The Solar Boom and China’s Dominance

In our article “The Solar Age – A Bright Future To Mankind“, we explained how the rise of solar energy was ushering a revolution in our energy supply, at least in the long term.

This has been in a very large part driven by the ever-declining cost of solar panels, while their efficiency also kept rising.

Source: EIA

It has created a massive market for solar energy systems, worth $296B in 2025, and expected to keep growing $1.1T by 2034, or an impressive 16.4% CAGR.

Source: Precedence Research

However, there is a problem from the Western industry and from the political order point of view: this boom in solar energy production is almost exclusively a Chinese affair, with the rest of the large producers mostly located in Asia as well, usually done by assembling Chinese components.

Source: Statista

It represents a major blow to Western economies, especially if the energy mix of the future will be very heavily solar-oriented. It does not help that the rest of the green energy ecosystem, especially batteries and rare earth supplies, is also very strongly controlled by China.

This is why the Trump administration is engaged in a trade war with China and also imposed up to 3,521% tariffs on Southeast Asia solar panels in April 2025.

And one company manufacturing solar panels at scale in the USA could be a major winner of these trade tensions: First Solar.

First Solar, Inc. (FSLR -4.9%)

Silicon Vs Perovskite Vs Cadmium Telluride

Silicon Dominance

So far, around 90% of solar panels are made using silicon-based technology, with the large majority using polysilicon designs, which have replaced the monosilicon older designs (monocrystalline silicon is more durable, but also less cost-efficient).

Source: EIA

However, polysilicon technology R&D is also starting to hit a point of diminishing returns. So, the industry is looking at multiple ways to increase the efficiency of solar panels.

Another method to produce solar panels is starting to take the lead, one that is inherently more able to capture a larger range of the total sun energy: perovskite.

The Promises of Perovskite

Perovskites, also often called thin-film solar cells, capture the Sun’s energy thanks to the unique crystalline structure of perovskite. Perovskite thin film solar cells are the technological focus of First Solar, together with cadmium telluride thin film cells.

The term thin film comes from the much thinner layer of material required for producing electricity, making for more flexible and lighter solar cells.

Naturally occurring perovskites are made of calcium and titanium oxide (CaTiO3), but other minerals can have the same crystalline structure with a chemical formula following an “ABX3” rule.

Perovskite solar cells can be installed in combination with silicon or as a stand-alone solar cell.

Source: Department Of Energy

Until recently, thin film cells were relatively new and mostly used in applications where their lower weight was critical. A recurring problem that needed to be solved was that perovskite cells degraded much quicker than polysilicon cells.

Since the first perovskite solar cell was made in 2009, the technology has gone a long way and is now more efficient than polysilicon solar cells.

Source: Department Of Energy

This is a scientific field which is absolutely booming, with many new developments coming out of research labs and universities in the past few years, for example:

The Cadmium Telluride Alternative

Cadmium telluride is another thin film solar cell technology, with higher efficiency than silicon-based cells. It is currently the one favored by First Solar, as well as the most mature alternative to silicon solar cells.

Source: Department Of Energy

As it is a mostly automated manufacturing process, it is relatively less sensitive to differences in labor costs. This can make its production in Western countries a lot more competitive, especially when they are sold locally and it removes shipping costs from the equation.

Source: Department Of Energy

First Solar Overview

First Solar is a well-established solar company, active since 1999. It is the largest solar panel manufacturer in the USA and in the whole Western hemisphere, with manufacturing sites in the US, India, Malaysia, and Vietnam.

Its Ohio factory has the largest solar manufacturing footprint in the Western Hemisphere, with a new factory expected to be commissioned in Alabama in 2025.

The company is not using the classic crystalline silicon technology and instead uses its proprietary thin-film photovoltaics. Based on cadmium-telluride, they are more efficient than most silicon cells, are produced at a lower cost, and can easily be mass-manufactured.

Source: Department of Energy

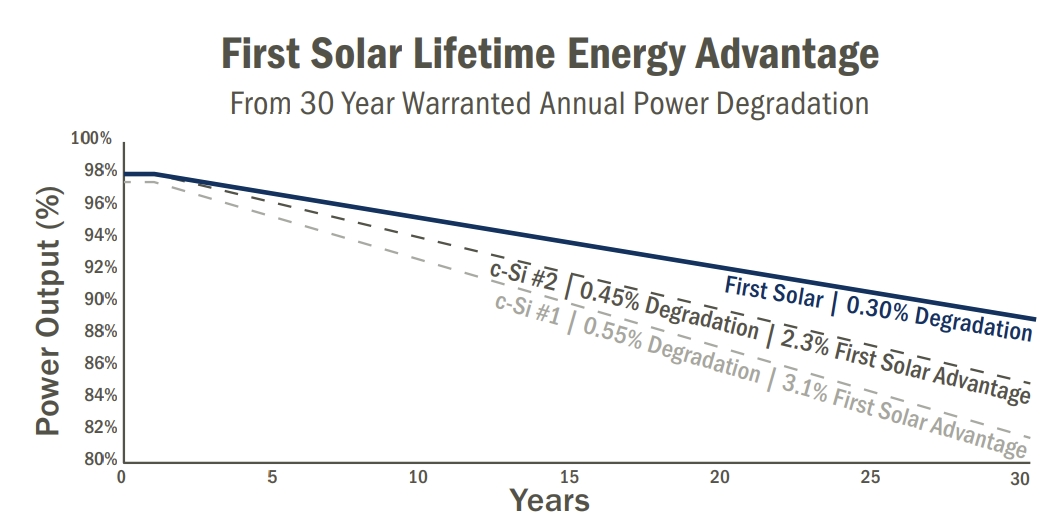

First Solar’s cadmium telluride thin film solar panels are also more durable, retaining 89% of the original performance after 30 years, making it a leading performance in both thin film cells and solar panels in general. As a rule, the longer deployment duration of 30+ years reduces resource consumption.

Source: First Solar

Cadmium telluride also delivers 4% more annual energy in hot climates and up to an additional 4% more annual energy in high humidity conditions, making it more performing in high insulation environments where humidity and heat normally reduce the performance of polysilicon panels.

First Solar’s Growth and Market Share

The company was founded in 1999 with an initial 74,000 square-foot facility in Perrysburg that initially created 50 jobs.

Today, it is very quickly expanding its production capacity, from the current 16GW nameplate capacity per year to 25GW by 2026. Of this total capacity, 14GW will be located in the USA, in Ohio, Alabama, and Louisiana.

It is also a historically very R&D-focused company, with $1.5B in cumulative R&D investment.

The company’s thin-film technology is overall more environmentally friendly than silicon-based solar panel techs, with up to 4x lower carbon footprint and 4x lower water footprint than silicon panels on a lifecycle basis.

Every year, First Solar products displace more than 7x the amount of greenhouse gas emitted through its global operations and supply chain.

First Solar Manufacturing

Different Production Process

The company’s focus on thin film semiconductor technology allows it to be fully vertically integrated, making it radically different from the silicon-based solar panel industry.

Instead of multiple factories, with each actor specialized in one segment like polysilicon purification, and with many days to produce a solar cell, First Solar can go from raw materials to finished product in less than 4 hours.

Source: First Solar

Ultimately, First Solar uses 98% less semiconductor material than traditional crystalline silicon technology.

The vertical integration represents a strategic advantage, as it allows First Solar to be fully independent of the Chinese supply chain. Instead, it can leverage the semiconductor supply chain to enable the construction and operation of new factories in as little as 18 months.

Resources & Recycling

Cadmium telluride production is the byproduct of other mining activity, and was until not long ago considered as a mining waste instead of a valuable resource. Cadmium comes from the refining of sulfidic ores of zinc, and, to a lesser degree, lead and copper, while telluride is produced from copper and copper-gold porphyry-type ore deposits.

This means that no new mining activity needs to be started to produce First Solar’s panel, further improving its environmental profile.

Another element is the very high recyclability of thin film solar panels, with as much as 90% of the material recovered.

This is even more important than for other types of solar panels, as cadmium is a heavy metal that could pollute soil and water supply if improperly managed at the end of the solar panel life.

The remaining 5-10% of the recycled module scrap consists primarily of glass fine particles which are captured by dust control systems and High-Efficiency Particulate Air (HEPA) filtration systems. So this “waste stream” is not cadmium rich nor constitutes long-term pollution risks.

Source: First Solar

The technical easiness of the recycling process helped First Solar create the “Recycling Service Agreements”, where the company preemptively takes responsibility for the end of life of its solar modules.

Not only does it help sales and reduce the risk of pollution, but it also provides the company with a circular supply of cadmium telluride.

“With every module sold, we also sold the service that we pick up the modules at the end of life and recycle them.

That was basically 8 years before regulation came in in Europe. We now have the electronic waste directive where PV is part of that.”

Andreas Wade – Global Sustainability Director at First SolarFuture Techs

The process could also be improved further, as First Solar is working on a mobile recycling unit that can be shipped to a solar farm that is being decommissioned, in order to mitigate unnecessary shipping.

Advancing Solar Technology: What’s Next for First Solar

Research and product development teams at First Solar forecast a thin film CdTe of 25% cell efficiency by 2025 and pathways to 28% cell efficiency by 2030.

In the long run, First Solar is looking to integrate its experience with cadmium telluride thin film to perovskite technology, making the resulting solar panels even more efficient.

Source: First Solar

In Q4 2024, it developed its perovskite capacity to acquire a “development line readied for producing technology samples simulating manufacturing-like condition”.

Tandem cells using perovskite thin film and cadmium silicon thin film are also possible, and will likely represent the end stage of the company’s technology.

While mostly focused on thin film solar using cadmium telluride so far, First Solar’s expertise in non-silicon solar panel manufacturing and thin film mass manufacturing could give it a significant head start with perovskite, especially considering its deep ties to some of the top researchers in the field.

Market Conditions

Made In America

In the context of tariffs, trade wars, and an embargo of rare earth exports by China, the future of renewable energy industries in Western countries has been difficult to forecast.

The shortages of rare earths could severely impact many actors in the supply chain, especially those linked to components like magnets (wind turbines, EVs) or relying on the import of polysilicon or solar cells from China.

However, the de-facto ban on solar panel imports from Asia is a massive opportunity for First Solar. Not only is cadmium telluride not a rare resource or dependent on China, but the company has made a conscious strategy to also source its other material from US-made sources.

This includes 100% American glass and steel for its Series 7 modules, an important factor as tariffs on imported steel and aluminum will rise to 50%.

These suppliers, in turn, are supported by supplementary supply chains – for instance, the glass produced in Ohio uses sand mined in Michigan and soda ash from Wyoming.

More Demand Than Supply

This “Made-in-America” supply chain comes in handy as the country is massively accelerating its investment in solar power.

Source: First Solar

The broader context is also important. The USA is looking to both lead on AI and reindustrialize, while also slowly transitioning away from fossil-fuel solutions for heating, transportation, and manufacturing.

All these goals are going to require a tremendous amount of new power capacity, and everything from gas to nuclear and solar will be needed to answer the demand.

The company is now looking at a growing backlog of orders (+0.6GW in just Q1 2025), with a total of 66.3GW extending through 2030.

Source: First Solar

So even if some solar subsidies are being canceled by the new administration, it is clear that between the impact of tariffs, the strategic importance of decoupling from China, the buildup of solar demand, and the growing demand for power in the USA from many massive trends will benefit First Solar.

Conclusion

Despite First Solar being uniquely positioned to benefit from the trade war, it has so far not seen much of it in its stock price, as the renewable industry as a whole is concerned about the perceived Trump administration hostility to the sector.

This could have indeed serious impact on wind projects, EV production, battery production, or even solar panel manufacturers relying on silicon technology.

None of these hold for First Solar, so it could be an opportunity for investors willing to take a shot at an innovative solar technology.

Another key factor in the long run, ignoring the current geopolitical turmoil, is the superior yield of thin film solar cells over silicon. Only perovskite technology could challenge the current superiority of cadmium telluride, but these are technologies with a lot in common in terms of manufacturing process, and very little overlap with silicon-based cells.

It is not to say that Chinese companies could not be severe competitors in international markets, notably with LONGi Green Energy Technology’s (601012.SS) 34.85% efficiency Silicon-perovskite Tandem Solar Cells.

However, it seems that the possibility of having a somewhat protected market in the USA could give First Solar the sort of scale and supply chain control that until now has been only available to Chinese companies, which led to their dominance of the solar industry.