Saudi Arabia has so far channeled $38 billion into the esports sector through its Public Investment Fund subsidiary Savvy Games Group.

This includes high-profile acquisitions such as the $4.9 billion purchase of the Monopoly Go developer Scopely and the $1.5 billion buyout of ESL FaceIt Group, one of the world’s largest esports companies.

Critics have raised concerns about the sustainability of such massive levels of spending, questioning whether Saudi Arabia is buying up quick wins that may not deliver lasting impact.

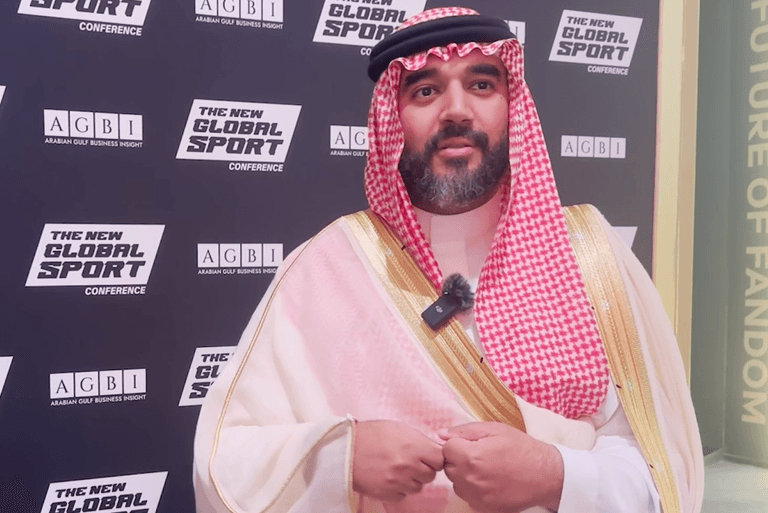

In an exclusive interview with AGBI Prince Faisal bin Bandar Al Saud, president of the Arab Esports Federation, agreed that the road to profitability is neither straightforward nor quick.

He acknowledged the need to balance ambition with the realities of building a new industry from the ground up.

Prince Faisal envisions Saudi Arabia becoming “a natural part of the conversation” in esports, much like the US, Japan and other established markets.

- Prince Faisal: growth, not profit, is focus for esports

- Gulf sports wins are sidelined by the summer season

- Magic Leap seeks additional funds after big PIF investment

A gamer himself, Prince Faisal sees the sector as an opportunity for young Saudis to make their mark in a still-evolving global sector.

“There are very few, if any, other industries where your first introduction to someone is not their history, culture, colour, or gender – it’s their avatar in a game,” he said.

“You gain respect and leadership through that lens. There’s no other medium or industry that you really have the chance to gain your own footing.”

Saudi Arabia’s substantial investments, he said, have put the country on the global stage, “to show the world we’re serious about what we’re doing.”

Abdullah Alswaha, Saudi Arabia’s minister of communications and information technology, believes the kingdom’s esports push will serve as a catalyst for social change and economic diversification.

It is part of the nation’s Vision 2030 plan to reduce reliance on oil revenues by developing new industries that can stimulate growth and create job opportunities for its youthful population.

Growth market

Saudi Arabia’s gaming and esports sector is projected to contribute about $13 billion to the national GDP and generate 39,000 jobs by 2030, a report by PwC says.

This growth is supported by government investments including Qiddiya City, a dedicated gaming district designed to attract an expected 10 million visitors annually; the Esports World Cup this year; and the Olympic Esports Games next year.

This growth is part of a broader global trend where esports revenues are projected to reach close to $2 billion by 2025, up from $996 million in 2020.

Gaming revenues in the Middle East and Africa crossed $7 billion in 2023, with Saudi Arabia emerging as a major player.

Alswaha described gaming as the “most under-valued and under-appreciated industry”.

“We need to grow this from a $200 billion industry to over a trillion dollars.”

For Alswaha, the investment is about shaping a sector that advances technology, pointing to OpenAI’s OpenAI Five, which trained an AI “team” to compete in the game Dota 2.

“That’s the investment thesis – shaping an industry and a sport that’s contributed to technological advancements,” he said.

Saudi Arabia is playing a long game, focusing on infrastructure, local talent and partnerships that could pay off over the next decade.

It is setting up local servers to reduce latency, and hosting global tournaments to enhance its credibility on the world stage.

The financial challenge and risk of running the first Esports World Cup and Olympic Esports Games is not lost on Saudi officials.

Turki Alfawzan, CEO at the Saudi Esports Federation, said: “One of the disadvantages of being a first-mover is financial sustainability.

“How [do we] make esports sustainable and generate more revenue streams?”

Saudi Press Agency

Saudi Press AgencyCompelling local stories

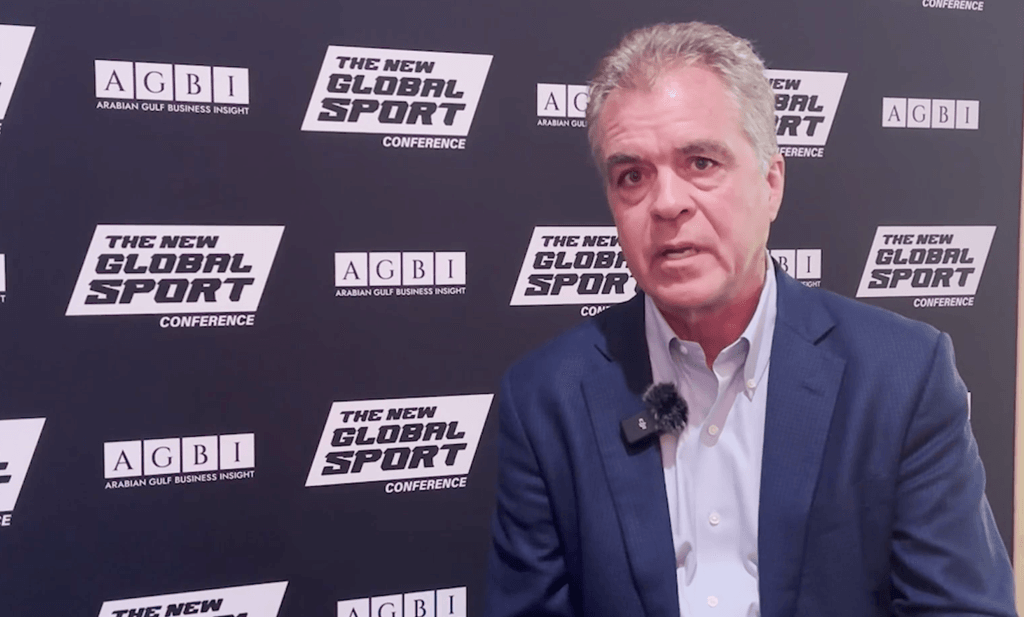

But Brian Ward, CEO of Savvy Games, sees plenty untapped potential in emerging markets.

“We’re focusing on localisation – not just language, but cultural relevance,” he said.

“The Middle East has compelling stories that haven’t been told through video games yet.”

Yannick Theler, CEO of Savvy Games-owned ESG, agrees that the road to profitability will be a long one and it will be seven to 10 years before he starts to see significant growth.

“The real return on investment will come as gaming becomes a generational pastime,” he said.

“The challenge now is execution. It’s about delivering on expectations, not just making investments.”