Growth Comes From Innovation

Economic growth can really come from only two sources: a larger pool of workers and/or resources or a more efficient use of available resources.

With limited natural resources and declining demography, the first source of growth is increasingly unlikely to play a big role in Western economies, or in China for that matter. So growth has to come from better use of resources. And a key way to do so is through improved technology.

A truck is more efficient than a horse, an excavator is more efficient than a man with a shovel, and a nuclear power plant is more efficient than burning wood or coal. More recently, technology has also started to improve intellectual professions with the rise of computers, the Internet, smartphones, software, and AI.

Investing In Technology

Any investment strategy prioritizing “tech” has probably outperformed the broader markets since the 1990s.

The few wise enough investors that held on for decades to stocks of Apple, Amazon, or Tesla have likely seen returns in the 10x, 100x, or even 1000x. Today is no different.

However, the most likely to grow exponentially are stocks that are just at the beginning of their journey, more than the established tech giants.

So, in this article, we will explore tech companies still at an earlier stage, with large growth potential, a very long runway, and large growing markets in which to expand. We will also cover more than purely software stocks, as technological innovation also concerns hardware.

10 Technology Stocks Poised for Future Growth

(This list is by nature subjective and does not constitute investment advice).

1. Tencent Holdings Limited

When the US tech giants were breaching multi-trillion dollar thresholds, Chinese tech companies suffered from a crackdown by the CCP. This created massive uncertainty at the time and crashed the price of the leading companies in the sector.

Constantly escalating US-China tensions and sanctions on China’s semiconductor industry and import of advanced chips only compounded market participant’s concerns.

As a result, Chinese tech stocks’ valuation has lagged severely behind US tech stocks for several years.

This led many investors to ignore the extremely dynamic and active Chinese tech scene. One name stands in the sector above the fray: Tencent, THE Chinese tech and software company.

Tencent is an absolute giant in the Chinese and Asian tech industry, with offering covering what is in the West divided between many tech giants like Google (search, video, and email), Facebook (social media), Microsoft (gaming), Amazon (e-readers, streaming) or Paypal (“super-app” WeChat & WePay).

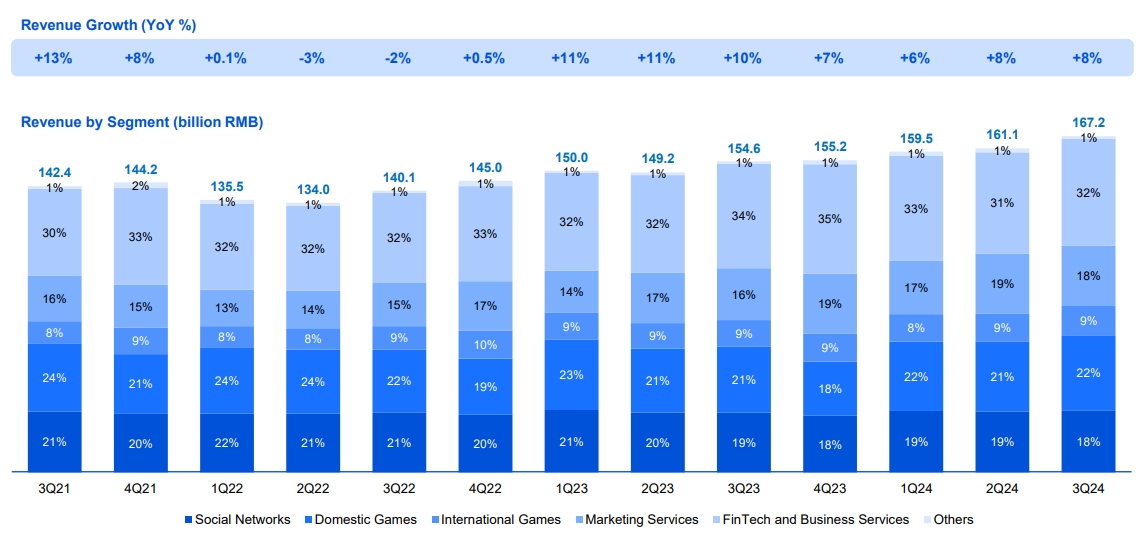

Source: Tencent

Combined with a 1.5 billion people market, and just the Chinese side of Tencent’s activity makes it a world-class company.

Tencent is the world’s largest gaming company by revenue and China’s largest provider of:

- Premium content (video, music, books)

- Mobile browser

- Community, service, and chat, with 1,38 billion users

- Mobile payments

Source: Tencent

This dominant position in the world’s largest market has guaranteed Tencent stability during the crackdown and a quick return to 8%-11% yearly growth since.

Source: Tencent

Another way for Tencent to keep growing is through aggressive investment abroad. For years, Tencent has channeled yearly $10B+ per year into its VC unit. This has somewhat slowed down in 2023 & 2024, with “only” $5B per year.

This gave Tencent a global position in gaming with ownership in games played by hundreds of millions like Roblox, From Software (Soul franchise), Riot Game (League of Legends), Ubisoft (Assassin’s Creed), and Epic Game (Fortnite), as well as partnerships with almost all the large videogame studios in the world as largest recent success in gaming (Baldur’s Gate 3, Path of Exile, Black Myth: Wukong).

Source: Josh Ye

Tencent’s VC unit is a shareholder in more than 1,200 Asian tech companies, especially in the ASEAN region, including EV maker Nio & e-commerce Pindudoduo and SEA.

Tencent has also entered the e-commerce segment since 2020, leveraging the fact that virtually all the Internet-using people in China already use WeChat (1.2 billion people).

The WeChat Minishops have seen the number of sellers double and the GMV (gross merchandise value) triple in 2024.

Overall, the strong position of Tencent in China’s superapp (WeChat), videogame (in China and abroad) and many VC investments in most of the Chinese and SE-Asia tech scene make it a good bet on Asia’s economy and tech development as a whole.

2. Intuitive Surgical, Inc.

Intuitive Surgical, Inc. (ISRG +1.3%)

Intuitive Surgical is a pioneer in robotic surgery, quickly becoming the gold standard of surgical intervention worldwide.

A pioneer in the field, Intuitive Surgical’s Da Vinci robots have performed 16,000,000 surgeries, with a 22% growth in procedures, accelerating exponentially year after year.

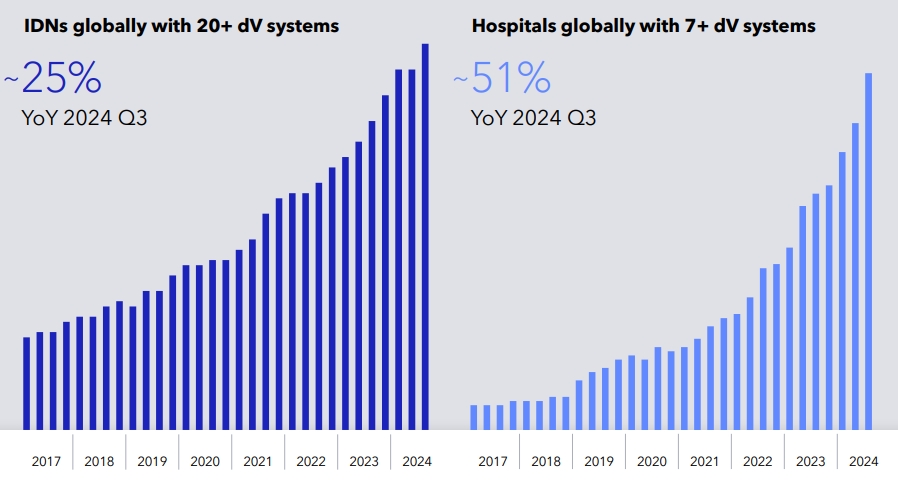

Source: Intuitive Surgical

A strong driver behind the explosive growth of Intuitive is the more and more hospitals increasingly switching their surgeries to robotic systems, with a massive exponential growth of hospitals with 7+ or even 20+ robots.

Source: Intuitive Surgical

This demonstrates not only the success of Intuitive in getting its systems adopted for some surgery by some doctors but also the tendency for robotic surgery to quickly become the norm once it has demonstrated its advantages in a given hospital.

Da Vinci 5, the latest robot, has 10,000 more computing power than the previous version, force feedback sensing technology, and 3D display and image processing.

Robotic Assisted Surgeries (RAS) have better outcomes than laparoscopic or manual surgeries, with fewer side effects, complications, blood transfusions, and quicker surgery time with more comfort for the surgeon.

Source: Intuitive Surgical

Initially especially active in the US, the company is quickly expanding internationally, planning for example to acquire in 2026 their local distributors Ab Medica, Abex, and Excelencia Robotica in Italy, Spain, and Portugal. Further approval for new types of surgery by the FDA and local health regulators also helps create a new market for the company.

Investors will want to take into account the company’s growth in their valuation model, as well as the company’s perennially high multiple valuation when compared to its current earnings.

3. CATL / Contemporary Amperex Technology Co., Limited (300750.SZ)

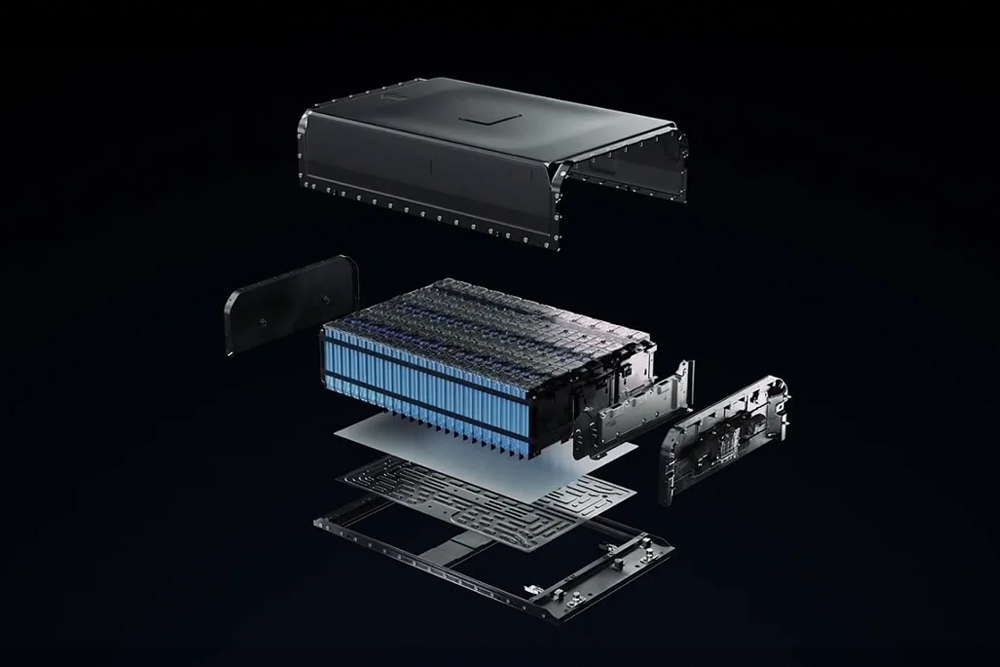

The company is the global leader in battery manufacturing, producing more than half of the global battery volume. It is present at every step of the battery manufacturing supply chain.

This is true for lithium-ion batteries, where the company has been a long-established leader for a long time. It is also strong in LFP (lithium-iron-phosphate) batteries, with the recently announced improved design that can add 600km of range in just 10 minutes. In total, the driving range could be above 1,000 km (600 miles), totally removing all “anxiety range” for future EV owners.

In parallel, CATL has also announced in the past few years impressive progress on many battery types :

Source: CATL

A lot of the highest energy density batteries by CATL use a honeycomb technology that could be as efficient as many solid-state batteries, with none of the difficulty to scale up production experience by solid-state battery companies.

CATL has invested 3.25B in battery recycling capacities in China. It has notably achieved a remarkable recovery rate of 99.6% for nickel, cobalt, manganese, and 91% for lithium.

Thanks to its scale, focus, and R&D achievements, CATL is likely to stay at the forefront of battery innovation, manufacturing, and recycling.

This makes it a key partner for EV manufacturers, including Tesla, NIO, Ford, Stellantis, etc, with Hyundai recently added to CATL’s growing roster of strategic alliances.

Lastly, on a negative note, investors should be aware of the growing rift between the USA and China, with CATL a potentially collateral victim. It has been added to the US Department of Defense’s Chinese Military Company (CMC) list.

CATL said in a statement that it had never engaged in any military-related business or activities and that its addition to the CMC list was “a mistake.”

The company noted that it doesn’t expect any substantially adverse impact on its business and that it was engaging with the US Department of Defense to address the situation, including by legal action if necessary.

Fast Market

This determination doesn’t impose any immediate sanctions on CATL or other companies on the list, but could still impact the stock price and CATL’s future exports to Western markets.

(You can also read our longer report from September 2024, entirely dedicated to CATL, for a deeper dive into the company’s history and technology).

4. Mercado Libre, Inc.

MercadoLibre, Inc. (MELI +3.05%)

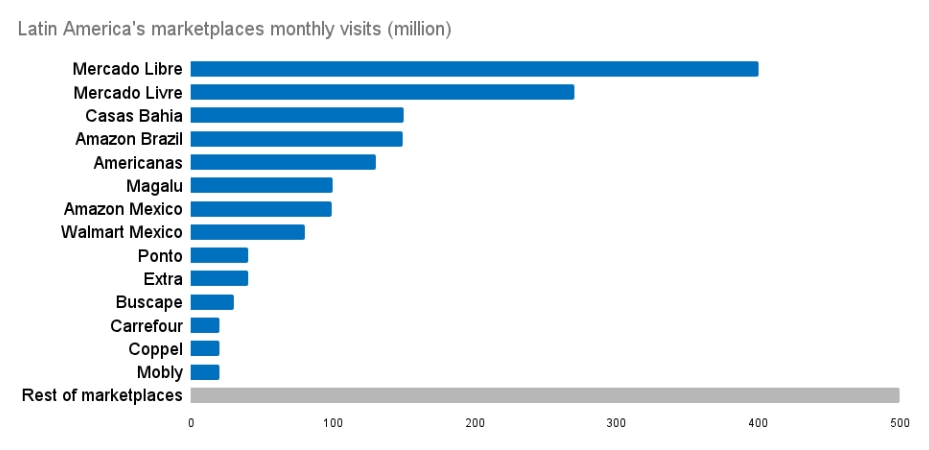

Mercado Libre is the largest e-commerce company in Latin America, dominating the market ahead of local competitors, Amazon, and Walmart. It is also growing quickly, from 22 million unique buyers in 2014 to 85 million in 2023.

Source: NocNoc Store

It is composed of a complementary offer of e-commerce solutions, including logistics, an online shop, a marketplace, real estate & vehicles (Mercado Libre), and financial services, including payments, loans, insurance, and investment (Mercado Pago).

Source: MercadoLibre

The FinTech segment of the company is a local leader in a region where half of the population has no bank account.

“We have a lot of room to continue growing in e-commerce. We wanted to boost users from around 100 million now to 300 million, without giving a specific time frame.

We don’t like buying market share, we like building market share.”

Marcos Galperin – Co-founder & Chief executive of Mercado Libre

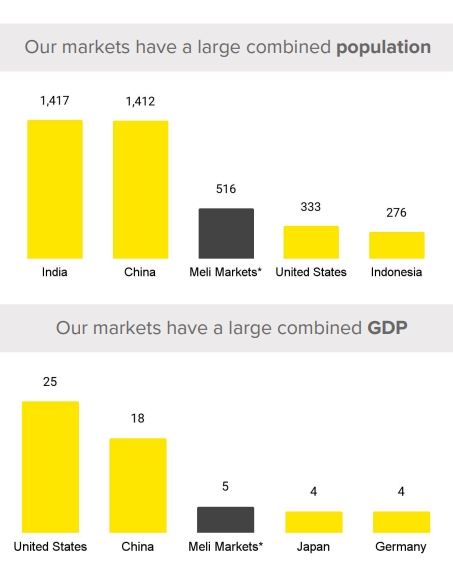

Because the region is home to 656 million people, these growth targets seem realistic, especially considering the company’s advantage in its region for logistics (cheaper and quicker delivery) and the still relatively low penetration of e-commerce into Latin American retail especially as the region is seeing the emergence of a large middle class, which grew by 50% in the last decade.

Source: Mercado Libre

(You can also read our longer report from January 2025, entirely dedicated to Mercado Libre, for a deeper dive into the company’s history and technology

5. SEA

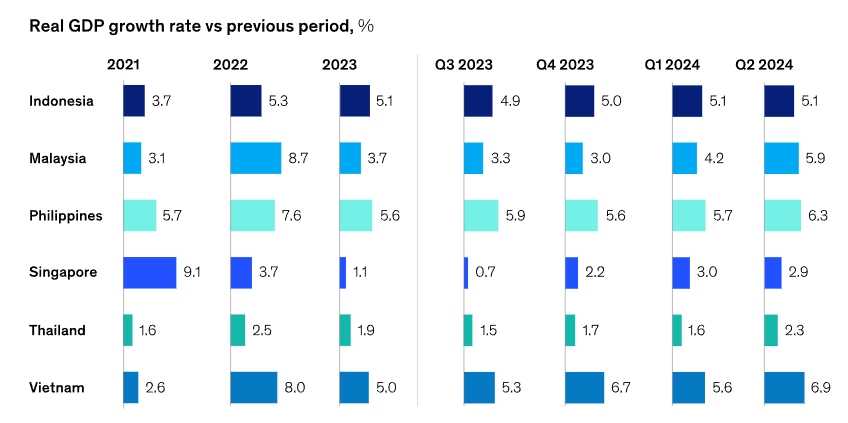

After the spectacular economic rise of China, investors are looking for the “next big thing.” And a good candidate is South-East Asia.

The region benefits greatly from China’s moving some of its industries to lower-cost countries like Vietnam, Thailand, Malaysia, and Indonesia. It is inhabited by 700 million people, with half of the USA’s land surface. Many of the countries in the region have GDP growth of 5-8%.

Source: McKinsey

SEA is a tech company founded in 2009 in Singapore, the financial center of the region. It was initially a videogame company named Garena, with this activity now just one part of the larger rebranded SEA Group.

To this activity, SEA also added Shopee, launched in 2015. Shopee is today the largest e-commerce platform in Southeast Asia and Taiwan.

A third segment of activity is SeaMoney, offering digital payment and financial services, like mobile wallets, loans, online payments, payment processing, etc.

Source: SEA

To this day, the “digital entertainment” part of SEA is the major profit driver, with $210M in Q2 2024 and making up 2/3rd of the total EBITDA.

However, the largest growth potential probably comes from the other 2 segments, as e-commerce is growing rapidly in the region, more than doubling between 2020 and 2023.

Despite intense competition with Alibaba-backed Lazada, Temu, and TikTok’s Tokopedia, SEA’s Shopee stays by a very large margin the dominant actor in the region, with more than triple their respective GMV.

Source: FintechNews

Even within the new segment of live commerce platform (a mix of e-commerce and live streaming popular in China and Asia), displaying explosive growth, Shopee beat TikTok with a 27% market share in 2022.

Similar to the situation in South America, a large part of the SE-Asia population is unbanked. SEA offers them e-wallets, online banking services, as well as consumer loans, loans to SMEs, and cash loans.

Source: Business Insider

SEA is a company that was built around the profitable core of gaming and used this cash flow to become an Amazon-like dominant actor in SE-Asia e-commerce, beating all the other tech giants, including American and Chinese ones.

Together, with the fintech segment, it is the e-commerce segment that is likely to help the company grow from this point onward, especially as the region industrializes and develops very quickly.

(You can also read our longer report from September 2024, entirely dedicated to SEA, for a deeper dive into the company’s history and technology).

6. Rocket Lab

Thanks to Elon Musk’s SpaceX demonstrating the viability of reusable rockets, the world is seeing a new space race unfolding.

One of its closest competitors to be publicly traded is Rocket Lab. Founded in 2006, the company has its own partially reusable rocket, called Electron.

Electron has given the company a strong focus on small launches as the payload is 300 kg / 660 pounds, a segment that has essentially been abandoned by SpaceX after the development of the Falcon 9 and Falcon Heavy.

This is also reflected in the company’s pricing power, with Electron’s average sale price increasing from $5M to $8.4M since its debut launch in 2017.

Rocket Lab has performed the most orbital launches in the world behind SpaceX.

The company has developed its own 3D-printed rocket engine (Rutherford engine) using a 90-ton, 30-meter metal 3D printer.

The next step for Rocket Lab is the launch of its next-generation rocket, called Neutron, which is still in development.

Source: Rocket Lab

With 13,000 kilos of payload to Low-earth Orbit (LEO), Neutron is lifting 43x more mass than Electron, and a bit below SpaceX’s Falcon9 payload.

Neutron could even send up to 1,500 kg to Mars or Venus, making it a credible option for NASA missions sending rovers and experimental equipment to the nearest planets.

Neutrons will be sent through the launch complex 3, currently under construction, adding to machinery and equipment that had been acquired at low costs in May 2023 out of Virgin Orbit’s bankruptcy proceedings.

Rocket Lab also has a solid business line of satellite building, making it a “one-stop shop” for companies looking for both a satellite and launch provider at once, or as its management calls it, an “end-to-end space company.”

It also provides parts for other satellite builders’ components, especially top-level solar panels from its 2022 acquisition of SolAero Technologies. These panels power more than 1,000 satellites.

Source: Rocket Lab

As access to space becomes cheaper and new applications like space-based Internet, the market for orbital launches constantly grows. This is positive for Rocket Lab, both for its launch services and its satellite manufacturing business.

So while the competition with SpaceX is likely to be intense, there is a good argument to be made that specific niches like quick satellite launches will probably be better served by companies like Rocket Lab, while SpaceX and Blue Origin compete with each other on the largest payloads, and space infrastructure building like Moon bases or missions to Mars.

(You can also read our longer report from January 2025, entirely dedicated to Rocket Lab, for a deeper dive into the company’s history and technology).

7. Palantir Technologies Inc.

Palantir Technologies Inc. (PLTR +1.83%)

Palantir Technologies Inc. (PLTR +1.83%)

Palantir is a somewhat secretive intelligence company founded by PayPal cofounder Peter Thiel. Its offer is to be “Powering AI-assisted decision making — from war zones to factory floors.”

The company claims to be at the forefront of a new arms race, fought in the field of developing AI weapons between democracies and autocracies.

Palantir also optimizes industrial operations, from Cisco to Panasonic or Novartis.

Still, it seems a lot of the company business is with the US government and the military-industrial complex, notably in May 2023 with a $463M contract for an AI-enabled mission command platform with the US Special Operation Command (SOCOM).

The company has grown its revenues more than 3x between 2019 and 2023 and had, for the first time, a profitable quarter in H1 2023.

Palantir is now at the center of the effort to modernize the American defense and intelligence apparatus, likely forming a consortium to bid jointly on public tenders, together with SpaceX, OpenAI, drone maker Anduril, autonomous shipbuilder Saronic, and artificial intelligence data group Scale AI.

Palantir is also part of the SOSA Consortium (Sensor Open System Architecture) to provide open interfaces for military systems.

The actual product delivered by Palantir is a little hard to grasp due to the rather confidential and sensitive nature of most of the details of its AI-powered services. We can however understand the general goals by looking at some of these initiatives:

As international tensions stay high, and warfare is quickly turning to drones and AI, while legacy large defense contractors often fail to keep up like Boeing, Palantir is in a unique position to grow quickly as a key service provider to the Pentagon, as well as any strategic manufacturing company in the West.

8. Unity Software Inc.

Unity Software Inc. (U +0.31%)

Unity Software Inc. (U +0.31%)

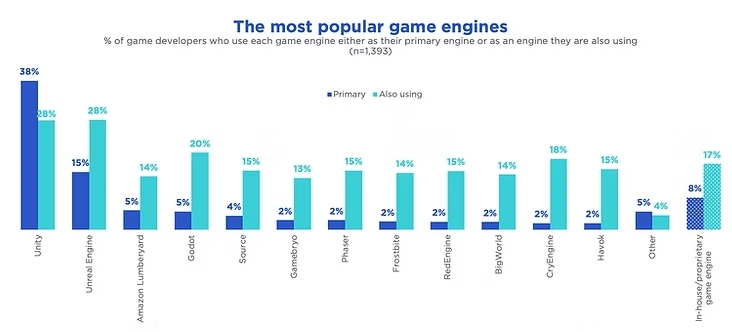

Unity core business is a 3D engine used by video game developers worldwide. It is one of the most popular engines, together with the Unreal engine, indirectly owned by Tencent.

38% of game developers who use game engines use Unity as their primary engine. The next most popular game engine, Unreal Engine, has only 15% usage as a primary engine.

Source: Slash Data

The engine also provides a very extensive asset shop, which for a few hundred dollars gives access to digital assets that would cost hundreds of hours of skilled labor to recreate from scratch.

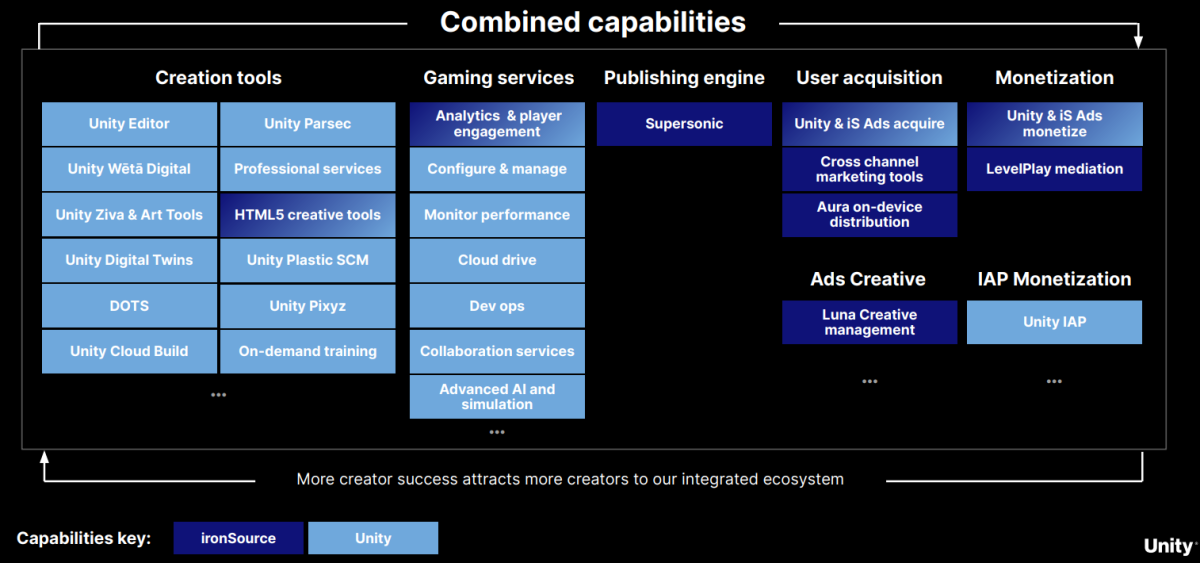

Unity acquired IronSource, an analytics, monetization, and marketing platform to add to its videogame offer, making it a one-stop shop for developing AND selling a videogame.

Source: Unity

This videogame focus has, since the early days, expanded to all 3D modelization, including in industries like automotive (Mercedes Benz (MBGAF +1.21%)) defense (CACI (CACI +0.25%)) or construction (Obayashi (OBYCF +0%)).

Source: Unity

Every segment where Unity is a dominant force is poised for strong growth. Videogames are now the most popular and highest-revenue entertainment sector, with AR/VR offers only beginning to reach the market. And many industries are now embracing 3D printing, VR, and 3D modeling for designing new components, interfaces, and products.

This makes Unity a strong “pick and shovel” stock for anything related to 3D models, AR/VR, 3D printing, and digital simulation.

The associated massive R&D spending is hurting the company’s short-term profitability. So, this is a stock for patient investors willing to wait for Unity to reach the critical mass where it can turn profitable and/or reduce its R&D costs.

(You can also read our longer report from January 2025, entirely dedicated to Unity Software, for a deeper dive into the company’s history and technology.

9. 10x Genomics, Inc.

10x Genomics, Inc. (TXG +1.62%)

When DNA sequencing became a routine procedure in research laboratories in the late 1980s, few realized that it would slowly become a common medical testing procedure (PCR tests) and the source of a massive wave of new biotech technologies, from gene editing to cancer treatments.

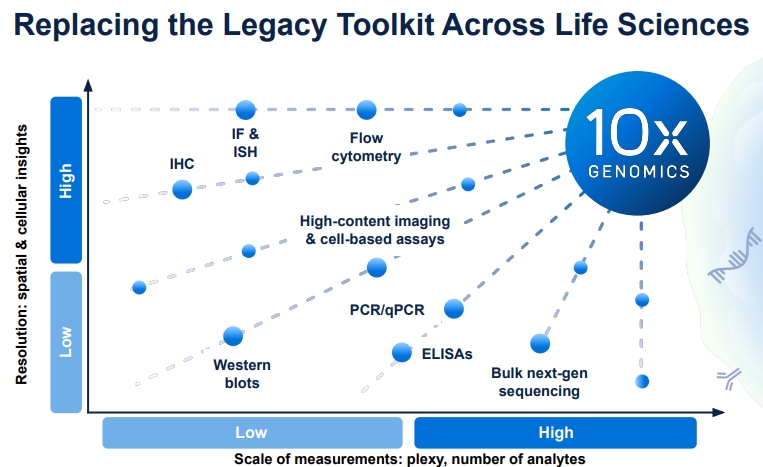

A similar new technology is spatial biology and genomics. This allows researchers to look at a cellular level or even infra-cellular, what genes are active, where, and when. In 2020, the prestigious scientific journal Nature Methods branded spatial transcriptomics “method of the year.”

In the long run, 10x Genomics targets that its technology should replace most biology labs’ older, often decades-old, analytic methods.

Source: 10x Genomics

This is a market that is just getting started, with most research institutes now starting to get equipped with that brand-new capability.

10x Genomics’ growth will be driven by 2 factors:

- Existing users will upgrade their machines or buy more of them once they have started to use them to achieve new scientific discoveries.

- Other labs and universities will become new clients as they must keep up with their competitors’ technical abilities and scientific publications.

A lot of top scientific publications are now using 10x Genomics machines, a growing trend as publishing new discoveries is a very competitive field.

Source: 10x Genomics

This dynamic should ensure a steadily growing market, even without considering growing spending in genomics and biotech in general.

In the very long term, the development of medical diagnostic methods reliant on spatial biology will also lead to top hospitals getting equipped as well, the way PCR slowly became a routine testing tool.

10. Nano Dimension

Nano Dimension Ltd. (NNDM -0.42%)

Nano Dimension is a 3D printing company that went public in 2015. The company started operating in a rather unusual corner of the 3D printing market: 3D printers for electronics.

This includes very specialized technologies like conductive or dielectric inks and ceramics. These can, for example, be used to build optical or radio components.

Nano Dimension has used the rebound in 3D printing stock valuation during the pandemic to raise a lot of capital that it later on deployed in R&D and, more recently, in a series of major acquisitions.

Most notably, Nano Dimension has acquired both its competitors, Desktop Metal and Markforged.

Source: Nano Dimension

Together, Nano Dimensions and Desktop Metal will have a much stronger position in metal and ceramic 3D printing at all scales, from electronics to large industrial equipment and aerospace.

Merging the customer base, which includes SpaceX, Tesla, GE, Honeywell, Emerson, Raytheon, NASA, Medtronics, etc., will also create economies of scale.

Lastly, the two companies were mostly active in different geographic areas, with Nano Dimension in Europe and Desktop Metal in the US, giving the combined team extra reach.

Source: Nano Dimension

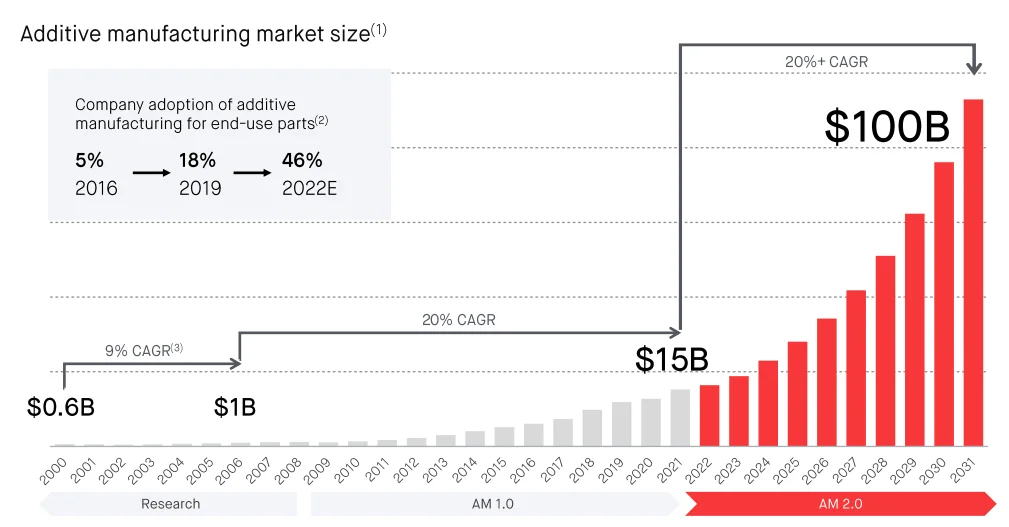

3D printing is becoming an important part of manufacturing, especially when it comes to complex parts, like rocket engines, medical implants, and robotics, but also potentially construction.

Source: Desktop Metal

As the industry consolidates, Nano Dimension is becoming a key actor with the scale and wide range of materials to become one of the leading suppliers of 3D printers.