The Rise Of Digital Brokerage

Online brokerage has revolutionized the financial industry, by providing easy digital access to financial instruments that were before reserved for more established financial firms. This changed how people perceive investing, especially the younger generation, making it more accessible.

The digitalization of trading helped reduce fees, made it easier to trade stocks and other financial instruments from home, and brought needed competition to older brokerage providers like banks and Wall Street brokerages.

Of course, this has also encouraged reckless speculation, especially during spikes of investors’ enthusiasm, for example, illustrated by the intense speculative activity around stocks like GameStop.

Among the important pioneers in this field has been eToro, an Israeli firm launched in 2007 and operating globally today.

As eToro has just filed for IPO in March 2025, investors and users of eToro will now be able to trade the company’s stock itself. The ticker should be the symbol “ETOR”, and will be listed on the NASDAQ.

eToro History

Soon after its launch, eToro quickly understood that the digital and connected nature of an online brokerage system changed how users could interact with it.

For example, it launched its Android app in 2010 (increasing reach to more smartphone users, with the iPhone app in 2012) and the “CopyTrader” feature, allowing users to replicate the trading strategies of top-performing investors.

This aspect of a “social investment platform”, built while social media platforms were booming as well, can be seen as a precursor to the mass investing and social media trends that would later dominate the investment landscape during the Covid-19 pandemic.

It also combined well with the very visual nature of investing on eToro, using graphic representations for various financial instruments to make the trade easier to understand.

Source: eToro

In its first seven years, the company raised $58.5M from diverse investors to fund growth. This allowed it to expand its offer from just a handful of stocks to CFDs (Contract For Differences), commodities, and currencies.

Source: eToro

After adding Bitcoin in 2013, in 2014, eToro would also start adding cryptocurrencies to its offering, as well as currency futures. The presence in crypto would be progressively reinforced with several strategic moves:

Expansion

The company joined the trend of zero-commission in 2019, allowing it to compete with the likes of Robinhood (HOOD -1.31%).

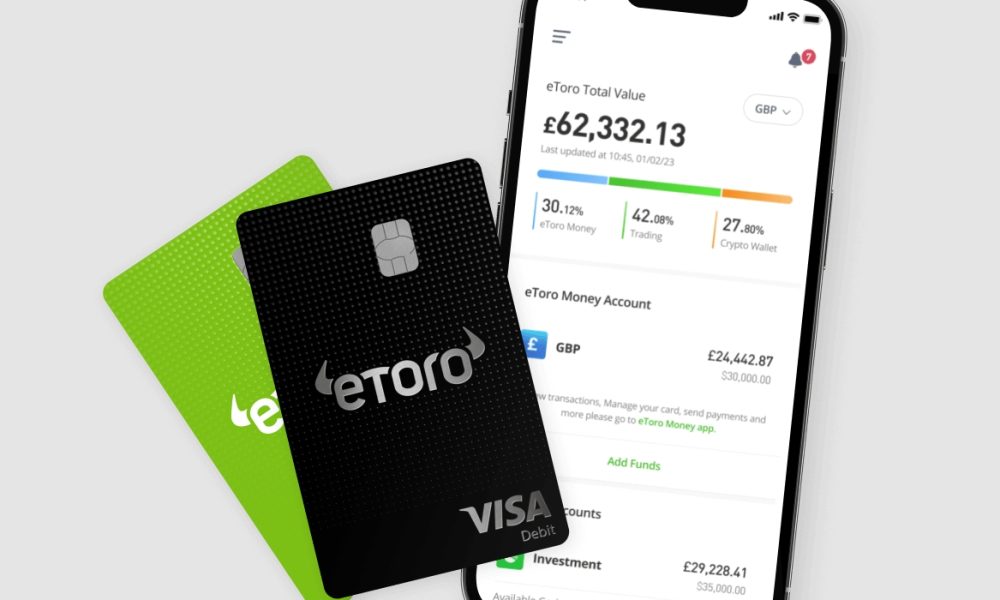

Progressively, eToro also explored other areas of finance, starting with the acquisition in 2020 of Marq Millions, rebranded into eToro Money, and used to issue debit cards.

The debit card offer is still available only in the UK for now, but the digital wallet has been expanded to the EU since 2022.

eToro almost did its public listing in 2021, via a SPAC merger. However, due to issues with this method of public listing and market instability, the deal was canceled in 2022.

In 2023, the company announced a partnership with X to leverage the common “$+ticker” symbol used by investing and finance-focused X accounts to talk about specific stocks (like, for example, “$FB” for Meta).

In 2024, X is also partnering with eToro to educate investors through social media, and the company launched its eToro Academy to provide free courses on investing, trading, and crypto.

Source: eToro

2024 was also a period for eToro to expand its offer on stocks, with partnerships with the London Stock Exchange, Dubai Financial Market (DFM), Italian Stock Exchange, and Deutsche Börse.

Source: eToro

eToro By The Numbers

After years of spectacular growth, eToro is now a large financial firm, with $$11.6B of assets under administration. It is active in 75 countries and employs 1,400+ people.

The assets under administration recently went up, thanks to the acquisition of Australian firm Spaceship in November 2024, and its AUD$1.5M of assets under management.

These assets are held by no fewer than 3.2 million accounts, with most of them created since 2019, when the platform had only 500,000 accounts.

By far, most of the company’s activity is in the EU + UK. The presence in the Americas is, in comparison, very small (11%), a region even smaller than the Asia Pacific for eToro (12%).

Source: eToro

This European focus, as well as the MENA region (Middle-East North Africa), is reflected in the ranking of the company in many of these countries, with a #1 awareness of the eToro in trading, and a top 3 ranking in some of the region’s largest countries.

Source: eToro

Social

By 2025, the company will offer its customers access to investing and trading in most of the largest stock exchanges, 100+ crypto assets, and the possibility to replicate the investing or trading strategy of thousands of popular investors.

Source: eToro

The average e-Toro user is 35 years old, and more than 86% of them trade more than one type of investment product.

This social investing aspect stays at the core of eToro’s advantage, a category it created and still dominates. Of the 0.1% of accounts approved as popular investors, 35% outperformed the S&P500 in 2024.

These accounts need to fit a strict series of criteria to get qualified as popular investors, with a minimum of assets under management and Cisi Level 3 or 4 (International Certificate in Wealth & Investment Management) for Elite and Elite pro categories, respectively.

100 of the top popular investors were also invited to eToro’s 3rd “Popular Investor Summit” in England.

eToro Club

In order to offer an even more superior experience to more active traders, investors, or just richer users, the company provides a multilayer “club”, calculated according to the Tier balance.

Source: eToro

This tier balance is calculated as all the cash and investment in eToro’s accounts (including the eToro Money account), minus excluded products. The excluded products cover leveraged CFD positions and crypto positions for UK residents.

The company is seeing a steady progression of its members over time, with more assets and more wealth leading to high ranks over time.

Source: eToro

Higher membership levels result in lower fees and other discounts, crypto staking rewards, access to premium content from leading digital financial publications, VIP events, etc.

Education

eToro Academy had 3 million unique users in 2024, listening or reading one of the 2,700 articles, videos, podcasts, or webinars available on the education platform, translated into 11 languages.

It is, however, unclear how much overlap there is between this 3 million and the 3.2 million accounts, and so if eToro Academy is more useful as a retention tool for existing users or as a client acquisition tool.

Growth Potential of eToro

As the company sees it, there is a massive growth potential stemming from a few mega-trends.

The first one is a generational shift, with no less than $72.6 trillion in assets to be transferred to the next generation by 2045.

As this transfer will benefit generations of digital natives, online brokerage solutions like eToro are in a prime position to benefit and capture an increasingly large part of the market.

A second element is the growing participation of retail investors in investing in stocks and other financial assets. This is, of course, partially in the form of passive investing, but also active investing and trading. This trend, too, should benefit from more ergonomic and reactive investing apps, compared to legacy solutions offered by banks and many historical brokerage firms.

Lastly, a third contributor to eToro’s long-term potential is the low level of European households having exposure to stock markets. While this is the majority of US households (58%), 1 out of 5 UK households owns stocks, and barely 1 out of 10 EU households do.

Source: eToro

This leaves a massive space for growth and the effect of more financial education to grow the EU + UK brokerage market.

AI

Another engine of growth for eToro is its willingness to embrace new technologies. In particular, AI is quickly changing not only the software and tech industry, but finance as well.

For example, eToro users can already ask the company’s AI assistant questions about the stocks they own or are interested in.

Combined with the database of education resources of eToro Academy, this can be used to answer dynamically almost any questions investors can have about finance in general, individual stocks, cryptos, etc., in particular.

This AI assistant is currently handling 57% of incoming customer inquiries, quickening answer speed and reducing customer service costs.

Source: eToro

Other AI tools are adopted by eToro’s employees to boost productivity, with 10 AI tools already developed in-house and approved.

Lastly, the company is embracing AI for marketing purposes, notably with a fully AI-generated advert on the occasion of the 2024 Paris Olympics.

Smart Portfolios

Another application of AI is to create “smart portfolios”, creating what otherwise would require a finance specialist to match a predetermined theme or investing strategy.

Currently, the company is offering 110+ smart portfolios to cover “trendy” topics, like AI, future mobility, e-commerce, renewable energy, etc.

This portfolio is partially guided by recommendations and partnerships with leading investment firms, like BlackRock, and more recently, the innovation-focused firm Ark Invest founded by Cathy Wood, very popular among retail investors through the ARK-Future First Smart Portfolio, which is invested in an array of ETFs invested in innovative and disruptive technologies.

Source: eToro

eToro IPO

Announced in March 2025, eToro IPO preliminary data revealed revenues of $824M and net income of $192M in 2024.

This represents a rise in revenue year-to-year of 45.6%. The rise in net income is even more spectacular, as it was only $15.3M in 2023, and a net loss of $21M in 2022.

It seems the valuation aimed for will be in the $5B, although the exact number is not clear yet.

Controversies

Global finance, digital revolutions, and explosive growth are unlikely to come without any criticism. At times, eToro has been criticized for its customer service quality. This, however, seems to have been either an occasional period where growth outmatched the company’s employees’ headcount or more individual problems and errors than a systemic failure.

A more fair criticism is that, like all zero-fee trading platforms, eToro has to make money in another way. This is usually done by handling the spread (the difference between the buying and selling price) more aggressively than on traditional platforms.

Withdrawal fees, or conversion rates between currencies are another way the platform makes money (some users have reported difficulty to get withdrawal, and the process can take in the worst case up to 10 days).

As a result, eToro might not be the best platform for very active traders who understand in depth the ins and outs of stock, currency, or option trading. This is especially true for traders using large leverage, as “hidden fees” from the spread will multiply accordingly, contrary to ordinary fees per transaction.

It is, however, a very beginner-friendly platform, thanks to its visual interface and comprehensive educational material. The very diverse array of available assets is also good for investors who are slowly expanding into new fields. Lastly, the possibility to copy experienced and vetted investors is an extra bonus.

Conclusion

eToro has built its business on the premise of an easy-to-understand visual interface for trading and investing, and single-handedly creating the category of social investing.

These two elements are still the core of the business and its advantage in a very competitive market of brokerage firms. Early presence in online brokerage helped as well.

From this foundation, eToro has become a leader in European online brokerage, consistently adding more functionality and investment options for its users: more stocks covered, CFDs, cryptos, leverage, etc.

As a result, it has been growing explosively since 2019, multiplying by 6x its user base, riding the tail of the pandemic, stock markets reaching all-time highs, and investing in stock and crypto going mainstream for a younger generation.

As revenues are up almost 50% year-to-year, ahead of its long-awaited IPO, it seems the growth is still now slowing down significantly.

So the company is likely to keep doing well with digital natives looking for a simple and user-friendly interface, and maybe otherwise a little intimidated by the world of finance.

It is also likely to keep collecting the occasional negative reviews from more demanding day traders, for whom the zero-fee system is not a good match.