- MTN Group plans to launch its own bank to enhance financial independence.

- The move aligns with Africa’s growing digital banking demand and fintech innovation.

- This could disrupt traditional banking and reshape financial services in key markets.

From Telecom Giant to Fintech Disruptor

MTN Group, Africa’s largest telecom operator, is making waves with its plan to launch its very own bank. This is not a pivot; it’s a power move. With over 290 million subscribers across 19 markets, MTN has long dominated telecom, but now it’s eyeing the fintech crown.

“We believe that we should move with the times and open up the system for the entry of non-banks.”

Tim Masela, SARB National Payments System Department Head

Through its fintech arm, MTN already offers services like mobile wallets and payments under MoMo (Mobile Money). These services are wildly popular, with over 73 million active users driving revenue growth of 30.9% in Q3 2023, reported MTN. However, by creating its own bank, MTN aims to take control of the entire financial services value chain, eliminating reliance on third-party banks.

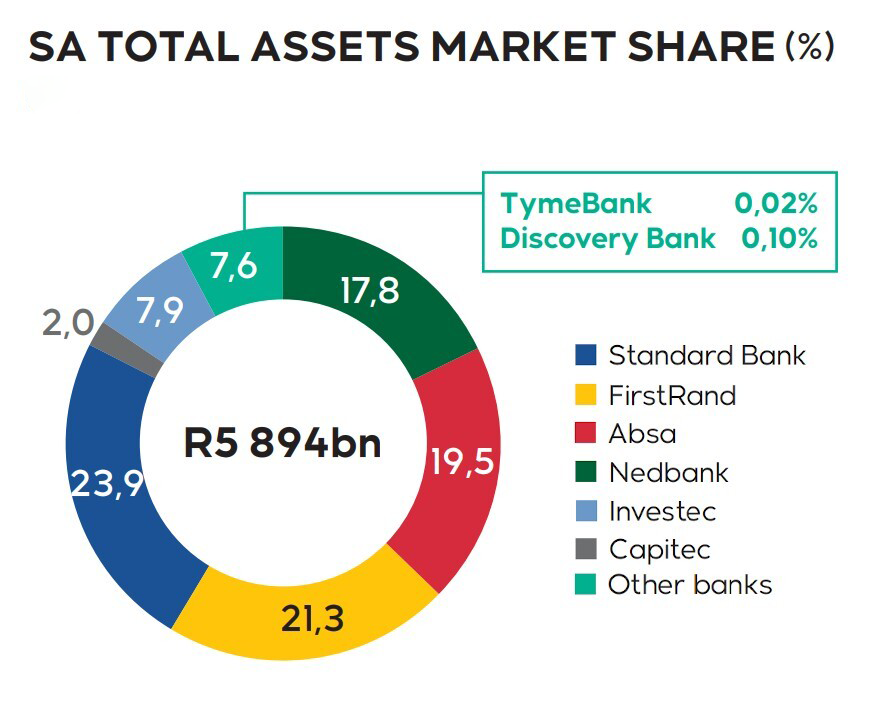

MTN is Disrupting the Status Quo

Africa’s banking penetration stands at just 43%, while mobile money users outnumber traditional bank account holders. This gap has created fertile ground for fintech innovation, and MTN is perfectly poised to capitalize.

By launching its own bank, MTN can scale its offerings beyond payments, potentially including loans, savings, and investments. This positions the company as a direct competitor to both traditional banks and fintech startups like Kenya’s M-Pesa.

The company’s push aligns with global trends toward digital-first banking. Consulting giant McKinsey notes that Africa’s fintech revenue could reach USD 30 billion by 2025, underscoring the market’s massive potential.

The move also reduces dependency on external banking infrastructure, strengthening its strategic autonomy while enhancing customer experience.

MTN’s Vision of Financial Empowerment

MTN’s entry into banking could reshape financial inclusion across Africa. By leveraging its vast telecom network, MTN can reach millions of unbanked and underserved individuals, offering secure, accessible financial solutions.

Moreover, MTN’s bank could foster innovation by integrating AI-driven financial insights, digital lending, and blockchain-backed security. With its substantial cash flow and regional dominance, MTN has the resources to disrupt traditional banking models.

As Africa embraces fintech, MTN’s bold step reflects a broader shift in the telecom industry’s evolution. No longer just carriers of calls and data, telecom giants are becoming architects of digital economies. For telecom company, the goal is clear: lead the charge and redefine how financial services are delivered.

If you see something out of place or would like to contribute to this story, check out our Ethics and Policy section.