Apptronik continues to push the robotics industry forward through its innovations and growing product line. The company’s commitment to creating a future where robots and humans can safely work alongside each other has sparked interest in both investors and robot enthusiasts. As such, the manufacturer’s shares are in high demand. Here’s everything you need to know about buying Apptronik pre-IPO shares.

What is Apptronik?

Apptronik entered the market in 2016. Its headquarters are in Austin, Texas, and it’s a leading robotics research and manufacturing firm. The company operates in the humanoid robots sector, where it competes against firms such as Tesla. Its goal is to provide safe, reliable, capable, and affordable humanoid robots for both home and industrial use.

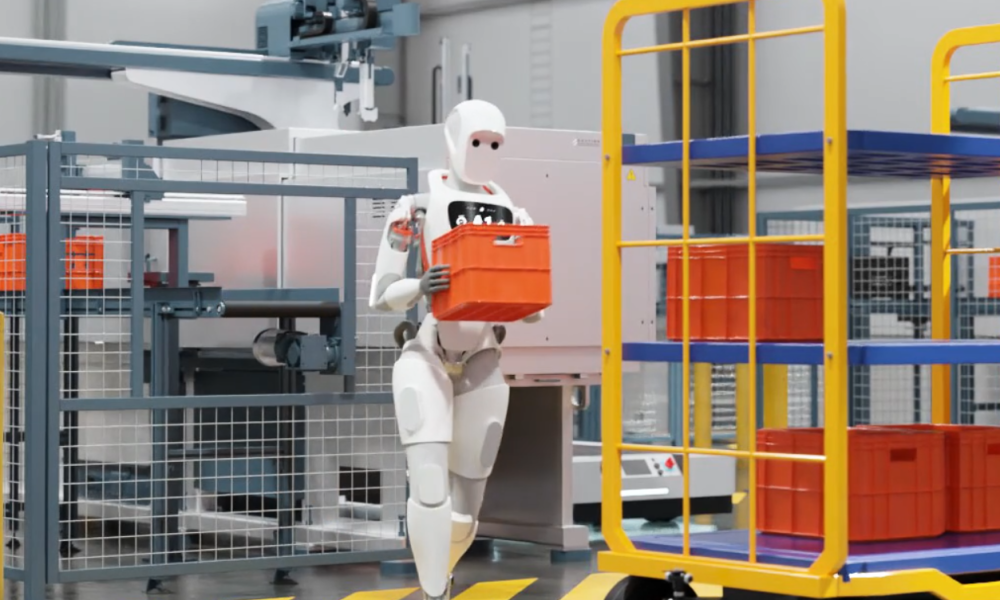

Competitors have found themselves behind Apptronik around many curves. The company’s flagship product, Apollo, will be among the first humanoid industrial robots to hit the market. The Apollo robot integrates a modular design that provides more flexibility to the device. Users can shift between different bases that combine legs, wheels, and other systems to improve their robots’ performance during particular tasks.

The Apollo robot will be priced at $50k, making it the most affordable option for industrial humanoid robots. The economically viable device will be capable of a variety of industrial tasks like stacking items, unloading trailers, managing pallets, sorting goods, and handling heavy lifting. Apollo sees their devices as the best option to provide support for unwanted tasks, increasing job satisfaction for human workers while pushing production capacity.

Historical Funding Rounds

Summary of Apptronik Funding:

Total Funding: Apptronik secured $436M across 7 funding rounds

Largest Round: Apptronik’s largest funding round secured $350M on January 31, 2025.

Investors: A total of 16 institutional investors back Apptronik

Latest Round: The latest funding round raised $53M and was a Series A round held on Mar 18, 2025.

Funding Rounds Breakdown:

- 4 Seed Rounds

- 2 Early-Stage Rounds

- 1 Grant Round

Apptronik Key Investors:

Apptronik secured the support of several well-known investors, including Google, Mercedes-Benz, Japan Post Capital, B Capital, Capital Factory, Terex Corporation, and Grit Ventures.

Funding Data is Sourced from Tracxn

Why Invest in Apptronik?

When you examine Apptroniks’ products and market positioning, it’s easy to see why this company is an exciting investment opportunity. The high-end humanoid robotics sector includes some of the most innovative and advanced names in tech. Apptronik competes and surpasses its competitors on many metrics. From humanoid robots that can talk to warehouse versions that can unload trucks, Apptronik’s products have real demand.

Robotics Industry Set To Grow

The robotics industry is on the rise, with analysts predicting humanoid robots will be in most factories within the next 5-10 years. Impressively, the robotics market hit $87.1B in value in 2024, with analysts predicting growth every year for the next decade. This growth opens the door for Apptronik to secure major funding as a first mover and as an affordable option versus the competition.

Smart Business Strategy

Apptronik’s unique approach to the market has helped it to remain a top contender. The firm has a vertically integrated hardware model with a B2B go-to-market strategy that has proven effective. Additionally, the company has a dual monetization strategy that could see their devices working in factories and homes within the next 5 years.

Major Partnerships

Another reason to consider purchasing pre-IPO shares in Apptronik is that the firm has strategic partnerships with reputable organizations and tech industry leaders. For example, the company partnered with NASA to create its humanoid robot, Valkyrie. In total, Apptronik has 15 robotic systems in operation today, all of which continue to help the firm push towards its commercially available product release.

Leading the Race to Get a Product to Market

Apptronik has put in the time and research to create a humanoid robot that is both affordable and accessible to the masses. For those who see robotics as a crucial element of mankind’s future, this marks a major milestone that could be seen in the same context as Henry Ford launching the Model T.

How to Buy Apptronik Pre-IPO Shares

Apptronik shares are in high demand. However, the company remains privately held, meaning that you will need to utilize a specialized approach to get access to shares. Here is what you need to consider.

1. Pre-IPO Secondary Marketplace

Secondary markets are purpose-built exchanges that connect pre-IPO shareholders with potential investors. These marketplaces can offer these assets because they work closely with employees, early-stage investors, and venture capitalists, who are crucial to the company’s pre-IPO growth.

Investing in pre-IPO shares of Apptronik could offer strong returns if the company’s valuation increases following its initial public offering (IPO). It is common for company valuations to increase following an initial public offering (IPO). As such, it makes sense to add pre-IPO shares to your portfolio before the firm announces plans to go public.

Secondary marketplaces have many requirements. Here are some concerns you should be made aware of:

Eligibility: Notably, this approach requires you to be an accredited investor, meaning you will have to show at least $1M in liquid assets to qualify. If you meet the requirements and are comfortable with the risks, several platforms offer access to pre-IPO opportunities:

-

Forge Global: One of the largest private stock marketplaces, offering shares in late-stage startups like SpaceX, Stripe, and Databricks. Minimums typically start around $100,000.

-

EquityZen: A popular platform allowing accredited investors to buy into private companies with minimums as low as $5,000. Past offerings include companies like Discord and UiPath.

-

Rainmaker Securities: A full-service broker that helps source and negotiate private share sales, including opportunities in companies like OpenAI, Stripe, and Palantir.

-

Hiive: A newer platform with live bid/ask pricing for hundreds of private companies. Transparent and low-fee, with minimums starting around $25,000.

-

MicroVentures: Offers pooled access to late-stage companies through special purpose vehicles (SPVs), including past investments in SpaceX and Instacart.

-

EquityBee: Allows investors to fund employee stock option exercises at startups, often at discounted valuations, with minimums around $10,000.

-

Augment: A digital-first marketplace showing real-time pricing for pre-IPO shares, targeting tech-savvy investors and offering lower transaction fees.

- StartEngine Private: Launched in late 2023, this platform offers accredited investors access to Regulation D offerings in later-stage, venture-backed companies. In its first nine months, it generated $16.5 million in revenue, with average investments around $32,000

Important: Always perform thorough due diligence and consult a financial advisor before investing in private company shares.

2. Private Equity Firms

Private equity firms gain access to pre-IPO shares during investment rounds. They then offer these shares to high-net-worth accredited investors with a commission. Notably, private equity firms are known to have extra stipulations, including blocking the sale of shares for years in some cases.

Considerations

Access: Significant capital is usually required, as private equity firms often deal in large transactions.

Long-Term Horizon: These investments typically come with a longer-term commitment, and liquidity may be limited until a public offering or company buyout occurs.

3. Employee Equity Sales

Many consider employee equity sales as the best way to acquire pre-IPO shares in Apptronik. This method of acquiring pre-IPO shares requires you to connect with former employees. It’s common for companies to issue shares as part of an incentive package. Notably, this profit-sharing method has become more popular, leading to more pre-IPO share opportunities for investors.

Considerations

Private Transactions: There are a lot of hoops you will need to jump through to complete a private pre-IPO transaction, including creating specific legal agreements, conducting valuations, and setting in place any limitations on the transfer of the asset.

Brokerage: Brokers will take a lot of the confusion out of the pre-IPO process. These professionals can guide you through each step, ensuring full compliance and avoiding common errors untrained professionals make.

Risks of Pre-IPO Investment

There are several risks that you should consider before jumping into the pre-IPO shares investment arena. Here are the top concerns:

Liquidity Risk

If you are looking for an asset that you can sell right away, pre-IPO shares are not the best option. These investments can include sales and transfer clauses that prevent the transfer of the asset until certain criteria, such as the IPO’s completion. It’s even common for pre-IPO shares to require you to wait years before gaining the ability to sell your assets.

Regulatory Risk

Apptronik operates in a field that may become increasingly regulated as humanoid robots become more integrated into workplaces and public spaces. Governments may introduce safety, data privacy, or labor-related regulations that affect the development, deployment, or commercial use of robotic systems. Such changes could impact Apptronik’s go-to-market strategy or increase compliance costs, affecting profitability and investor returns.

Market Risk

Investing in pre-IPO shares of Apptronik means betting on the future growth of the robotics sector and the company’s ability to maintain a competitive advantage. While the robotics market is projected to expand significantly, broader economic conditions, technological competition, or slower-than-expected adoption of humanoid robots could impact Apptronik’s valuation and future revenue. Delays in product rollout, shifts in customer demand, or new entrants offering alternative solutions could also affect the company’s market position and investor returns.

Valuation of Apptronik and Future IPO

Apptronik offers a glimpse into the future of robotics today. The company secured a $1.5B valuation in 2025 following a successful series A funding round. It achieved this valuation due to a combination of market positioning, business strategy, strategic partnerships, and game-changing tech.

Source – Apptronik

Demand for Apptronik’s pre-IPO shares is through the roof as many see this company as an innovative pioneer. If the firm were to launch an IPO, it could result in billions in funding that would go towards improving its current robotics systems. This decision could cement the company as a market leader and drive revenue higher.

If Apptronik does go public in the coming year or so, it will see massive support from both institutional and public investors. As such, anyone holding Apptronik’s pre-IPO shares before the company’s IPO could find they are optimally positioned to secure returns during the robotics market breakout.

Conclusion: Should You Buy Apptronik Pre-IPO Shares?

Investing in Apptronik places you directly in the center of the robotics industry. This company intends to drive innovation and push the boundaries of what it means to be a robot. Its business strategy and product line have lots of growth potential, and the firm’s strategic partnerships ensure it will be around for many years.

Before investing in any pre-IPO shares, you should do additional research. It’s recommended that you consult a financial professional to ensure that you remain within your risk appetite. If Apptronik can successfully beat the competition to market and provide a reliable and affordable humanoid robot, it will make owning its pre-IPO shares worth the risks.

Learn about Other Pre-IPO Opportunities Now

Disclaimer: This article is for informational purposes only and does not constitute financial, legal, or investment advice. Pre-IPO shares are typically available only to accredited investors and carry significant risk. Always perform thorough due diligence and consult a financial advisor or legal expert before making investment decisions.