Information is probably the most valuable asset of an investor, as markets are driven by fundamental factors as well as short-term news. This is why high-quality analysis and data are the fuel of future investing success.

In this article, we present seven financial magazines that every savvy investor should know about. Most of them have built a global network of quality sources consisting of experienced journalists, business executives, government representatives, and expert analysts who have first-hand knowledge of current affairs.

According to The Economist, which we are about to review below, “the world’s most valuable resource is no longer oil, but data.”

It is however important to understand that every news and data source has its own biases, specialties, and blind spots. So the astute investors will read enough, and from sufficiently different sources, to see the whole forest and not just the tree.

Here are our picks for the best financial magazines:

The New York-based newspaper has been around for over 130 years and is still a respected institution. The Wall Street Journal (WSJ) provides some of the most solid insights into financial and economic topics, mostly focused on the US markets.

As its name indicates, it tends to have a close proximity to Wall Street and will be a good source of information about the financial industry (banks, insurance, funds, private equity, etc.) and the tech industry.

This focus on finance also translates into high-quality analysis of macroeconomics, as well as good insider’s takes on the highest level of US politics and international news.

In terms of political affiliation, the WSJ editorial is often right-leaning, while its articles are more left-leaning, leading to it being mostly classified as a relatively neutral publication.

A few free articles per month are available, but more require a paid subscription. Subscribing to the WSJ can be done in physical form in some countries, but the digital subscription is today the most commonly used, costing only $9.99/month (when the discount first 12 months offer expires) and including the WSJ tablet app, full WSJ.com access, and the WSJ Smartphone app..

It can also be bought as a bundle to get access to Barron’s and MarketWatch at the same time, as WSJ is part of Dow Jones & Company, also behind Barron’s and MarketWatch. A cheaper rate for corporate subscriptions (10 employees or more) is also available, saving up to 35%.

Source: WSJ

Bloomberg is an independent media business founded by billionaire Michael Bloomberg, a businessman and former mayor of New York.

The magazine part is made up of the news site, the weekly BusinessWeek magazine, podcasts, and Bloomberg TV, supported by the work of 2,700 journalists and analysts.

The company was built upon its Bloomberg Terminal service, which includes a dedicated keyboard for trading and advanced analytical software tools that help investors monitor financial markets.

Source: Dark Readings

Besides financial news, Bloomberg publications also cover international trade, deal-making, geopolitics, and US politics. It has also embraced coverage of crypto news with a dedicated section.

Bloomberg publications are overall considered as left-leaning, a shift from a more centrist position that has been happening since 2019-2020. Michael Bloomberg was a candidate for the 2020 Democratic nomination for president of the United States.

Source: Allsides

Only a few stories per month can be accessed for free. A subscription is required for more, and costs $329/year ($210 the first year), and more if paid monthly. There is a student subscription option at only $9.99/month until graduation.

Source: Bloomberg

Bloomberg terminals are mostly the domain of institutional traders and professional investors, as they cost around $25,000/year per user.

The Financial Times (FT) can be regarded as the London version of the WSJ, as the FT has been around for over 130 years.

The paper is now run by Japanese media giant Nikkei, which purchased it in 2015 for over $1.3 billion, and also owns the Nikkei Asia weekly news magazine (which has its own separate subscription at $10/month).

Thanks to its UK location, this is a good publication for keeping track of news out of the USA, with a strong coverage of the UK and offering more news and analysis about Europe, the Middle East, and Asia.

FT provides many subsections of special interests for investors interested in deeper specialization, organized by geography, industries/sectors, tech sub-segments, investing style, etc.

It also includes editorial sections on non-financial topics like climate change, opinion columns, life & arts, HTSI (“How to Spend It”) lifestyle guide, law, and career advice.

FT is considered a non-biased publication, trying to strike a balance between both sides of the political spectrum.

A Financial Times subscription costs $75 per month for Premium Digital access.

Source: FT

The digital version of the Financial Times is one of the most reliable business intelligence resources on the web. FT publishes news and analysis on multiple markets and assets. It also provides data and tools to monitor financial markets in real-time.

Another major economic newspaper based in London, The Economist, is an even more venerable publication, founded in 1843.

The company behind the paper is owned by a group of shareholders that includes the powerful Italian family Agnelli, as well as Rothschild and Cadbury.

The news and analysis resource is more focused on business, general economics, and politics than purely on finances, with a strong emphasis on expert opinion and data journalism.

The magazine is renowned for its creative cover and high-quality infographics, synthesizing complex datasets in one image complex datasets.

Source: The Economist

These creative covers can however cast a shade of doubt about the publication’s reliability for investors, at least on its weekly main story, colloquially known as “The Economist cover curse”.

While often overblown, it seems to be a real phenomenon indicating that in the short term, The Economist top covers might be more reactive and trend following than predictive of future market moves. This is overall less true for the other analysis inside the magazine.

Source: Trung Phan

Readers of The Economist are usually familiar with the fundamental concepts of economics and already understand terms like macroeconomics or the invisible hand. The writing style may include a lot of metaphors and allusions, and most articles usually don’t display the author or the editor.

The magazine is generally considered leaning to the center-left, although it considers itself to be in the “radical centre.”

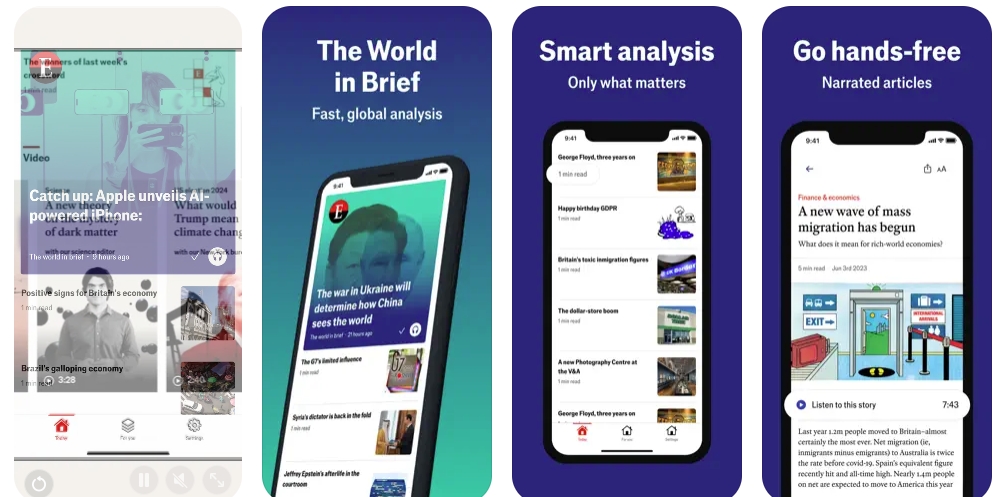

Subscription for the digital version costs $249/year and auto-renews annually. Regular promotions and student offers can bring this price down. It is also possible to order a subscription for the digital + print version, or a cheaper subscription for the Espresso app, focused on economic news.

Source: App Store

The MIT Sloan Management Review presents itself as a research-based magazine aimed at business executives. It is published at the Massachusetts Institute of Technology (MIT) by the university’s business school, known as the MIT Sloan School of Management.

By providing long-form analysis and reflection on tech, business models, management, and strategy, it can provide investors with an edge when it comes to deep thinking and trend identification.

It also offers the podcast Me, Myself, and AI, with experts’ take on the intersection of AI and business.

This can make it an important source for investors favoring a long-term approach, growth investing, or a focus on fundamental analysis. The review is overall considered unbiased, with a centrist position.

Readers can either buy articles separately in PDF format or subscribe for a discount price of $69 per year (regular discount from the “normal” $90/year price). These include unlimited access to the magazine’s 30-year archive and the mobile app.

Source: MIT Sloan

MorningStar is a Chicago-based research and analysis platform that provides regular news as well as analysis tools and ratings to help investors make informed decisions. The platform focuses on stocks, funds, exchange-traded funds (ETFs), and bonds, among others.

Investors can select from a wide range of tools to analyze the best and worst-performing assets, create a custom portfolio, monitor prices, and conduct in-depth analysis.

Some of the professional tools include Morningstar Direct, ESG Investing Solutions, Morningstar Reporting Solutions, Morningstar Research, Pitchbook, Morningstar Data, and Morningstar indexes, among others.

MorningStar also provides personal finance resources to help investors become financially independent. A large array of free newsletters is available and can be a good resource for beginner investors.

Source: MorningStar

MorningStar can be a great source for generating investment ideas and giving a quick overview of a stock. It is also possible to consult the site’s “Best Investment Ideas” section to get suggestions of possible stock or fund picks matching a specific strategy (moat-focused, high dividends, aggressive allocation, etc. )

Source: MorningStar

The service is aimed mostly at retail traders across the US and globally. Access to MorningStar news and tools costs about $249/year, with a seven-day free trial available to newcomers and a higher price for monthly subscriptions.

Forbes is a magazine dedicated to wealth as a whole, known for creating rankings of the world’s wealthiest people and most valuable companies.

It also covers topics such as business trends, investing, health care, and lifestyle topics. So overall, this is more of a magazine to understand the world as a whole, and even be entertained, than a pure financial news source.

The magazine has multiple versions of the magazine for many countries and regions, containing a mix of local articles and translated one from the US, making it a true international publication.

Source: Forbes

Forbes is considered mostly as a centrist publication, with maybe a slight leaning to the left.

In addition to the magazine, book publishing, and podcasts from the magazine’s authors, the Forbes group offers a recruiting service (Global Talent), a global real estate properties service, and “vetted” high-end goods.

This is a relatively cheap publication to try, with an offer of subscription as low as $20/year, gradually rising to the full price of $59.99/year over 4 years.