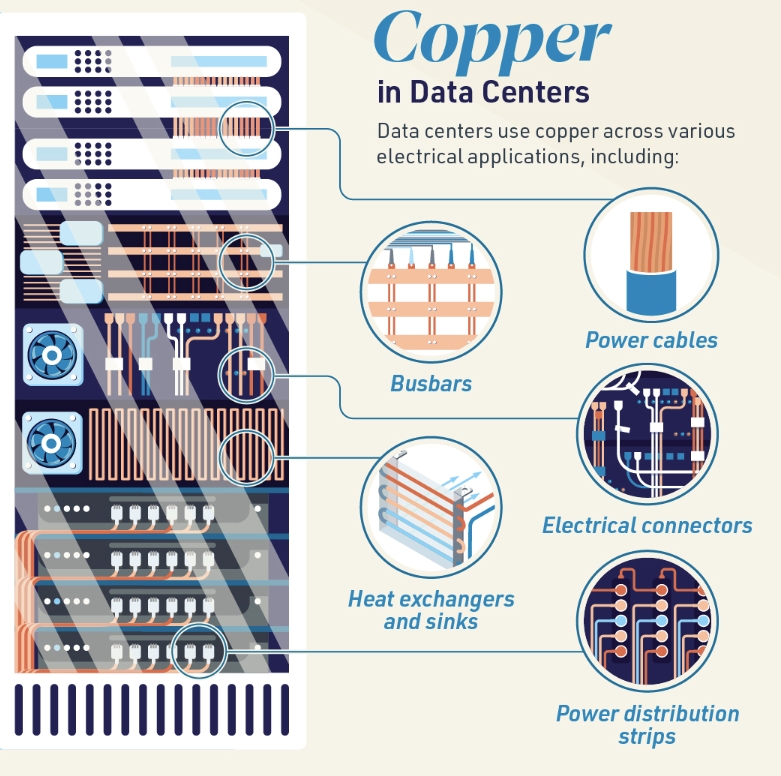

AI and computing, in general, are also major consumers of copper. This is true at all levels, from copper in the chips to power cables and heat sinks that keep the server from being damaged due to their own heat production.

Source: Visual Capitalist

For example, Microsoft’s US$500M data center facility in Chicago found it used 2,177 tonnes of copper, equivalent to 27 tonnes of copper for every megawatt of applied power. Currently, data center power capacity is around 55 GW, and might increase to 84 GW by 2027, or the equivalent of 810,000 tons of additional copper demand globally.

“Today, data centers are less than 1 percent of copper demand, but that is expected to be 6 to 7 percent by 2050.”

Vandita Pant – BHP’s chief financial officer

Other Uses for Copper: Construction, Healthcare, and More

Asides from wiring, copper is also used in piping, especially the piping inside buildings. It is also sometimes used for roofs, waterspouts, gutters, etc.

The red metal also has antibacterial activity, and could help limit the spread of diseases in hospitals if used for door knobs. For the same reason, copper is sometimes used in aquaculture, as it is also corrosion-resistant.

Copper Alternatives: Can Substitutes Ease Demand?

Because copper prices have been rising and shortages are expected, many industries are looking at potential alternatives.

One way to do it is to substitute copper with another metal that shares enough of the desired capacity. This is especially possible with aluminum, which has relatively similar electric and thermal conductivity. For example, aluminum is a good candidate for the replacement of copper in all thermal-focused applications, like heat pumps, air conditioners, and heat management of data centers.

You can read more about aluminum’s investment potential in the corresponding report “Investing In Aluminum: The Metal Of The Future”.

Another way to reduce copper needs is to replace it with other materials or adopt different technology that requires less copper. For example, while still more carbon-intensive than EVs, hybrid vehicles could help reduce emissions without the same explosive copper demand.

Lastly, using less copper for the same applications while maintaining the same functionality, thanks to more efficient designs, is an option. Additive manufacturing (3D printing) can help in this task, especially for more efficient heat transfer solutions using less metal.

Final Thoughts: Copper as a Strategic Investment

Copper is back to being one of the world’s most important metals for human civilization, and will likely stay so as long as we use electricity and need to move heat for people’s needs and industrial purposes.

The trend of electrification of transportation, heating, and industries will require more copper, not only to power these applications but also to generate electricity and store that power, especially if we want our energy grid to be based on renewable energies.

Meanwhile, the current mines are already insufficient to match consumption, with a growing supply deficit. This trend is expected to keep up, especially as on top of the energy transition, the growing computational need for AI and other tech applications is demanding more copper as well.

This can be an opportunity for investors to bet on companies with sufficient copper reserves and/or upcoming new production from some of the rare new copper mines or expanding existing mines.

Investing in Copper Mining

Freeport-McMoRan

Freeport-McMoRan Inc. (FCX -2.45%)

While many mining companies are producing copper, only a few are mostly copper-focused. Even then, they will generally produce some other metals as well, as copper ore is usually rich in other metals as well.

This is the case of Freeport, a copper producer with a significant exposure to gold.

The company started as a spin-off of its former parent company after the discovery of the Grasberg copper and gold deposit in Papua, Indonesia.

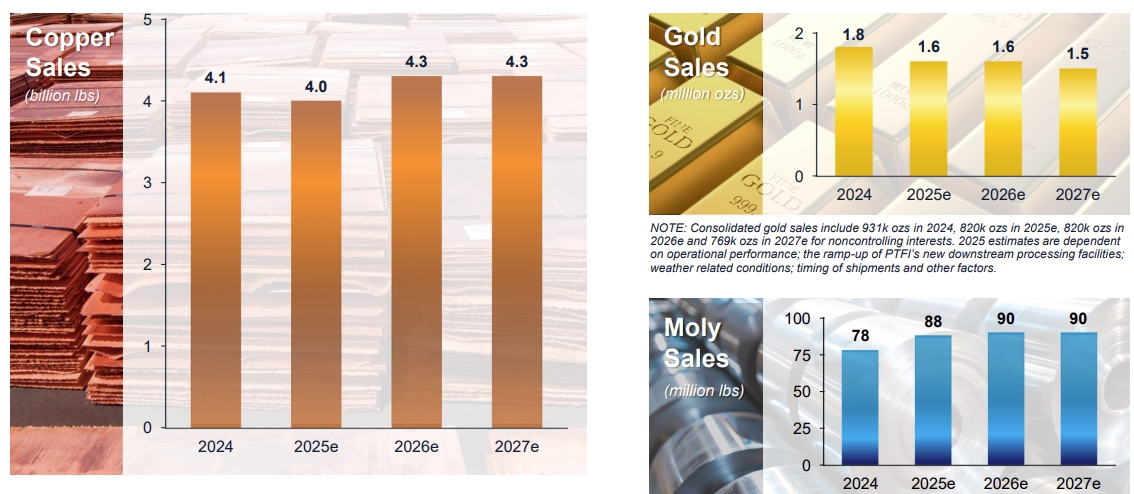

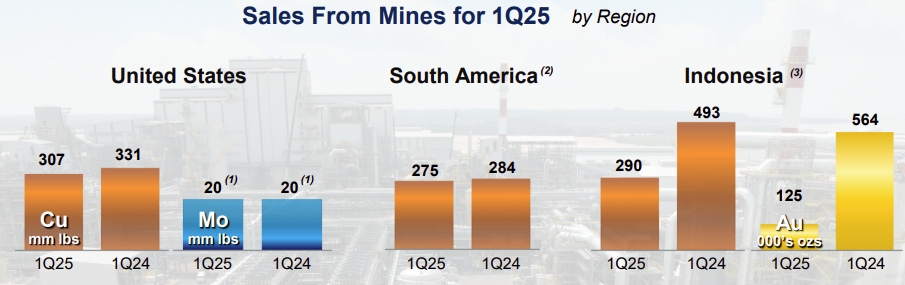

It produces annually around 4 billion pounds of copper, or 2 billion tons, almost 8% of global output. It also produced 1.8 million ounces of gold in 2024, and 78 million pounds of molybdenum.

Source: Freeport-McMoRan

The company’s portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world’s largest copper and gold deposits; and significant operations in the Americas, including the large-scale Morenci minerals district in North America and the Cerro Verde operation in South America.

Source: Opportimes

The US operations of the company represent 1/3rd of the company production, and about 70% of the USA copper production, making it a good choice in the context of US tariffs and the White House issuing an executive order citing copper as a critical material in February 2025.

The rest of the copper production is split between Indonesia and South America, with gold production coming exclusively from the Grasberg mine in Indonesia.

Source: Freeport-McMoRan

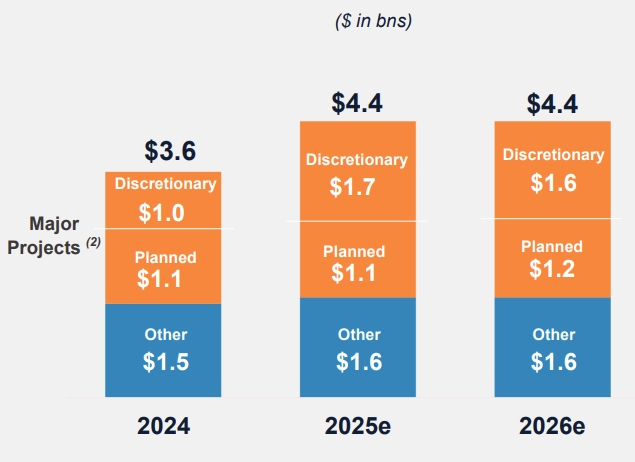

While overall, the copper industry is not growing much, and definitely not enough to match the growing demand, this is not the case for Freeport itself. The company has a strong pipeline of projects which should ultimately add a production of 2.5 billion of copper per year, mostly in the US, and 0.5 million ounces of gold per year from Indonesia.

Source: Freeport-McMoRan

So this puts Freeport in the position of having massive capital expenditure in the coming years, but with most of it discretionary. If copper prices were to fall, due to a global recession for example, it could quickly cut back on expansion plans and save cash instead.

Source: Freeport-McMoRan

Freeport is also looking to improve its environmental profile, notably by replacing its electricity production in Grasberg from coal to a 265 MW gas turbine instead.

Since 2021, the company has distributed as much as $5B to its shareholders, mostly in the form of dividends (61%) and share repurchases (39%).

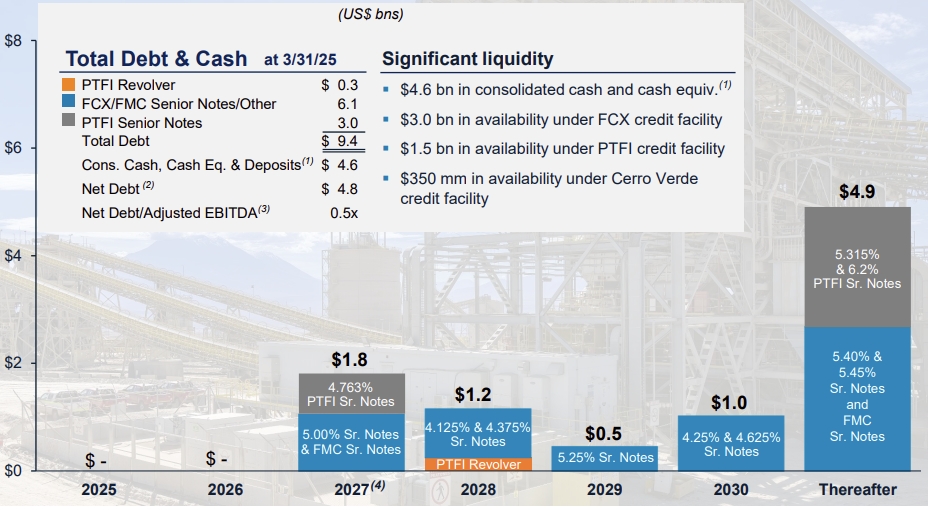

The company is relatively secure regarding debt, with no significant repayment before 2027, and the bulk of the debt due for 2031 or later.

Source: Freeport-McMoRan

Overall, Freeport-McMoRan is mostly a stock for investors looking for exposure to copper, with also revenues from gold production as well, with a diversified risk profile through production spread out in North America, South America, and Indonesia.