Investing In Trends Early

Many investors dream of having invested early on in the Chinese internet and tech sector, with early investments in Alibaba or BYD, before they were famous outside of China and had turned highly profitable.

Such an opportunity may be available in another region of the world whose growth story is just getting started: Southeast Asia.

The region is home to almost 700 million people (Half of China’s population), is rich in natural resources, and forms one of the most dynamic economic regions in the world. It covers 5,000,000 square miles (13,000,000 square km) of land and sea, of which about 1,736,000 square miles is land or half of the USA’s land surface.

Source: University Of Wisconsin

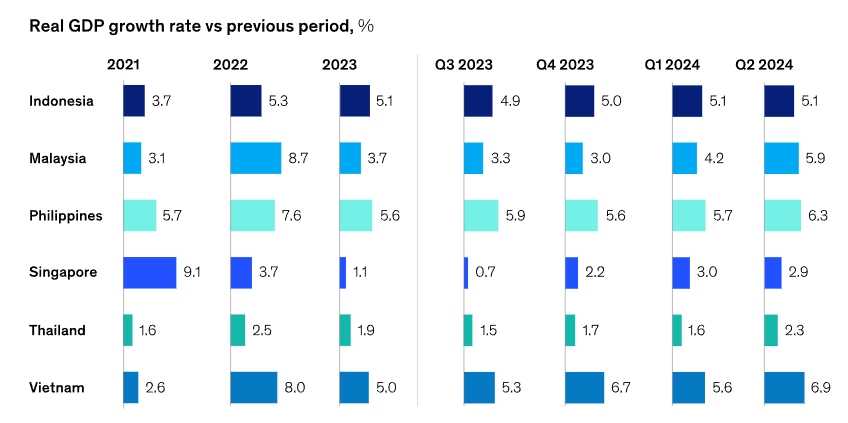

Its population is relatively young and growing, with a quickly expanding middle class. SE-Asia countries have often displayed >5% growth rate in the past years, and are industrializing quickly. The region is benefiting from its proximity to China, as well as the outsourcing of some manufacturing industries out of China, leading industrialization and to a deeper integration into the global supply chains.

Source: McKinsey

One company is benefiting greatly from the region’s growing wealth: SEA, the local leader in e-commerce. The company’s stock price has recently soared to a 52-week high, reflecting the growing interest of investors in the company.

An Expanding Tech Company

SEA is a tech company founded in 2009 in Singapore, the financial center of the region. It was initially a videogame company named Garena, with this activity now just one part of the larger rebranded SEA Group.

To this activity, SEA also added Shopee, launched in 2015. Shopee is today the largest e-commerce platform in Southeast Asia and Taiwan.

A third segment of activity is SeaMoney, offering digital payment and financial services, like mobile wallets, loans, online payments, payment processing, etc.

Source: SEA

Garena

Garena was founded by Forrest Li, who was previously managing GGame, the ancestor of Garena. This startup provided an online real-time gaming platform for all its users (gaming players) across Asia and Europe to connect with each other.

The company progressively moved toward a focus on online game publishing and the development of new online games. It is also a global leader in e-sports and organizing video game competitions.

Garena was awarded in 2010 the publishing rights of League of Legends (LoL) to the company for the game’s first launch in Southeast Asia. To this day, LoL has as many as 131 million active players, making it one of the most popular video games in history, both in player count and duration power. Since 2015, LoL creator Riot Game has been part of the Chinese company Tencent and terminated the agreement regarding League of Legends with Garena in 2023.

Garena also launched several successful games of its own, notably Free Fire released in 2017, and which had 150 million daily active users globally as of May 2021. It is still a very active game, as Free Fire was the most downloaded mobile game globally in Q2 2024.

Source: SEA

To this day, the “digital entertainment” part of SEA is the major profit driver, with $210M in Q2 2024 and making up 2/3rd of the total EBITDA.

Source: SEA

So while investors will likely for the future pay more attention to the Shopee and SeaMoney segments for growth, they should know that the gaming segment is what has been the foundation of the company and still represents a very profitable activity, with operating income at almost 50% of gaming revenues.

Shopee

SE-Asia E-Commerce

South-East Asia is seeing a very quick growth of e-commerce, with its size more than doubling in the 2020-2023 period. This was especially striking in Vietnam and Thailand, which led to the growth trajectory with their GMVs (Global Merchandise Value) increasing in 2023 by 52.9% and 34.1%, respectively.

Source: FintechNews

The largest e-commerce market in the region is also the most populated: Indonesia. It contributed 46.9% to the region’s GMV and Shopee has captured 48% of the Indonesian market share.

Despite intense competition with Alibaba-backed Lazada, Temu, and TikTok’s Tokopedia, SEA’s Shopee stays by a very large margin the dominant actor in the region, with more than triple their respective GMV.

Source: FintechNews

Even with the new segment of live commerce platform (a mix of e-commerce and livestreaming popular in China and China), displaying explosive growth, Shopee beat TikTok with a 27% market share in 2022.

SEA’s e-commerce revenue has grown by 33.7% year-to-year in Q2 2024.

SEA Strategy

SEA has been working to improve its logistics, a notorious problem in the region that is still suffering from poor infrastructure. In Q2 2024, it has managed to reach 70% of orders to be delivered within 3 days, despite the cost per order declining by 8%. It also managed to reach >50% of return-and-refund cases resolved in 1 day.

Due to intense competition and investment in growth, the e-commerce section is the only loss-making segment of SEA’s business. In that respect, it is repeating Amazon’s playbook of pursuing growth at all costs, with scale and brand recognition helping build a massive business, in a region with twice the population of the USA.

This has allowed the company to grow its GMV by an astonishing 73x times from 2016 to 2023.

Source: Cube Asia

So far, Shopee seems to be holding on despite aggressive moves by the region’s e-commerce and tech giants like Alibaba, TikTok, and Temu. It is likely that its growth will slow down and progressively match the growth of the region’s GDP and e-commerce sector as a whole.

A lot of SEA’s future profitability will depend on its ability to leverage the size of its e-commerce segment into profit in one way or another.

Source: SEA

While this could come from raising its profit directly from e-commerce activity (higher fees, etc.), it could be risky considering the intense competition. Instead, it could be providing down-the-road online services like Cloud Services (like Alibaba and Amazon), or keep using its presence in virtually almost every Internet users’ smartphone in the region (295 million users) to sell other services.

SeaMoney

SE-Asian Fintech Opportunity

With 144 million downloads of the Shopee app in just 2023, it is easy to see that Shopee provides SEA with a massive treasure trove of data and branding power.

Sea Money was established in 2014 with the goal of bringing financial services to the largely unbanked population of SE Asia. It can be seen as the fintech operation of the SEA Group.

A significant part of the local economy is only working with cash. With 50% of the region’s population having no access to banking services (unbanked) and another 24% being “underbanked”, this represents a massive financial opportunity.

Source: Business Insider

It also directly competes with incumbent banks and financial services providers, usually a lot less adept at online offerings and digital payments.

Dominic, Student: I used to pay for my online purchases through bank transfer, which usually took about 3 days before I received a confirmation message. But with ShopeePay, I get confirmation within just 10 minutes!

Vy, Young Professional: I don’t have to go to counters to pay my bills or wait in line to buy movie tickets anymore. This app makes my life a lot easier.

Sea Money Testimonials

Here too, SEA is imitating some of the best initiatives of other regional leading e-commerce and tech firms, like Alibaba’s Ant Financial, Tencent’s WeChat Pay, and MercadoLibre’s MercadoPago. In these regions, mobile e-wallets dominate the payment market, unlike credit cards.

SeaMoney’s Offers

SeaMoney is covering the most important segments of digital banking and fintech:

- Mobile e-wallet and merchant service for digital payments.

- SeaBank in Indonesia, Singapore, and the Philippines, providing a full set of online banking services.

- Sea Credit, with consumer loans (buy now, pay later), cash loans, and loans to SMEs (for micro- and small-sized businesses).

Because SeaMoney has direct access to its clients’ consumption history or online merchant profiles through Shopee’s data, it can make use of this data to better determine the risk profile.

The e-wallet also helps keep money inside the SEA’s online ecosystem and earn the company interest on the cash float.

In Q2 2024, SeaMoney registered 4 million new first-time borrowers and became the first to offer instant credit approval for smartphones, with 1,000+ merchants partnering.

The company’s loan book has been growing steadily, with the delinquent loans in a steady decline over the last quarters, standing at just 1.3%.

Source: SEA

SEA digital financial services have grown steadily overall and contributed strongly to the company’s revenues and EBITDA.

Source: SEA

Together with online gaming, SEA has managed to add a solid revenue and profit driver with SeaMoney. This makes the company a lot more resilient in the long term, as it is not any more highly dependent on a few massive hits in gaming to maintain profits and cash flow.

Conclusion

SEA stock prices and investors in the company have suffered for a while from the 2021 high of $344/share. The subsequent fall was due to a few combining factors:

- A slowdown in growth with the end of the pandemic is shared by all tech and e-commerce globally.

- Skepticism about the growth trajectory due to fear of competition from Chinese tech companies expanding into SE-Asian markets in all of SEA’s segments:

- Gaming (Tencent).

- E-commerce (Alibaba, Temu, TikTok).

- Payments and financial services (Alibaba, Tencent).

The latest SEA results show that the company has so far successfully fended off these threats, despite its competitors aggressively cutting prices and investing in the region. This follows a general trend of e-commerce toward rationalization and local oligopoly, more than a global monopoly by firms like Alibaba or Amazon.

On top of its success competing with foreign giants, SEA benefits from the region’s very strong dynamism, often coming as strong as China’s in terms of GDP growth.

The difference is however that SE-Asia is still very much an emerging market, with most of the region’s population only entering the middle-class, and with a lot of catch-up to do in e-commerce adoption. The same can be said about the adoption of digital payment, cashless transactions, and online banking.

The region is also greatly benefiting from international tensions, becoming an alternative supply source for all the major actors, be it Russia & China, or Japan, South Korea, and Western countries.

So this makes the SEA Group with 3 major, interconnected businesses: a leader in online competitive gaming, a regional juggernaut in e-commerce, and a nascent world-class fintech company. As long as SEA’s competitive position holds, and SE-Asia’s growth story is intact, we can expect SEA to keep up with its remarkable growth story.

You can invest in SEA stock through many brokers, and you can find here, on securities.io, our recommendations for the best brokers in the USA, Canada, Australia, the UK, as well as many other countries.

If you are not interested in SEA stock solely, you can also look into ETFs like the Global X FTSE Southeast Asia ETF (ASEA), the VanEck Indonesia Index ETF (IDX), or the Amundi MSCI Emerging Markets Asia (AASI) which will provide a more diversified exposure to capitalize on the growing South-East Asia and Asian emerging countries economies.