In the Asian session, Bitcoin (BTC) tanked to $103,895, down 4% in 24 hours. This broke below the $105,095 support. This is a big trend change as BTC exits the ascending channel that had held since early June. The breakdown was confirmed by a bearish engulfing candle and a strong rejection near $110,376, forming a three-candle reversal pattern and a series of lower highs.

Technically, Bitcoin is under pressure. It now trades below its 50-period EMA ($107,446), and the MACD has crossed bearishly with a deepening histogram, confirming momentum is with the sellers. If $103,132 fails to hold, BTC could slip toward $101,705 or even test the psychological $100,000 level.

Key Takeaways:

- Bitcoin trades at $103,895, down 4.36%

- Below $105K and 50-EMA: bearish shift

- MACD and candle patterns support downside

- Key support levels: $103,132 → $101,705

Binance Launches in Syria, Expanding Bitcoin Access

Binance’s formal entry into Syria follows the lifting of EU and US sanctions in May, which unlocked access for Syrians to trade over 300 cryptocurrencies, including Bitcoin, XRP, and Toncoin.

Full access to futures, spot, and P2P markets is now available, alongside Arabic-language educational tools and Binance Pay for borderless payments.

With local banking systems constrained and inflation soaring, crypto offers an alternative to traditional finance. This move is expected to drive regional demand for BTC as a hedge and remittance tool.

Highlights:

- Syrians can now trade BTC and more on Binance

- Binance Pay eases cross-border payments

- Crypto seen as hedge in conflict zones

BlackRock and ECB Shift Sentiment Toward Crypto and Gold

Meanwhile, BlackRock is ramping up its crypto ambitions. At its investor day, the $11 trillion asset manager set a goal to become the top crypto asset manager by 2030.

Its IBIT ETF sold $260.9M in BTC and bought $930.6M in June while overseeing the $53B Circle Reserve Fund backing USDC. It’s already registered as a crypto asset firm in the UK.

Simultaneously, the ECB also announced that gold is now the second largest reserve asset in the world, 19.6% of central bank holdings vs 15.9% for the euro. This is a shift towards “safe-haven” assets due to inflation, war and currency instability.

Together these two things make for a mixed but powerful picture for Bitcoin: a macro pullback and rising institutional and regional demand.

Final Thoughts: Bitcoin Under Pressure

Since BTC is volatile and technicals are under pressure, it’s keeping Bitcoin price prediction bearilong-termong term fundamentals are strong. Watch $103,132 and $101,705 for reversal or further breakdown.

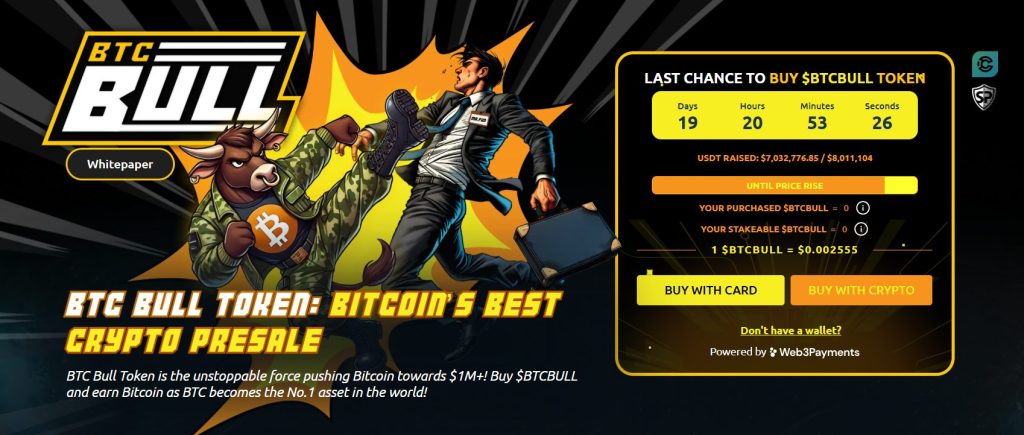

BTC Bull Token Nears $8.1M Cap as 58% APY Staking Attracts Last-Minute Buyers

With Bitcoin trading near $103K, investor focus is shifting toward altcoins, especially BTC Bull Token ($BTCBULL). The project has now raised $7,103,849.89 out of its $8,153,354 cap, leaving less than $1 million before the next token price hike. The current price of $0.00256 is expected to increase once the cap is hit.

BTC Bull Token links its value directly to Bitcoin through two core mechanisms:

- BTC Airdrops reward holders, with presale participants receiving priority.

- Supply Burns occur automatically every time BTC increases by $50,000, reducing $BTCBULL’s circulating supply.

The token also features a 58% APY staking pool holding over 1.81 billion tokens, offering:

The token also features a 61% APY staking pool holding over 1.73 billion tokens, offering:

- No lockups or fees

- Full liquidity

- Stable passive yields, even in volatile markets

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income.

With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Bitcoin Price Prediction: BTC Crashes to $103K as Binance Enters Syria and BlackRock Eyes Crypto Crown appeared first on Cryptonews.

LATEST: Binance opens full access to Syrian users after US sanctions suspension.

LATEST: Binance opens full access to Syrian users after US sanctions suspension. $11.5 trillion BlackRock aims to become the world's largest crypto asset manager by 2030.

$11.5 trillion BlackRock aims to become the world's largest crypto asset manager by 2030.