Genome Sequencing Cost Curve

For most of the history of medicine, doctors have been limited to observing symptoms and trying to alleviate them. This has been especially true for non-infectious diseases stemming from dysfunction in the body, including genetic diseases.

With the discovery of DNA structure and function, awarded the 1962 Nobel Prize in Medicine, we started to have a better understanding of how the biological system truly works. PCR technology, awarded the 1993 Nobel Prize in Medicine, would open new ways to analyze it.

This further expanded when full genomes started to be sequenced. The first human genome was sequenced in 2003 after 13 years of hard work, for a cost of $3B. Quickly, full-genome sequencing started to become cheaper and cheaper. By 2007, it would cost “only” $1M to sequence a full genome. By 2014, just $1,000. Today, the cost stands at around $200 and is still dropping.

This mimics Moore’s Law, which made computers a part of our daily lives by predicting that the number of transistors per square inch on a microchip would double each year while the manufacturing cost per component would halve.

However, the decrease in genomic costs has been even more spectacular. It was made possible by NGS: Next Generation Sequencing. It uses the advances of silicon chips, but instead of reading binary code, it reads genetic code. And the more silicon chip manufacturing progressed, the more NGS became efficient.

In just the last 10 years, the cost per genome has been collapsing to the point that it is becoming a cheap test among the arsenal of tests available to medical professionals.

Source: Illumina

At the center of this revolution has been the largest genome sequencing machine company: Illumina.

Illumina, Inc. (ILMN -0.34%)

Illumina Overview

Illumina By Numbers

By far the largest producer of genome sequencing machines, Illumina has been a pioneer in the field and pushed forward sequencing technology for decades.

It currently has 22,000+ installed sequencers in 165 countries.

Around half of Illumina’s sequencing machines’ consumables are used in clinical applications, with the other half used in public and private research labs. In clinical applications, half of the demand comes from oncology, followed by gene-disease-tests (GDT).

Source: Illumina

Most of Illumina’s income is from the Americas and Europe, with only 7% coming from China. So the recent classification of Illumina in China’s “unreliable entity list” in retaliation to Trump’s tariffs is unlikely to have much consequences. It might, however, put a halt to the company’s plans to expand its China-localized production to include both instruments and consumables by 2028.

Source: Illumina

Short Read Genomics

Illumina is focused on short genetic sequence reading. This means it reads small segments of the genome one by one, before assembling it into a coherent whole.

This is not necessarily the type of sequencing used for complex research projects, which prefer long-read sequencing, but this is the most commonly done. Long-read is progressively becoming the niche chosen by a long-time rival of Illumina, Pacific Bioscience (PACB +0.97%).

Short read is the method used for genotyping, discovering single nucleotide variants associated with genetic disease (most common case), and detecting cancer early with liquid biopsy (more on that technology and market below).

The company expects the demand for NGS (Next Generation Sequencing) to grow by 18% CAGR for clinical applications and 6% CAGR for research, boosting the sector’s total addressable market (TAM) from $100B for clinical and to $25B for research by 2033.

Source: Illumina

Business Model & Market Share

Illumina makes some money when selling its sequencing machine, but the bulk of its income is from the consumables used to operate these machines and perform the sequencing. These consumables are special chemicals and DNA strands, with each sequencing machine usually working only with the products supplied by the original manufacturer.

For example, in Q4 2024, $698M out of $1.1B total revenues were from consumable sales. A large part of these recurring revenues are tied to Illumina’s latest high-speed sequencing machine NovaSeq X, released at the end of 2023 and now fully deployed, responsible for 2040% of total consumable revenues.

So this not only creates a steady stream of revenues for Illumina, but also locks its customers in a long-term partnership with the company.

Existing customers can also be reluctant to switch to another supplier as their existing research or medical protocols are calibrated with Illumina machines. It could also be hard to compare results between different machines for follow-up research.

So any redesign would be costly and time-consuming, and also involve retraining the technicians and researchers performing the sequencing.

Historically, these effects, locking in existing customers in the Illumina ecosystem, have been a strong competitive advantage, greatly limiting the ability of rivals like Pacific Biosciences to penetrate the market.

A reflection of this market dominance, Illumina had more than 90% market share of clinical genomics testing in 2024.

So while niche markets and specific research areas are seeing more competition (like PacBio long read, Element Bioscience medium-throughput, or Ultima Genomics low-cost sequencing), Illumina still controls most of the DNA & genome sequencing market.

Illumina’s Financial Performance

Despite explosive progress in genomic technology, and the approval of the first CRISPR-based gene editing medicine for CRISPR Therapeutics (CRSP -1.42%) (follow the link for the associated investment report), the last few years have been tough for Illumina’s investors.

This follows a general decline in the biotech sector, after strong growth and even stronger expectations during the pandemic years, peaking in 2021.

Source: Google Finance

These stock market numbers do not reflect the company’s growth, with a 30% year-to-year growth in sequencing activity, especially due to the growing adoption of high- and mid-throughput instruments.

And Illumina has been spending massive amounts of money in R&D to prepare the next generation of sequencing technology, around $1.2B in just 2024.

Illumina’s Future

Multiomics

The emergence of cheap and automatized genome sequencing has generated a flood of biological data like never before.

In parallel, the sheer complexity of living systems has led to the emergence of multiomics, a field merging together all the -omics sub-segments of biological sciences and touted as the next step in biotechnology:

- Genomics: the analysis of the DNA sequence in the cells’ nucleus.

- Transcriptomics: the analysis of mRNA carrying the DNA’s instructions.

- Epigenomics: the modification of the genome without affecting the genetic sequence, or “epigenetics”.

- Proteomics: the analysis of proteins, including the modification of proteins with sugars (“post-translational”).

- Metabolomics: the analysis of chemical compounds and the metabolism.

- Microbiomics: the analysis of all the microbes living inside or on the body.

- Single-cell multiomics: the multiomics analysis on individual cells.

- Spatial biology: analyzing in 3D the location of specific mRNA, proteins, or cells.

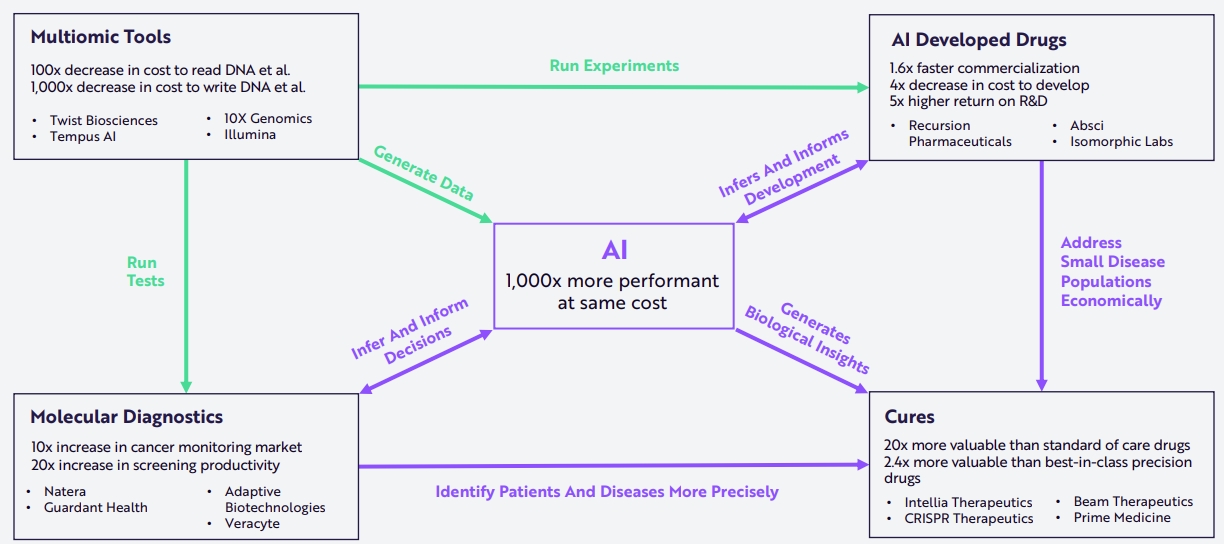

Source: Ark Research

New fields are emerging, like, for example, Agrigenomics (genomics to improve agricultural yields), Ecological genomics (accurately evaluating the health of an ecosystem and its genetic diversity), or Synthetic Biology (creating new genes, traits, or entire organisms with a specific purpose).

While this might look overwhelming (and it somewhat is even for the researchers in the field), two elements need to be understood to make sense of the multiomics revolution:

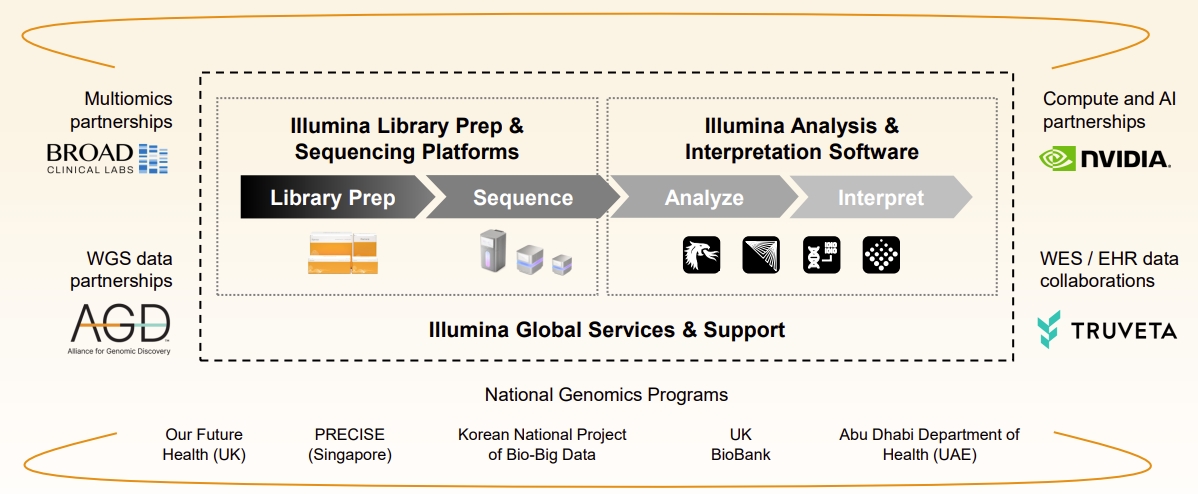

In response to this explosion in the complexity of biological data, Illumina is quickly growing into a software company as well, looking to provide natively integrated solutions at multiple points of multiomics analysis.

Source: Illumina

This is also achieved with tight partnerships with many actors to integrate together genomics data and tools: national genomics programs, Nvidia (NVDA +0.32%), Broad Clinical Labs, etc.

Source: Illumina

Transcriptomics

A growing field besides genomics is transcriptomics, the science of analyzing mRNA, the molecules carrying the DNA information, and having it form useful proteins. If DNA is the blueprint for the biological machine parts (proteins), mRNA is the instruction set detailing how many to make and where the parts go.

So, the transcriptome gives us how much, when, and where a gene is active. So far, such analyses have mostly been done on targeted genes, with full transcriptome sequencing a rather expensive proposal, and technical challenges.

Illumina has announced for 2026 a new full transcriptome machine combining transcriptomics to spatial biology, a sector until now mostly controlled by 10x Genomics (TXG +2.29%).

Illumina spatial technology will allow researchers to examine the spatial proximity of millions of cells per experiment, enabled by a capture area nine times larger than existing technologies, and with four times greater resolution.

As a complete end-to-end solution, it will also deliver the highest value for single-cell and spatial researchers at a more affordable price point. The spatial solution surpasses industry standards for scale and accuracy.

Source: PR News Wire.

This solution will be compatible with Illumina’s NextSeq and NovaSeq sequencers, which will help reduce the cost of large-scale programs.

This aggressive move into transcriptomics and spatial biology will complement Illumina’s launch in the first half of 2025 of its proteomics solution (protein analysis) to further boost its role in multiomics analysis.

Liquid Biopsy

Besides individual medicine through full genome, and complex multiomics research, a quickly growing application of sequencing is in cancer therapy.

Currently, full genome sequencing of cancer cells collected by biopsy has become a key component of cancer therapy, helping oncologists determine what treatment will work best on a given patient, driving Illumina’s sales in the clinical market.

However, a new and even larger market is opening in early cancer detection, a method called liquid biopsy. It detects cancer abnormal genetic sequences, or ctDNA (circulating tumor DNA).

What makes it unique is that it does not rely on organ-specific radiography or biopsy but on a simple blood sample.

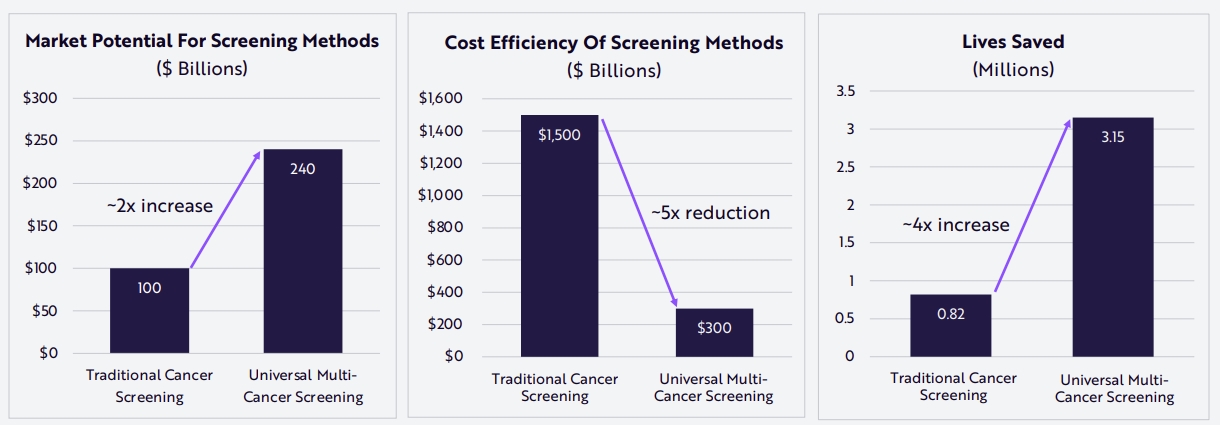

Also called Multi-Cancer Earlier Detection (MCED), this method is known to work, but was until now too expensive and unreliable to be used in a clinical setting, and even less for detecting cancer in general population screening.

Thanks to more powerful sequencing tools, this is changing rapidly.

Source: Ark Invest

The Grail Saga

This is where it gets a little complicated for Illumina. The company was a pioneer in liquid biopsy and developed internally its own department, pushing the technology by leveraging its deep expertise in the detection of genetic material, as a company called Grail.

It then spins-off the company from Illumina later reacquired at a much higher price than the IPO price, and is now forced back into a spin-off by competition authorities in the US and the EU.

So Grail is now its own company completely independent from Illumina, and listed on the NASDAQ (GRAL +4.91%).

The whole debacle caused investors to question Illumina’s board honesty and has been another contributor to Illumina’s stock price poor performance in the past 2 years. Especially as activist investor Carl Icahn actively shaking things up, ultimately leading to Illumina’s CEO departure.

This is, however, now in the past, and Grail has been doing strong since its IPO, with new health insurance adding the Grail multi-cancer early-detection tests in its coverage, including TRICARE, which is one of the largest health plans in the U.S.

The company sold almost 3x more tests in 2024 than in 2022, and expects the growth to keep going in the coming years, even before starting in other countries than the US.

Grail is only one of many liquid biopsy companies, and now that Illumina does not directly own it, other liquid biopsy companies (like Exact Sciences Corporation (EXAS +2.88%), Guardant Health (GH +1.73%), or Natera (NTRA -1.26%)) are less likely to pick a competing sequencing technology than Illumina. The market for liquid biopsy is expected to grow by 13.9% CAGR until 2034.

Source: Precedence Research

So, while it was an unwanted distraction, ultimately, the spin-off of Grail might help Illumina stay the main provider of genetic sequencers used in liquid biopsy technologies, agnostic of which test provider is being used.

Long-Term Perspective

Illumina has been a major contributor to the ongoing genomic revolution in biotech and medicine. This is only now starting to reach the mainstream consciousness, with gene editing therapies for rare diseases and cancer screening the first multi-billion market emerging from this new approach of medicine.

These are also fields with still low market penetration for Next-Generation Sequencing (NGS) techniques, giving them space to grow 10-20x by replacing older, less sensitive, more costly, or more invasive technologies.

Source: Ark Research

In the long term, it is likely that genomics and multiomics technology will become part of our daily lives. For example, every newborn might be offered by health insurance a full genomic analysis from his very first day.

This data can then be used to fine-tune the choice of medicine to use and their dosage, evaluate the risks of specific cancer or other health risks, and even provide the best lifestyle advice to adopt accordingly.

This will likely occur in parallel to AI technology speeding up the development of new drugs and therapies, as well as handling the massive amount of data multiomics science is generating.

Source: Ark Research

Conclusion

Illumina is one of the leading “pick and shovel” stocks of the biotech sector, leading the charge in decreasing cost of genomics analysis. It is now evolving into a full-fledged multiomics company, leveraging its existing stellar reputation and installed park of sequencer to expand into the key new -omics sectors or transcriptomics and proteomics.

It will also be a key analytical tool for clinicians, with growing importance over time, starting with liquid biopsy screening for invisible and silent cancer using only blood samples.

In the long run, new markers and insights into our bodies will likely create further demand for genomics and multiomics analyses, making part of the preventive tools to keep us healthy and detect health issues even before symptoms appear.

The company stock action has been, however, challenging for investors, with a biotech sector in a downturn combined with less-than-ideal decisions regarding Grail by the company’s management.

With new people in charge and Grail divested (again), the path back to technical excellence in biological analysis is now clear, and so is the lineup of software, proteomic, spatial biology, and transcriptomics tools for the next two years.