Battery As The 21st Century Key Technology

Batteries used to be an essential but cheap component of small electric and electronic devices. But with the rise of EVs and renewables, they have become maybe the most important technology for the green transition.

The growth in battery demand is barely getting started, with an exponential rise in demand from EVs and energy storage expected in the upcoming years.

Source: Statista

The company leading the charge globally in battery production is CATL – Contemporary Amperex Technology Co Ltd, responsible for manufacturing 36.8% of total battery volume worldwide.

The company has recently announced a few new products that could radically change its growth potential and make it one of the largest industrial companies in the world in a few years.

Its stock reflects the recent good news and product release, with a price up 54% so far this year, partially riding on a dramatic rebound of Chinese equities as a whole.

Source: Yahoo Finance

Battery Market

EV Batteries

Batteries are important when it comes to EVs because almost every part of an EV system is superior to internal combustion engines (ICE): electric motors are more efficient, more reactive, smaller, more sturdy, and require less maintenance due to almost no moving part, and can even collect energy back when braking.

ICE cars have however one advantage. Liquid fuels are incredibly energy-dense. So for EVs to compete, they need the densest batteries possible. This way, the EV does not carry “dead weight” reducing the performance of the whole car.

We discussed in detail the possible chemistries and challenges of EV batteries in “The Future of Mobility – Battery Tech”.

Energy Storage

Another sector in dire need of more and better batteries is renewable energy. Wind and solar are very efficient, but they also produce energy intermittently and often not when most needed (like in the evenings and winter).

So for electric grids to stay stable, massive storage capacity is required. Here the issue is not battery density, as energy storage stays immobile.

Instead, the 2 key factors are:

- Cost: the more expensive the storage, the more it adds to the utility bill, potentially negating the low cost of renewables.

- Safety and durability: The energy storage should ideally last decades, allowing for a slow amortization of its costs.

This market is expected to grow quickly, with a 26.4% CAGR from 2023 to 2033.

Source: Market US

We discussed in detail the possible chemistries and challenges of EV batteries in “The Future Of Energy Storage – Utility-Scale Batteries Tech”.

Economy Of Scale

Battery production is a complex task, requiring massive scale for a few reasons:

- R&D costs to improve designs are enormous, and understanding what is happening inside the battery at the atomic scale is necessary.

- The large volume required by EV and energy storage creates a need for an ultra-efficient supply chain and mass deployment of automation to cut costs.

This is why, in the battery business, the bigger the better.

- More battery manufacturing means lower costs, which means more sales.

- More sales means more money to improve the technology.

- Better technology means more widespread adoption, which leads to more battery manufacturing.

This creates a business flywheel that greatly rewards the largest companies and makes any smaller startup competitor struggle. Even with better technology, the need for multi-billion-dollar factories can cause problems in successfully producing and selling the batteries.

For example, the company Freyr stopped battery production in the summer of 2024, and Northvolt is cutting jobs and downsizing its production targets.

Global Expansion

Meanwhile, CATL is expanding as quickly as it can, with many news in the last few months indicating how precious of a partner to global tech and industrial corporations and government CATL has become:

- March 2024: Partnership with Tesla to optimize charging times

- April 2024: EV Battery Alliance with Hyundai, with CATL to supply its state-of-the-art batteries for Beijing Hyundai’s future electric vehicle models.

- May 2024: Partnership with French shipping giant CMA CGM to explore electric ships’ potential.

- June 2024: Breaking ground for construction of a new battery plant in Beijing in collaboration with BAIC, Beijing Energy, and Xiaomi.

- June 2024: Strategic cooperation with Rolls-Royce for fixed energy storage solution TENER (more on this below)

- June 2024: Collaboration on building a zero-carbon city in Nanjing.

- July 2024: Certification by Volkswagen for for both module testing and cell testing at its German factory, while also building a large battery factory in Hungary.

TENER, The Potential Game Changer

Past Results

For now, a lot of CATL attention is focused on EVs, and improving battery technology through tweaking the manufacturing process of lithium-ion batteries.

Previously, the industry was expected to switch as soon as possible to solid-state batteries, due to their higher energy density, quicker charge, and better safety profile (no electrolyte that can catch fire).

Source: Nature

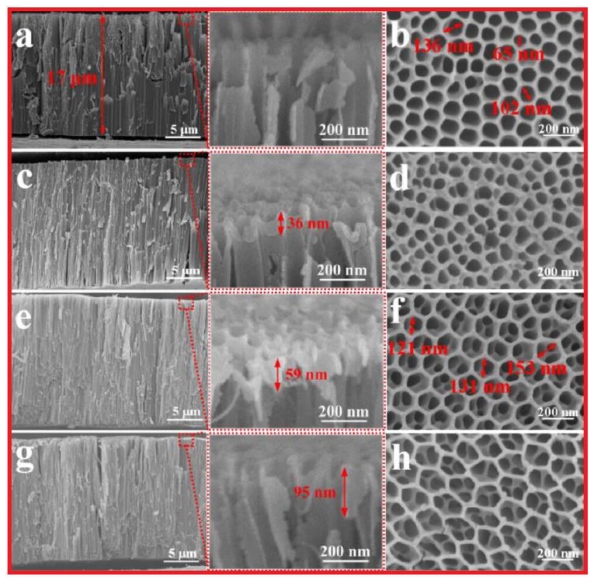

Future domination by solid-state batteries might not be so clear cut, since CATL released a new lithium battery with a honeycomb design that makes it a lot denser and durable.

Source: Chemistry Europe

This is the key behind the announcement by CATL of a new LFP (lithium-iron-phosphate) battery that can add 600km of range in just 10 minutes. In total the driving range could be above 1,000 km (600 miles), totally removing all “anxiety range” for future EV owners.

Overall, this means 1 km worth of range can be charged every second and a full charge for 1,000km will take 16.6 minutes.

The TENER Revolution

Until recently, it was somewhat of a consensus that in the long run, lithium-ion was not the right chemistry for utility-scale energy storage. This is because lithium-ion is expensive, and degrades too quickly, usually losing performance badly in more or less 10 years.

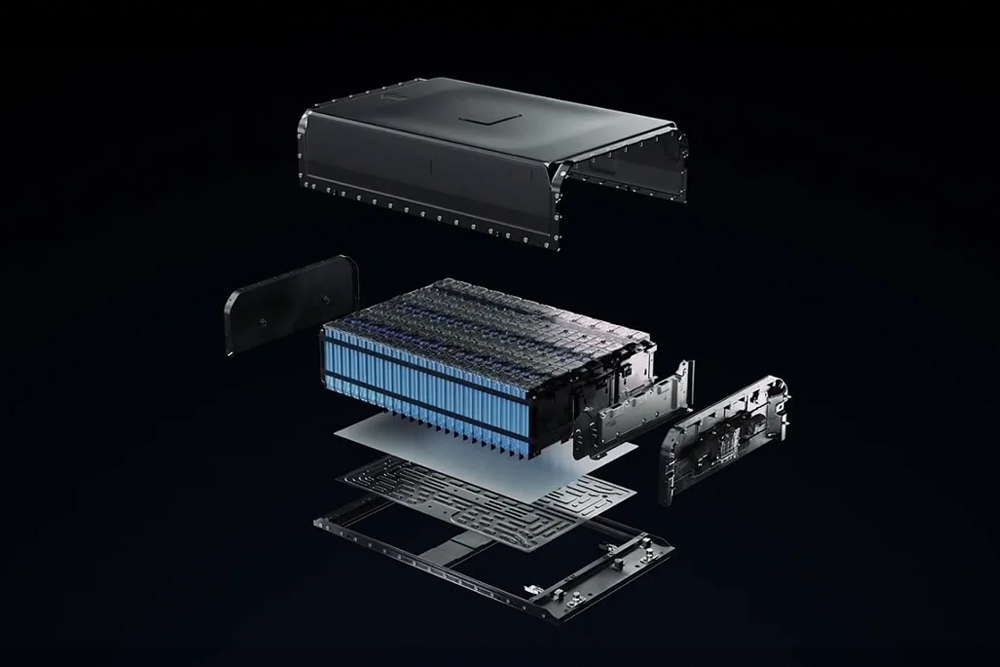

So, when CATL revealed the performance of its TENER containerized battery system, the whole battery industry was shocked.

Source: Sustainability Environment

The pilot project using the TENER has demonstrated zero degradation in capacity after a full 5 years of operation.

The honeycomb structure is likely becoming a central part of CATL’s battery architecture. While not explicitly stated as such, this is probably what CATL referred to when talking about TENER:

To realize TENER, the company used an SEI with biomimetic ion channels and high stability, together with self-assembled electrolyte technologies creating what it calls an “ageless energy storage system.

Based on state-of-the-art technology and extreme manufacturing capabilities, we have solved the challenges of highly active lithium metals […], which effectively helps prevent the thermal instability caused by the oxidation reaction,”

This model of TENER, announced in June and able to generate energy output of over 6 MWh, is designed for utility companies to build large battery parks to store renewable energy.

So it is possible that lithium chemistry ends up winning the utility market, which is potentially much larger than even the gigantic and growing EV market.

TENER Flex

On 25th September 2024, CATL announced the creation of a new version of TENER, TENER Flex. It is smaller and more modular.

This makes it compatible with existing infrastructures, along with reduced labor, time, and operating costs.

Source: CATL

So not only TENER could be an industry-winning technology for utilities, but it could also be transformative for industrial and residential applications with the Flex version.

It is also very robust, able to operate from -40°C to 60°C, operating at altitudes up to 4000 meters, and featuring an IP56 rating for protection against heavy rain and 0-100% humidity. Due to its smaller size, it can also be easily transported by many types of vehicles.

Finally, low noise levels (<65 decibels) can make a difference in places like hospitals, schools, and shops.

Another Revolution – Heavy Duty Trucks

Another sector waiting to be electrified is heavy-duty logistics. Buses, trucks, delivery vans, and ships, are all for now almost 100% powered by fossil fuels.

On 17th September 2024, CALT announce the commercialization of TECTRANS – T Superfast Charging Edition & the TECTRANS – T Long Life Edition.

Source: Electrive

This responds to the 2 main objections to the electrification of commercial vehicles:

- The need for continuous operation, meaning slow charging, is either too impracticable or expensive.

- The need to drive the vehicle a lot of distance and for many work hours per year leads to premature battery failure.

- If EV car owners are concerned about battery life after 10 years, trucking companies absolutely need as much mileage as possible, hence a lot more charge-discharge cycles for the battery pack.

TECTRANS SuperFast Charging Edition

In response, TECTRANS Superfast Charging Edition can charge up to 70% of the maximum charge in just 15 minutes, reducing idle time to a period almost identical to ICE vehicles.

This is still not perfect, but it can be enough for buses and trucks, especially as they usually require the drivers to take regular breaks anyway.

Of course, this will be reliant on a good infrastructure of charging stations. Something that CATL is also working on, with plans for 10,000 super-fast charging stations in 100 Chinese cities by the end of 2025.

TECTRANS Long Life Edition

The TECTRANS – T Long Life Edition displays a lifespan of up to 15 years or 2.8 million kilometers.

Several million kilometers is 2-3x larger than the usual lifespan of ICE commercial trucks, which usually range from 800,000 – 1,600,000 km (500,000 – 1,000,000 miles).

As electric motors are also more durable than ICE motors, this could give these trucks a total utility many times greater than traditional ICE models. Especially as both battery packs offer up to a 500km range.

This alone could make them the only competitive choice for trucking companies moving forward, not even taking into account the cheaper maintenance and fuel costs.

Trucking tends to be a very competitive industry, with low margins. So if new models are more cost-efficient, it is likely that the first companies to adopt them will be able to undercut their competitors.

In this scenario, this would force the entire industry to quickly switch most of their new order to trucks equipped with batteries displaying similar performance to CATL’s TECTRANS – T Long Life Edition.

Recycling

With batteries produced in increasing numbers, it is clear that efficient resource utilization is required.

The company is at the forefront of improving the battery recycling chain. This way, the lithium, nickel, manganese, and other minerals mined in massive quantities can be reused many times in new batteries once they are not efficient or safe enough anymore. Already, CATL has achieved a 99.6% recycling rate for nickel and cobalt.

Source: CATL

In fact, CATL estimates that in 2042 it will almost not need mining anymore, at least for its Chinese operations, as recycling of already extracted resources will provide the bulk of material needed for the new generation of batteries.

“The demand for critical materials might increase by five times in the next 10 years, considering the fast growth of the industry. But at the end of the day, when we achieve 100% electric cars, there will be very tiny amounts of new critical materials to be mined.”

Robin Zeng Yuqun -CATL Founder

In the meantime, CATL is also cautious to not face a shortage of material, with the launch in 2023 of a $1B consortium led by CATL for lithium extraction investment in Bolivia.

Conclusion

CATL is producing more than a third of the world’s batteries and is growing its grip on the battery industry with a neck-breaking pace of innovation.

The combination of production volume and technological advantage makes it very secure in an otherwise very competitive industry, with only a few giants getting close, like BYD, Panasonic, Samsung, and Tesla.

This has made it a key partner and technology supplier for most of the Western automakers (including Tesla).

It is now looking to replicate its success in EVs in other industries, all of them potentially larger in terms of battery volumes: utility-scale electricity storage & logistics (semi-trucks and heavy-duty vehicles, shipping, and maybe even planes, with a 2,000 k range plan vision).

You can invest in CATL stock through many brokers, and you can find here, on securities.io, our recommendations for the best brokers in the USA, Canada, Australia, the UK, as well as many other countries.

If you are not interested in CATL stock solely, you can also look into ETFs like the Amplify Lithium & Battery Technology ETF (BATT), Global X’s Lithium & Battery Tech ETF (LIT), or the WisdomTree Battery Solutions UCITS ETF which will provide a more diversified exposure to capitalize on the growing demand for battery and green energy.