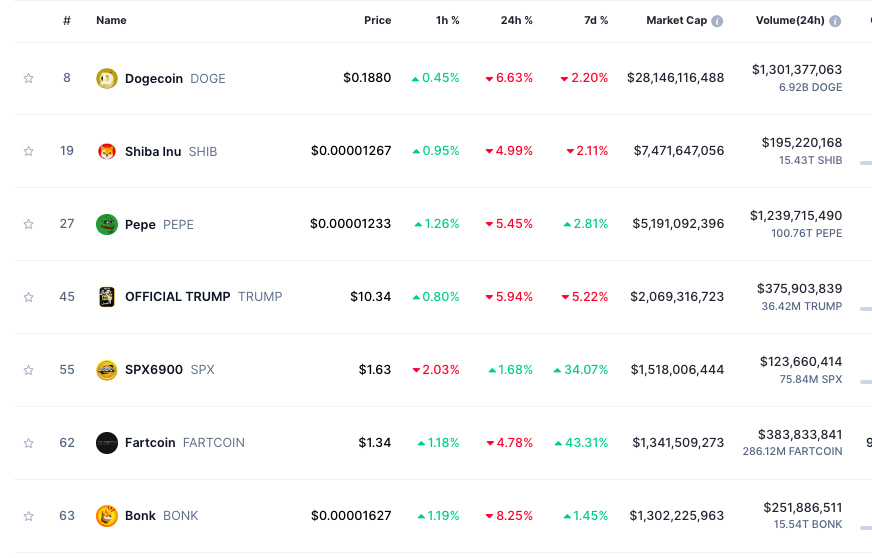

As Dogecoin, Shiba Inu, and Pepe dropped more than 5%, SPX6900 ($SPX) moved against the trend, gaining 2% to reach $1.66. This is the asset’s highest price in five months.

The Ethereum-based memecoin now holds a $1.5 billion market cap, surpassing competitors like FARTCOIN, BONK, and WIF.

The token’s steady climb contrasts with broader declines in memecoin prices, reinforcing its position among the top five in the category despite ongoing market volatility.

Is SPX6900 the Next $1 Trillion Crypto? Murad Mahmudov Thinks So

SPX6900 is a token that bridges traditional finance and decentralized investing. By bringing the S&P 500 Index on-chain, it simplifies market exposure for everyday crypto investors, making it far less intimidating.

Murad Mahmudov, a well-known crypto investor, is a vocal supporter of SPX6900. He even incorporated it into his “Memecoin Supercycle” thesis, which suggests that tokens like this, even without traditional utility, can deliver massive gains thanks to viral appeal and strong community backing.

The results speak for themselves. Since its launch in August 2023, SPX has skyrocketed by 62,337%. To put that in perspective, a $1 investment back then would now be worth over $62,000, dominating the market and outperforming even Bitcoin’s legendary rise from $200 in 2013.

Murad’s confidence in SPX6900 only grew. In April, he released a 97-minute video laying out 150 reasons why its market cap could hit $1 trillion.

And his bet seems to be paying off. Following a 35% rally last week, a leaked screenshot of his portfolio revealed his position had rebounded from a $40 million loss to over $55 million in unrealized gains, just as the SPX neared its all-time high.

$SPX Breaks Out With BlackRock Backing—Is a $50 Target Realistic?

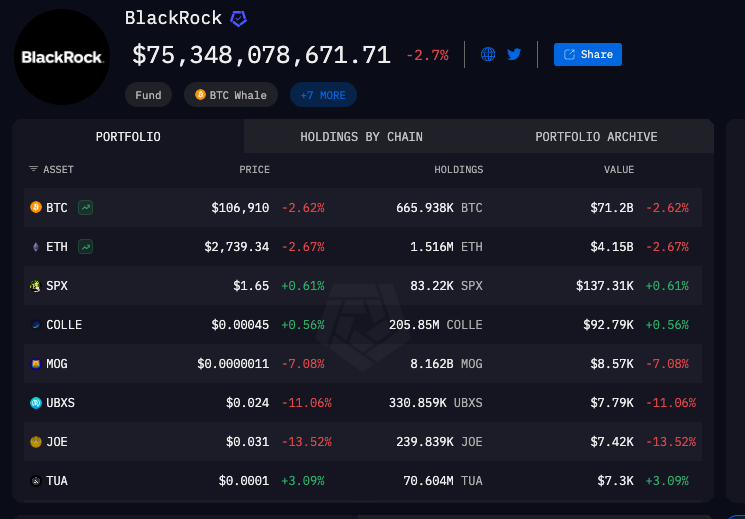

Adding to the coin’s credibility is the backing of major institutional players.

On-chain data from Arkham reveals that BlackRock, the trillion-dollar asset manager, now holds SPX as its third-largest crypto asset, behind only Bitcoin and Ethereum.

This high-profile endorsement has energized the SPX6900 community. On Reddit and other forums, members are increasingly bullish, with many calling for a $50 price target as they believe the token still has substantial upside potential.

SPX6900 Just Flipped Major Resistance—Traders Eye $2 Next

The SPX6900/USDT chart shows strong bullish momentum that’s held steady since late April.

Prices have been climbing steadily within a well-defined upward channel, with each rally supported by increasing trading volume—a classic sign of sustainable growth.

Key price levels also tell an important story.

After breaking through resistance at $0.60 and $0.80, the token successfully retested these levels, which have now become solid support zones. This transformation from resistance to support confirms the market’s strengthening confidence in SPX6900’s upward trajectory.

Now, at a key juncture, the token faces its biggest test at the $1.64–$1.67 resistance zone—the same level that halted January’s rally.

Current price action proves particularly compelling as the token trades slightly above this level, indicating buyers may finally have the strength to overcome this historic barrier.

Momentum indicators support the bullish case. The RSI’s surge to 81.44 typically suggests overbought conditions, but during powerful uptrends, such extended highs often reflect genuine buying pressure rather than impending reversal.

With the $1.67 breakout within reach, traders are eyeing the next psychological target at $2.00. However, some consolidation would be healthy as the market absorbs these gains.

The post BlackRock Quietly Accumulates SPX6900 as Memecoin Prices Plunge – Traders Target $2 Breakout appeared first on Cryptonews.

(@MustStopMurad)

(@MustStopMurad)