Electric vehicle adoption is on the rise globally, fueled by strong government incentives, infrastructure improvement, and advancements in battery technology.

This growth is expected to continue, with Gartner forecasting that 85 million EVs will be in use worldwide by the end of 2025. This will include not only cars but also buses, vans, and heavy trucks. A vast majority of these are expected to be battery electric vehicles (BEVs), which are predicted to see a 35% increase, while plug-in hybrid electric vehicles (PHEVs) could see a 28% jump compared to last year.

The growing EV adoption will be supported by a drastic reduction in EV battery prices, which will be driven by scaled-up production and technological advancements. Goldman Sachs projects EV battery prices to be cut down by half by 2026.

Even the battery recycling industry is expected to see continued growth, with Statista reporting an estimated 250 kilotons of batteries being processed in 2020 by EV battery recycling companies worldwide. These numbers are likely to surge by more than seven times by 2030 and further surpass 200 million tons by 2040.

This along with increasing competition among car makers will also drive down the prices of EVs, in turn, boosting their adoption. Yet another factor contributing to this growth is accessible, ultra-fast charging technology. According to the International Energy Agency (IEA), the number of public charging stations worldwide will exceed 15 million by the end of this decade.

Another key EV trend is a focus on zero-emission, with regulators, consumers, and automakers supporting cleaner and sustainable mobility.

As for the market size of electric powertrains, it was valued at $86.9 billion in 2023 and is projected to climb past $300 billion by 2031 at a CAGR of 17.1% during this period. Now, the future of this market is segmented based on integration type: vehicle type, which includes passenger cars (PC) and light commercial vehicles (LCV), propulsion which involves BEV and PHEV, and component which covers battery, motor, controller, inverter/converter, battery management system (BMS), power delivery module (PDM), and onboard charger.

Based on the integrated type, the market is divided into integrated and non-integrated, with the integrated e-powertrain segment expected to have the highest growth rate. This growth is supported by advancements in technology, cost-efficient EV production, and the need for improved vehicle performance.

The integration of key components reduces complexity, brings down production costs, frees up space in EVs, and enhances energy efficiency.

Meanwhile, the battery-based segment currently dominates the market and for obvious reasons. A battery is the main component of an EV powertrain and determines the vehicle’s performance, energy efficiency and range. It also makes up for the largest portion of an EV’s total cost and, as such, has the largest financial impact on the powertrain market.

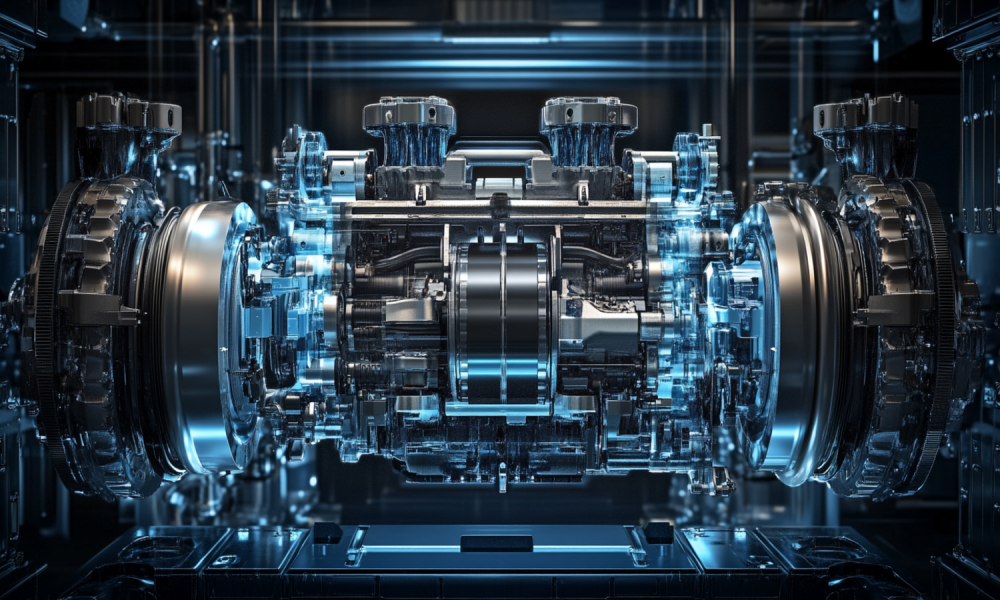

Powertrains in Electric Vehicles

Much like how an engine is a key part of your car, electric powertrains are a vital component of an electric car, be it a pure EV or hybrid EV.

In your gasoline or diesel vehicles, an internal combustion engine (ICE) works as the primary power source where fuel is converted into mechanical energy. Meanwhile, in an EV, an e-powertrain is responsible for converting electrical energy into mechanical energy to drive your vehicle. So, E-powertrain basically replaces the traditional ICE in your EVs to generate and deliver power to it.

Now, a powertrain is made up of a few key elements, including an energy storage system—such as a battery or fuel cell—power electronics like an inverter or converter, an electric machine for conversion, and a transmission system. In addition to that, the EV powertrain also includes the drive shaft to transmit the power to the wheels.

In comparison to an internal combustion engine, which has many complex moving parts, the design and components in the powertrain are much simpler with no noise and zero tailpipe emissions.

When it comes to power generation systems in powertrains that provide the required electric power to move the vehicle; they are available in the form of a battery pack and an onboard charger.

A battery pack utilizes cells to store energy. Lithium-ion cells are the most popular and widely used due to having high energy density which increases their storage capacity while fuel cells are another type of energy storage which are known for being lighter and having higher energy efficiency. The battery pack also contains a battery management system (BMS) to ensure safe battery operation by preventing overcharging or discharging.

An onboard charger uses an external charging source like the grid for the alternating current, which is converted into direct current for storage in the battery.

Now, the power distribution system in the powertrain controls the power from the source by integrating power electronic components.

This includes a DC-to-AC inverter that transforms DC power from the battery to AC power and generates alternating voltages needed to control the speed and acceleration of the motor and DC a DC-to-DC converter to adjust the battery’s high-voltage DC output to supply the low-voltage DC to power auxiliary systems like air conditioning.

A thermal management system protects the battery and motor from extreme temperatures, while firmware-powered electronic control units ensure the efficient and safe operation of EV powertrain components.

The power distribution unit makes sure each system receives the right amount of power while the vehicle control unit gathers and processes data from various systems, sensors, and controllers and synchronizes activities between systems.

Now, there are a few different types of electrified powertrains, each one having distinct configurations and functionalities.

Pure-electric vehicles or BEVs like Tesla Model 3, Nissan LEAF, and BMW i3 use rechargeable battery packs for all of their power needs and do not make use of secondary energy storage sources. They, however, need to be charged from an external source.

Hybrid electric vehicles (HEVs) like the Honda Civic Hybrid, Toyota Camry Hybrid, and Ford Fusion Hybrid combine an ICE with an electric drivetrain, allowing them to offer better fuel economy and performance than a traditional ICEV. These vehicles utilize features like regenerative braking to convert kinetic energy back into electrical energy for storage, ICE-powered electric generators for additional power or to recharge the battery, and start-stop systems to shut down the engine when idle.

Plug-in hybrid electric vehicles (PHEVs) like Chevrolet Volt and Toyota Prius Prime can be charged from an external source in addition to utilizing gasoline or diesel.

The fuel cell electric vehicle (FCEVs) make use of hydrogen fuel cells rather than batteries to produce electrical current.

While ICEs have been the main power source for vehicles for over a century now, they are responsible for environmental pollution, which has led to the rise of EVs. These vehicles with powertrains come with several benefits including reducing pollution and greenhouse gases. They also contribute to a quieter environment by reducing noise pollution.

Another great benefit of powertrains is that they are significantly more energy-efficient than ICE, converting more than 80% of stored energy into motion. The fewer moving parts in powertrains mean their maintenance costs are reduced, too. Then there’s the cost of electricity required to power an EV, which is lower than diesel or gas. In fact, fueling a gasoline-powered vehicle will cost you about twice as much as an EV in the US.

This, however, doesn’t mean that EVs don’t have their disadvantages. For starters, the upfront cost to buy an EV is higher than what you have to spend on an ICE vehicle. Then there’s the charging time, which can be anywhere from 30 minutes to several hours depending on the charging station’ capacity while it takes just a few minutes to fill up your ICEV tank. Limited driving range for EVs from a single charge causes range anxiety among consumers, presenting yet another issue with these vehicles.

Despite these challenges, EVs allow for improved fuel economy and reduced emissions while contributing to a more resilient transportation system. This has led to a push for electrification, which is resulting in exciting innovations in EV powertrains to offer enhanced benefits in performance, efficiency, and eco-friendliness.

AI-based OPED to Accelerate Powertrain Development

Given the key role powertrains play in electric vehicles, improving powertrain development is critical to achieving resource, cost, and time savings.

Researchers from Graz University of Technology, Austria’s oldest science and technology research and educational institute, have done just that by revolutionizing EV powertrain development with an AI-driven system called OPED that optimizes components to reduce months of complex engineering to just one day.

The new solution developed by researchers is the Optimisation of Electric Drives (OPED), which is a software that optimizes technical design while taking greenhouse gas emissions along the entire supply chain into account.

With this solution, the team of researchers led by Martin Hofstetter from the Institute of Automotive Engineering aims to shorten the development phase of the powertrain by combining simulation component models with evolutionary algorithms.

The AI system automatically optimizes the entire powertrain in line with the manufacturer’s technical requirements covering production costs, efficiency, and package space requirements in the vehicle.

OPED has actually been in the making for a decade. In 2018, the concept of electric axle drive system design optimization began the official journey of OPED, using which the first gearbox model was also introduced.

Over the years, this journey progressed forward with the introduction of quantity-dependent cost models, an overall development process, a basic approach to optimize product families with it, an overview of the general methodology behind the model, a modeling approach to optimizing the integration of a parking lock, and an inverter model for OPED.

Last year, the team released papers on extending the solution to enable product families optimization and minimization of the carbon footprint of an electric axle drive among other design objectives.

After over ten years of research, the team has successfully created this model, which, according to the official OPED website, aims to simplify the challenging task of designing electric drives needed for EVs. The task requires making a lot of critical decisions about the design, each of which affects different customer objectives that are in conflict with each other, making it difficult to find the best solution. According to Hofstetter:

“Electric drives consist of a large number of components that can be designed very differently in order to fulfill the desired requirements. If I make a small change to the electric machine, it has an effect on the transmission and the power electronics. So it’s extremely complex to make optimal decisions.”

Not only must numerous design decisions about the electric machine’s subcomponents be made to optimally fit the customer requirements, but increasing competition also requires sophisticated product designs and a short time-to-market for commercial success.

Here, OPED presents itself as the solution to the complex design problem, which utilizes AI and autonomously searches for optimal system designs. The algorithm covers the EV’s gearbox, electric machine, and power electronics and optimizes their best possible integration in the available vehicle space in a multi-objective manner.

The software actually combines about 50 design parameters at the same time and then compares them with the priorities of the manufacturers. It removes bad variants and optimizes better ones. After several hundred thousand simulation cycles, it finds the best solution for the manufacturer, who can select variants they want to develop and implement.

“What engineers would need months to do without AI support takes about a day with OPED. This allows the development teams to focus on top-level decisions instead of investing their limited time in manual calculation and simulation work.”

– Hofstetter

Through its diverse set of optimal designs, the model guides engineers and decision makers in the entire development process from the very beginning, which reduces development time significantly and increases quality and competitiveness.

Researchers have also added CO2 emissions generated during powertrain production across the entire supply chain as an optimization criterion that enables manufacturers to take sustainability into account right from the early development phase.

“The OPED approach can be used for a wide variety of product developments,” said Hofstetter, adding that they “are happy to work with new industrial partners to adapt it to their challenges and goals.”

The solution has been extended for the optimization of electric powertrains for an entire vehicle platform by Dominik Lechleitner as part of his doctoral thesis. OPED assists in finding optimal components to be utilized as carry-over parts in different models’ powertrains, saving development and production costs.

Building on its powertrain expertise, the team is now working on expanding its methods to other products and industries through a generic product called OPx, which enables convenient scaling.

Key Market Players

Some of the key players In the electric powertrain market include Mitsubishi, Nissan, Sigma Powertrain, Continental Ag, Denso, Valeo, BYD Auto, CATL, LG Corporation, Samsung, Panasonic, Cummins (CMI -0.21%), Hyundai, Volkswagen, Delta Electronics, Hitachi Astemo Americas, Dana Incorporated (DAN +0.19%), Magna International (MGA -1.23%), Marelli Holdings, and Robert Bosch Gmbh.

Now, let’s take a deeper dive into a couple of prominent names:

1. BorgWarner Inc. (BWA -2.98%)

Actively investing in EV technologies and AI-driven solutions, BorgWarner’s line of products includes turbochargers, e-boosters, e-turbos, emissions systems, thermal systems, control modules, onboard chargers, DC/DC converters, DC fast chargers, and lithium-ion battery systems for electrified bus and truck applications.

BorgWarner Inc. (BWA -2.98%)

As of writing, the $6.85 billion market cap company’s shares are trading at $31.33, down 1.45% YTD. For Q4 2024, BorgWarner’s US GAAP net sales were $3,522 million, and net earnings were $0.64 per diluted share, while free cash flow was $679 million. During this period, the company signed an agreement with BYD’s subsidiary FinDreams Battery, a joint venture with Shaanxi Fast Auto to develop a high-voltage inverter application for the Chinese market, and acquired Eldor Corporation’s Electric Hybrid Systems.

“We offer a full suite of products for the commercial vehicle space, catering to combustion, hybrid, and fully electrified powertrains. Our portfolio is resilient to the pace of industry change.”

– BorgWarner’s Chief Strategy Officer, Dr. Paul Farrell, said recently in an interview

2. XPeng Inc. (XPEV +3.32%)

The China-based Xpeng produces smart electric vehicles, which have been gaining a lot of attention. CEO He Xiaopeng recently said that he expects annual deliveries of budgeted intelligent cars to double this year, meaning 380,000 vehicles.

As of writing, the $16.14 billion market cap company’s shares are trading at $16.65, up 43.74% YTD. In Q3 2024, Xpeng recorded total revenues of $1.44 billion, an increase of 18.4% from 3Q23 and a 24.5% increase from 2Q24.

Revenue from vehicle sales was $1.25 billion with 46,533 vehicles delivered by the company in the quarter, up from 40,008 in the same quarter the previous year. Its self-operated charging station network meanwhile reached 1,557 stations. Cash and cash equivalents, restricted cash, short-term investments, and time deposits at the end of the quarter were $5.09 billion.

Xpeng actually emerged as China’s top-selling EV startup in the first month of 2025, which along with February are traditionally low seasons for local automakers in China due to Chinese New Year. The same month, Xpeng’s aerospace company also unveiled its “modular flying car” at CES 2025.

Meanwhile, CEO He has been talking about realizing L3 full-scenario autonomous driving in the second half of this year.

“I believe that L3 autonomous driving will drive AI cars into the ‘iPhone 4 era.”

– CEO He

Conclusion

Electric vehicles are having their big moment as technological advancement brings their prices down. As electric mobility rises, the powertrain market is also experiencing rapid growth. The integration of electric powertrains with autonomous driving and connected vehicle technologies is further expected to revolutionize the automotive industry.

Amidst this, solutions like OPED mark a significant advancement in EV powertrain development, which can significantly reduce time, enhance efficiency, and minimize production costs.

By allowing superfast optimization of EV powertrains and balancing performance, cost, and sustainability objectives, OPED not only sets a benchmark for efficiency and sustainability in engineering but can also help support EV growth and adoption, accelerating the transition to a greener future.

Click here for a list of top EV stocks.