A New Era For Biotech

Over time, knowledge about medicine and biotechnology has changed in successive important phases. At first, it was mostly about understanding natural biochemical processes. Then, synthetic chemical drugs started to alter these processes. Then, bioengineering allowed for the production by GMO microbes of cheap and safe insulin, growth hormone, etc.

Today, many technologies are converging to open another era of biosciences: Big data, AI, automation, precise genetic engineering, advanced analytics, etc.

This phase of newly engineered organisms and therapies is not just correcting or replicating what nature made, but instead creating from scratch entirely new capacities. This could be a radical new tool for solving most of the modern world’s problems: plastic pollution, climate change, sustainable agriculture, non-polluting industrial production, biosecurity, incurable diseases, regenerative medicine, longevity treatments, etc.

Managing to tackle this entirely new tech stack, on top of the already complex setup of medical research, clinical trials, or industrial facilities, can be difficult, even for industry leaders.

This is why specialized companies are emerging to provide their expertise as a service with “Research-as-a-Service” or “organisms-on-demand” new forms of offering. And leading this emerging sector is one company: Ginkgo Bioworks.

Ginkgo Bioworks Holdings, Inc. (DNA +2.59%)

The Origins of Ginkgo Bioworks

The company was founded in 2008 by five MIT scientists, to produce GMO bacteria for industrial applications. The core idea was that most projects using modified microorganisms have to repeat separately the same steps before reaching a usable product.

Instead, a company like Ginkgo could perform these steps once and then license multiple products from this common technological and biological base.

Think of a cell. It’s kind of like a little machine that runs on digital code, very similar to a computer, except in this case the code—instead of zeros and ones, it’s A’s, T’s, C’s, and G’s.

So synthetic biology is programming cells like we program computers, by changing the DNA code inside them. We’re sort of like cell programmers for hire. Our job is to make the cell do what our customers want.

Jason Kelly – Ginkgo Bioworks CEO

Ginkgo was the first biotechnology company to join the famed Y Combinator start-up accelerator program in 2014 and was at one point one of the world’s largest privately held biotech companies, valued at $4.2 billion in 2019.

The company went public in 2021 through a SPAC merger and managed to secure the NYSE ticker DNA, previously held by biotech pioneer Genentech (before its acquisition by Roche).

Ginkgo’s Unique Services & Infrastructure

Ginkgo Automation

An original selling point for Ginkgo has been that it generated biological data in an automatized and consistent fashion.

This is a crucial development for biotech, as hard-to-replicate or compare studies have plagued the industry and any tentative attempts to systematize scientific discoveries.

Automation, instead of painstaking and slow manual labor by PhD-level researchers is also needed to keep control of costs.

To solve these issues, the company developed the Reconfigurable Automation Carts (RACs), a modular building block to create automatized biolabs, with robotic arms, wireless connection, and modular analytical device slots.

Source: Ginkgo Bioworks

They can then be connected with each other in order to create a sort of “assembly chain” for scientific experiments and bioanalyses.

Source: Ginkgo Bioworks

This solution is combined with a software offering, creating a flexible solution that can be adapted and modified in just days or hours, compared to more rigid research infrastructures requiring months of costly reconfiguration for new projects.

Ginkgo Datapoint

While Automation generates the biological data, Datapoint processes them into useful insights.

The key element is the quick generation of data that can guide further hypotheses, and the rapid iteration of new experiments to keep moving forward.

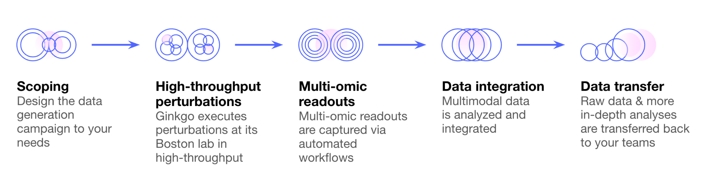

Source: Ginkgo Bioworks

With this service, Ginkgo can provide data that entirely belongs to the client, which is a competitive advantage to partnerships with other biotech or pharmaceutical companies.

Data can be generated in as little as 3 weeks, with over 10,000s of in vitro chemical and genetic perturbations in each cell type, and a large choice of analytical methods available to study the results.

The same system can be used for the quick generation of new antibodies, a type of molecule quickly becoming a key medicine in oncology and other medical fields. Ginkgo can screen up to 2,400 different antibodies in parallel, thanks to a $1B worth of automated wet lab infrastructure.

Source: Ginkgo Bioworks

Lastly, this technology can also be used to generate and test new mRNA sequences very quickly.

Source: Ginkgo Bioworks

Overall, these data could also be used to train AI agent specialized in biotech research, either directly by Ginkgo or by its clients if they are ready to pay for an unlimited access to said data. Or for that matter, maybe helping AI to compute in a more energy efficient way with organoids, micro-brain grown in lab and that can connect to silicon chips.

Ginkgo Bioworks Segments

Because the potential for custom bioengineered organisms and synthetic biology is so vast, Ginkgo has potential in many extremely large markets, notably agriculture, biologic pharmaceuticals, biosecurity, government programs, and industrial biotechnology.

Agriculture

As modern farming is under pressure from the need for more sustainable practices, invasive species, degrading soils, and climate change, new crop varieties are in high demand.

The company operates its own greenhouse facility and has access to 387,000+ strains of agronomic plants, as well as 2.7 billion genes in a private metagenomic database that virtually does not overlap with public gene databases.

The focus of this segment is split between crop protection (against pests and diseases), crop nutrition (fertilizers optimization), and plant traits (growth rate, yields, resistance to water or thermal stress, etc.).

Ginkgo’s products help create biocontrol for pests that otherwise need chemical treatments to not destroy the crops, like for example the partnership with Vitales to control critical soybean diseases in Brazil.

“Partnering with Ginkgo allows us to accelerate our timeline for bringing vital new biocontrol solutions to market. Ginkgo’s expertise in fermentation and formulation, with teams working collaboratively under the same roof, will speed up the development of economically viable product concepts.”

Fernando Eduardo Alves de Sousa – Biological Sciences, Vitales

Ginkgo’s client list in agribusinesses includes leading firms like the global leaders Bayer and Syngenta.

The partnership with Bayer is looking to replace nitrogen fertilizers with bacteria; nitrogen fertilizer consumes 5% of the total worldwide natural gas used and is responsible for 3% of global greenhouse gas emissions.

Biopharma

As one of the largest money makers in the biotech industry, the biopharmaceutical sector is very important for Ginkgo. The company has secured relations with an impressive roster of large pharmaceutical companies, including Pfizer, Novo Nordisk, Biogen, Moderna, and Boehringer Ingelheim.

“We believe that Ginkgo’s unique combination of cell programming expertise, proprietary tools, and knowledge of biological systems make them an ideal collaboration partner.”

Alphonse Galdes – Fmr. Head of Pharmaceutical Operations & Technology at Biogen

The partnership and services are organized around 6 different main topics:

“Access to Ginkgo’s proprietary platform will help enable Pfizer to search for novel and exciting RNA constructs with improved stability and expression that could lead to more effective treatments.”

Will Somers – Head of Biomedicine Design at Pfizer

Among the key partnerships growing recently, Novo Nordisk has expanded its connection to Ginkgo in 2024. What started in 2022 with a narrow focus on production optimization is now also looking at expanding it wider, as well as adding discovery and development of new protein-based pharmaceuticals.

“This progress is a strong indicator of the potential we have to engineer biological systems that will expand the chemical space of biological medicines.”

Brian Vandahl – SVP, Global Research Technologie at Novo Nordisk”

Other Ginkgo’s various research programs and partnerships that can be mentioned include:

Source: Ginkgo Bioworks

Biosecurity & Government

During the pandemic, Ginkgo provided help in producing tests for the detection of Covid-19, with 15+ million samples tested in 11 key international airports.

It is now helping with monitoring H5N1 (avian flu) through genomic surveillance using anonymized milk samples.

The company performs these tasks primarily through 2 tools: Horizon and Canopy.

Horizon

This is a biological reporting suite of software and database with Localized biointelligence (BIOINT) for geographies of interest. The overall idea is to provide better data to decision-makers in hospitals, governments, airlines, etc.

This is done through early warning systems, forecasting & modeling of infections, identification of high-risk hubs, preparedness assessment, and supply management, and can even be used to train custom AIs.

Canopy

Canopy is a localized pathogen surveillance system using rapid PCR for detection, next-generation sequencing, and AI-powered analysis.

This is made to provide early warning, better evaluation of the real-time situation, and fill gaps in public data.

Together with Horizon, Ginkgo can help better handle potential pandemics, ongoing epidemics, and general bio-threats.

Industrial Biotech

Many chemical and manufacturing industrial systems rely on large supplies of toxic and/or polluting materials and can be very energy-intensive. In theory, most of these could be replaced by the biochemical abilities of microorganisms, plants, or isolated enzymes.

Ginkgo is currently partnering with important companies in the sector producing colorants, flavors, perfumes, etc. like Givaudan, Robertet, or Solvay.

This can replace chemical or metallic catalysts with biocatalysts, replace artificial ingredients with natural ones, or produce cheaply and more reliably functional proteins.

Ginkgo’s Business Model Incertitude

Despite its remarkable technical achievements, Ginkgo has been struggling from an investment and stock price point of view.

This was in large part due to its unique business model, which many are doubting could bring enough money to justify its very high 2021 valuation, which was further inflated by the general high valuation of the whole biotech sector during the pandemic.

The fact that Ginkgo does not receive royalties for its discovery is a commercial advantage for signing deals but can also severely hinder its ability to profit from them in the long term.

Some elements showing this are probably starting to change. First is the delivery of a major milestone in a project with Merck, leading to a $9M payout in Q4 2024, and the start of stage 2 of the project with further larger payments to be expected.

As this should lead to improvement in Merck’s biomanufacturing process, it is also likely to generate further income for Ginkgo’s down the road. The previously mentioned expansion of collaboration with insulin giant and Ozempic-fame Novo Nordisk will also be important.

Source: Ginkgo Bioworks

In total, the company has as much as $1.7B in aggregate potential future cash revenue in the downstream milestone pool.

The company is also now making direct sales of its tools to researchers in both public and private labs, creating another flow of income (including future maintenance, update, and consumable sales) that might be more steady than the irregular milestone payment from partners.

Overall, the revenues from biosecurity are shrinking in the post-pandemic era but are being replaced by cell engineering contracts.

Source: Ginkgo Bioworks

Restructuring

Another element to improve the company’s financial situation is to reduce overhead costs. In 2024, the company has aggressively reduced its costs unrelated to people and office/lab space, reducing quarterly spending by almost $150M.

Source: Ginkgo Bioworks

It is also consolidating its multiple sites accumulated over expansion and several acquisitions, with only one site left in Europe, and 3 in the US. Consolidation of the activity spread between multiple buildings will also occur soon.

Source: Ginkgo Bioworks

Ginkgo’s Future Business Model

To some level, the company is likely to still have to perform some additional transition to its business model to convince investors to come back to the company.

One could be a switch to a more hardware-focused direction, something already initiated by the selling of automated labs to researchers, after having been mostly only operating by these facilities.

Another option could be for Ginkgo to start more contract manufacturing at scale. Its expertise in biosciences, lab hardware design, and optimization of production for giants like Merck gives it a serious credential to succeed in this path.

Lastly, it should also be noted that the company assets, like for example billions of dollars in automated wet labs, are severely discounted at the current market capitalization, standing below $0.5B.

Far from just an IP-heavy company, Ginkgo also has some solid physical assets to back up its activity and would be difficult to replicate by any competitor.

Conclusion

Ginkgo Bioworks is a pioneer in synthetic biology, having made a move in the industry early on, almost 2 decades ago.

From a technical point of view, it has and still is revolutionizing the way biological data are generated, analyzed, and put into useful applications. This has far-reaching ramifications in agriculture, medicine, biotech, and industrial use of bioproducts.

It is also a company that might have been too ambitious for its own good, and for the investors that bought the company’s stock at its peak in 2021. The difficulty in making the business generate enough cash quickly has caused concerns and triggered a durable crisis, reflected by the company’s stock prices crashing.

Nevertheless, Ginkgo Bioworks has become a key partner to many of the largest pharmaceutical companies, with none having an interest in a potential bankruptcy that would likely see it acquired by one of its competitors.

This simple fact, combined with changes to the business model and cost structures, should give the company a new growth trajectory and help it turn into a central keystone of a new more sustainable biology-centered century.