Green Energy At Scale

As our energy systems transition to green energies, at least three major challenges are still to be solved.

The first one is the issue of intermittence of production of solar and wind energies, which can only be solved by pairing with more stable energy generation or very large battery systems.

The second one is improving the efficiency of green energy technologies, in order to produce more with an ever decreasing consumption of resources or pollution generated. You can see many of the most recent discoveries on this topic in our “Energy” section.

The third is how to build a sufficient amount of green energy fast enough that it can reduce carbon emissions and pollution generated by fossil fuels. Of course, more efficient production and cheaper technology helps a lot in speeding up the adoption of green energy. But the ability to build large solar power plants or wind farms at scale is equally important.

And so is the ability to raise capital, manage the facilities, and overall turn the activity into a profitable endeavor that can be repeated again and again with new projects.

This is where the best green utility companies excel, and it can have as much impact as the most revolutionary scientific discovery, as this is where the science is actually put to good use.

And few companies have been as expert at building giant green energy projects as Brookfield Energy Partners.

Brookfield Renewable Partners L.P. (BEP +1.32%)

(The company can also be accessed under the ticker (BEPC +1.05%)), a Canadian corporation created to provide investors with greater flexibility in how they access BEP’s stock.

Brookfield Renewable Partners Overview

The Brookfield Galaxy

Brookfield Renewable Partners, or BEP, is part of the massive Canado-American asset management firm Brookfield, handling over a trillion dollars in assets, which owns 48% of BEP.

Source: Brookfield Renewable Partners

BEP has $126B under management, managing 7,000 power-producing facilities and indirectly employing 18,000 people.

In total, the Brookfield group employs 2,500 people directly, and 250,000 in its subsidiaries’ operations.

Other major segments of Brookfield (BN +2.25%) include:

- Brookfield Infrastructure (BIP +3.05%), mostly rail, power grid, and pipelines, with $202B under management.

- Brookfield Private Equity, with $145B under management.

- Brookfield Real Estate (BPYPP -0.64%), with $271B under management.

- Brookfield Credit, with $371B under management, owning 62% of Oaktree Capital Management (OAK-PB +0.04%)

- BEP, BIP, and Brookfield Credit can be accessed at once through the ticker (BAM +2.38%).

This complex and multi-layered ecosystem of investment firms gives BEP an extremely solid backing and reputation, as well as potential business and fundraising connections unmatched in the industry.

BEP Business Model

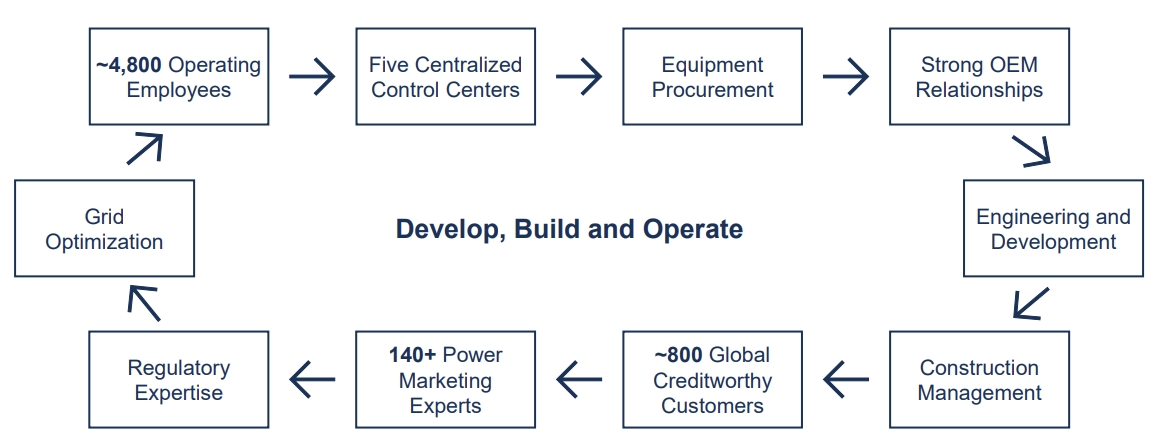

BEP’s core business model is to build with the latest technology of the time of the project more green energy generation capacity.

This relies on the capacity to raise capital at a low cost, using the scale of the company, the backing of the even larger Brookfield group, as well as the reputation for high-quality, profitable projects to obtain money from investors and banks at a lower rate than its competitors.

Access to capital is more important than ever, and we are exceptionally well-equipped to fund accretive growth opportunities.

Brookfield Renewable Partners

The expertise of the company also gives it experience in managing such large green utility projects, both from a project management angle and from the required technical expertise angle.

Source: Brookfield Renewable Partners

BEP’s model is to deploy capital together with its partners, which are sometimes also partially owned by BEP or other branches of Brookfield, providing better diversification, increasing risk-adjusted returns, and helping learn from the best in the industry.

Source: Brookfield Renewable Partners

This partnership strategy also gives BEP local expertise and skills for each of the regions where it operates, as well as the occasional unique technical still for a given project.

Source: Brookfield Renewable Partners

BEP also has expertise in negotiating the often complex or outright byzantine regulations regarding electricity markets and correctly anticipating the effect they can have on the company’s cash flow.

BEP Finances

The company’s money-raising methodology makes it intrinsically an inflation hedge, as it raises money either through equity raise or debt with fixed rates. However, the price of its product, electricity and energy, tends to follow inflation, or is even legally indexed to inflation in many markets and countries (70% of the total).

So overall, BEP would benefit from periods of durable inflation.

BEP is a prime example of the benefit of green bonds for raising money, with the latest being a $450M issue of green bonds in March 2025, at an interest rate of 4.542% per annum.

In total, 95% of its debt is at fixed rates with almost no near-term maturity, and an average of 12 years to maturity.

Source: Brookfield Renewable Partners

The company cash flow is highly predictable, with 90% contracted for an average duration of 13 years.

In the past 20 years, BEP grew its distribution by 6% CAGR, and is currently trading at prices low enough for a dividend yield of 6.5%.

Overall, the company’s funds from operations (FFO) grew by 12% CAGR in the 2016-2023 period.

Source: Brookfield Renewable Partners

(FFO is a way to measure fund performance, often used by REITs, which excludes non-cash items like depreciation and amortization and gains and losses on property sales).

Together with cash & credit facilities, the company has at its disposition no less than $4.4B in liquidity, limited greatly by its credit risk.

Source: Brookfield Renewable Partners

BEP Energy Assets

BEP is present in all forms of green energy, including hydropower, solar, and wind. It is also present in energy storage, carbon capture, green hydrogen, and nuclear energy.

Source: Brookfield Renewable Partners

Renewables

Currently, BEP operates 37GW of capacity. In total, this avoids the emission of over 250 million tonnes of carbon annually.

The power generation activity is relatively equally split between all categories. However, in the long run, considering the much larger pipeline in the development of solar and energy storage solutions, these technologies are going to ultimately take a much larger place in BEP’s portfolio.

In contrast, hydropower, which used to be a much larger part of the company’s assets, will slowly drift to represent a single-digit percentage of the total.

Source: Brookfield Renewable Partners

New Project Pipeline

In 2024, BEP deployed 7GW of new energy-generation projects, mostly in the Americas and Europe. This was a record year for capital deployed, with no less than $43B, or more than twice what the company did in 2021, and quadruple its activity in 2017.

Source: Brookfield Renewable Partners

In the long run, BEP is looking at 10 GW of new projects per year until 2030, with a pipeline of more than 65GW in an advanced stage.

Source: Brookfield Renewable Partners

Around 75% of the total 200 GW pipeline is in developed markets, with the whole pipeline having an estimated enterprise value of ~$100B.

Source: Brookfield Renewable Partners

Other Assets

Nuclear Power

Besides renewable energy generation and storage, BEP is also the owner of 51% of Westinghouse. Westinghouse is the US leader in nuclear energy, for half of the world’s nuclear reactor fleet and the immense majority of non-Russian, non-Chinese nuclear power plants.

This deal was done together with the world’s second-largest uranium miner, Cameco (CCJ +2.27%), in a $7.9B acquisition in 2023.

(You can read more about investing in nuclear energy in “Investing In Uranium – Powering A Zero Carbon Future”, “Cameco (CCJ) Spotlight: The Foundation of the Western Nuclear Renaissance”, and “Top 5 Nuclear Stocks To Invest In”)

Alternative Fuels

Alongside nuclear, BEP is also active in several sustainability initiatives, notably:

- 3 million Btu of biofuel production, to be raised to 10 million in the future.

- 57,000 tons per year of carbon captured, to be raised to 73,000 tons in the future.

- A project for producing 3GW per year of solar panels.

- The construction of Canada’s largest green hydrogen project, with a 20 MW electrolyzer in partnership with Gazifère Inc, a subsidiary of Enbridge (ENB +1.53%).

For now, the “other” category, or sustainable solutions, has been a small part of the business. But between the ongoing renaissance of the nuclear sector, growing demand for carbon capture, and the promises of green hydrogen, this is a segment likely to experience quick growth in the next 10 years.

New Power Demand

Overall, the need for more power generation is increasing, and low-carbon generation is not going to be affected by potential carbon taxes in the future.

Contracting Power To Tech Companies

A new trend in the green energy industry has been the contracting of power not to countries or local grids, but directly to corporate customers. This is an activity that has grown 11x for BEP since 2016.

Source: Brookfield Renewable Partners

This included a landmark agreement with Microsoft (MSFT +0.3%), which is concerned with securing enough power for its cloud and AI operations. BEP signed then its largest-ever corporate partnership to deliver over 10.5 gigawatts of new onshore wind and solar energy capacity between 2026 and 2030 in the U.S. and Europe.

AI data centers

This direct contracting is a reflection of the larger trend for utility companies to have to provide AI data centers with increasing amounts of power.

The global data center energy demand is expected to grow by 15x between 2022-2030, moving it from 2% of global consumption to 10%.

While the exact power demand could change depending on the exact power requirement of newer AI models, like the recently released DeepSeek, it is likely that the generalization of AI in business and everyday life will have a major impact on global energy demand.

Electrification

In order to decarbonize our energy system, a lot more green energy is needed. This covers not only the current electricity consumption, but also the switch to electric power for transportation (EVs), heating (instead of gas and oil), and heavy industries.

This will require 3x today’s investment in power generation for 2023-2030 and 5.6x more for 2041-2050.

Source: Brookfield Renewable Partners

While the exact composition of our future energy mix is hotly debated, it is likely that solar will indeed be a central part of it. You can read more about the technical and business case for this scenario in our special report “The Solar Age – A Bright Future To Mankind”.

Powered By Downturns

It is no secret that the renewable energy industry has had less than stellar results in the last 2 years. A combination of rising interest rates, grid saturation in some regions or time periods, and overall slower-than-hoped adoption of EVs has, for a while, created a crisis for the industry.

This is a topic that we covered back then in “The 2023 Renewable Energy Crash”.

Such a crisis can be an opportunity for the larger players in the industry. Smaller firms or projects with less ideal economics are likely to suffer the most, as they are a lot more reliant on high share prices to raise capital.

And while the sector is in crisis and interest rates stay persistently higher, access to cheap capital becomes not a source of increased profit but a matter of survival.

This gives companies like BEP an opportunity to make several strategic moves:

- Raise money with long-duration bonds and low interest rates to shield itself from future rising rates.

- Use cash and cash flow (including from freshly emitted debt) to buy distressed assets or smaller companies going into bankruptcies, taking advantage opportunistically of temporary lower prices or forced selling & deleveraging.

- Enter new sectors with long-term potential, like how it did with nuclear energy and the acquisition of Westinghouse.

- Provide capital to firms unable to find it, especially if they have profitable opportunities available, and are mostly constrained by capital availability.

Project Highlights

While it is important to look at BEP from a broader perspective to understand the company, especially for potential investors, a few project spotlights can illustrate how the company operates and on which type of projects.

X-Elio

BEP acquired the other 50% of Spanish company X-Elio it did not already own in 2023, in a $900M transaction, buying it from its partner, the investment firm KKR (KKR +2.53%).

This a relatively common practice for BEP to slowly increase its participation this way, allowing it to carefully assess the potential of a company before investing more in it.

X-Elio has 1.3GW of wind power under management, with 19.5GW under development. The initial investment generated an internal rate of return of almost 30%, prompting the decision to double down on the company when KKR was looking to cash in its profits.

Neonen

BEP provides capital to the French company, which is a leader in the development of renewable energy in France, the Nordics, and Australia.

With 8GW operating and under construction and 20 GW in its advanced development pipeline, the company can contribute to BEP’s goal of quick growth in power generation capacity.

This also provided a solid entry point for BEP in attractive markets where it was, for now, not having a strong presence.

Duke Energy Renewables

BEP took the opportunity to acquire 100% of Duke Energy’s unregulated renewable power business for ~$1B when it was put on sale. It has since been renamed Deriva Energy.

Deriva operates 5.9GW of solar and wind power and has 6.1 GW in its pipeline.

This consolidated BEP’s presence in the US green energy sector, allowing for immediate synergies with similar projects in immediate proximity to Duke Energy’s assets.

Conclusion

Brookfield Energy Partners is shaping to become an absolute giant of green energy generation, with hundreds of billions of assets under management, leveraging in this sector the successful formula of the even larger Brookfield group: low cost of capital, excellent management, technical expertise, solid risk management and opportunistic investing, long-term outlook.

This possibility for BEP to make investments in the long term with “cheap money” is a durable advantage the company has over smaller competitors. As it builds it portfolio, it also reaches a scale where synergy between projects, like maintenance service, supply chains, etc. can be shared between projects, increasing profitability even further.

Ultimately, BEP is riding on the long-term trend of green energies, electrification and higher demand for energy from growing economies.

And by being flexible instead of dogmatic, like, for example, embracing nuclear energy when the time had come, it could keep delivering the double-digit return on investment it historically brought to its shareholders.

Especially as the stock price has followed the sector’s decline since 2022, boosting dividend yields and reducing risks for new investors.

So BEP has been a favorite of long-term investors looking for stable returns in the form of both growth and generous cash distributions and will likely stay on this track for the coming decade or even decades.

(You can also read more about other companies similar to BEP in “Top 10 Renewable Energy Infrastructure Stocks”)