This week, all eyes are on Bitcoin (BTC) as crypto market participants anticipate key US economic indicators. President Trump’s economic policies, in particular, have made Bitcoin and crypto markets susceptible to macroeconomic data and associated woes.

As the pioneer crypto holds above $100,000, its upward potential hinges on the following US economic data.

US Economic Data To Watch This Week

The following US economic indicators will interest crypto traders and investors this week.

CPI

“We are starting with a no-news Monday followed by CPI on Tuesday, which is the main focus for the week.” This is the general sentiment among crypto market participants watching this week’s US economic calendar.

Perhaps the most critical US economic indicator for Bitcoin and crypto traders is April’s US CPI (Consumer Price Index), due on Tuesday.

After China’s CPI inflation came in at 0.1% MoM (Month-over-Month) in April versus March’s 0.4% decline, coupled with the country’s capital injection, all eyes are on the US CPI this week.

The April CPI comes after the FOMC meeting and Fed chair Jerome Powell’s remarks last week. As was widely expected, the Fed’s move to steady interest rates turned attention to the bank’s accompanying statement and Fed Chair Powell’s press conference.

According to Powell, uncertainty about the economic outlook has increased further, making Tuesday’s CPI inflation data a key indicator.

Notably, the Fed is concerned over the US’s trade policies, with Powell implying that the Fed may be prepared to remain on hold for a prolonged period.

“CPI is one of the main indicators for the Fed, and this release could show whether tariffs are pushing inflation higher,” a user noted on X (Twitter).

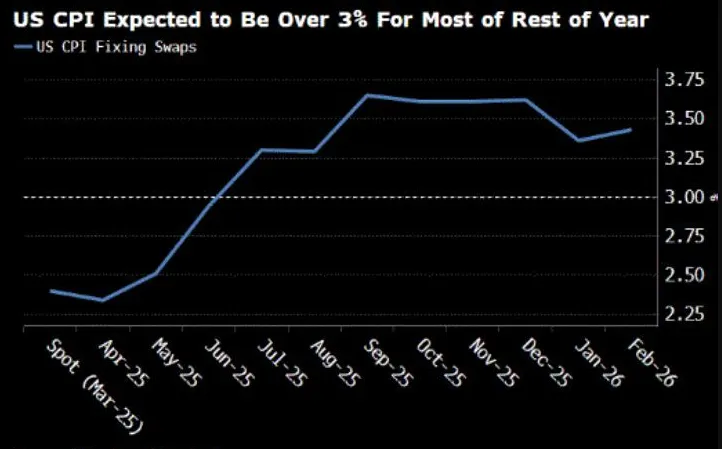

However, amid the trade chaos, some say US CPI could remain over 3% for most of the rest of the year.

According to data on MarketWatch, the US CPI forecast is 2.3%, compared to the 2.4% recorded in March. The March reading came below the expected 2.5%, indicating cooling inflation in the US.

If the trend extends in April, showing easing inflationary pressures, it may increase calls for the Fed to cut rates soon. Such an action could weigh the dollar but boost interest in Bitcoin and crypto.

Conversely, if the CPI rates indicate an acceleration of inflationary pressures, coming in above March’s CPI rate of 2.4%, it could amplify calls for the Fed to prolong its current monetary policy stance. Such an outcome could aid the dollar and draw sentiment away from Bitcoin.

Initial Jobless Claims

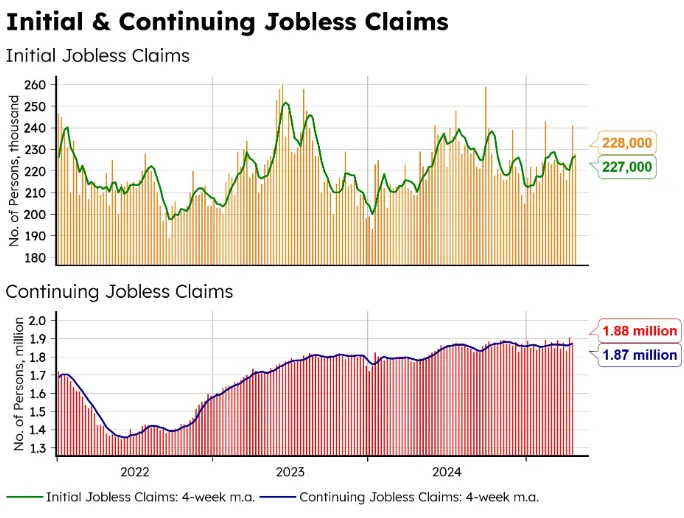

Another US economic indicator to watch this week is the initial jobless claims, detailing the number of US citizens who filed for unemployment insurance for the first time last week.

For the week ending May 3, initial jobless claims recorded 228,000. This marked a drop that beat market expectations after 241,000 claims in the week ending April 26 and the projected 230,000.

“No signs of labor market stress in the last week of April. Jobless claims—both initial and continuing—are steady, right in line with the past 3 years,” global macro researcher The Bitcoin Layer remarked in a post.

Notably, a lower-than-expected reading is generally considered positive or bullish for the USD and therefore bearish for Bitcoin.

Against this backdrop, the drop suggested a healthier employment outlook in the US. It also pointed to an improvement in the labor market, interpreted as a positive sign for the economy.

If the trend sustains, initial jobless claims for the week ending May 10 could come in below analysts’ median forecast and projections of 227,000. This would weigh on risk-on assets like Bitcoin.

PPI

Adding to the list of US economic indicators this week is the US PPI (Producer Price Index), tracking the price changes companies see.

March PPI dropped 0.4% MoM, below the expected 0.2% rise, signaling easing inflation pressures. Year-over-year (YoY), PPI was 2.7%, under the forecasted 3.3%.

Lower-than-expected PPI could fuel optimism for Fed rate cuts, potentially boosting risk assets like Bitcoin. However, Trump’s tariff policies inspire volatility due to their ability to inspire disinflationary trends.

“Hot CPI and PPI data this week could likely trigger short-term downside for the S&P 500 (2–5% pullback) and Bitcoin (5–10% decline) due to fears of tighter Fed policy and rising yields. However, cooling geopolitical tensions (India/Pakistan and Russia/Ukraine) and potential US/China trade deal progress could mitigate losses by fostering risk-on sentiment and capping commodity-driven inflation, and S&P 500 and BTC could quickly recover,” an analyst wrote on X.

Consumer Sentiment

The Consumer Sentiment report is also a key watch, reflecting whether the market is growing pessimistic or optimistic. Therefore, the May 16 preliminary data will be a crucial watch as traders and investors gauge sentiment shifts.

In April 2025, the University of Michigan’s Consumer Sentiment Index plummeted to 52.2, an 8% drop from March’s 57, hitting a near five-year low.

This decline, driven by fears of inflation (expectations surged to 6.5%) and trade policy uncertainty from Trump’s tariffs, signals reduced consumer spending. Lower spending may limit liquidity for risk assets like crypto, potentially triggering a correction in Bitcoin price.

BeInCrypto data shows BTC was trading for $103,991 as of this writing, down by 0.09% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.