Financial management tools are essential for anyone looking to gain control over their finances, streamline budgeting, and achieve their financial goals. These platforms provide a range of services, from basic budgeting and expense tracking to comprehensive investment management and financial planning. By offering real-time insights, personalized advice, and automated features, they empower users to make informed financial decisions, reduce debt, and save for the future.

Choosing the right financial management tool depends on individual needs and preferences. Factors to consider include the complexity of your financial situation, desired features, ease of use, and budget. By evaluating these aspects, you can identify the platform that best aligns with your financial objectives and helps you achieve financial stability and growth.

Financial Management Platforms

*Figures provided below were accurate at the time of writing and are subject to change. Values are provided in USD.*

1. Refresh.me

Pros and Cons

- User-friendly interface simplifies financial planning.

- Comprehensive budgeting and expense tracking features.

- Clear financial health overview with visual representations.

- Lacks advanced investment tracking features.

- Integration with financial institutions could be improved.

Refresh.me is a financial management platform designed to help users gain a comprehensive view of their financial health and make informed financial decisions. It offers several core features, including budgeting, expense tracking, and financial goal setting, all through a user-friendly interface. This simplicity makes Refresh.me particularly appealing to individuals and families who want to streamline their financial planning without getting bogged down by overly complex tools.

Refresh.me allows users to easily create and manage monthly budgets, automatically categorizing expenses to provide a clear picture of where their money is going. The platform also helps users set and track financial goals, such as saving for a vacation, paying off debt, or building an emergency fund, with tools to monitor progress and stay motivated.

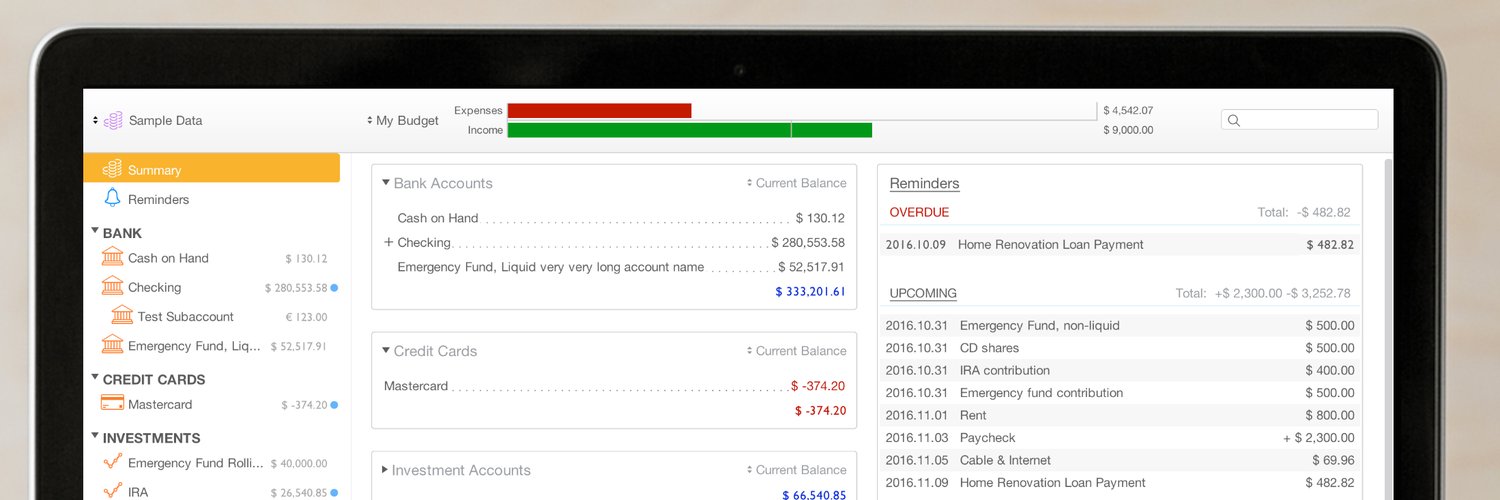

The standout feature of Refresh.me is its intuitive design, making it accessible even for users who are not tech-savvy. It consolidates all financial information in one place, offering visual representations like charts and graphs to make understanding your financial status straightforward. However, it lacks the advanced investment tracking features that some competitors offer. Adding more robust investment management tools could broaden its appeal. Additionally, improved integration with a wider range of financial institutions could enhance functionality, allowing for more automatic synchronization of account balances and transactions.

Overall, Refresh.me is an excellent choice for those looking for a straightforward, easy-to-use financial management tool that provides essential budgeting and expense-tracking features. Its focus on simplicity and clarity makes it a great starting point for individuals and families aiming to improve their financial health.

Pricing: Individual $12 per month, Couple $22 per month, Family $32 per month

2. Mint

Pros and Cons

- Comprehensive and real-time financial tracking.

- Free to use with a wide range of integrated financial institutions.

- Includes credit score monitoring.

- Synchronization issues reported by users.

- Presence of ads can be distracting.

Mint is a comprehensive financial management tool that provides real-time updates on account balances and transactions. It offers budgeting, bill tracking, credit score monitoring, and investment tracking and integrates with a wide range of financial institutions. Its user-friendly interface and detailed financial overviews make it a popular choice for those seeking to manage their finances effectively.

Users can create and manage budgets, automatically categorize expenses, and receive alerts for unusual account activity or bill reminders. Mint also provides insights into spending habits and offers tips for saving money. However, some users report synchronization and transaction categorization issues, and the presence of ads can be distracting.

Overall, Mint is a robust, user-friendly financial tool ideal for comprehensive budgeting and financial tracking.

Pricing: Free, with ads.

3. YNAB (You Need A Budget)

Pros and Cons

- Emphasizes proactive budgeting and financial education.

- Detailed budgeting tools and goal tracking.

- Real-time updates for financial management.

- Steep learning curve for new users.

- Higher cost compared to some other tools.

YNAB (You Need A Budget) focuses on proactive budgeting. It encourages users to assign every dollar a job and emphasizes financial education and building better money habits. It offers detailed budgeting tools, financial education resources, goal tracking, and real-time updates.

Users create budgets, track expenses, and set financial goals with YNAB”s intuitive interface. The platform provides educational resources to help users improve their financial habits and achieve long-term financial stability. While the learning curve can be steep for new users, additional tutorials and an easier onboarding process can be helpful.

Overall, YNAB is a powerful tool for those committed to proactive budgeting and financial education, though it may require an initial adjustment period for new users.

Pricing: $14.99 per month or $99 per year.

4. Empower

Pros and Cons

- Combines budgeting with investment tracking and retirement planning.

- Robust wealth management tools.

- Access to financial advisors.

- Can be overwhelming for users mainly interested in budgeting.

- Higher fees for advisory services.

Empower (formerly Personal Capital) is a financial management platform that combines budgeting with investment tracking and retirement planning. It offers robust tools for wealth management, including budgeting, investment analysis, retirement planning, and access to financial advisors. Empower provides a comprehensive view of your financial health, helping users make informed decisions and plan for the future.

Using Empower’s intuitive interface, users can track their spending, manage investments, and plan for retirement. The platform also offers personalized investment advice and wealth management services. While Empower is excellent for those with complex financial needs, it may be overwhelming for users primarily interested in basic budgeting. Additionally, its advisory services come with higher fees compared to some other platforms.

Overall, Empower is ideal for users seeking a comprehensive financial management tool that includes investment and retirement planning.

Pricing: Free for budgeting and investment tracking; advisory services start at 0.89% of assets managed annually.

5. Quicken

Pros and Cons

- Comprehensive financial tools for personal and business use.

- Detailed tracking of expenses, investments, and bills.

- Includes tax planning features.

- Can be expensive compared to other tools.

- User interface can feel outdated.

Quicken is a comprehensive financial management tool that caters to both personal and business use, offering detailed tracking of expenses, investments, and bills. It includes budgeting, investment tracking, bill payment, and tax planning features, making it a versatile option for managing various aspects of financial health.

Quicken’s robust suite of tools allows users to create and manage budgets, track income and expenses, and plan for taxes. It also offers investment tracking and reporting features, which can help users manage their portfolios and monitor performance. However, Quicken can be more expensive than other financial tools, and its user interface can feel outdated. Modernizing the design and improving stability could enhance the user experience.

Overall, Quicken is a powerful tool for those needing comprehensive financial management for both personal and business finances.

Pricing: Ranges from $41.88 to $119.88 per year, depending on the plan.

6. PocketGuard

Pros and Cons

- Simplified view of available finances.

- Automatic categorization of expenses.

- Insights into spending habits.

- Limited customization options for budget categories.

- Some advanced features require a paid subscription.

PocketGuard is a financial management tool that offers a simplified view of your finances. It focuses on how much money is available to spend after bills and savings. It provides insights into spending habits, helping users manage their money more effectively. Key features include budgeting, expense tracking, bill tracking, and setting savings goals.

With PocketGuard’s easy-to-use interface, users can create budgets, automatically categorize expenses, and track bills. The platform provides a clear picture of available funds, which can help prevent overspending. However, PocketGuard has limited customization options for budget categories and detailed financial insights. Expanding these options could enhance user experience.

Overall, PocketGuard is ideal for users seeking a straightforward, easy-to-use tool for managing daily finances and avoiding overspending.

Pricing: Free basic version; PocketGuard Plus costs $7.99 per month, $79.99 per year, or $99.99 for a lifetime plan.

7. Goodbudget

Pros and Cons

- Uses the envelope budgeting method.

- Great for manual budgeters.

- Includes debt tracking.

- Lacks automatic transaction synchronization.

- Can be time-consuming to manage manually.

Goodbudget is a financial management tool that utilizes the envelope budgeting method, helping users allocate funds into different categories or “envelopes.” This approach is particularly useful for manual budgeters who prefer to plan their spending in advance. Key features include budgeting, expense tracking, and debt tracking.

Users can create and manage budgets by allocating their income to various spending categories, track their expenses, and manage debt with Goodbudget’s straightforward interface. The envelope system encourages disciplined spending and saving. However, Goodbudget lacks automatic transaction synchronization with banks, which can be time-consuming as users must manually enter their transactions. Adding this feature could save users time and increase accuracy.

Overall, Goodbudget is ideal for users who prefer the envelope budgeting method and manual tracking.

Pricing: Free basic version; Plus plan costs $8 per month or $70 per year.

8. Moneydance

Pros and Cons

- Supports international currencies.

- Advanced features for investment tracking.

- One-time fee structure.

- User interface can be outdated and complex.

- Not cloud-based, may require manual updates.

Moneydance is a desktop-based financial management software that supports international currencies and offers advanced features for investment tracking. It includes budgeting, online banking, investment tracking, and detailed financial reporting. This makes it a versatile tool for users who require comprehensive financial management.

Users can create budgets, track expenses, and manage investments with Moneydance’s extensive suite of features. It also supports online banking, allowing users to download transactions directly from their financial institutions. Moneydance’s investment tracking capabilities are particularly robust, providing detailed insights into portfolio performance. However, the user interface can feel outdated and complex, which might deter some users. Modernizing the design and improving user experience could enhance its appeal.

Overall, Moneydance is ideal for users who need advanced investment tracking and support for international currencies.

Pricing: One-time fee of $49.99.

9. Tiller Money

Pros and Cons

- Customizable financial tracking with spreadsheets.

- Automated data import.

- Detailed reporting with customizable templates.

- Requires a good understanding of spreadsheets.

- Limited integration with other financial apps.

Pricing: $79 per year.

10. Albert

Pros and Cons

- Combines budgeting, savings, and investment features.

- Offers financial advice through human advisors and AI.

- Automatic savings feature.

- Some users may find the advice aspect intrusive.

- Premium features require a subscription.

Albert is a financial management tool that combines budgeting, savings, and investment features. It offers financial advice through human advisors and AI. Albert includes features such as budgeting, automatic savings, investment guidance, and bill monitoring designed to help users manage their finances efficiently and reach their financial goals.

With Albert’s intuitive interface, users can create budgets, track expenses, and set up automatic savings. The platform also provides personalized financial advice through its Genius subscription, which includes access to human advisors. Albert’s investment guidance helps users make informed decisions about their portfolios. However, the app’s premium features require a subscription, which can be a barrier for some users. Enhancing the free version with more robust features could increase its accessibility.

Overall, Albert is ideal for users looking for a comprehensive financial management tool with personalized advice, though the premium features require a subscription. The platform’s focus on budgeting and investment guidance makes it a versatile choice for users aiming to improve their financial health.

Pricing: Free basic version; Genius subscription costs $8 per month.