Funds from the UAE and Qatar have invested in a US-based clinical-stage biotechnology start-up.

Mubadala Capital, a wholly owned subsidiary of Mubadala Investment Company, co-led the $50 million Series B extension in funding to Iambic Therapeutics, based in San Diego, California.

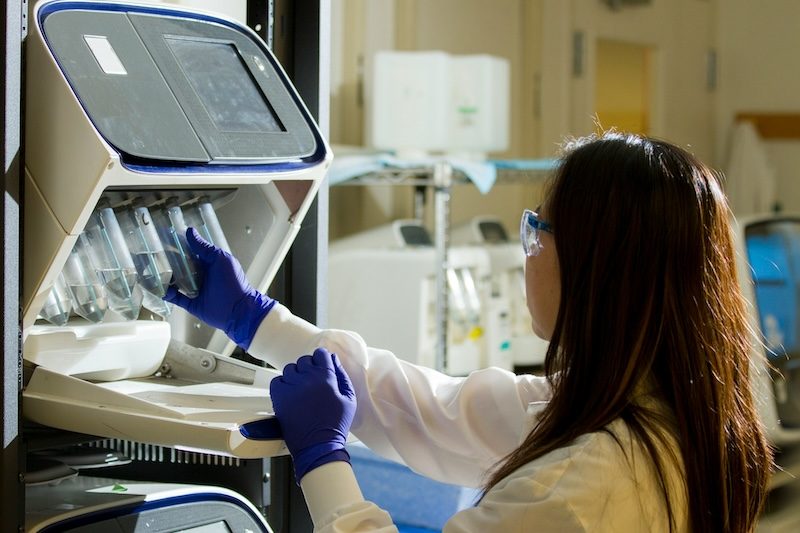

The funds will allow the American start-up to broaden its pipeline of AI-discovered clinical oncology programs.

Other parties in the fundraising were Exor Ventures and existing investors Abingworth, Illumina Ventures, Nexus Venture Partners, Coatue, and Tao Capital Partners.

The extension adds to an oversubscribed $100 million Series B which closed in October 2023.

Proceeds will be used to expand Iambic’s pipeline of clinical and pre-clinical cancer programmes.

“Iambic is a company purpose-built for AI and drug discovery,” said Ayman AlAbdallah, partner at Mubadala Capital.

The company has demonstrated its ability to rapidly advance candidates from discovery to human studies, he said.

- Presight takes majority stake in Adnoc-G42 AI venture

- UAE-Estonia trade grows around tech collaboration

- How tech is reinventing regional healthcare

Earlier this month a US genomics start-up, backed by Abu Dhabi-based Mubadala, said it was working with OpenAI, the creator of ChatGPT, to improve cancer screening and treatment using artificial intelligence models.

Color Health, which uses data science and machine learning for genetic testing and counselling in hereditary cancer and heart conditions, has developed an AI assistant, or “copilot”, using OpenAI’s GPT-4o model to help doctors care for their patients.

Mubadala has invested in other healthtech companies, including Recursion Pharmaceuticals, which is also backed by Nvidia, Vir Biotechnology, and Innovaccer.

M42, launched by Mubadala Investment Company and G42, an AI tech holding company, has also invested in genomics as healthcare shifts towards personalised medicine.