A new political player has entered the crypto stage. American Bitcoin (ABTC), backed by Donald Trump Jr. and Eric Trump, has quietly accumulated over 215 BTC, valued at $23 million, since its launch on April 1. As revealed in a recent SEC filing dated June 6, ABTC isn’t just a mining company; it’s a Bitcoin accumulation vehicle with long-term ambitions.

Operating over 60,000 miners housed in Hut 8 facilities, ABTC generates over 10.17 EH/s of hashpower without owning any real estate. Instead of converting mined Bitcoin into cash, the company stores its reserves securely using Coinbase Custody.

With Eric Trump joining the board and a public listing in the works via a merger with Gryphon Digital Mining, the company is tying its identity and brand equity to Bitcoin itself.

Key points:

- ABTC’s mining approach focuses on BTC accumulation, not fiat conversion.

- Trump family’s backing adds political clout and media visibility.

- Market sees this as bullish supply-side pressure—less BTC on exchanges.

U.S. Charges $500M Crypto Laundering Plot

While ABTC builds a bullish case, U.S. regulators dropped a bombshell. The DOJ arrested Iurii Gugnin, founder of Evita Pay and Evita Investments, for laundering over $500 million through U.S. banks and crypto platforms, mainly using Tether (USDT).

Gugnin is accused of helping sanctioned Russian entities like Sberbank and Rosatom dodge international restrictions. The indictment includes 22 counts of bank fraud, each carrying up to 30 years in prison. Prosecutors allege he:

- Bought U.S. technology for banned firms.

- Falsified documents to hide ties to Russia.

- Exploited crypto’s opacity to bypass sanctions.

This case reinforces growing concerns that digital assets are being used to sidestep international law, prompting stricter global oversight. Still, Bitcoin’s transparent and decentralized nature differentiates it from intermediated platforms and may continue to attract regulatory favor.

Japan’s QE Pivot May Ignite Bitcoin Rally

Meanwhile, BitMEX co-founder Arthur Hayes sees a potential global liquidity wave on the horizon. If the Bank of Japan (BoJ) resumes quantitative easing (QE) at its June 16–17 meeting, Hayes believes it could be the next big tailwind for Bitcoin.

Why? Japan recently signaled plans to reduce bond purchases by ¥400 billion per quarter. But with rising yields, 30-year JGBs hit 3.185% in May—officials may reverse course. Bitcoin previously surged to $112,000 when yields spiked, suggesting investors see it as a hedge against sovereign debt instability.

Hayes predicts:

- QE would boost risk assets, including BTC.

- Institutions may turn to Bitcoin as a “counterparty-risk-free” asset.

- A renewed rally could push Bitcoin toward the $200,000 mark in 2025.

Bitcoin Technical Outlook: $112K and Beyond?

Technically, Bitcoin price prediction is bullish as BTC remains in a bullish ascending channel on the 2-hour chart, trading above the 50-EMA ($107,510) and making consistent higher lows. A bullish engulfing candle on June 9 pushed the price above a key barrier at $108,627, with current resistance at $110,668.

The MACD is flattening, hinting at weakening momentum, while candlesticks show upper wicks—a sign of hesitation. A confirmed breakout above $111,000 could ignite momentum toward $112,000 and $113,500.

Technical Levels to Watch:

- Support: $108,000 (channel base), $107,510 (50-EMA)

- Resistance: $111,000, $113,500

- Trade idea: Buy on breakout or bounce off 50-EMA with a tight stop-loss

Conclusion

Macro shifts, regulatory crackdowns, and high-profile political support are reshaping the narrative surrounding Bitcoin. As ABTC accumulates, Japan considers more stimulus, and chart patterns remain constructive, the path toward $200K is no longer a fringe theory; it’s a data-backed possibility.

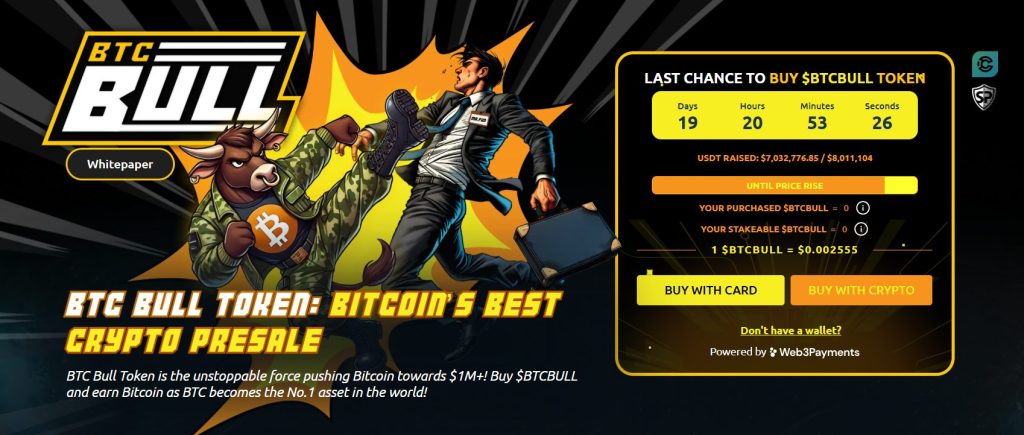

BTC Bull Token Nears $8M Cap as 58% APY Staking Attracts Last-Minute Buyers

With Bitcoin trading near $102K, investor focus is shifting toward altcoins, especially BTC Bull Token ($BTCBULL). The project has now raised $7,032,776.85 out of its $8,011,104 cap, leaving less than $1 million before the next token price hike. The current price of $0.002555 is expected to increase once the cap is hit.

BTC Bull Token links its value directly to Bitcoin through two core mechanisms:

- BTC Airdrops reward holders, with presale participants receiving priority.

- Supply Burns occur automatically every time BTC increases by $50,000, reducing $BTCBULL’s circulating supply.

The token also features a 58% APY staking pool holding over 1.81 billion tokens, offering:

The token also features a 61% APY staking pool holding over 1.73 billion tokens, offering:

- No lockups or fees

- Full liquidity

- Stable passive yields, even in volatile markets

This staking model appeals to both DeFi veterans and newcomers seeking hands-off income.

With just hours left and the hard cap nearly reached, momentum is building fast. BTCBULL’s blend of Bitcoin-linked value, scarcity mechanics, and flexible staking is fueling strong demand. Early buyers have a limited time to enter before the next pricing tier activates.

The post Bitcoin Price Prediction: $200K Target in Sight Amid Trump & Japan Tailwinds appeared first on Cryptonews.