Trade War Free For All

As the Trump presidency ramps up tariffs and pressure on other nations, international trade is in turmoil. On the 2nd of April 2025, a flood of new tariffs was enacted, with the baseline level being a 10% tariff on everything imported into the USA.

Some countries will be submitted to this baseline level only, including, for example, the UK, Brazil, Australia, New Zealand, Argentina, and Turkey.

Others are not so lucky, and are submitted to punitive tariffs, for example:

- 20% for the EU.

- 24% for Japan.

- 54% for China.

- 46% for Vietnam.

- 32% for Taiwan.

Meanwhile, the 25% tariffs on Canada and Mexico still hold, but with no extra added on the 2nd of April.

Source: Reuters

“The tariffs are wrong and not in the interest of either party. We will do everything we can to work on an agreement with the U.S., with the aim of averting a trade war that would inevitably weaken the West in favor of other global players,” t

Giorgia Meloni – Prime Minsiter of Italy

Overall, according to James Surowiecki, it seems that the formula used to decide the tariffs, besides a few exceptions for allied countries at the 10% baseline, was to take the trade deficit the US has with each country and divide it by US imports from that country.

Source: Ryan Petersen

Another set of tariffs, independent of geography-based tariffs, is regarding the import of cars made out of the USA, with a blanket 25% tariff.

This can cause a massive shift of the North American auto industry, as many automakers had moved part of their supply chain to Canada and Mexico to save costs.

And overall reverse a very old trend of declining tariffs of the past decades.

Source: Bianco Research

Automotive Production In North America

To understand the impact of the tariffs, a look at how the industry and trade flows are currently structured is a good start.

The North American automotive industry was worth almost a trillion dollars in 2024. It is also expected to expand at 5.4% CAGR until 2029.

In 2024, the USA saw the sale of 16.3 million cars and light vehicles. Of these sales, 7.5 million were imported, or 46% of all vehicles sold.

In order, the largest import source was Mexico, with 15% of all vehicles sold in the US from there, followed by Canada (7%). Other major exporters of automobiles to the USA were Japan, South Korea, and European countries, especially Germany.

Tariffs Impacts

Financial Impact

Thanks to an analysis from S&P Global Mobility, we can estimate the impact of these tariffs on imported cars. The average $25,000 landed cost of a vehicle from Mexico and Canada will see an additional $6,250 for a new vehicle.

As the two countries are subjected to a blanket 25% tariff on almost all goods (excluding some exceptions for oil products), the import of Canada or Mexico-made parts will also see a similar rise in prices.

In the very short term, a mix of manufacturers absorbing part of the price rise from their profits and a direct increase in price tags will likely occur.

Short-Term Effects

In the short term, this could create severe supply chain disruption, as well as a shock to the sales number of new cars. It will likely take years for automakers to relocate back in the USA the parts of the supply chain that have been moved abroad.

In addition, labor costs and another tax differential might make the production of certain parts abroad still a winning proposition compared to local manufacturing, even when not considering the one-time costs of relocation. In this case, car prices would rise without much impact on domestic production.

For now, domestically-made cars were not especially competitive compared to imported ones, nor cheaper. So at best, this should boost sales of locally made cars.

Whether local production is able to respond to such increased demand is yet to be seen. If not, an increase in price and shortage of US-made/tariff-free cars might persist for 12-24 months until US production can be ramped up.

It is also not impossible that some automakers might consider, at least for some models, a rise in price to capture more margins and finance the needed investments and factories relocation.

The Battery Question

Another question looming over the US automotive industry is electrification. Besides Tesla, the “Big 3” car companies or General Motors Company (GM -2.5%), Fiat Chrysler, now Stellantis (STLA -7.59%), and Ford (F -3.84%) have somewhat lagged in EV technology.

This means that many are importing their battery packs from abroad, fully made or their components, with China a key supplier.

As the 54% tariffs imposed on China are some of the highest in the world, this could lead to some confusing tentatives to bypass the tariffs: for example, a battery pack could be imported from China to Mexico, assembled in Mexico, and then sold at “only” a 25% tariff as a car made in Mexico.

This could, however, be a risky move, as it is likely that the Trump administration might catch on with it and bring additional rules, tariffs, and sanctions to stop the practice, the way Chinese goods re-exported to Vietnam are now punished with a general 46% on the whole country.

Long-View Perspective

The Intended Long-Term Results

Of course, the intended goal of these tariffs is to relocate heavy industry in the USA, after decades of globalization and offshoring.

In part this should work, simply because with high enough tariffs, it will become completely unviable to import cars into the USA.

However, it is yet to be seen if this will just create more jobs, or also create a permanent increase in car prices, as the US economy is structurally more expensive when it comes to goods manufacturing, stemming from high salaries and more regulations.

Strategic And Defense Considerations?

Another likely set of reasons for the tariffs are the national security and defense aspects. Car factories are the basis of most heavy industry supply chains in a country, supporting a dense network of machining tools, design expertise, logistical networks (including railroads), and metallurgical companies (steel and aluminum especially).

So this should probably be understood in the broader context:

So overall, despite potential negative effects on inflation and short-term disruption, automakers should expect the tariffs to stay, and even intensify if considered “not enough” by Trump and its advisors.

“Big Three” Automakers Companies

As the tariffs are put in place, we can look at the position of each of the largest US manufacturers, as well as a selection of some of the other international brands active in this market.

General Motors

General Motors Company (GM -2.5%)

Like many automakers, the company stock prices have been on a downtrend due to the upcoming extra costs and incertitudes, as parts and production steps often cross borders one or more one times during the car assembly.

In 2019 & 2020, GM was “leading in in shipping jobs to Mexico” and “retreats overseas”. So, while in the long term, the tariffs might protect the company’s domestic production, it might not be such an advantage in the short term.

This is not to say that some adjustments couldn’t be made in the upcoming months:

“We have the capacity in the United States to transfer some of that production. We also sell trucks globally, so we can analyze the origin of international market shipments. There are steps we can take to minimize the impact if tariffs are imposed on Canada or Mexico,”

Mary Barra – GM CEO during a January 2025 conference

It would, however, severely impact previous investment in Mexico & Canada, notably the recent $1B to modernize its Ramos Arizpe plant in Mexico, a factory shifting to 100% EV production.

Ford

Ford Motor Company (F -3.84%)

Ford is in a rather similar position as GM when it comes to offshoring, a strategy the company has pursued for many years by now.

Even back in 2024, Ford’s CEO said the UAW strike made him consider offshoring truck jobs.

However, it is far less advanced in the process of offshoring, which might suddenly turn into a benefit.

“We make 100% of our trucks with UAW workers in the U.S.,” he said. Our competitors do not do that. They went through bankruptcy and they moved production to Mexico and other places.

And so it’s always been a cost for us, and we always thought it was the right kind of cost.”

Jim Farley – Ford CEO

However, past decisions like the production of the next-gen Focus moved to China in 2017 and the export of these cars into the US might come as a mistake after all.

Stellantis

Stellantis N.V. (STLA -7.59%)

Contrary to the other “Big 3”, Stellantis is a much less US-focused company, as Chrysler, Jeep, and Ram are only some of the brands of the group, together with European brands like Citroen, Fiat, Lancia, Peugeot, Alfa Romeo, etc.

Source: Motor1

Nevertheless, the tariffs are impacting the company as well, with the announcement of pause in production in Canadian and Mexican factories and 900 temporary layoffs, after the White House decision.

Temporary layoffs at US factories, producing parts for the paused Canadian and Mexican factories are also to be expected.

Notably, the Jeep Compass crossover, the Jeep Wagoneer S electric SUV, and Ram heavy-duty pickups are produced in Mexico.

Other Automakers

Tesla

Tesla, Inc. (TSLA -5.32%)

Tesla is known for having all of its North American factories in the US, which should help protect the company. Still, this is not a clear-cut decision either. As explained by Musk himself, maybe in a bid to avoid an accusation of being favored by the Trump administration due to Musk’s activity at DOGE:

“Important to note that Tesla is NOT unscathed here.”

Tesla is also a lot more vertically integrated than the rest of the industry, so overall, it is less likely to depend on the import of parts from Mexico, Canada, or other countries for its cars.

Still, Tesla apparently joined Ford Motors in seeking tariff relief, looking to exclude Chinese equipment used to make power equipment, drive axles, battery modules, and microchips. Petitioning for equipment not being sanctioned might be a smart move, as it can be justified by speeding up the relocalization of the final production using this equipment.

Another Tesla activity that might be impacted by the tariffs on China, not the auto tariffs, is the energy storage business of Tesla. To some extent, this has been a business of “repackaging” China-made battery components, now under heavy tariffs. Here, too, managing to import Chinese equipment without tariffs could help build a more domestic battery supply chain.

Toyota

Toyota has no less than 10 manufacturing plants in the US, with best-selling models like its Highlander SUV. However, these plants are also important key parts from Japan, and all the Prius cars are shipping from Japan.

Overall, Toyota sales in the US represented 2.3 million units in 2024, on a total of 10.1 million cars globally.

So paradoxically, as historical American brands have offshored factories to the US’s closest neighbors, a Japanese company like Toyota might be in a position, if not better, to benefit from the protectionist tariffs.

In large part, this is because the company has been dealing with previous protectionist tariffs against Japanese automakers since the 1980s-1990s, and shaped its North American business accordingly.

(You can also read more about Toyota, including its electrification strategy, in “Toyota (TM): Playing it Safe with a Well-Rounded Approach”)

Hyundai

Hyundai is a company doing most of its business in Korea and out of the USA and Europe. Still, the almost 1 million vehicles sold in the US per year are not a rounding error for the company, so we can expect tariffs to have an impact as well.

Source: Hyundai

So far, the company seems to be ready to suffer the tariffs and aims to maintain its price advantage, even at the price of its margins.

“What I can tell you is that we are not going to increase prices right now. Our position in the market is to always be competitive.

We have to offer to our customers competitive products with good design, good technology and good services We will remain doing so.”

Jose Munoz – Hyundai Motor CEO

This will likely be a strategy to swallow that bitter pill, and then work on the plan announced last week to invest $21 billion in the United States through 2028, which can be described as a victory for the Trump administration for its reindustrialization goals.

(You can also read more about Hyundai, including its innovation strategy, in “Hyundai Motor Company (HYMTF): Solid-State Batteries, Hydrogen, And Robots”)

Volkswagen

The German group, including not only the Volkswagen brand but also Audi, Porsche, and Skoda, might see its US sales impacted by the tariffs mostly due to the nature of these sales.

It is mostly selling high-end models, at a high price tag. So a price increase by 25% will likely have a much larger nominal impact on the price tag than for cheaper models.

However, the US sales are rather small at the scale of the group, with just 370,000 cars in 2022 on 8.6 million vehicles worldwide. So the overall impact should be limited, and this could make the company a relatively safe automaker when it comes to tariffs’ impact.

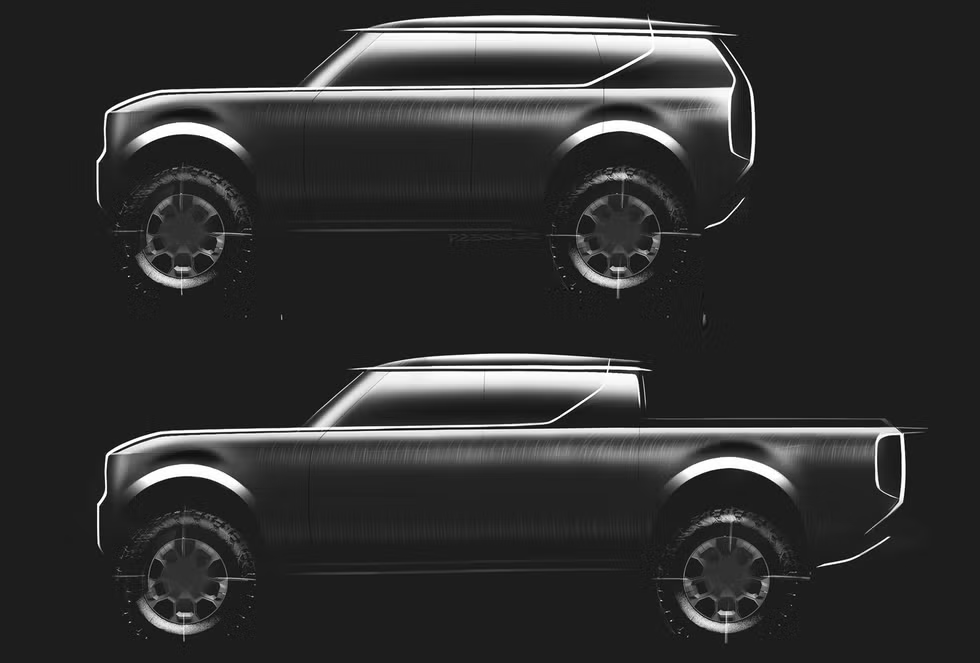

Volkswagen has also recently rebooted the abandoned Scout truck brand with an EV revamp. Production is scheduled for 2026 from a brand-new $2B factory in Blythewood, South Carolina, with a target of 200,000 EVs / year.

Source: Inside EVs

This local production should be a boon for the company. However, it is not yet clear where the battery would come from, as Volkswagen had planned for Ontario to become a key hub for EV battery manufacturing, with a focus on solid-state batteries.

(You can also read more about Volkswagen in “Volkswagen Closing German Factory? What’s Next for the Troubled Automaker?”)

Chinese Brands

Many Chinese brands like BYD had considered plans to open factories in Mexico to avoid tariffs leveraged on China. As the US is now putting tariffs on every foreign car, as well as its closest neighbors, this will simply not happen.

It also comes on top of Chinese ministers having expressed concerns that its very advanced battery technology could “leak across the border into the United States”.

“The main concern of the ministry is the proximity of Mexico to the United States,” the sources explained, according to whom the “hostile attitude” of Mexican President Claudia Sheinbaum – which aims to correct the trade imbalance with the Asian country – makes the situation even more difficult for BYD”

Overall, it can be expected that as the main target of Trump’s tariffs and trade war, Chinese cars will be for all practical purpose entirely shut out of the US market, with some rare exports hardly competitive on price and more of a curiosity.

Conclusion

The tariffs on foreign automobiles are likely to quickly cause disruption and price rises, including for historical brands produced entirely or partially in Mexico and Canada. Even some US factories producing parts for exports to these countries could be affected.

In the long run, this could, however, have a positive impact on the domestic production, with a large part of the 46% of cars sold in the US being imported.

Further higher tariffs are a possibility, as Trump has been known to rely on this macroeconomic tool heavily and seems determined to make it the primary way by which he aims to rebuild America’s international competitiveness and reduce trade deficits.

In general, this topic should also be understood with the greater context in mind: re-industrialization policy, other tariffs, and geopolitical tensions. It is yet to see if retaliatory tariffs by other nations, political opposition, and powerful lobbies could derail this policy, especially if it causes serious turmoil in the US and global stock markets.